Location tax rates and filing codes. Rate variation the 80921's tax rate may change depending of the type of purchase.

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

This is the estimated amount that you will have to pay.

Colorado springs vehicle sales tax rate. Colorado springs city rate(s) 2.9% is. Taxes for auto dealers get a little trickier because we collect taxes based on a couple of different factors. In colorado, localities are allowed to collect local sales taxes of up to 4.20% in addition to the colorado state sales tax.

Tops, psst, 2c road tax; Colorado springs is considered a very low tax area of the country to live, especially compared to other major cities. 2021 colorado state sales tax.

Exact tax amount may vary for different items. Please refer to the colorado website for more sales taxes information. This is the total of state, county and city sales tax rates.

The minimum combined 2021 sales tax rate for colorado springs, colorado is. Centennial, co sales tax rate: The current total local sales tax rate in colorado springs, co is 8.200%.

Fort collins, co sales tax. The rate will drop in subsequent years until reaching a flat rate of $3 in the tenth model year. Companies doing business in colorado need to register with the colorado department of revenue.

Sales tax rates in the city of glenwood springs. A motor vehicle leased for 30 or more days by a colorado springs resident (lessee) must be registered in the same manner as a purchased vehicle. 80901, 80903, 80904, 80905, 80906, 80907, 80909, 80910, 80914, 80916, 80917, 80918, 80919, 80920, 80922, 80923, 80924, 80927, 80932, 80933, 80934, 80935, 80936, 80937, 80938, 80939, 80941, 80942, 80946, 80947, 80949, 80950, 80960, 80962 and 80997.

City sales tax must be collected by the vehicle leasing company (lessor) on each lease payment. Fees are based on the empty weight and type of vehicle being registered, c.r.s. The colorado sales tax rate is currently %.

Putting this all together, the total sales tax paid by colorado springs residents comes to 8.25 percent. The maximum tax that can be owed is 525 dollars. The colorado springs, colorado sales tax rate of 8.2% applies to the following 35 zip codes:

Denver, co sales tax rate: The december 2020 total local sales tax rate was 8.250%. The combined rate used in this calculator (5.13%) is the result of the colorado state rate (2.9%), the 80921's county rate (1.23%), and in some case, special rate (1%).

The colorado state sales tax rate is 2.9%, and the average co sales tax after local surtaxes is 7.44%. Motor vehicle dealerships, should review the dr 0100 changes for dealerships document, in addition to the information on the dr0100 changes web page. Our taxes are paid in several pieces:

The colorado (co) state sales tax rate is currently 2.9%. The 80921, colorado springs, colorado, general sales tax rate is 5.13%. Effective with january 2014 sales tax return, the penalty interest rate has changed to.5%.

Any business in these jurisdictions would be expected to collect sales tax on items they sell in the area. State of colorado, el paso county, and pprta effective january 1, 2016 through december 31, 2020, the city of colorado springs sales and use tax rate is 3.12% for all transactions occurring during this date range. All *pprta pikes peak rural transportation authority:

Broomfield, co sales tax rate: Additional fees may be collected based on county of residence and license plate selected. The colorado springs's tax rate may change depending of the type of purchase.

However, a county tax of up to 5% and a city or local tax of up to 8% can also be applicable in addition to the state sales tax. For those who file sales taxes. Every 2021 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (1.23%), the colorado springs tax rate (0% to 3.12%), and in some case, special rate (1%).

The colorado springs sales tax rate is %. All about taxes in colorado springs (cos)! If that vehicle is three years old, that taxable value is then multiplied by a tax rate of 1.2 percent:

The sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. On a $30,000 vehicle, that's $2,475. The county sales tax rate is %.

Colorado springs, co sales tax rate: Groceries and prescription drugs are exempt from the colorado sales tax. Englewood, co sales tax rate:

Collected by the colorado department of revenue: Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction. For a more accurate figure, visit a branch office in person and keep your title papers handy.

For example, if you owned a retail store selling books at the lakewood address you would charge 7.5% tax on each sale. Brighton, co sales tax rate: Commerce city, co sales tax rate:

Castle rock, co sales tax rate: To find out your auto sales tax, take the sales price of your vehicle and calculate 7.72 percent of this price. These taxes are based on the year of manufacture of the vehicle and the original taxable value which is determined when the vehicle is new and.

This downloadable spreadsheet combines the information in the dr 1002 sales and use tax rates document and information in the dr 0800 local jurisdiction codes for sales tax filing in one lookup tool. If at the start of a lease the lessee was not a colorado springs Depending on local municipalities, the total tax rate can be as high as 11.2%.

Welcome to the city of colorado springs sales tax filing and payment portal powered by. Colorado collects a 2.9% state sales tax rate on the purchase of all vehicles.

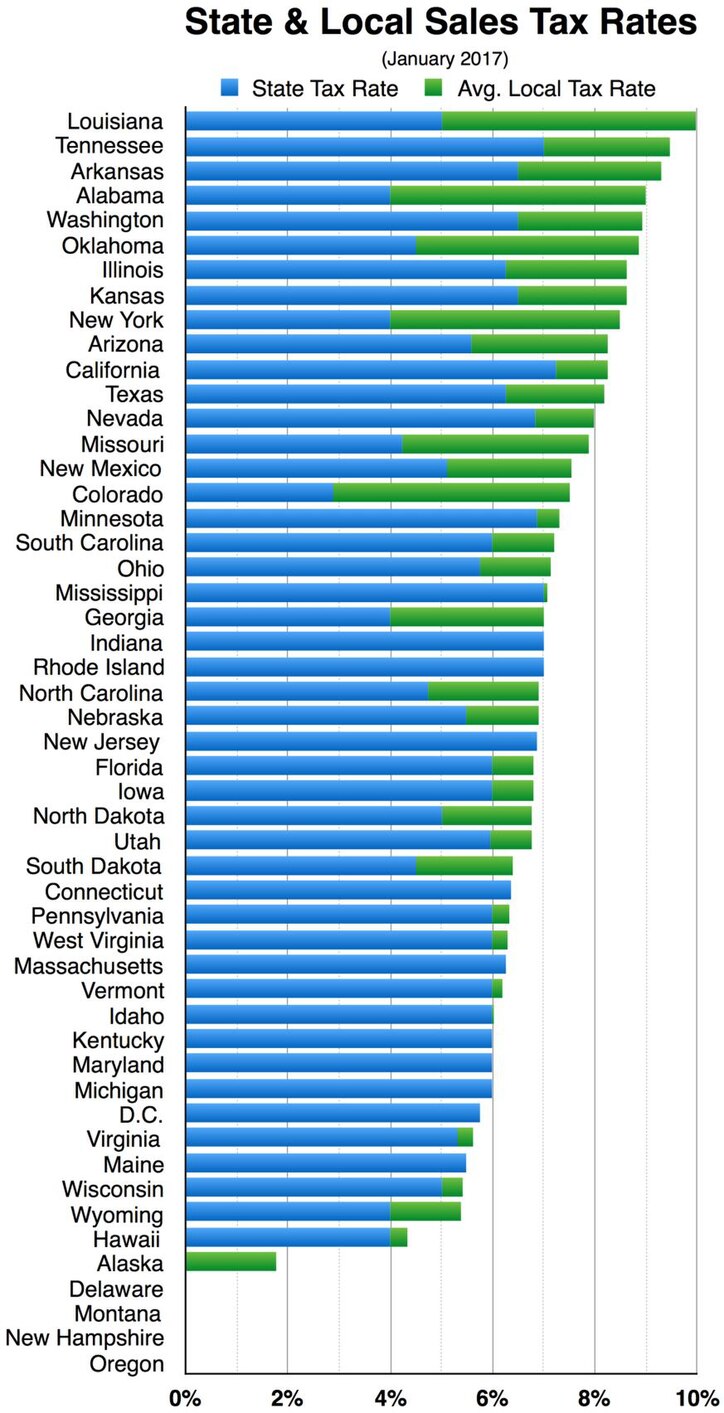

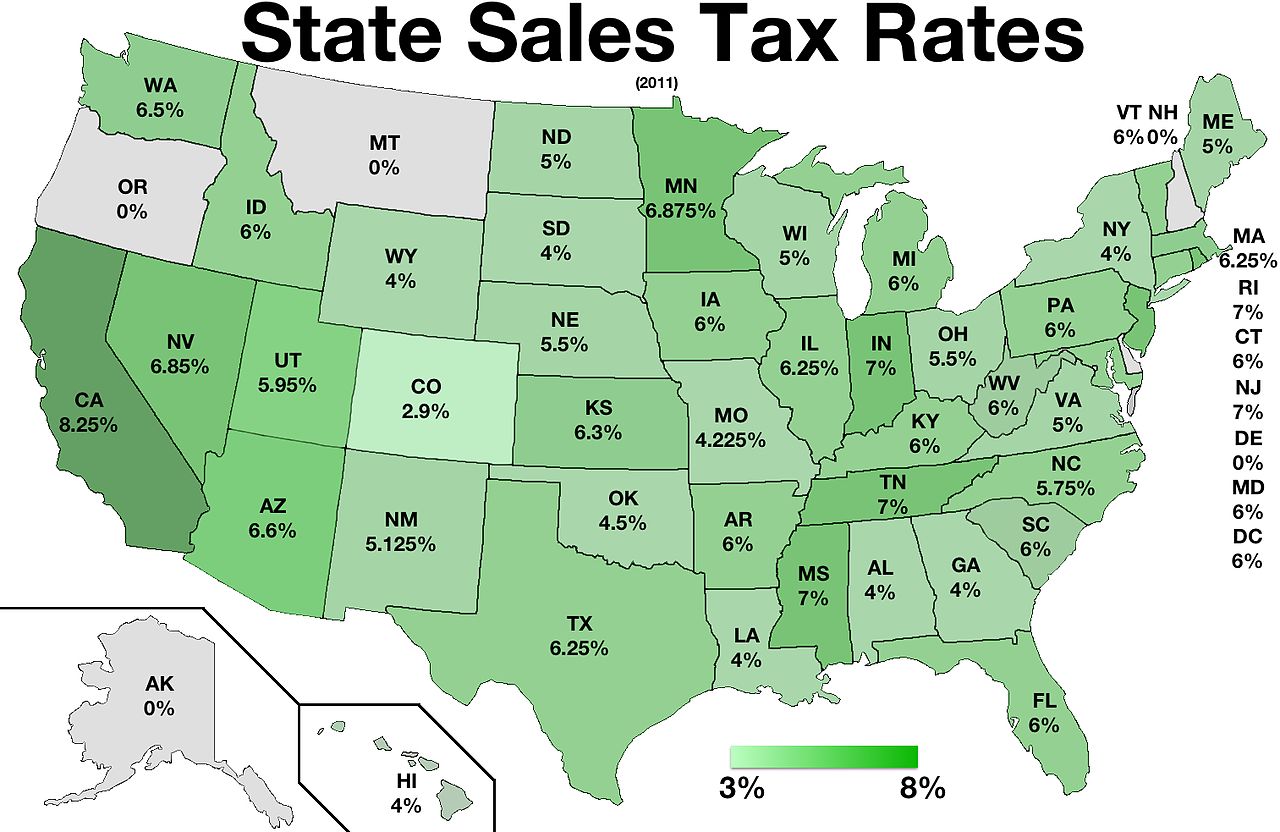

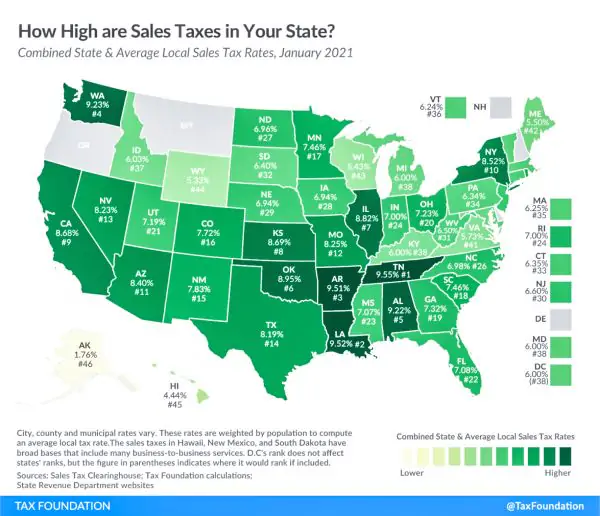

Sales Taxes In The United States - Wikiwand

Sales Taxes In The United States - Wikiwand

Pin By Alicia Hunt On Budgeting Tax Prep Tax Prep Checklist Financial Tips

How To Calculate Cannabis Taxes At Your Dispensary

Insurance Ads Life Health Life Insurance Banner - Banner Ads Web Template Psd Download Here Graphicr Insurance Ads American Life Insurance Life Insurance

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

How Colorado Taxes Work - Auto Dealers - Dealrtax

2

Car Buyers Beware Cheapest And Most Expensive States For Unexpected Fees Car Buying Car Buyer Used Cars

Sales Taxes In The United States - Wikiwand

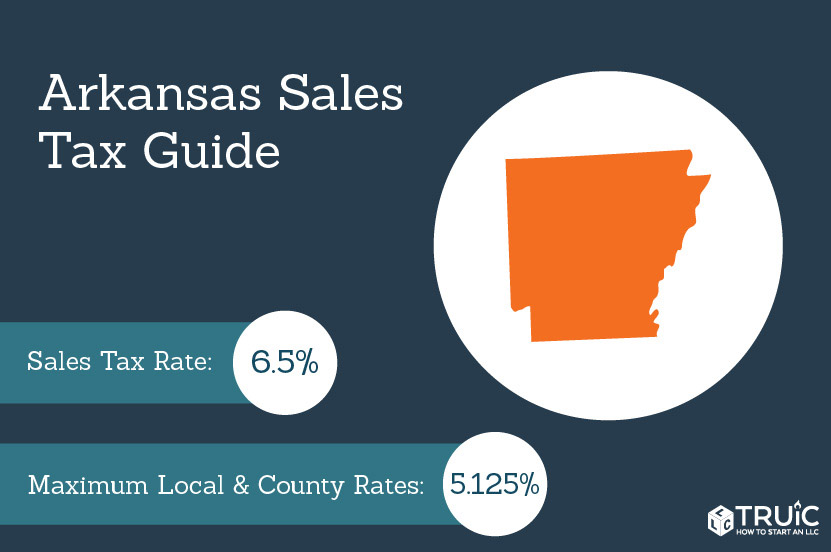

Arkansas Sales Tax - Small Business Guide Truic

How Colorado Taxes Work - Auto Dealers - Dealrtax

Httpwwwwatsoncpagroupcomcoloradospringstaxesphp Tax Accountant Tax Services Tax

Health Insurance Tax Health Insurance Infographic Infographic Health Health Insurance

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Income Tax Irs Tax Forms

How Colorado Taxes Work - Auto Dealers - Dealrtax

Sales Taxes In The United States - Wikiwand

Colorado Sales Tax Rates By City County 2021

Tax Benefits Of Living In Wyoming - Wyoming Real Estate Blog