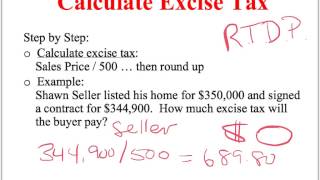

The title of the article, excise stamp on conveyances, was changed to replace the word stamp with the word tax. the change was necessary due to the repeal of the statute requiring issuance of conveyance stamps. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home.

Wake County North Carolina Property Tax Rates 2020 Tax Year

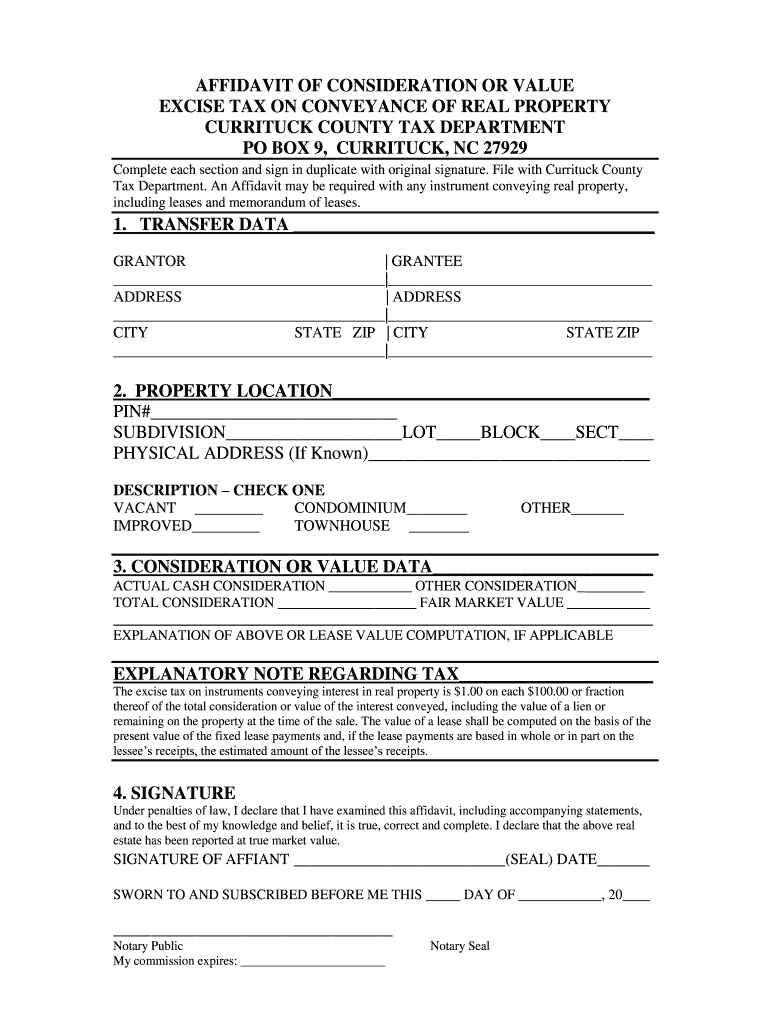

When ownership in north carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property.

Excise tax nc real estate. This article applies to every person conveying an interest in real estate located in north carolina other than a governmental unit or an instrumentality of a governmental unit. Dollars per $100 of assessed value. The tax amount is based on the sale price of the home and varies by state and local government.

The state of north carolina charges an excise tax on home sales of $2.00 per $1,000.00 of the sales price. Easily calculate the north carolina title insurance rates and north carolina property transfer tax; North carolina real estate transfer taxes:

1 week ago oct 21, 2021 · when ownership in north carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property. North carolina real estate principles and practices, 7th edition revised Such property is both an interest in real estate, and personal property.

It’s primarily paid by businesses and merchants, who then apply it to the cost of their product, but there are a few cases where a consumer will pay an excise tax related to real estate or their retirement fund. Transfer taxes in north carolina are typically paid by the seller. This article applies to every person conveying an interest in real estate located in north carolina other than a governmental unit or an instrumentality of a governmental unit.

Published by ka plan real estate education, 2017 (8 30 page text). 63a am.jur.2d, property, § 23. When ownership in north carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property.

The grantor must pay the real estate excise tax at the time of recording. Your property has an assessed value of $80,000. When ownership in north carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property.

First thing you’re gonna have to pay is the mecklenburg county register of deeds or the excise tax. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home. Property taxation in north carolina.

Excise tax on conveyances article 8e of chapter 105 of the north carolina general statutes general information excise tax is a state tax computed at the rate of $1.00 on each $500.00 or fractional part thereof of the consideration or value of the interest conveyed payable by the seller at the time of recording. Shipping costs and state sales taxes may also apply. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home.

How are tax rates for real estate expressed in north carolina? This title insurance calculator will also estimate the nc land transfer tax where applicable this calculator is designed to estimate the closing costs for one to four family residences and condominiums. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home.

It's paid by the seller to the escrow agent or the attorney responsible for closing the deal, who then pays it to the government. Not exclusive to real estate, excise taxes are paid on most goods produced within a country. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home.

The state of north carolina charges an excise (transfer) tax on home sales of $2.00 per $1,000 of the sales price. Is the conveyance of such property the transfer of lands, tenements or other realty, in the words of the statute? According to the nc register of deeds, an excise tax is levied on each instrument by which any interest in real property is conveyed to another person. this means that when you sell your home, you have to pay this tax at closing to the state of north carolina.

The quoted language of the statute comes directly from the former federal law. The required recording fees must be paid before recording all documents. The excise tax is usually paid by the.

So this is $2 per thousand of the sales price of the property. Includes nc real estate license law, commission rules, and license law and rule comments in appendices. The tax rate is $2.00 per $1,000 of the purchase price of the real estate.

When ownership in north carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property. That is just a tax that you pay to mecklenburg county for you selling your property. Total real estate commission is typically between 5% and 6% of the total purchase price (between 2.5% and 3% for each agent).

Customarily called excise tax, or revenue stamps.

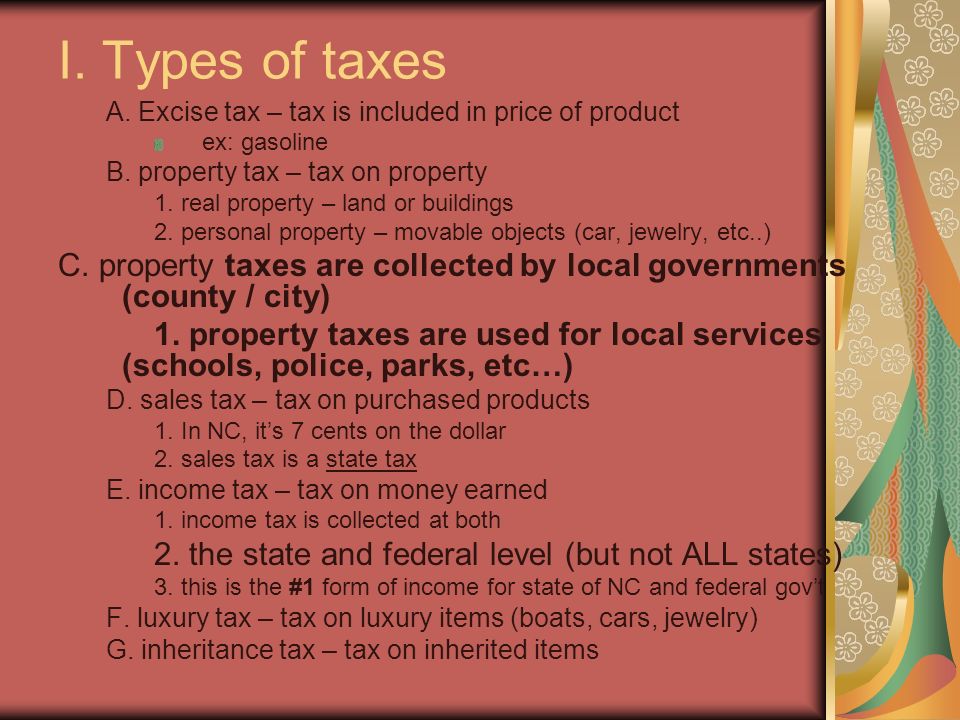

Taxes Notes I Types Of Taxes A Excise Tax Tax Is Included In Price Of Product Ex Gasoline B Property Tax Tax On Property 1 Real Property Land - Ppt Download

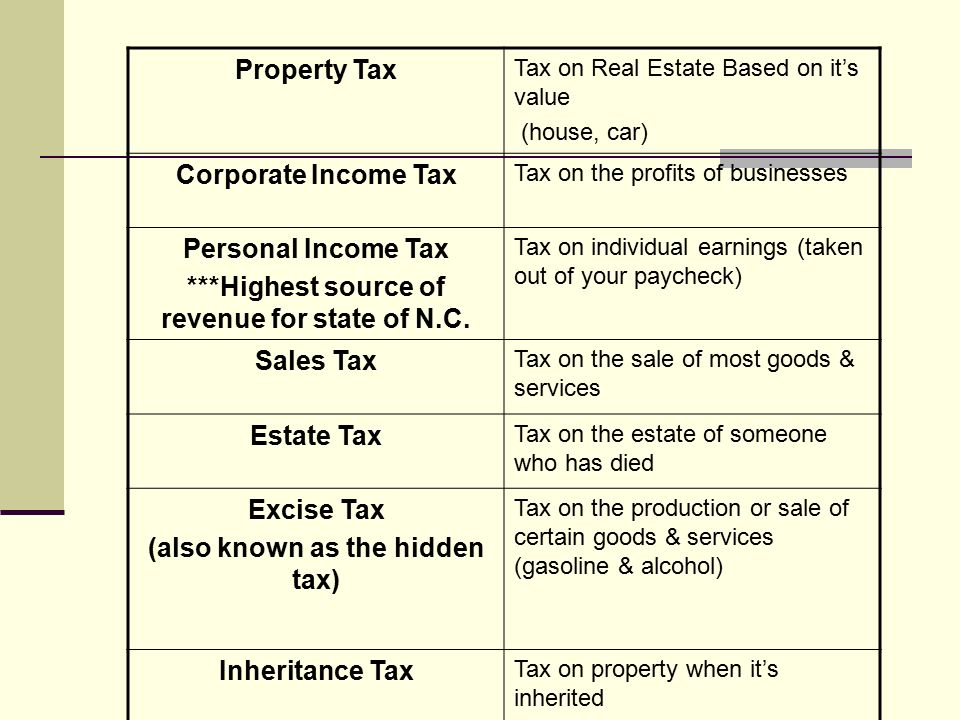

State Local Taxes And Services Property Tax Tax On Real Estate Based On Its Value House Car Corporate Income Tax Tax On The Profits Of Businesses - Ppt Download

Nc Affidavit Of Consideration Or Value Excise Tax On Conveyance Of Real Property - Fill And Sign Printable Template Online Us Legal Forms

Pdf Tax Systems And Tax Harmonisation In The East African Community Eac

Calculating Excise Tax - Help With Closing Statments - Youtube

Proposed Increase In Real Estate Excise Tax Results In Outpouring Of Public Input News Dailyrecordnewscom

Excise Tax Real Estate Exam Prep For North Carolina - Youtube

Gdkqrrylag7n1m

Wake County North Carolina Property Tax Rates 2020 Tax Year

Real Estate Transfer Taxes - Deedscom

Historical North Carolina Tax Policy Information - Ballotpedia

Proposed Increase In Real Estate Excise Tax Results In Outpouring Of Public Input News Dailyrecordnewscom

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

North Carolina Real Estate Transfer Taxes An In-depth Guide For 2021

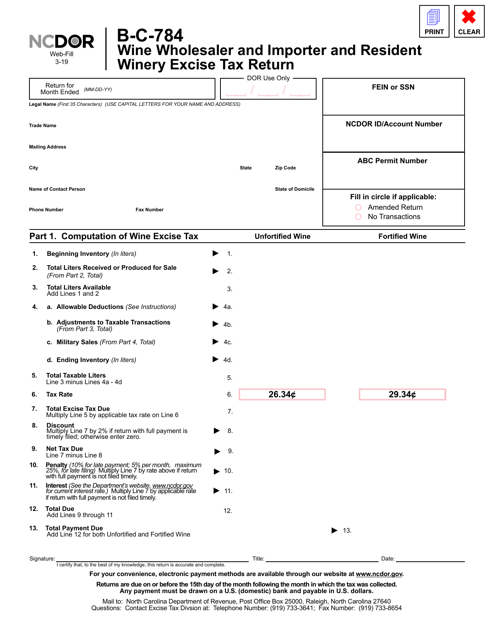

Form B-c-784 Download Fillable Pdf Or Fill Online Wine Wholesaler And Importer And Resident Winery Excise Tax Return North Carolina Templateroller

Calculating Excise Tax - Help With Closing Statments - Youtube

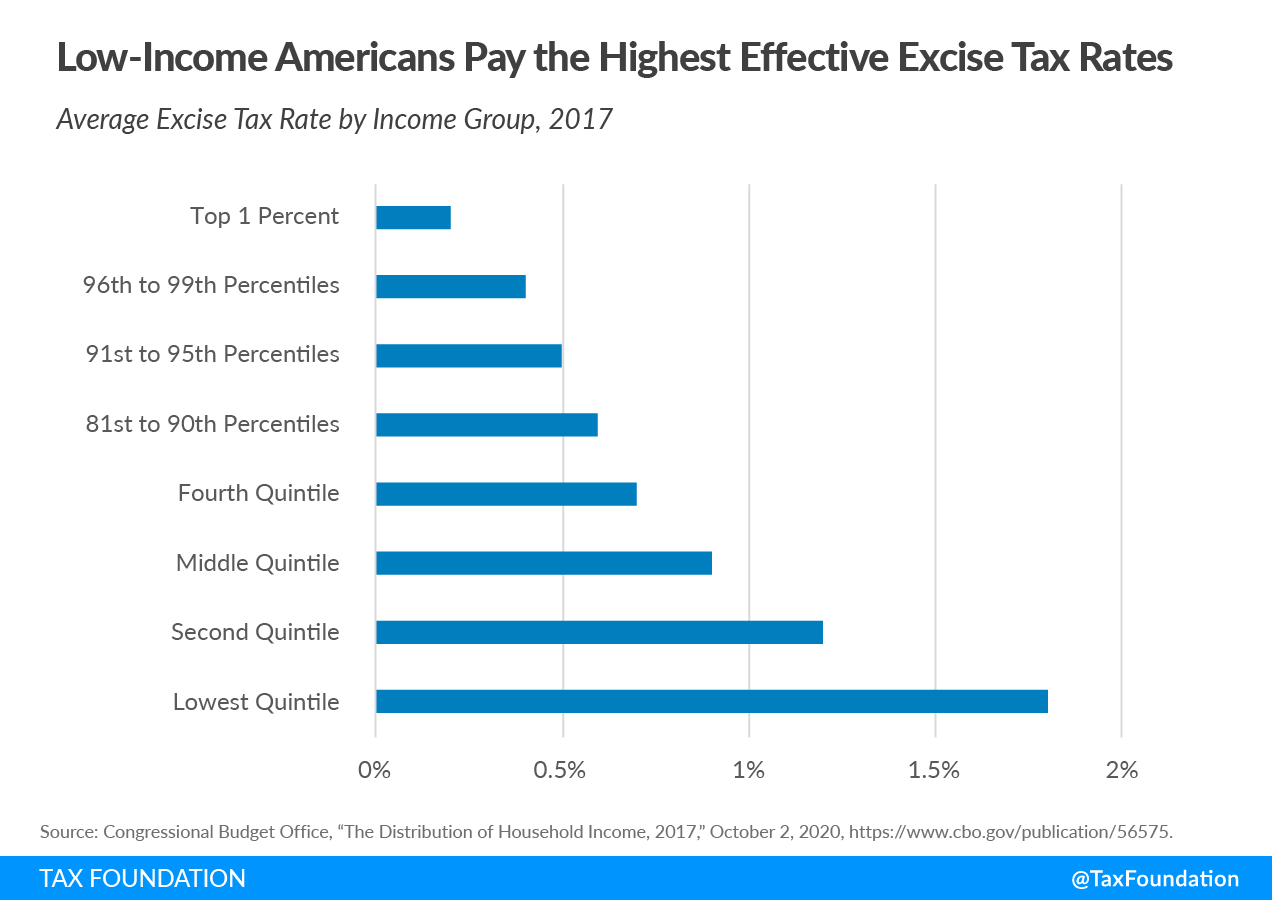

Excise Taxes Excise Tax Trends Tax Foundation

State Property Taxes Reliance On Property Taxes By State

All Veteran Property Tax Exemptions By State And Disability Rating