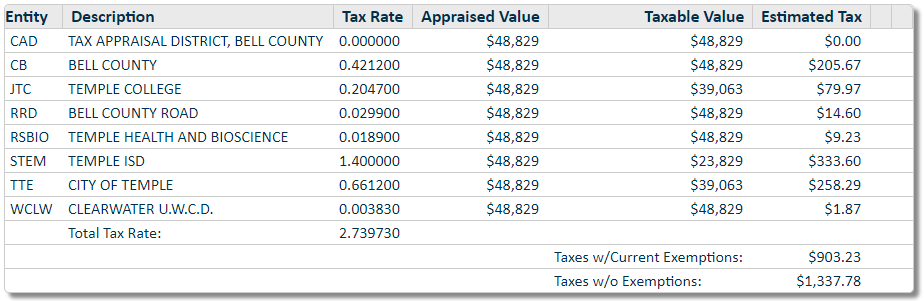

As you can see, taxes can vary a great deal depending on where you are in the state. A real estate experts shares tips for getting your appraisal lowered.

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune

The bill would replace the lost property tax dollars.

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How to lower property taxes in texas. Applications for property tax exemptions are filed with appraisal districts. Forecasting your texas business property tax. Governor dan patrick — would allow the state to use $2 billion in projected budget surplus money to.

Texas property tax useful information. To reduce this expense, property owners should annually review and consider appealing property taxes. The average property tax rate in texas is 1.80%.

The general deadline for filing an exemption application is before may 1. If you get a reduction, but not under the cap, you owe us nothing! Property taxes in texas are calculated based on the county you live in.

With the two chambers unable to reach an agreement on the senate’s priority bill to reduce property tax rates, texas lawmakers started. Exemptions from property tax require applications in most circumstances. Lower property taxes in texas with a property tax exemption the most reliable method of lowering taxes is by qualifying for a property tax exemption.

Look for local and state exemptions, and, if all else fails, file a tax appeal to lower your property tax bill. The three factors are used by the county appraisal district to calculate the property tax. The tax rate that is applied to the taxable value.

To build an estimate, you’ll need three pieces of information: Now, more than ever, it’s important to employ property tax reducing strategies to offset the higher property values. Appraisal district chief appraisers are responsible for determining whether or not property qualifies for an exemption.

The legislation — a priority of lt. The formula they use follows: The district's total tax rate would drop from $1.41 per $100 of taxable value to $1.33.

Exemptions for homestead, over 65 homestead, disabled homestead and disabled veteran are just the start. Increases in property appraisals means an increase in property tax for texas residents. Now that you’ve filed your texas returns for this year, you need to forecast next year’s tax liability.

One strategy that can help you lower your taxes is applying for property tax exemptions, and the veterans’ exemption is one of them. The taxing authorities multiply the taxable value of your property by the tax rate to arrive at the tax you'll owe. To use this information for next year’s forecast, age them an additional year, and re.

In jefferson county texas, property taxes average around $1,800 for homes with a median value of $101,000 and a tax rate of 1.78%, and in williamson county texas, the property tax value is around $4,600 when the tax rate is 2.03% for a home appraised at $227,000. The texas legislature has provided numerous property tax exemptions for texas taxpayers. For example, a tax rate of 1.8% applied to an appraised value of $200,000 works out to more than 1.8% of an.

Breaking this out in dollars, if your home is valued at $200,000, your personal property taxes at the average rate of 1.80% would be $3,600 for the year. It exempts at least $25,000 of a property’s value from taxation. Cutting your property taxes in.

Texas property taxes can be reduced by legitimate use of. There is no fee unless you save actual tax dollars. King county collects the highest property tax in texas, levying an average of $5,066.00 (1.56% of median home value) yearly in property taxes, while terrell county has the lowest property tax in the state, collecting an average tax of $285.00 (0.67% of median home value) per year.

The exact property tax levied depends on the county in texas the property is located in. There are a number of exemptions that help lower your property taxes in texas. Imagine that the taxable value of your property is $300,000 and the tax rate is $10 for every $1,000 of taxable value.

The most common is the homestead exemption, which is available to homeowners in their primary residence. The value of your current assets, including the costs, classifications, and acquisition dates. Property taxes are a substantial expense for texas homeowners, averaging about $3,600 annually.

Assessed value minus exemptions = taxable value. Property tax creep is not a figment of your imagination. Whether you are eligible for a certain exemption depends on the requirements within your county.

Property tax exemptions are one of the most meaningful and simple ways to reduce property taxes. A property tax exemption may reduce the taxable value of the property. Your property tax for the year will be $3,000 (300 x $10 = $3,000).

Lower my texas property taxes in the news. If we can’t lower your property taxes, you owe us nothing! The state relies heavily on property taxes to make ends meet.

An average homeowner in texas pays around $3,390 in property taxes a year.

Lower My Texas Property Taxes

Highest Property Taxes In Texas Why Are Property Taxes So High In Texas Tax Ease

Tac - School Property Taxes By County

The Long Long History Of The Texas Property Tax

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

Why Are Texas Property Taxes So High Home Tax Solutions

Lower My Texas Property Taxes

Tac - School Property Taxes By County

Texas Property Tax Reductions - Home Facebook

/https://static.texastribune.org/media/files/b906b80467cec17d09ef438a570ef45c/day2-prop-tax-art.png)

Texas Property Tax Relief Bills Wouldnt Cut Tax Bills Or Local Revenues The Texas Tribune

Everything You Need To Know About Fort Hood Tx Property Taxes

Texas Property Tax Reductions - Home Facebook

Tac - School Property Taxes By County

How To Protest Your Property Taxes In Texas - Home Tax Solutions

Property Taxes In Texas - What Homeowners Should Know

/https://static.texastribune.org/media/files/7eaf54967fd9e1e99018c3430a2e7340/Aerial%20Suburbs%20JV%20TT%2002.jpg)

Texas Legislature Sends Property Tax Constitutional Amendment To Voters The Texas Tribune

Lower My Texas Property Taxes

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Heres A Primer The Texas Tribune

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

/https://static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG)