Deduct your contributions on line 15 of the 2020 schedule 1 (form 1040). The chief advantage of a tsa is that it can help reduce your taxes.

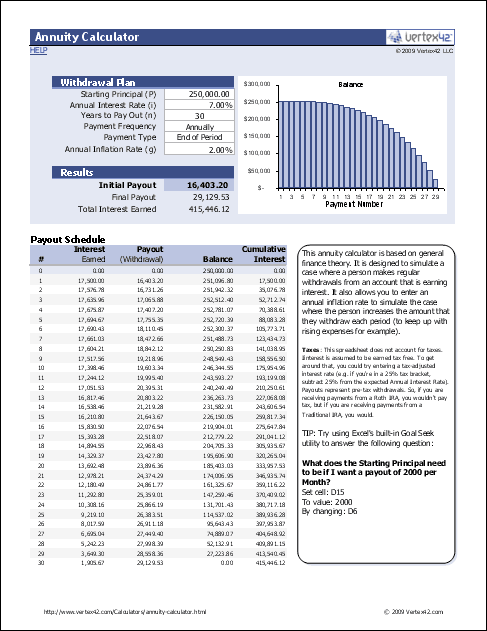

Free Annuity Calculator For Excel - Retirement Annuity Calculator

Use this calculator to help you determine how.

Tax sheltered annuity calculator. The early withdrawal penalty, if any, is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. Assume your gross pay per pay period is $6,500.00 and you are in the 33 percent tax bracket. Does the internal revenue service have any programs to help school systems comply with the law?

A tax sheltered annuity (tsa) is a pension plan for employees of nonprofit organizations as specified by the irs, under sections 501 (c) (3) and 403 (b) of the internal revenue code. If you pull your funds out early, the bank profits less. If you withdraw money from your retirement account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax.

How does a tax sheltered annuity work? There is no tax deduction for contributions made to a roth ira; The institution with which you established the tsa account derives profit from holding the principal, and it has agreed to pay interest to you for the privilege of using your money.

The payment that would deplete the fund in a given number of years. An annuity is an investment that provides a series of payments in exchange for an initial lump sum. It can provide a guaranteed minimum interest rate, with no taxes due on any earnings until they are withdrawn from the account.

Employers can also contribute to employees' accounts. The tool assumes that you will incur this 10%. If someone works for a school or other qualifying teahouse organization covered under irc section 501(c) (3), they can accumulate money for your retirement in a special tax sheltered plan known as a 403(b).

(do not round intermediate calculations. However, all future earnings could be sheltered from taxes, and qualified distributions are tax free, under current tax laws. Round your answers to the nearest whole dollar.) question:

Choose a 403 (b) plan. Suzy is a professor of rhetoric at a public university, with a $70,000 annual salary. Assume your gross pay per pay period is $6,500.

But at age 72 the rmd table calls for. If you transferred $100,000 to the ira annuity at age 72 you may receive $7,250 a year, or 7.25% of your premium in annual income (annuity rates change often, you can get your best annuity quotes from the blue calculator on this page). Tax sheltered annuity a tax sheltered annuity, or tsa, is a long term retirement plan that provides a systematic, tax sheltered way to accumulate funds for retirement.

You live longer than 10 years. Under the partnership for compliance, trained and experienced irs Employees save for retirement by contributing to individual accounts.

Contributing to a roth ira could make a big difference in your retirement savings. Annuities held inside an ira or 401(k) are subject to rmds.

What You Should Know About Tax-sheltered Annuities The Motley Fool

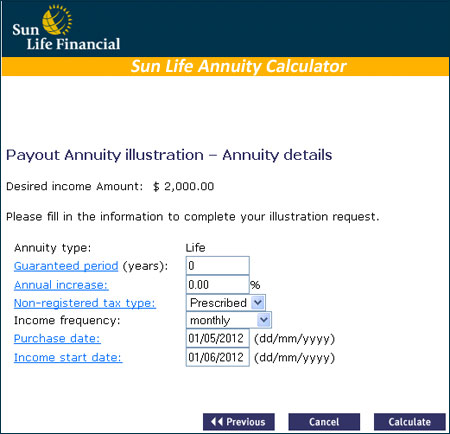

Sun Life Annuity Calculator Calculate Your Annuity Income - Lifeannuitiescom

Free Annuity Calculator For Excel - Retirement Annuity Calculator

Retirement Calculator 49 Free Online Financial Planning Tools

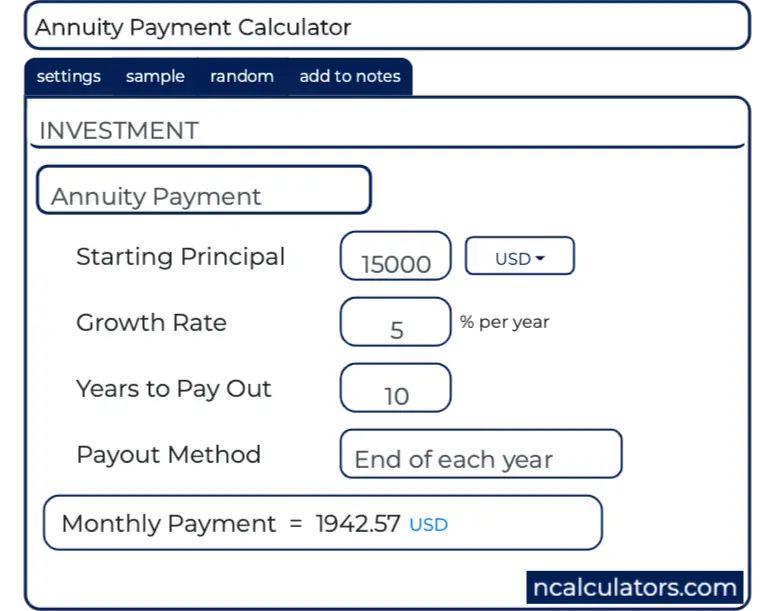

Annuity Payment Calculator

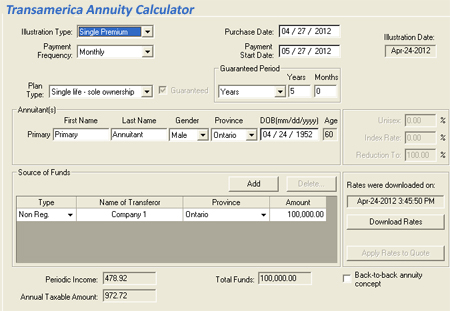

Transamerica Annuity Calculator Calculate Your Annuity Quote Using A Transamerica Annuities Calculator - Lifeannuitiescom

Computing The Value Of A Deferred Annuity Retirement - Youtube

Shutterstock - Puzzlepix

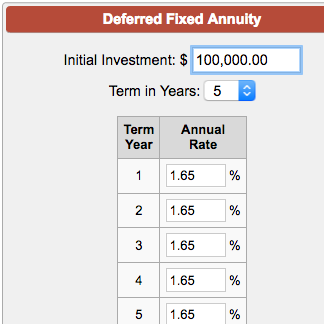

Deferred Fixed Annuity Calculator

How To Figure Tax On Inherited Annuity

Withdrawing Money From An Annuity How To Avoid Penalties

Annuity Investment Calculator Investment Annuity Calculator

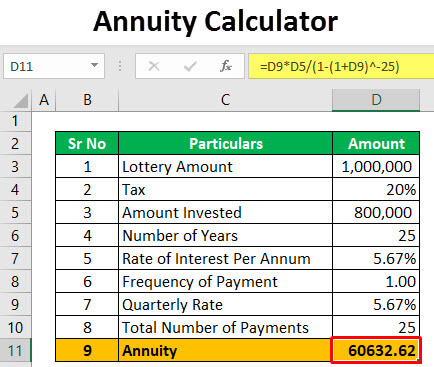

Annuity Calculator Examples To Calculate Annuity

Obamacare Investment Tax - Problem For High-income Earners

Fixed Index Annuity Calculator Let Us Find The Best Fit For You

Small Business - Chroncom

What Is A Straight Life Annuity Retirement Watch

Retirement Calculator 49 Free Online Financial Planning Tools

Present Value Of Annuity Calculator