Winning bidders then pay the outstanding tax. Tax relief & tax freeze:

Williamson County Illinois Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

The median property tax on a $87,600.00 house is $919.80 in the united states.

When are property taxes due in williamson county illinois. How does a tax lien sale work? All 102 counties in illinois are. Online payments are only available during a portion of the tax collection period.

Of this amount, $3,241,359.49 (or approximately 11.9%) will go to franklin county government. See detailed property tax report for 4133 lagrande trce, williamson county, il. • applicant must be 65 years old as of june 1st of the tax year claimed.

Joab goodall was named overseer of the poor in 1840 and. Will county sits to the south of dupage and cook counties and is home to one of the largest cities in the state, joliet. The payment is void if made by a check which is not honored by the bank.

I have applied for and thought that i received the senior freeze exemption; 3% penalty on 1st installment, 1.5% penalty on 2nd installment; The county treasurer conducts a sale of the unpaid taxes every year for the property in delinquency.

Professional tax buyers and private citizens bid on the right to buy the delinquent taxes on individual parcels of property. • total household income $55,000.00. The average effective property tax rate in the county is 2.64%, more than double the.

Online payments will be available again starting approximately may 31, 2020 and ending november 27, 2020 at 4:00 p.m. Be sure to enclose the 1st or 2nd installment stub to insure the proper credit. The certificate is then auctioned off in williamson county, il.

The median property tax in williamson county, illinois is $1,213 per year for a home worth the median value of $87,600. The buyer of the tax lien has the right to collect the lien, plus interest based on. The average homeowner in lake county pays $7,347 in property taxes annually.

Counties in illinois collect an average of 1.73% of a property's assesed fair market value as property tax per year. Williamson county treasurer 407 n. When will the 2020 payable 2021 tax bills be mailed?

Williamson county collects, on average, 1.38% of a property's assessed fair market value as property tax. 2021 property tax statements will be mailed the week of october 18th. Monroe st., suite 104 marion, il 62959.

Once the tax sale is complete, the county clerk is responsible for receiving payment of delinquent taxes. However, we are happy to arrange alternative ways to submit your application. Property owners who have their taxes escrowed by their lender may view their billing information using our search my property program.

Tax relief appointments are being honored. If you qualify, but have not received credit, call or visit the supervisor of. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

When you register an account, you are able to enjoy the benefits of the following information being stored: Under illinois law, areas under a disaster declaration can waive fees and change due dates on property taxes. Pay property taxes online in williamson county, illinois using this service!

Tax bills were mailed on july 23, 2021. Payment can be made by: The median property tax in illinois is $3,507.00 per year for a home worth the median value of $202,200.00.

• proof of house insurance This policy is powered by trust guard pci compliance scans. Illinois has one of the highest average property tax rates in the country, with only six states levying higher property taxes.

For the 2013 tax year, the total county tax extension is $27,260,419.67. In most cases this year, tax rates have increased. Illinois is ranked 1156th of the 3143 counties in the.

Please call our tax relief specialists at. Yearly median tax in williamson county. Late penalties for the first installment began to be assessed on august 20, 2021 and late penalties for the second installment began to be assessed on october 20, 2021.

You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report. The median property tax on a $87,600.00 house is $1,208.88 in williamson county. The median property tax on a $87,600.00 house is $1,515.48 in illinois.

How could my tax bill go up? The senior freeze exemption does freeze the assessment, but it does not freeze the tax rates. Property taxes in will county are well above both the state and national averages.

The county home law was renewed in 1935 and 1945. • maximum shall not exceed $5,000.00 per taxpayer per year. 2021 property taxes must be paid in full on or before monday, january 31, 2022, to avoid penalty and interest.

Check your tax bill for owner occupied and senior citizens exemptions. A $10.00 cost will be added for certified mail/advertising for each delinquent tax bill. The remaining $24,000,000 will go to the other taxing districts located throughout the county.

Williamson county was formed in late 1839, and during the year of 1840, the williamson county court appointed overseers of the poor, and up to 1861, when the county bought the poor farm, there were a great many sickly people in the county.

Commissioners - Williamson County Illinois

59- Acres Williamson County Il Farmland Farm Tillable Barn Timber 2400l - Buy A Farm Land And Auction Company

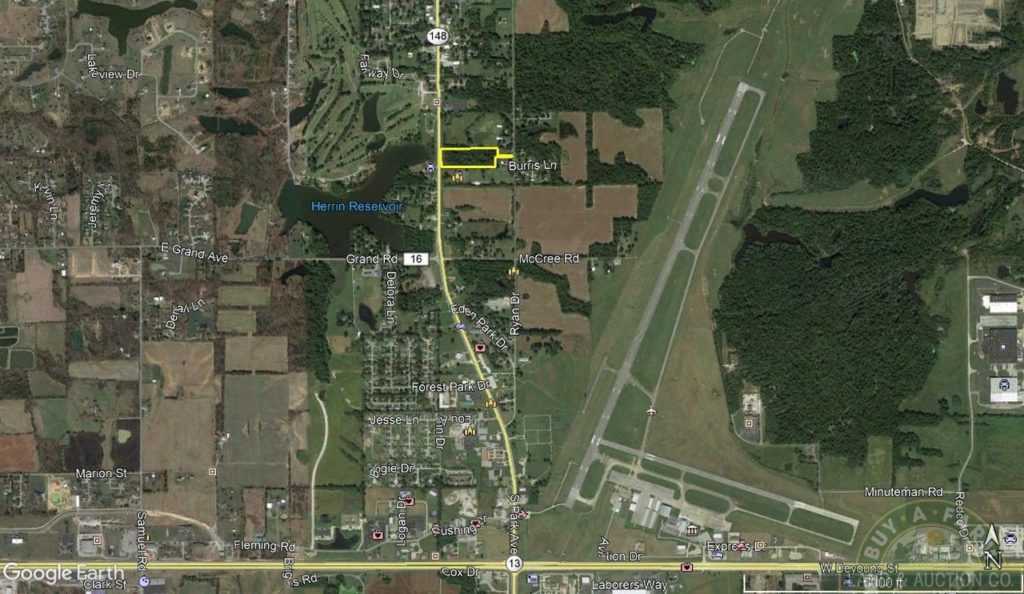

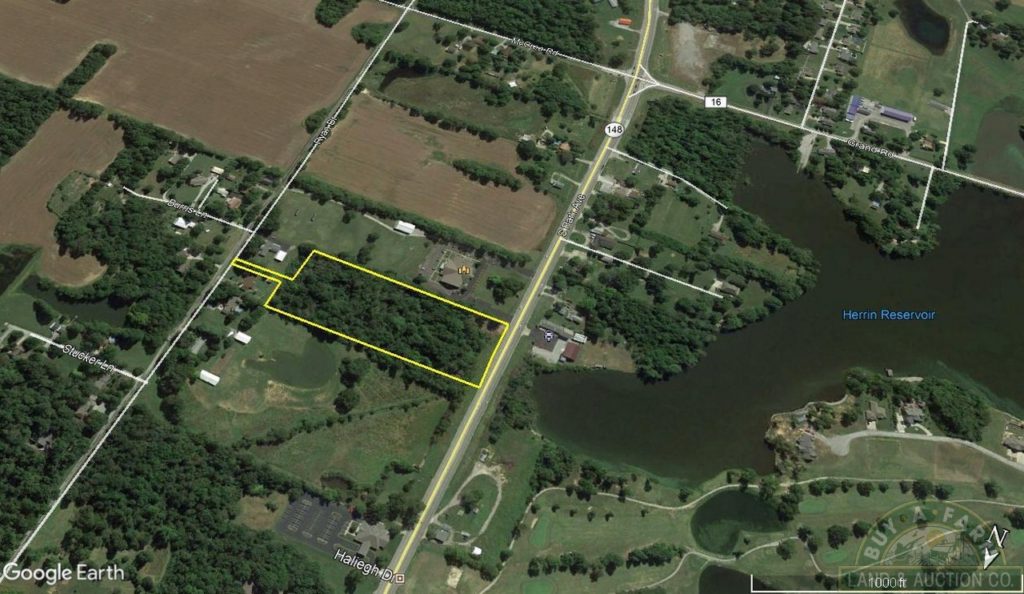

Online Land Auction Williamson County Il 9- Acres Wooded Home Building Site 1 Tract 2717a - Buy A Farm Land And Auction Company

History - Williamson County Illinois

Williamson County Illinois Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

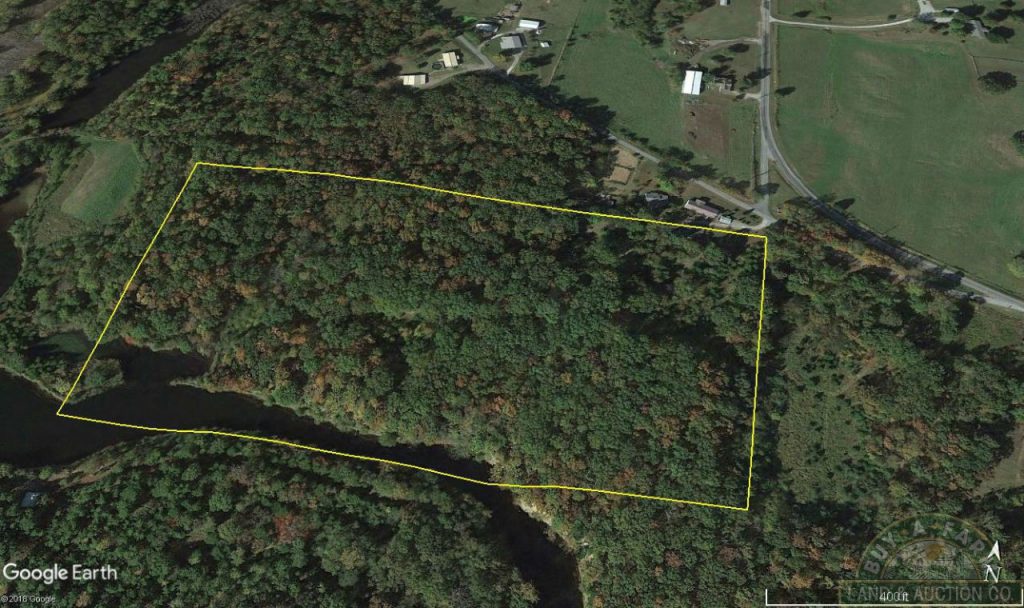

20- Acres Williamson County Il Wooded Strip Lake Hunting 2292l - Buy A Farm Land And Auction Company

Williamson County Illinois Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Williamson County Illinois Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Williamson County Illinois Detailed Profile - Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Supervisor Of Assessments - Williamson County Illinois

Illinois Property Taxes By County - 2021

Online Land Auction Williamson County Il 9- Acres Wooded Home Building Site 1 Tract 2717a - Buy A Farm Land And Auction Company

Online Land Auction Williamson County Il 9- Acres Wooded Home Building Site 1 Tract 2717a - Buy A Farm Land And Auction Company

Elections - Williamson County Illinois

Cook-county Property Tax Records - Cook-county Property Taxes Il

Pre Payment - Williamson County Illinois

In Illinois How Are My Property Taxes Determined

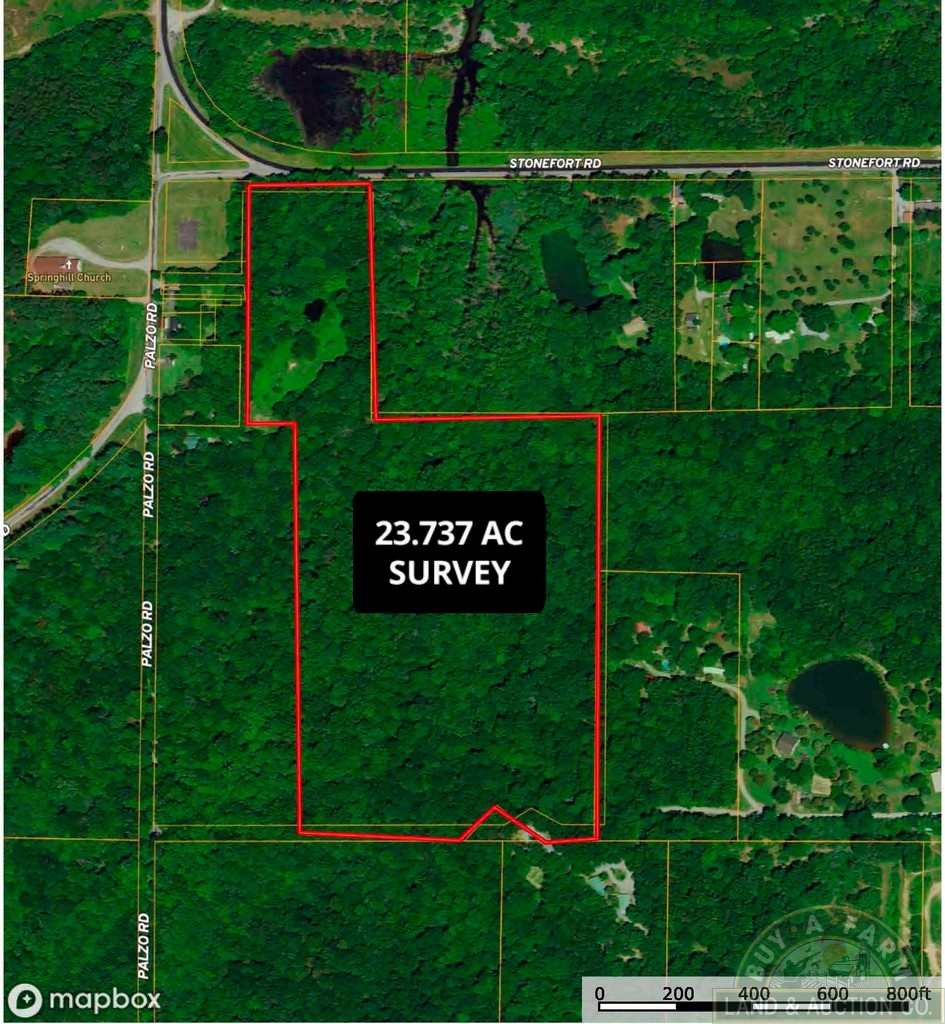

For Sale 24- Acres Williamson County Il Deer Turkey Hunting 2757l - Buy A Farm Land And Auction Company

Circuit Clerk - Williamson County Illinois