2021 oklahoma sales tax by county. Counties and cities in oklahoma are allowed to charge an additional local sales tax on top of the oklahoma state sales tax.

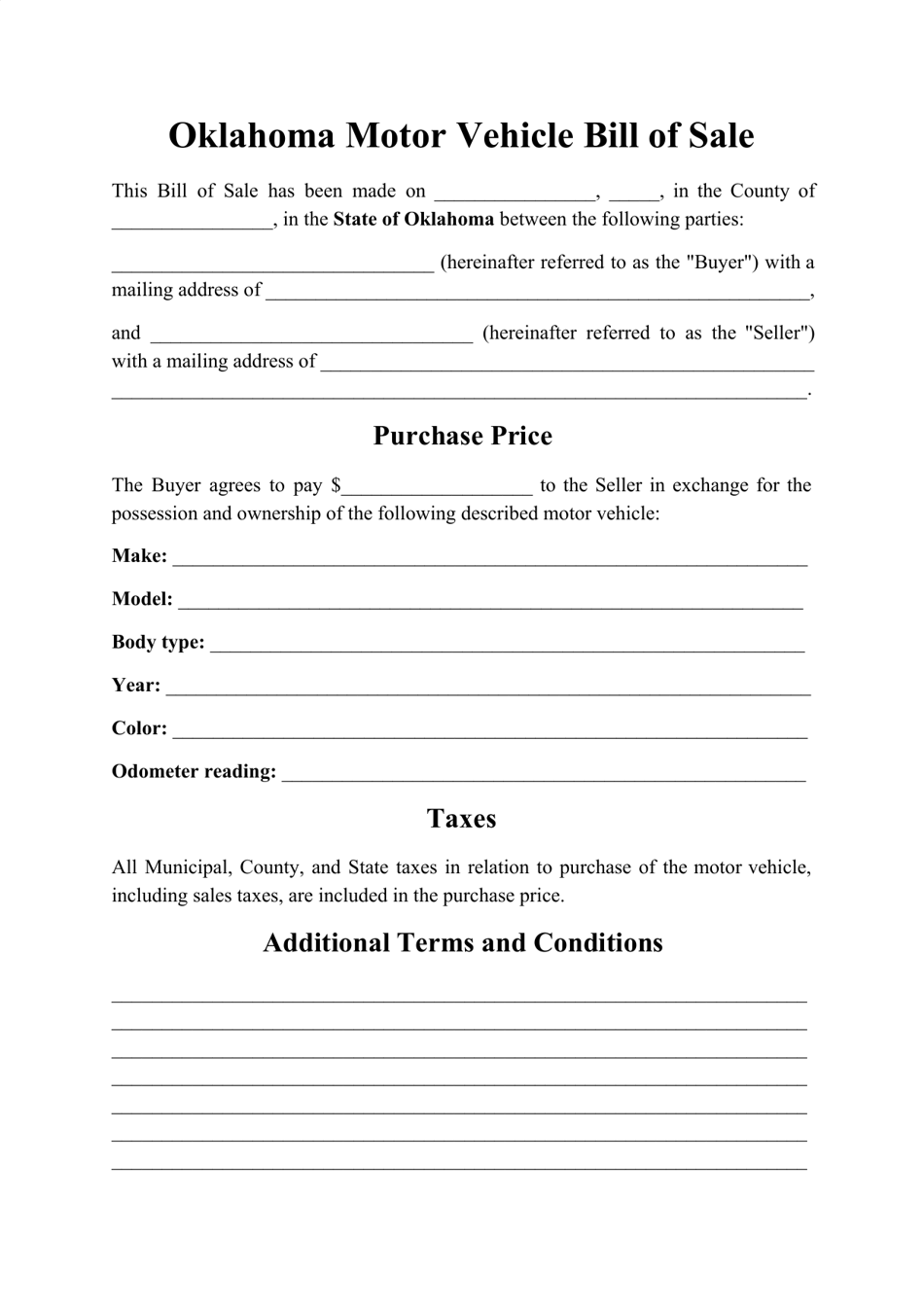

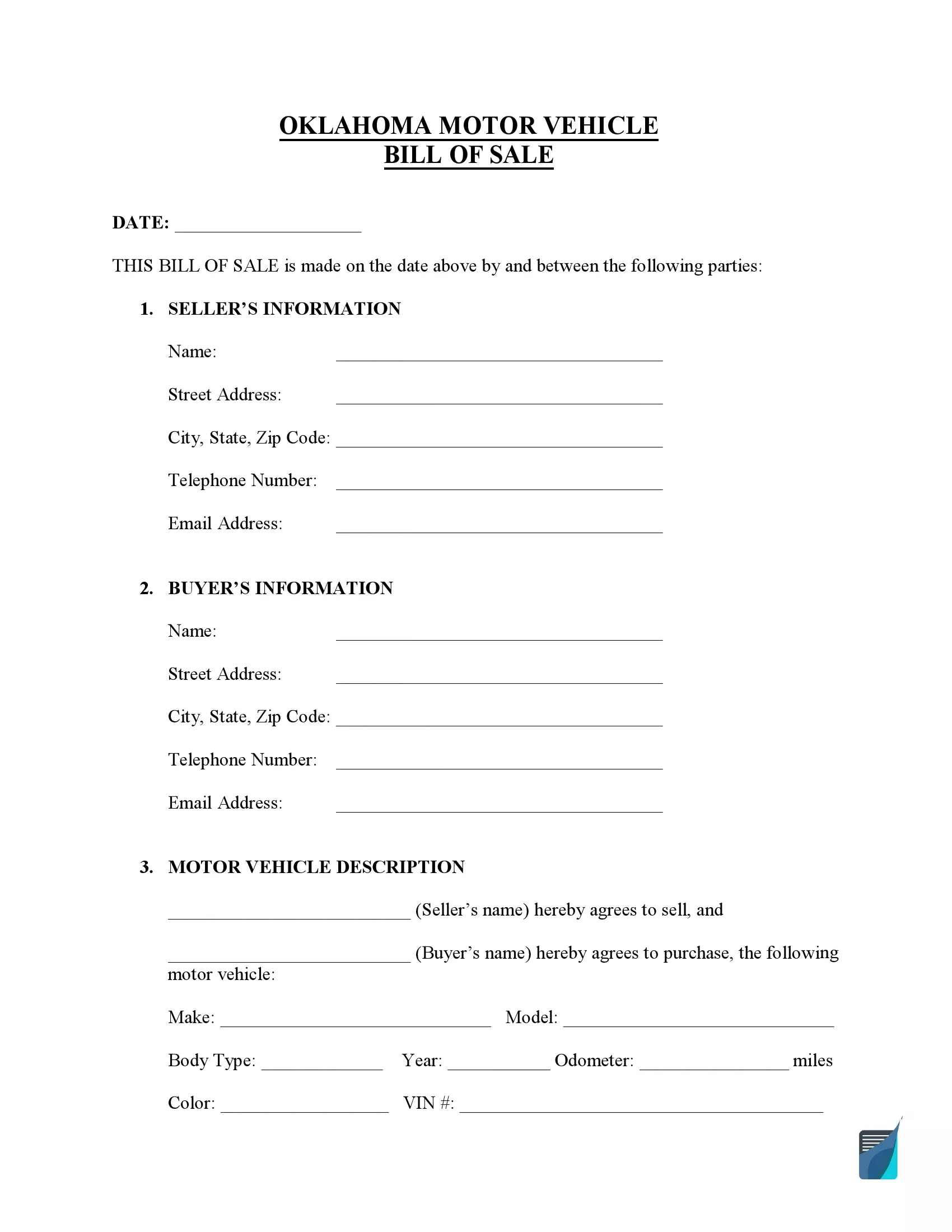

Free Oklahoma Motor Vehicle Dmv Bill Of Sale Form Pdf

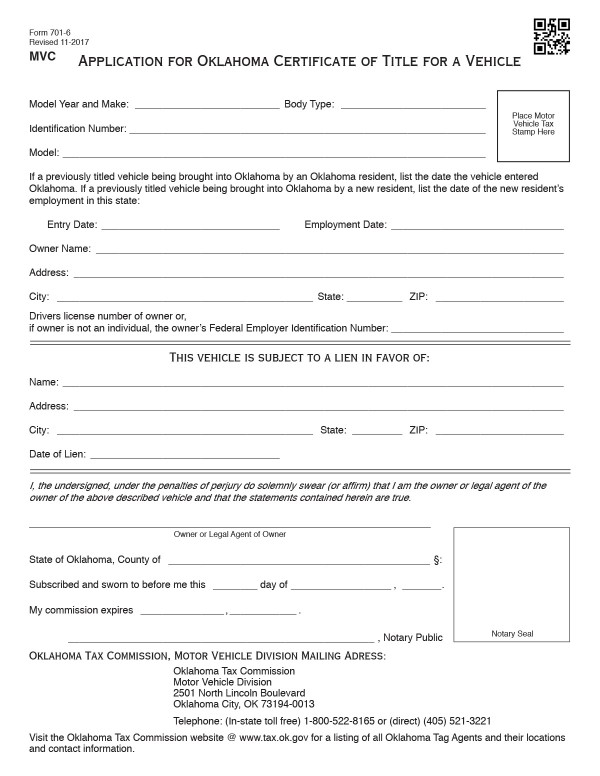

Once you have completed your application, please return it to:

Oklahoma state auto sales tax. State engraving comments authority editorial reference ok not taxable engraving services are not among the services subject to oklahoma sales and use tax okla. Oklahoma collects a 3.25% state sales tax rate on the purchase of all vehicles. Oklahoma has 762 cities, counties, and special districtsthat collect a local sales tax in addition to the oklahoma state sales tax.

Oklahoma has a statewide sales tax rate of 4.5%, which has been in place since 1933. Oklahoma first adopted a general state sales tax in 1933, and since that time, the rate has risen to 4.5 percent. 68 § 1354 ¶21,860 escort services

On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range between 0 percent and 7 percent. In oklahoma, you must pay an excise tax of 3.25% of the vehicle's purchase price when you register it. States with some of the highest sales tax on cars include oklahoma (11.5%), louisiana (11.45%), and arkansas (11.25%).

Does the sales tax amount differ from state to state? Average sales tax (with local): States with high tax rates tend to be above 10% of the price of the vehicle.

However it must be noted that the first 1,500 dollars spent on the vehicle would not be taxed in the usual way; Unfortunately, if you live close to a state with a lower or no car sales tax, such as if you live near delaware, you cannot buy a car in that state to avoid sales. Utilize leading marketing tools to boost your business and get found online.

The oklahoma local sales tax is generally between 3% and 4%, based on the municipality. 26 usc section 501(c)(3) are exempt from sales tax in oklahoma. Utilize leading marketing tools to boost your business and get found online.

Oklahoma has state sales tax of. The cost for the first 1,500 dollars is a flat 20 dollar fee. Oklahoma tax commission oklahoma city, oklahoma 73194 be sure to visit us on our website at tax.ok.gov for all your tax needs including forms, publications and answers to your questions.

3.25% of 65% of ½ the actual purchase price/current value. Oklahoma sales and use tax okla. 8:00 am to 4:30 pm

68 § 1354 ¶22,080 engraving services this chart shows whether or not the state taxes engraving services. 3.25% of ½ the actual purchase price/current value. 3.25% of taxable value which decreases by 35% annually.

Oklahoma city, ok 73116 phone: You can only avoid this tax if you purchase the car in a no sales tax state and then register the vehicle in that state as well. As of july 1, 2017, oklahoma charges a 1.25 percent sales tax on vehicle purchases in addition to motor vehicle taxes.

The sales tax rate for the sooner city is 4.5%, however for most road vehicles, there is a motor vehicles excise tax assessed at the time of sale or when the new oklahoma car title is issued in the new owner's name. Ad start your dropshipping storefront. The maximum local tax rate allowed by oklahoma law is.

Until 2017, motor vehicles were fully exempt from the sales tax, but under hb 2433 , the exemption was partially lifted and motor vehicles became subject to a 1.25 percent sales tax. The states with the highest car sales tax rates are: The oklahoma state sales tax rate is 4.5%, and the average ok sales tax after local surtaxes is 8.77%.

This means that, depending on your location within oklahoma, the total tax you pay can be significantly higher than the 4.5% state sales tax. Whether you live in tulsa, broken bow or oklahoma city, residents are required to pay oklahoma car tax when purchasing a vehicle. Where you register the vehicle:

Advantages of the motor vehicle tax are: If you need access to a database of all. 3.25% excise tax plus 1.25% sales tax = 4.5% total for new vehicles$20 on first $1,500 + 3.25% excise tax on balance + 1.25% sales tax on full price = total for used cars

Oklahoma has a 4.5% statewide sales tax rate, but also has 356 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 3.205% on top of the state tax. Click any locality for a full breakdown of local property taxes, or visit our oklahoma sales tax calculatorto lookup local rates by zip code. States that do not charge a sales tax include new hampshire, oregon, delaware, montana and alaska.

Can i buy a car out of state and drive it home? Oklahoma’s motor vehicle taxes are a combination of an excise (sales) tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem (property) taxes. Which states have no auto sales tax?

Ad start your dropshipping storefront.

Best-selling Car In Every State Map

Virginia Sales Tax On Cars Everything You Need To Know

How To Sell A Car In Oklahoma - Documents Required And More

Nj Car Sales Tax Everything You Need To Know

Oklahoma Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Oklahoma Sales Tax - Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

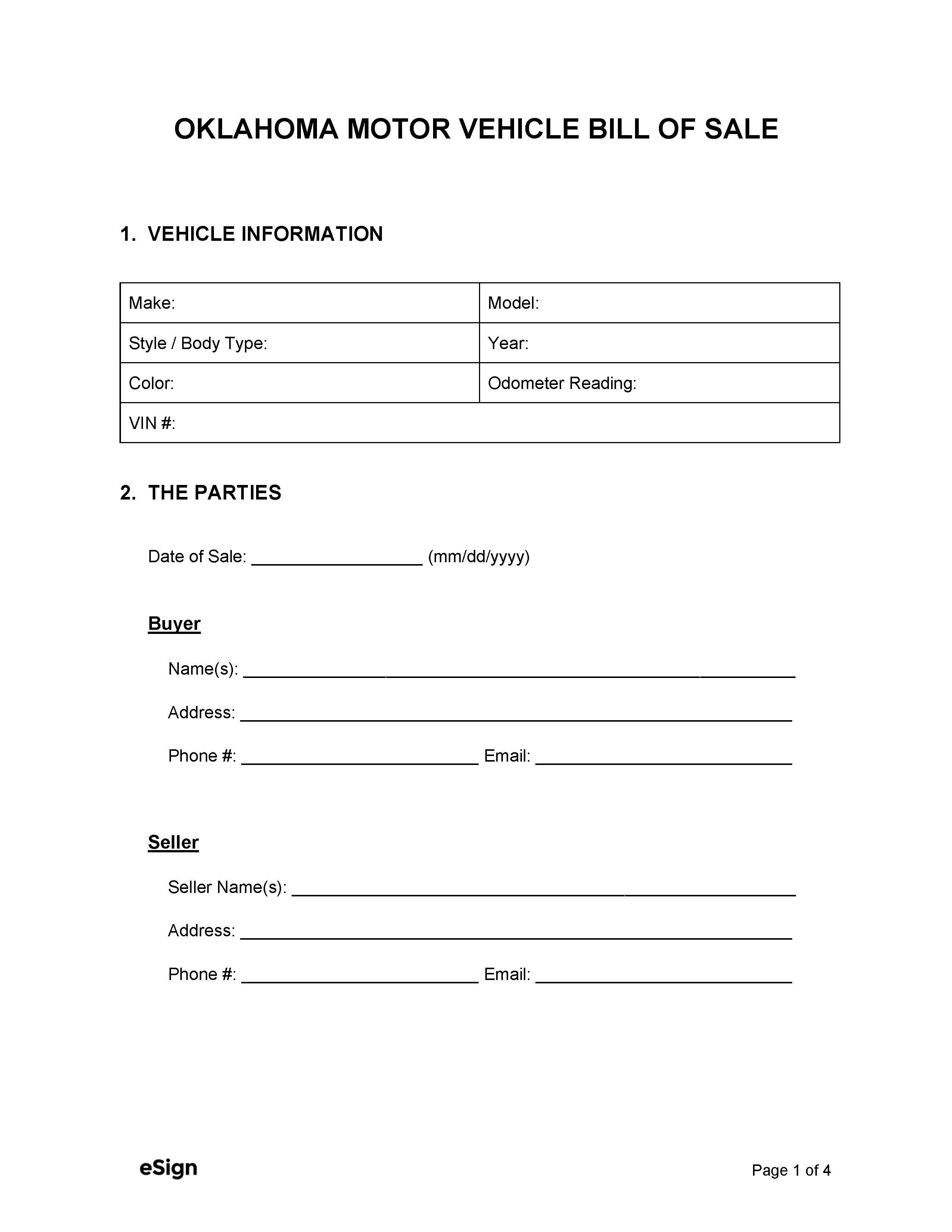

Bills Of Sale In Oklahoma The Templates Facts You Need

Free Oklahoma Motor Vehicle Bill Of Sale Form - Pdf Word

2

Sell A Car In Oklahoma How To Sell A Car In Oklahoma Autotrader

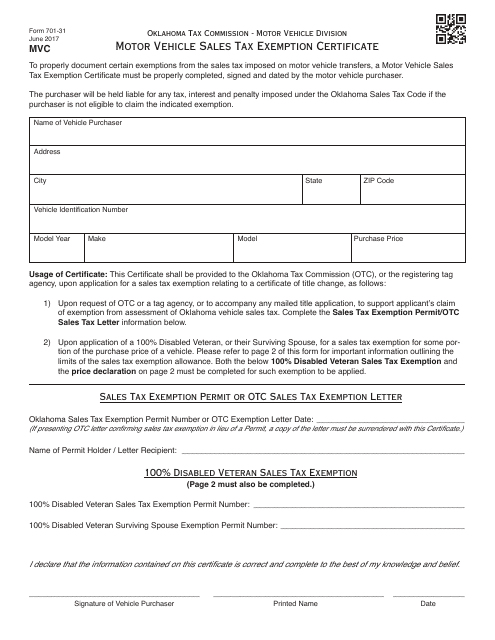

Otc Form 701-31 Download Fillable Pdf Or Fill Online Motor Vehicle Sales Tax Exemption Certificate Oklahoma Templateroller

2

States With No Sales Tax On Cars

How Great An Oklahoma State Car Oklahoma State University Osu Cowboys Oklahoma State

Free Oklahoma Dps Motor Vehicle Bill Of Sale Form Pdf Word Doc

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Free Oklahoma Vehicle Bill Of Sale Form Pdf Formspal

States With Highest And Lowest Sales Tax Rates