Using this option, employers benefit from tax deductions, but employees end up paying higher taxes. Cost of paying the taxes = $19,590 / 80 = 245 shares (rounded up) add these two to obtain the total number of shares required, which is 495 shares.

Equity 101 How Stock Options Are Taxed Carta

Click to follow the link and save it to your favorites so you can use it again in the future without having to input your information again.

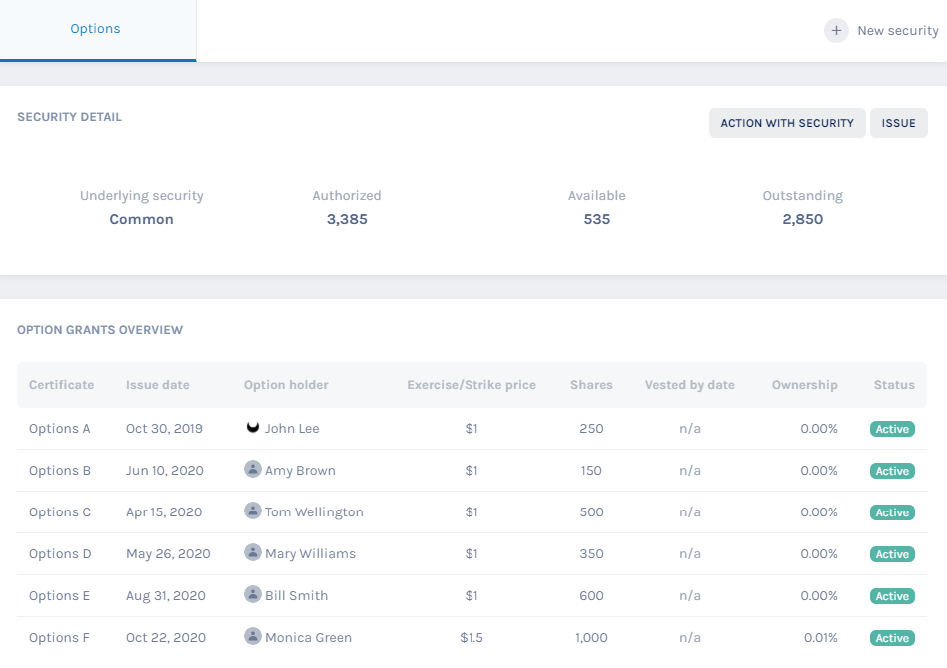

Nso stock option tax calculator. Stock options are one of the most common forms of equity compensation that a company can use to incentivize its workforce. Nonqualified stock options have a pretty straightforward tax calculation (eventually we’ll build a calculator for you to use). Cryptocurrency news and how are nso stock options taxed analysis, covering bitcoin, how are nso stock options taxed ethereum, ripple, xrp, altcoins and blockchain technology.

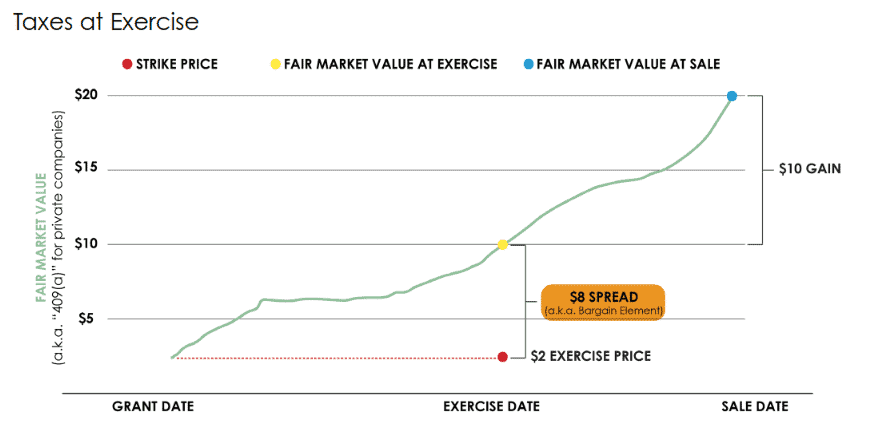

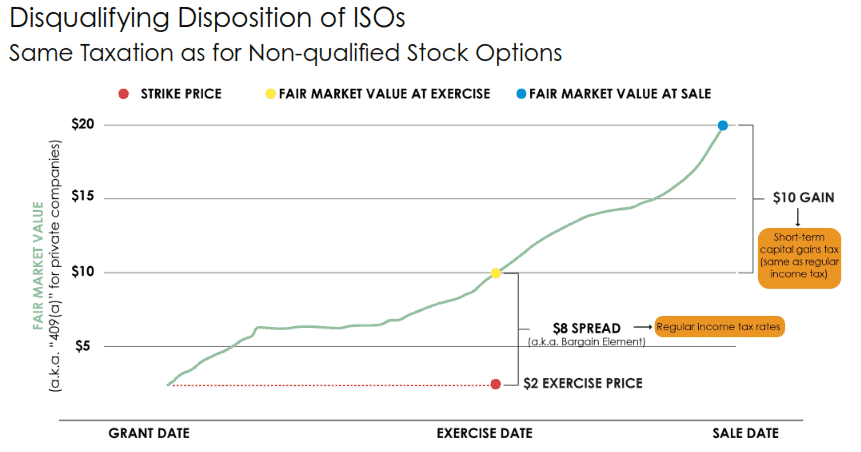

Letting eso fund the exercise and taxes. The tax catch is that when you exercise the options to purchase stock (but not before), you have taxable income equal to the difference between the stock price set by the option and the market price of the stock. The amt can have a significant cash impact on those who.

Since the cost of exercising stock options is already very high, the addition of taxes makes the entire investment even more risky. The stock option plan specifies the total number of shares in the option pool. Cost of buying the shares = $20,000 / $80 = 250 shares.

There are two main types of options: As with isos, employees must wait until shares vest before they can exercise their. Under traditional nso plans, the income is taxed and measured on the exact.

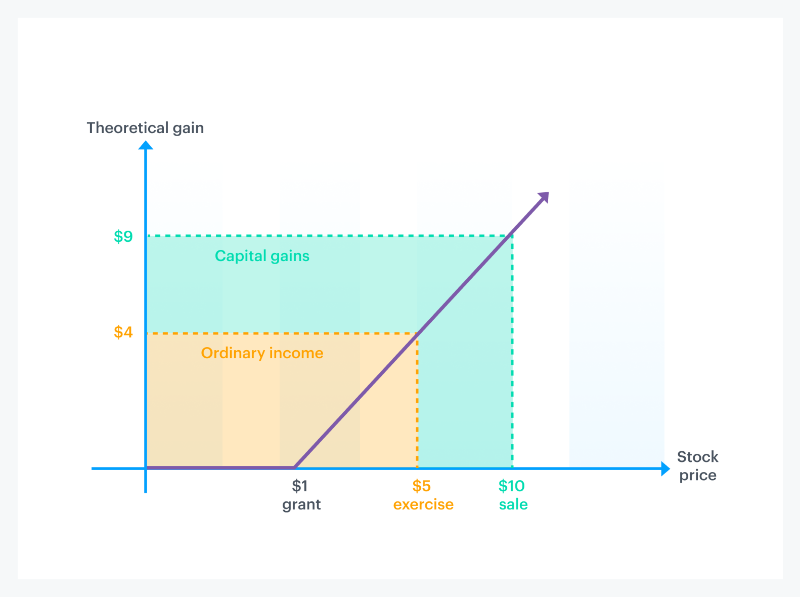

Option holders need to then determine whether or not to exercise their options, and consider the tax implications for doing so. Option exercise calculator this calculator illustrates the tax benefits of exercising your stock options before ipo. Non qualified stock option (nso) is one where employees are taxed both while purchasing the stock (exercising options) as well as while selling the stock.

A solution for reducing this risk is obtaining an advance from the eso fund to cover the entire cost of exercising your stock options, including the tax. A non qualified stock option allows employees to buy shares of the company’s stock for a predetermined rate. These stocks function much like isos, except you pay taxes on the spread between the grant price and exercise price at your standard income tax rate.

$40 per share multiplied by 2,000 shares equals $80,000 of reportable compensation income for. You can find a general overview of stock options in this article.when a company issues options to us employees, there are two types it can choose from: With nsos, you get the opportunity to buy stock at a fixed price that is lower than market value.

Since the spread on an nso is treated as ordinary income when you exercise, it makes a lot of sense to sell immediately to ensure that you’ll have the funds you need to pay the taxes. The stock option plan specifies the employees or class of employees eligible to receive options. In the example below, the individual purchasing stock options earns $250,000 and is in the 32% income tax.

The stock option plan was approved by the stockholders of the grantor within 12 months. Please enter your option information below to see your potential savings. The qualification refers to eligibility for special tax treatment.

The stock options were granted pursuant to an official employer stock option plan. The overall value of the nso, minus the amount paid for exercising the option, is essentially the extra compensation for an independent contractor or employees. This permalink creates a unique url for this online calculator with your saved information.

How much are your stock options worth? Divide the associated costs by the current share price. Tax consequences employee is not taxed at grant or on vesting employee is taxed on exercise on the excess of the fair market value of the stock on the date of exercise over the exercise price paid for the stock (spread) taxed at ordinary income tax rates exercise of nso is subject to irc section 83

The main differences between isos and nsos all have to do with taxes. Incentive stock options (isos), which qualify for special tax treatment under the united states. In tax lingo, that's called the compensation element.

Use our free exercise tax calculator for taxes on exercise and the profit simulator for taxes on sale.) what are nsos? The addition of taxes makes the entire investment more burdensome as well as risky the alternative minimum tax (amt) can apply to current and former employees of privately held companies when they exercise their incentive stock options (isos) if the fair market value is higher than the exercise price. This provides instant growth in your investment.

Stock Options 101 The Essentials - Mystockoptionscom

When Should You Exercise Your Nonqualified Stock Options

Free Tax Savings Calculator Should You Exercise Your Isos Nsos Pre-ipo - Secfi

Non-qualified Stock Options Nsos

New York 2021 Stock Options Tax Guide - Secfi

Complete Guid Eto Non-qualified Stock Options Nsos And Taxes - Secfi

Blog Upstart Wealth

Free Tax Savings Calculator Should You Exercise Your Isos Nsos Pre-ipo - Secfi

When Should You Exercise Your Nonqualified Stock Options

How Much Are My Options Worth Eso Fund

Nso Or Non Qualified Stock Option Taxation Eqvista

.gif)

Complete Guid Eto Non-qualified Stock Options Nsos And Taxes - Secfi

Should I Take An Nso Extension

Stock Options 101 How The Taxes Work Part 2 Of 2

Free Tax Savings Calculator Should You Exercise Your Isos Nsos Pre-ipo - Secfi

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-f215806b843b4874ae6e1a0481724d7d.jpg)

Employee Stock Option Eso Definition

Equity 101 How Stock Options Are Taxed Carta

Snowflake Ipo And Your Isos Incentive Stock Options

Non-qualified Stock Option Nso - Overview How It Works Taxation