South dakota collects a 4% state sales tax rate on the purchase of all vehicles. Has impacted many state nexus laws and sales tax collection requirements.

How Is Tax Liability Calculated Common Tax Questions Answered

South dakota has recent rate changes (thu jul 01 2021).

South dakota vehicle sales tax rate. Counties and cities in south dakota are allowed to charge an additional local sales tax on top of the south dakota state sales tax. Every 2021 combined rates mentioned above are the results of south dakota state rate (4.5%), the south dakota cities rate (0% to 2%), and in some case, special rate (0% to 4.5%). The state sales tax rate in south dakota is 4.500%.

The south dakota state sales tax rate is 4%, and the average sd sales tax after local surtaxes is 5.83%. The state of south dakota relies heavily upon tax revenues to help provide vital public services, from public safety and transportation to health care and education, for our citizens. There is no applicable county tax or special tax.

Think of this as you would a sales tax. The sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any product. Fortunately, there are several states with low car sales tax rates, at or below 4%:

Mobile / manufactured homes are subject to the 4% initial registration fee. The 2018 united states supreme court decision in south dakota v. South dakota municipalities may impose a municipal sales tax, use tax, and gross receipts tax.

With local taxes, the total sales tax rate is between 4.500% and 7.500%. Depending on local municipalities, the total tax rate can be as high as 6.5%. The state general sales tax rate of south dakota is 4.5%.

This table shows the total sales tax rates. South dakota has a 4.5% sales tax and turner county collects an additional n/a, so the minimum sales tax rate in turner county is 4.5% (not including any city or special district taxes). The states with the highest car sales tax rates are:

4% lower than the maximum sales tax in sd. All fees are assessed from purchase date regardless of when an applicant applies for title and registration. The south dakota department of revenue administers these taxes.

The 6.5% sales tax rate in sturgis consists of 4.5% south dakota state sales tax and 2% sturgis tax. This table shows the total sales tax rates. Municipalities may impose a general municipal sales tax rate of up to 2%.

The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Click search for tax rate. What rates may municipalities impose?

If purchased in south dakota, an atv is subject to the 4% motor vehicle excise tax. In south dakota an atv must be titled. Including local taxes, the south dakota use tax can be as high as 2.000%.

The south dakota use tax rate is 4%, the same as the regular south dakota sales tax. South dakota on which south dakota sales tax was not paid. What is south dakota's sales tax rate?

For you folks who are from the east coast, what south dakota calls an excise tax is not what you are used to. The south dakota state sales tax rate is currently %. This means that, depending on your location within south dakota, the total tax you pay can be significantly higher than the 4.5% state sales tax.

The fall river county sales tax rate is %. Cities and/or municipalities of south dakota are allowed to collect their own rate that can get up to 2% in city sales tax. In addition to taxes, car purchases in south dakota may be subject to.

South dakota has a 4.5% sales tax and meade county collects an additional n/a, so the minimum sales tax rate in meade county is 4.5% (not including any city or special district taxes). With local taxes, the total sales tax rate is between 4.500% and 7.500%. For cities that have multiple zip codes, you must enter or select the correct zip code for the address you are supplying.

Enter a street address and zip code or street address and city name into the provided spaces. The south dakota sales tax and use tax rates are 4.5%. South dakota has a 4.5% statewide sales tax rate, but also has 193 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.125% on top of the state tax.

The south dakota (sd) state sales tax rate is currently 4.5%. Can i import a vehicle into south dakota for the lone purpose of repair or modification? The total sales tax rate in any given location can be broken down into state, county, city, and special district rates.

You pay the state's excise tax (4% of the vehicle's purchase price) only when registering a vehicle for the first time after a recent purchase/change of ownership. However, if purchased by an out of state business, you will need to show proof of tax paid to your local department of revenue office. Higher sales tax than any other south dakota locality.

4.5% the following tax may apply in addition to the state sales tax: At a total sales tax rate of 6.500%, the total cost is $372.75 ($22.75 sales tax). Motor vehicles registered in the state of south dakota are subject to the 4% motor vehicle excise tax.

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Tax Collection Tips Ten Quick Tax Rules To Help With The Murkiness Of State Taxes If You Need More Help Visit Our Sales Tax Tax Rules Tax Preparation

Iowa State Sales Tax Guide Tax Guide Sales Tax Tax Holiday

Car Tax By State Usa Manual Car Sales Tax Calculator

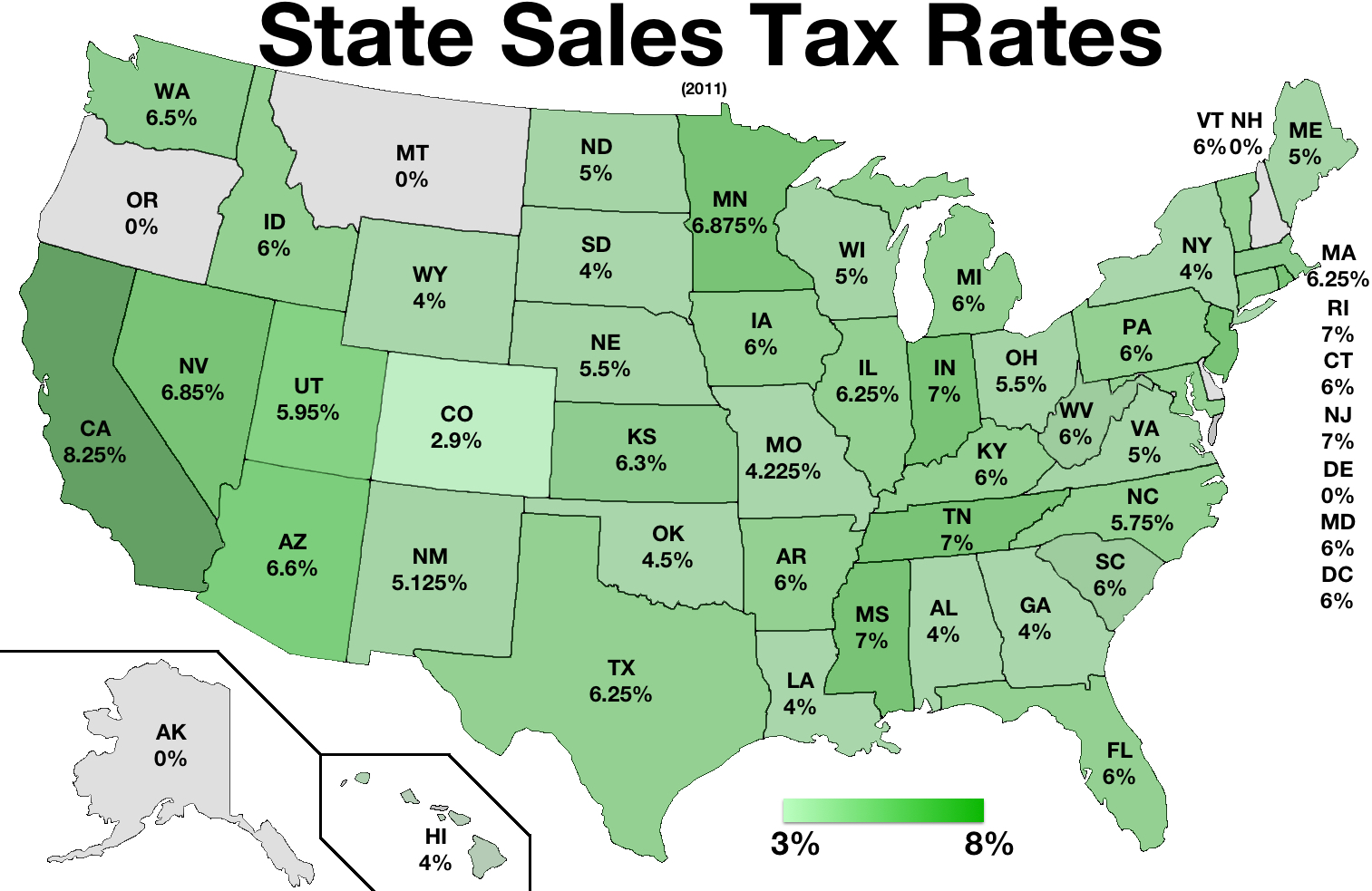

Sales Taxes In The United States - Wikiwand

States With Highest And Lowest Sales Tax Rates

.png)

States Sales Taxes On Software Tax Foundation

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Taxes In The United States - Wikiwand

Ranking State And Local Sales Taxes Tax Foundation

Sales Tax Definition What Is A Sales Tax Tax Edu

Maps Itep

Sales Taxes In The United States - Wikiwand

Car Buyers Beware Cheapest And Most Expensive States For Unexpected Fees Car Buying Car Buyer Used Cars

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Sales Taxes In The United States - Wikiwand

What Is The Gas Tax Rate Per Gallon In Your State Itep

South Dakota Sales Tax - Small Business Guide Truic