The current exemption will sunset on dec. The exemption is subtracted from the value of estate assets, with the result being subject to the estate.

2021 Guide To Potential Tax Law Changes

Estate and gift tax retained, with increased exemption amount.

Estate tax exemption 2021 sunset. Additionally, several candidates have proposed a progressive estate tax rate and. Clair law wants to make you aware that this combined tax exemption is scheduled to bounce back on january 1, 2026 to the sum of $5 million per individual (with future inflation adjustments). Federal estate tax exemption sunset is not far off.

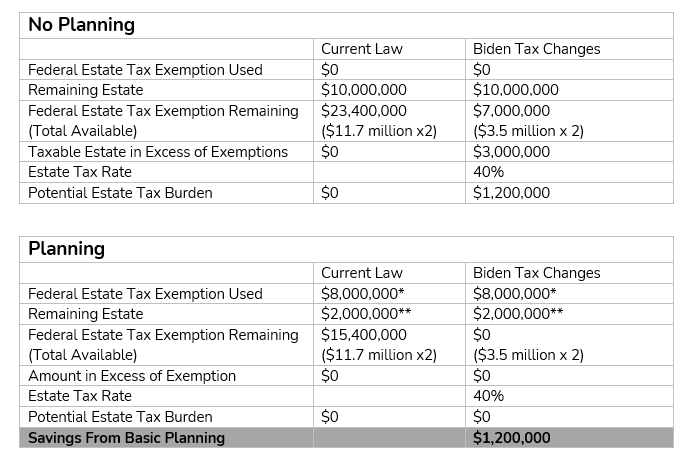

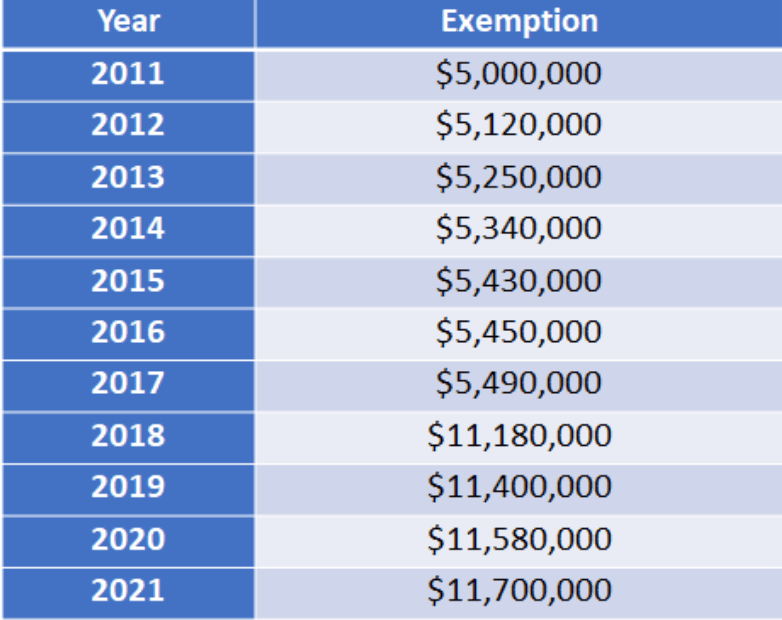

The following are some key income and transfer tax exemption and rate changes under the tcja, including inflation adjusted amounts for 2021 and 2022: Families will have to seek to amend and adjust their estate planning prior to the end of 2021 in anticipation of the tax law changes in 2022. The exemption is, in fact, indexed annually for inflation, so it does increase over time.

Take advantage of exemptions now. 31, 2025, and will return to the obama exemption of $5 million, adjusted for inflation. As of 2021, the federal estate tax exemption is $11.4 million.

Dramatic reduction in estate and gift tax exclusions in 2021? For 2021, the personal federal estate tax exemption amount is $11.7 million (it was $11.58 million for 2020). The $11.7m per person gift and estate tax exemption will remain in place, and will be increased annually for inflation until it’s already scheduled to sunset at the end of 2025.

The adjusted exemption in 2026 is projected to be between $6 million and $7 million. However, democrats are looking to reverse those changes, if they sweep the house, senate and white house in the 2020 national elections. Don't be complacent about the current 2026 sunset date of the gst tax exemption amounts, writes contributor alyse reiser comiter.

The exemption will increase with inflation to approximately $12,060,000 per person in 2022. The maximum gift and estate tax rate is. The 2017 trump tax cuts also increased the lifetime gift tax exemption to, as of 2021, $11.7 million.

This increase in the estate tax exemption is set to sunset at the end of 2025, meaning the exemption will likely drop back to what it was prior to 2018. The combined estate and gift tax exemption for the year 2021 is an astronomical $11,700,000 for individuals. Therefore, a person can gift $11.7 million over the course of their lifetime.

This means that when you pass away, the value of your estate is calculated and any. 31, 2017 and before jan. This higher exemption amount has continued to increase indexed for inflation and the exemption in 2021 is $11.7m.

The 2018 “tax cuts and jobs act” that created the “bonus exclusion” has a “sunset” provision that will cause a reduction of the exclusion to about $6 million ($12 million per couple) for taxpayers dying after. 29, 2021, president biden presented a “framework” for a modified bill that eliminated this change, leaving the current law to sunset in 2025. Nearly every democratic presidential candidate would like to see the.

1, 2026, the act doubles the base estate and gift tax exemption amount from $5 million to $10 million. In 2026, the exemption is predicted drop to about $6,600,000 per person. Accordingly, estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estate/gift tax exemption available in 2021 should it disappear.

2 presidential candidates’ various proposed changes to the estate tax law have included reducing the estate exemption amount to $1 million, $2 million or $3.5 million, and raising the estate tax rate to 45% or higher (all the way up to a top rate of 77% for estates over $1 billion). Temporary 100% cost recovery of qualifying business assets. Estates in excess of the exclusion are currently taxed at 40%.

The current lifetime estate exclusion amount is $11,700,000 per taxpayer, or $23,400,000 for a married couple. Then, the gift and estate tax exemption is lowered from $11.7 million to $6 million with the gift and estate tax rate increased from 40% to 45%, all effective january 1, 2022. For estates of decedents dying and gifts made after dec.

The exemption was $5.5 million prior to the law change. Federal estate, gst and gift tax rates for 2021, the federal estate, gift and. However, the favorable estate tax changes in the tcja are currently scheduled to sunset after 2025, unless congress takes further action.

With adjustments for inflation, that exemption in 2020 is $11.58 million, the highest it’s ever been, reports the article “federal estate. The current exclusion from federal estate and gift tax is $11.7 million ($23.16 million for a married couple).

Biden Tax Plan And 2020 Year-end Planning Opportunities

Three Estate Planning Strategies For 2021 - Putnam Investments

Federal Estate Tax Exemption 2021 - Cortes Law Firm

Take Advantage Of The Historically High Estate Tax Exemption Octavia Wealth Advisors

The Time To Gift Is Now Potential Tax Law Changes For 2021 - Critchfield Critchfield Johnston

He Coming Estate Tax Debate

Estate Tax Exemptions 2020 - Fafinski Mark Johnson Pa

Gift Money Now Before Estate Tax Laws Sunset In 2025 The Wealthadvisor

Estate Tax Exemptions 2020 - Fafinski Mark Johnson Pa

High Net-worth Families Should Review Their Estate Plans Pre-election

Potential Reduction In Estate Tax Exemption In 2021 And What We Can Do About It - The Law Office Of Kris Mukherji

Thoughtful Gifting Part 1 Use It Or Lose It Now Could Be The Time To Use Your Gift And Estate Tax Exemption

2021 Guide To Potential Tax Law Changes

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc - Jdsupra

Estate Taxes Under Biden Administration May See Changes

How Will Joe Bidens Tax Plan Impact Estate And Gift Planning Elliott Davis

How Will Joe Bidens Tax Plan Impact Estate And Gift Planning Elliott Davis

Five Tax Planning Questions To Answer Before Year End

2021 Federal Gift Estate Tax Exemption Update - Sessa Dorsey