Registration renewals (license plates and registration stickers) vehicle title transfers. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property.

Sweet Swede For The Safety Conscious Who Dont Want To Drive A Boring Car Heres A Beautiful 2012 Volvo S60 T5 Fwd Luxury Used Cars Cars For Sale Volvo S60

A texas homeowner is a veteran of the u.s.

Parker county texas tax appraisal office. For information about valuation on personal or business property, property tax exemptions, to request an extension or to protest a value, parker county residents need to contact the parker county appraisal district: You can contact the parker county assessor for: The parker county assessor is responsible for appraising real estate and assessing a property tax on properties located in parker county, texas.

Change of address on motor vehicle records. The district appraises property according to the texas property tax code and the uniform standards of professional appraisal practices (uspap). This tax office does not collect property taxes.

45th st corsicana, texas 75110. The parker county tax assessor is the local official who is responsible for assessing the taxable value of all properties within parker county, and may establish the amount of tax due on that property based on the fair market value appraisal. The office also provides boat registrations;

The parker county assessor's office can help you with many of your property tax related issues, including: Parmer county appraisal district is responsible for appraising all real and business personal property within parmer county. Office information for the parker county, texas property appraiser name:

Information on your property's tax assessment; Appealing your property tax appraisal; Acrevalue helps you locate parcels, property lines, and ownership information for land online, eliminating the need for plat books.

Armed forces and their service branch or the veteran's administration has officially classified. To appeal the parker county property tax, you must contact the parker county tax assessor's office. Alabama alaska arizona arkansas california colorado connecticut delaware florida georgia hawaii idaho illinois indiana iowa kansas kentucky louisiana maine maryland massachusetts michigan minnesota mississippi missouri montana nebraska nevada new.

The acrevalue parker county, tx plat map, sourced from the parker county, tx tax assessor, indicates the property boundaries for each parcel of land, with information about the landowner, the parcel number, and the total acres. Or contact us and we’ll get back to you. 1108 santa fe dr weatherford, texas 76086.

Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. Taxnetusa offers solutions to companies that need delinquent property tax data in one or more counties, including parker county, tx, and want the data in a standard form. Delinquent tax data products must be purchased over the phone.

As a property owner, you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the parker county tax assessor's office is incorrect. These records can include parker county property tax assessments and assessment challenges, appraisals, and. The williamson central appraisal district is located at 625 fm 1460, georgetown tx.

Disabled veteran exemption a texas homeowner qualifies for a county appraisal district disabled veteran exemption if:. Download disabled veteran exemption form; Fisher county appraisal district is responsible for appraising all real and business personal property within fisher county.

Parker county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in parker county, texas. 1112 santa fe dr., weatherford, tx 76086 The district appraises property according to the texas property tax code and the uniform standards of professional appraisal practices (uspap).

The parker county assessor's office, located in weatherford, texas, determines the value of all taxable property in parker county, tx. We have a new website! The williamson central appraisal district is a separate local agency and is not part of williamson county government or the williamson county tax assessor’s office.

Parker County Appraisal District - How To Protest Property Taxes

The Effects Of Drought Stress And Type Of Fertiliser On Generalist And Specialist Herbivores And Their Natural Enemies - Shehzad - 2021 - Annals Of Applied Biology - Wiley Online Library

Cherokee Male Seminary Cherokee History Native American Ancestry Trail Of Tears

Pin On Tech Tools For Teaching And Learning

Armstrong Selected As New Parker County Chief Appraiser Local News Weatherforddemocratcom

Shop Cheap Online Store Canopus Hand Operated Mini Drone Quad Induction Levitation Ufo 360 Indoor Dr For Sale Online Sale Cheap Online Shop -aksarapubliccom

Parker County Appraisal District - How To Protest Property Taxes

Parker County Appraisal District

Parker County Appraisal District

Shade Gappa Pennsylvania History Historical Marker Altoona

Why Are Texas Property Taxes So High Home Tax Solutions

How To Protest Your Property Taxes In Texas - Home Tax Solutions

Bonnie Clyde Bonnie And Clyde Photos Bonnie Bonnie And Clyde Death

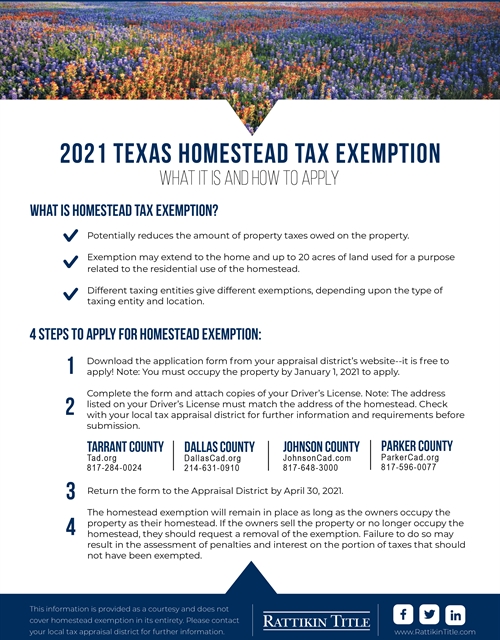

2021 Texas Homestead Tax Exemption

Pin On Afrotexan - Fort Worth Tx

Home Comanche Nation Quanah Quanah Parker Native Texan

Ccn Mapping Information

How To File Your Texas Homestead Tax Exemption - League Real Estate

Lake Street Theatre - Oak Park Illinois Il Photo Oak Park Chicago Oak Park Places In Chicago