For manufactured homes, the amount of the credit is $1,000 or $2,000, depending on the energy savings that are achieved. Be at least 50% more efficient than the 2006 iecc benchmark.

Federal Energy Tax Credits 45l Are Back - Ducttesters Inc

Read on for eligibility requirements and.

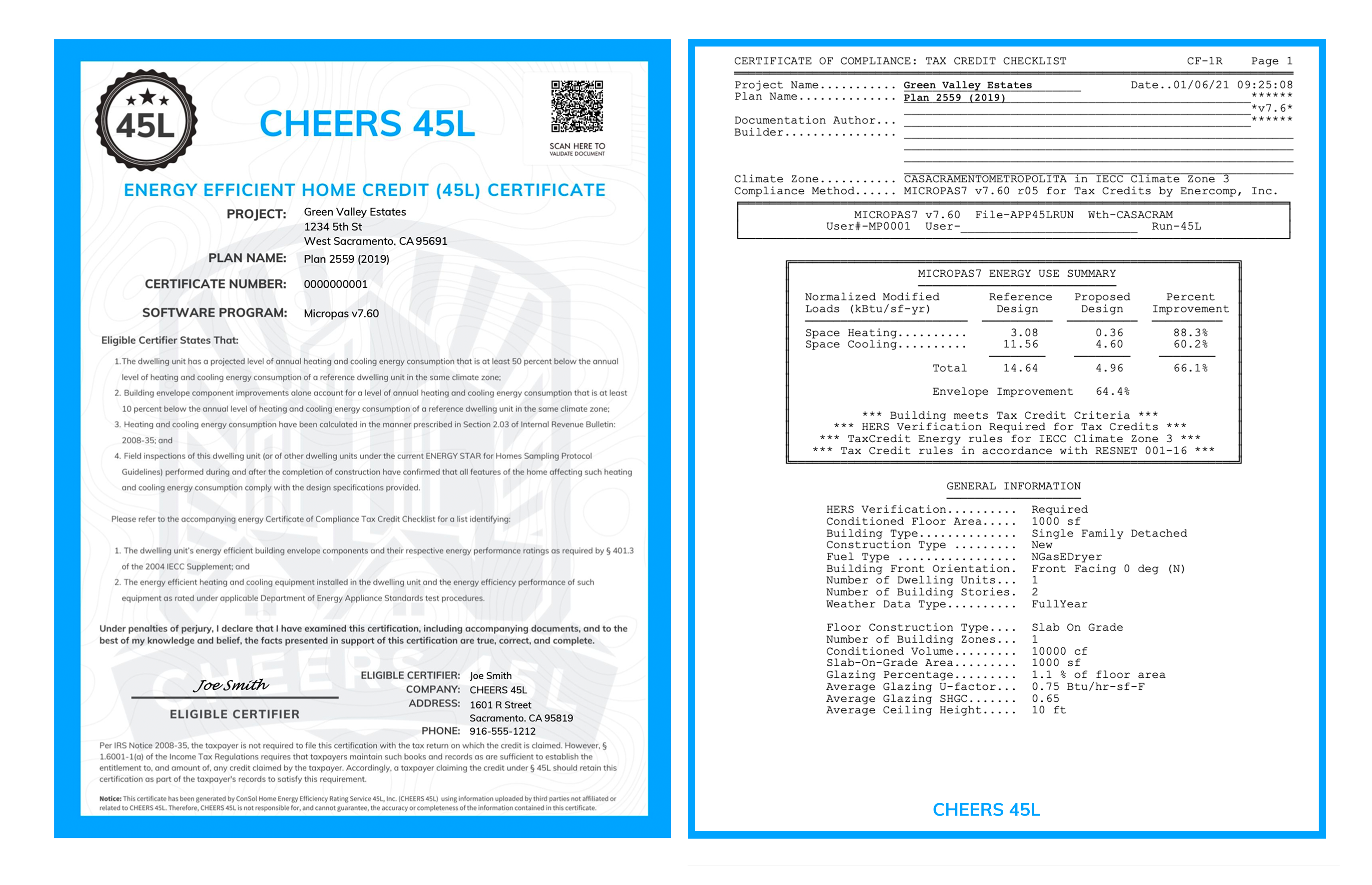

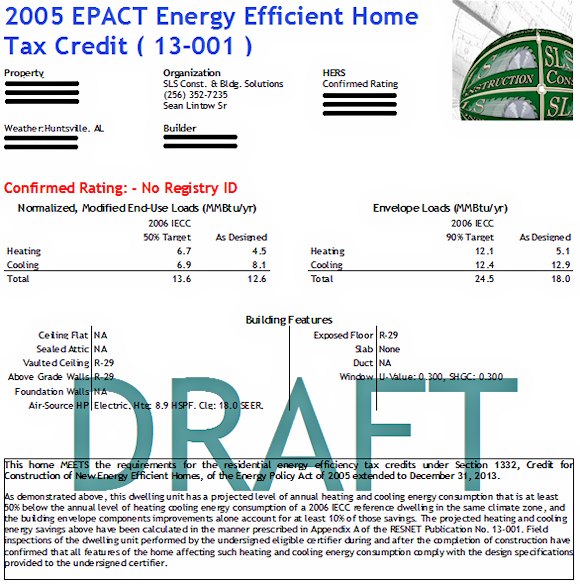

45l tax credit certification. A contractor is not required to file the certification with the return on which the credit is claimed. Importantly, the certification will be treated as satisfying the requirements of section 45l(c) if all the construction has been performed in a manner consistent with. The 45l credit is federal tax incentive that promotes the construction of energy efficient residential buildings.

Under section 45l, eligible builders with qualified. The 45l was established to help and encourage builders, manufacturers and developers to construct more “energy efficient” buildings. What is the process to file for the 45l tax credit?

The certification will be treated as satisfying the requirements of section 45l(c) if all the construction has Any unused credits can be carried over for up to 20 years. You can claim the 45l tax credit retroactively, although you can only claim the credit for properties that have been built or remodeled in the past three years.

45l energy efficient dwelling unit tax credits if you develop, build or own energy efficient residential dwelling units, you could earn tax credits of $2,000 per unit. This incentive was a program enacted back in 2006, and. An eligible contractor must obtain a certification that the dwelling unit meets the requirements of section 45l(c) from an eligible certifier before claiming the section 45l credit.

An eligible taxpayer must obtain a certification that the dwelling unit meets the requirements of section 45l(c) from an eligible certifier before claiming the section 45l credit. To qualify for the $2,000 tax credit, an eligible “dwelling” must: Asset environments can assess and qualify.

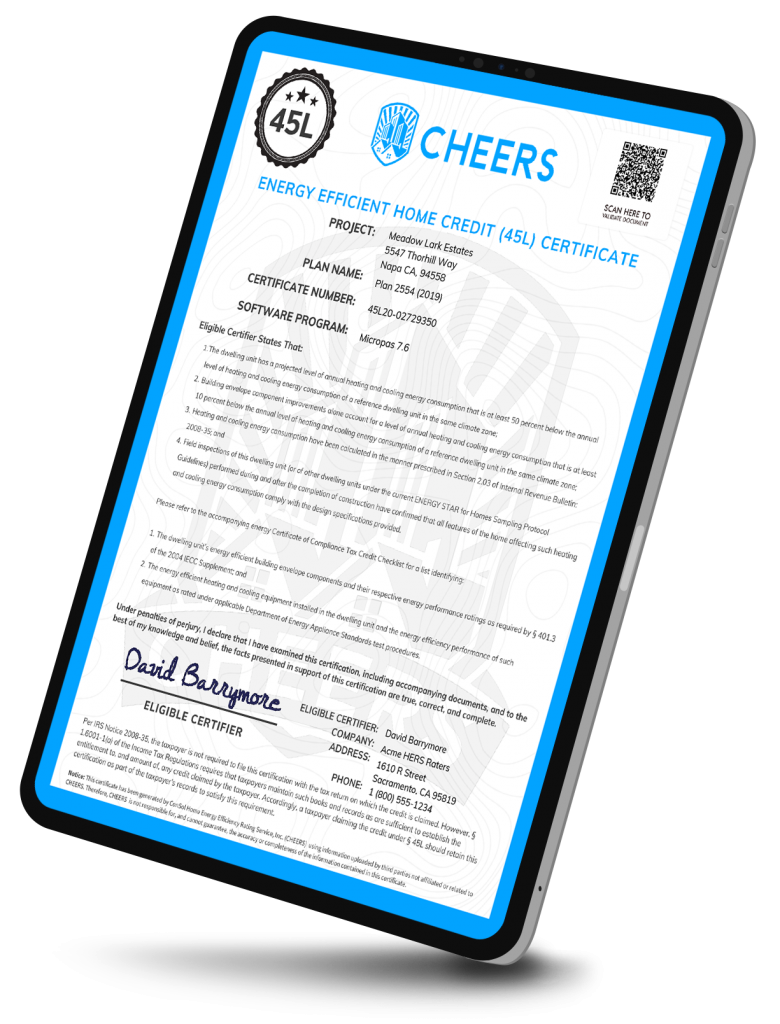

The leader in 45l tax credit certification support service including energypro 45l software, raters services and free 45l plan reviews. 45l energy efficient tax credit. Through recent passage of a new tax extenders bill, the energy efficient home credit (the 45l credit) which provides eligible contractors with a $2,000 tax credit for each energy efficient dwelling unit, is retroactively available for projects placed in service from 2018 to 2020, and through the end of 2021.

Internal revenue code 45l provides a tax credit for an eligible contractor who constructs a qualified energy efficient home. The 45l program is the best kept secret among developers and builders! The credit is available to builders, developers and others who build homes for sale or lease.

The tax credit was retroactively extended in late 2019 for 2018 and 2019 through the end of 2020. In most cases, the eligible certifier is the project’s hers rater that. To qualify for the $2,000 tax credit, an eligible “dwelling” must:

Construction or rehabilitation of a unit must be substantially completed after august 8, 2005 and the until sold or leased before the end of 2016. The credit is available to builders, developers and others who build homes for sale or lease. Be at least 50% more efficient than the 2006 iecc benchmark.

The term 45l comes from the federal statute called, us code 26 subsection 45l. The 45l credit is federal tax incentive that promotes the construction of energy efficient residential buildings. To qualify for the $2,000 tax credit, eligible dwelling units must be certified to meet or exceed the required energy efficiency benchmarks, and then sold or leased no later than december 31, 2021.

The contractor must obtain certification from an independent certifier that must be accredited or authorized by a rating network like the residential energy services network (resnet) and approved by the irs. Certified properties quality for a $2,000 tax credit per unit. The 45l credit is claimed on irs form 8908.

A contractor must obtain the certification required under § 45l(c)(1) with respect to a dwelling unit (other than a manufactured home) from an eligible certifier before claiming the energy efficient home credit with respect to the dwelling unit.

45l Tax Credit - Cheers

The Energy Efficiency Home Credit 45l

45l Tax Credit Services Using Doe Approved Software

Dpis Builder Services 45l Energy Efficiency Tax Credit

The Home Builders Energy Efficient Tax Credit An Faq

2

45l Tax Credit - Cheers

2

45l Tax Credit Certificates Now Available In The Cheers Registry - Youtube

45l The Energy Efficient Home Credit

Is It Too Late To Take Advantage Of The 45l Tax Credit Cost Segregation Authority

45l Tax Credit Powerpoint Show 2016

Free Webinar Tax Incentives For Energy Efficient Designers

Requirements To Claim The 45l Home Energy-efficient Tax Credit Engineered Tax Services

31 Best Rebates And Understanding Title 24 Ideas Understanding Energy Consulting Energy

Certifications - Tacoma Energy

45l Tax Credit Services For Energy Efficient Homes - Cheers 45l

45l Tax Credit Energy Efficient Tax Credit 45l

45l Tax Credit Extended For 2021 Homes - Ducttesters Inc