If you are buying or already own a property in france, you will have to pay the taxe foncière or french property tax, even if you’re renting it out. Property tax refers to any tax concerning real estate.

France Les Assurances A Ne Pas Oublier En Matiere Immobiliere Vous Etes Couvert Pour Tout Pour Votre Semaine De S Real Estate Real Estate Investing Renter

All australian nationals who are domiciled in france, are taxed on their worldwide income.

Property purchase tax in france. Oftentimes these fees are included in the listed price, but it’s important to confirm that. There are two types of property taxes in france, the taxe d´habitation and the taxe foncière. Property purchase tax in france.

These include a departmental tax, usually 4.5% of the purchase price, as well as a communal tax at the rate of 1.20%, and another government charge of 2.37%. Let’s take a look at the different fees and taxes involved in a french property purchase. The different options for french property ownership.

Wealth tax only affects those with assets over a certain rate and is calculated in bands above that figure. Broadly put, there are 2 main categories of french property taxes: Buying property in france of more than 1,300,000 euros, the owner will have to pay a wealth property tax.

Calculating fees and taxes for buying property in france. The government also pointed out that the capital gain tax rules in france were designed to dissuade speculative acquisition of property, as relief to the tax was based on duration of ownership. The main two taxes in france for property are the taxe foncière and the taxe d’habitation.

What to expect when buying a house in france. The rate is changeable according to the type and value of the property. Ifi, the wealth property tax, came into effect in 2018.

All of these things mean that it’s highly recommended to seek specialist advice on property ownership and inheritance before you purchase a property in france. The main factors that affect the level of fees are: The tax is calculated by the value declared in the deeds or on the rateable value.

This needs consideration whether it’s a permanent home or a second home. A double taxation treaty has been signed with france to ensure you are not taxed twice. French estate agency fees and commission.

If you do rent your property out and gain less than €15,000 a year from it, you can benefit from a simplified tax regime called ‘micro fonciere’. The rates of tax vary across the country, due to the varying rates of tax imposed by the regional and local governments. Advice and information on buying and selling property and renting in france with french mortgage, legal and tax information from complete france.

Once you’ve purchased a property, you’ll more than likely need to start paying taxes in france. The notaire can advise you on the rate in your department. Generally, rental leases also provide that the tenant will reimburse the landlord for the taxe foncière , which is otherwise payable by the owner of the property.

Buying property in france has never been easier with the uk's number one property website. There are two taxes on all residential property called ‘taxe d’habitation’ (local tax) and ‘taxe foncière’ (land tax). The bill for the taxe foncière arrives in the last quarter of the year and the amount is based on the estimated annual rental value of the property multiplied by a percentage set by the commune (ask for more information at your.

Buying property in france has never been easier with the uk's number one property website. Discover the 3 key property taxes you need to be aware of in france. Together, these taxes are the equivalent to uk council tax.

These include a departmental tax, usually 4.5% of the purchase price, as well as a communal tax at the rate of 1.20%, and another government charge of 2.37%. These include a departmental tax, usually 4.5% of the purchase price, as well as a communal tax at the rate of 1.20%, and another government charge of 2.37%. House buying fees and taxes in france.

Property purchase tax (imt) the imt (imposto municipal sobre as transmissões onerosas de imóveis) tax is collected each time when a house is bought in portugal. There were also other tax measures the government had taken to moderate price increases, notably with a tax on vacant homes and higher local rates payable. The notaire can advise you on the rate in your department.

This page provides a checklist of what you as a buyer can expect to pay. Property purchase tax in france. The fees associated with buying a property in france can be alarming.

The annual wealth tax (called isf, l’impôt de solidarité sur la fortune) is transformed into the property tax, ifi (l'impôt sur la fortune immobilière). Sales taxes are the ones you encounter when buying or selling property. A typical property purchase in france will incur combined charges from a notaire and estate agent of between ten and fifteen percent of the final purchase price.

Whoever actually resides in a building is obliged to pay the tax d´habitation. Maintenance taxes are paid regularly on property that you already own or rent. What’s property tax in france?

There are two local taxes, called the taxe d'habitation and the tax foncière. There are three ways in which two or more persons buying a property in france can hold the property.

We Help You Navigate French Real Estate There Is No Mls In France So We Help You Find Property And Walk You Through The Pro In 2021 France Find Property Estate Agency

Pin On Money Investing Tips

Pin On French_leaseback French_leaseback_property French_leaseback_resale French_leaseback_mortgage Leaseback_investments_in_french_residences

Common French Property Pitfalls Avoid These Buyers Mistakes - Frenchentree

Taxe Dhabitation - French Residence Tax

How Much Does A French Property Really Cost - A Place In The Sun

Mexican Real Estate Blog - What Is The Trust Deed California Real Estate Real Estate Estates

What Should I Know Before Buying A Property In France - Vendome International Property

St Tropez An Der Cote Dazur Saint Tropez St Tropez France Day Tours

Buying A House In France As A Foreigner

House For Sale In Ste Colombe - Charente - Lovely Location For This 3-bedroom 2-bathroom Stone House W French Property Above Ground Swimming Pools Stone House

What Are The Tax Minimization Strategies In France For Non-french Residents Take A Brief Look At What The French Taxation French Property Property French

In-depth Guide To French Property Taxes For Non-residents Expats

The Property Tax Handbook For Brrr Btl Investors By Joshua Tharby The Ultimate Tax And Account In 2021 Property Tax Accounting Investors

Why Invest In Dubai Real Estate Dubai Real Estate Real Estate Investing Quotes Investment Quotes

What Are Property Taxes Like In The South Of France - Mansion Global

A Site Devoted To Real Estate Law Property France Buying Property In France Real Estate Buying

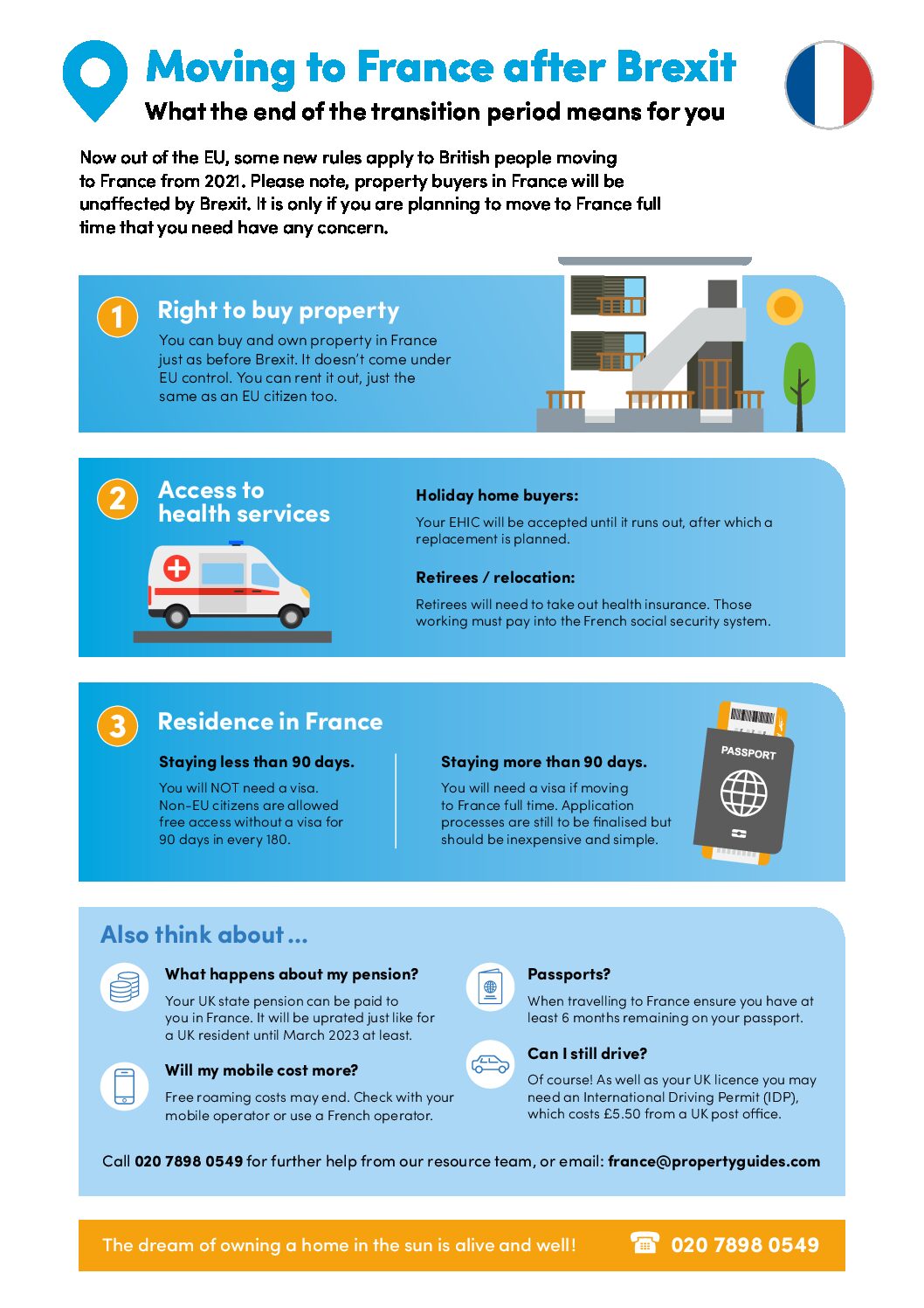

Buying Property In France After Brexit France Property Guides

Pin On Living France Covers