Paid family leave benefits, available to employees as of january 1, 2018, may be financed by. Payroll deduction for ny’s paid family leave starting july 1st.

The Deficit Myth Theories Myths Book Club Books

3) complete the employer portion of the paid family leave request form when a worker applies for leave.

Ny paid family leave tax deduction. 2) collect employee contributions to pay for their coverage; Keep in mind the contribution is subject to change each year. The goal amount depends on the number of weeks left in 2017;

If you are eligible for paid family leave, you pay for these benefits through a small payroll deduction equal to 0.511% of your gross wages each pay period. New york designed paid family leave to be easy for employers to implement, with three key tasks: The maximum contribution is $196.72 per employee per year.

The weekly contribution rate for new york paid family leave is 0.511% of the employee's weekly wage (capped at new york state's current average weekly wage of $1,450.17). If you are eligible for paid family leave, you pay for these benefits through a small payroll deduction equal to 0.270% of your gross wages each pay period. The maximum annual contribution is $385.34.

New york offers a pfl calculator on its website to help determine the payroll deduction amount. How the nypfl tax deduction works: Based upon this review and consultation, we offer the following guidance:

Workers will start paying into the fund on oct. In 2021, the contribution is 0.511% of an employee’s gross wages each pay period. New york paid family leave is insurance that may be funded by employees through payroll deductions.

These contributions are separate and distinct from one another and may be funded by employees through payroll deductions. As of january 1, 2018, the 0.126% rate will be automatically deducted for all eligible employees. 1) obtain paid family leave coverage;

No deductions for pfl are taken from a businesses tax contributions. In 2020, these deductions are capped at the annual maximum of $196.72. Use the calculator below to view an estimate of your deduction.

For 2021, the contribution rate for paid family leave will be 0.511% of the employee’s weekly wage (capped at the new york Use the code other mandatory deductible state or local tax not on above list thanks. Will see a new deduction on their paychecks starting today.

The state of new york communicated paid family leave rates and initial payroll deduction guidance on june 1, 2017. Effective from july 1, 2017, to dec. The maximum annual contribution is $385.34 per employee.

Withhold 0.511% of each eligible employee’s wages. New york state paid family leave; Therefore, a maximum contribution of $7.41 per week per employee in 2021, regardless of age, gender, or

Contribution rate for paid family leave in 2020 is 0.270% of the employee’s weekly wage (capped at new york’s current average annual wage of $72,860.84). June 7, 2019 4:17 pm. Average weekly wage of $1,450.17).

Tax treatment of family leave contributions and benefits under the new york program. State governments do not automatically withhold paid family leave federal tax from an employee’s pfl benefits. Paid family leave act rates are set by new york state and are state mandatory.

An employee’s wages are capped at $1,305.92 per week, which means the. New york made headlines last year when it announced the passage of the nation’s strongest family leave plan, known as the new york state paid family leave program. This will help fund the state's paid family and medical leave law.

The weekly contribution, determined by the state, is by employee and is 0.126% of an employee’s weekly wage. Employees can request voluntary tax withholding The weekly contribution rate for new york paid family leave is 0.511% of the employee's weekly wage (capped at new york state's current.

The 2021 contribution rate for ny family leave is 0.511%. The new york department of financial services announced that the 2021 paid family leave (pfl) payroll deduction rate will increase to 0.511% of an employee's gross wages each pay period, up from 0.270% for 2020. Now, after further review, the new york department of taxation and finance has provided important guidance regarding payroll deduction and pfl taxation.

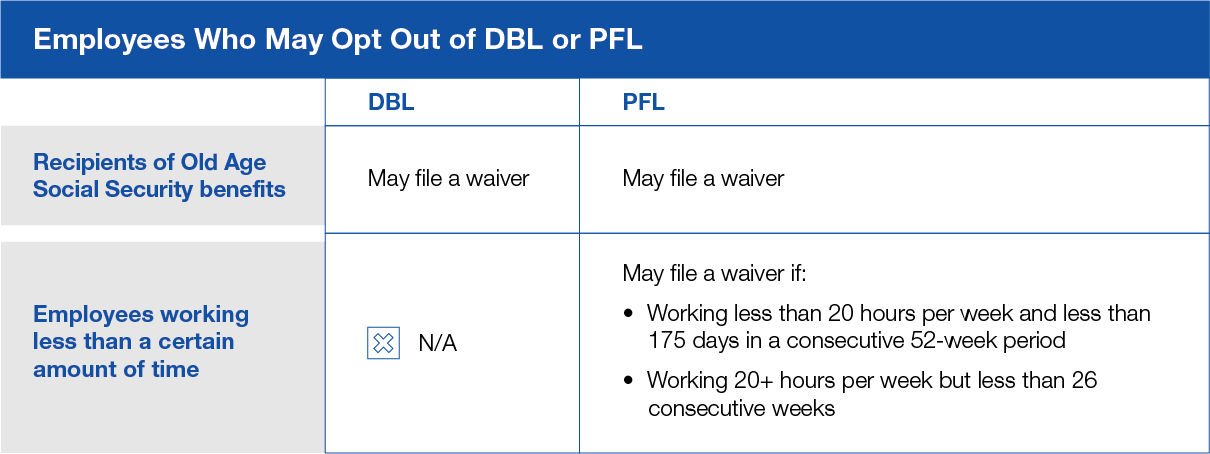

An employer is allowed, but not required, to collect contributions from its employees to offset the cost of providing disability and paid family leave benefits.

Salary Taxes Social Security

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released

Tax Deductions For Therapists 15 Write-offs You Might Have Missed

The Irs And Incontinence Supplies Home Care Delivered

Can An Employee Opt Out Of Paid Family Leave The Standard

Record Keeping Tax Deduction Family Child Care Provider Clearinghouse

Its Tax Season Will My Alimony Be Tax Deductible In 2021

Paid Family Leave Ny Pfl Adp

How Much Tax Is Deducted From A Paycheck In Ny Cilenti Cooper - Overtime Lawyers In Ny

What Are Tax Deductions The Turbotax Blog

Home Business Tax Deductions - Keep What You Earn - Legal Book - Nolo

Tax Strategies For Parents Of Kids With Special Needs - The Autism Community In Action Taca

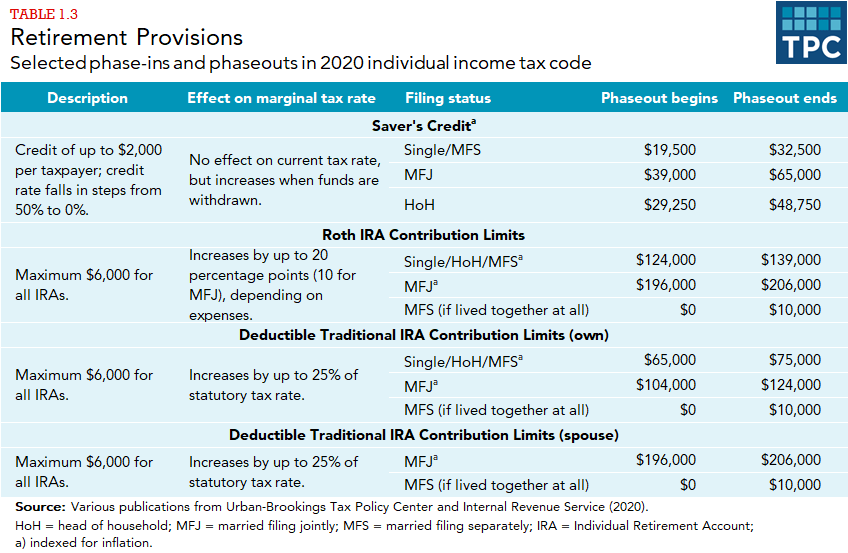

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Cost And Deductions Paid Family Leave

Tax Deductions All Bloggers Should Be Making Tax Deductions Make Money Blogging Deduction

Tax Deductions For Professionals - Legal Book - Nolo

Child Benefit Graphic Finland Vs Us Family Medical School Reform Finland

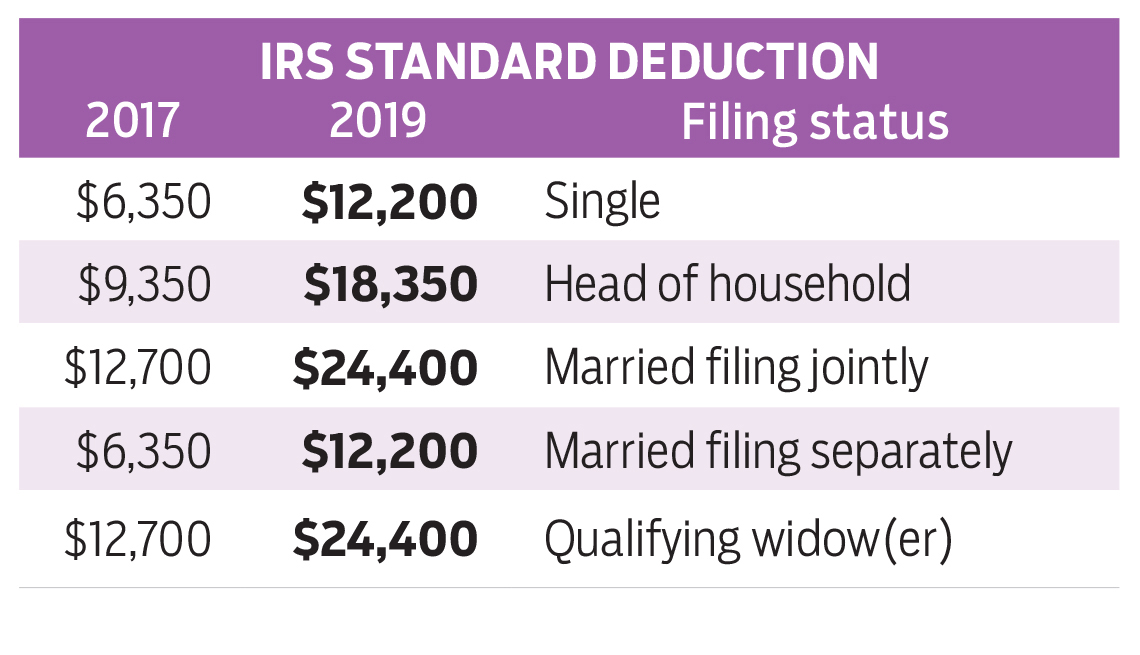

What Is Schedule A Hr Block

Give To Charity But Dont Count On A Tax Deduction