All intangible property of a resident decedent, including stocks, bonds, bank accounts, closely held business. You do not need to draft another document.

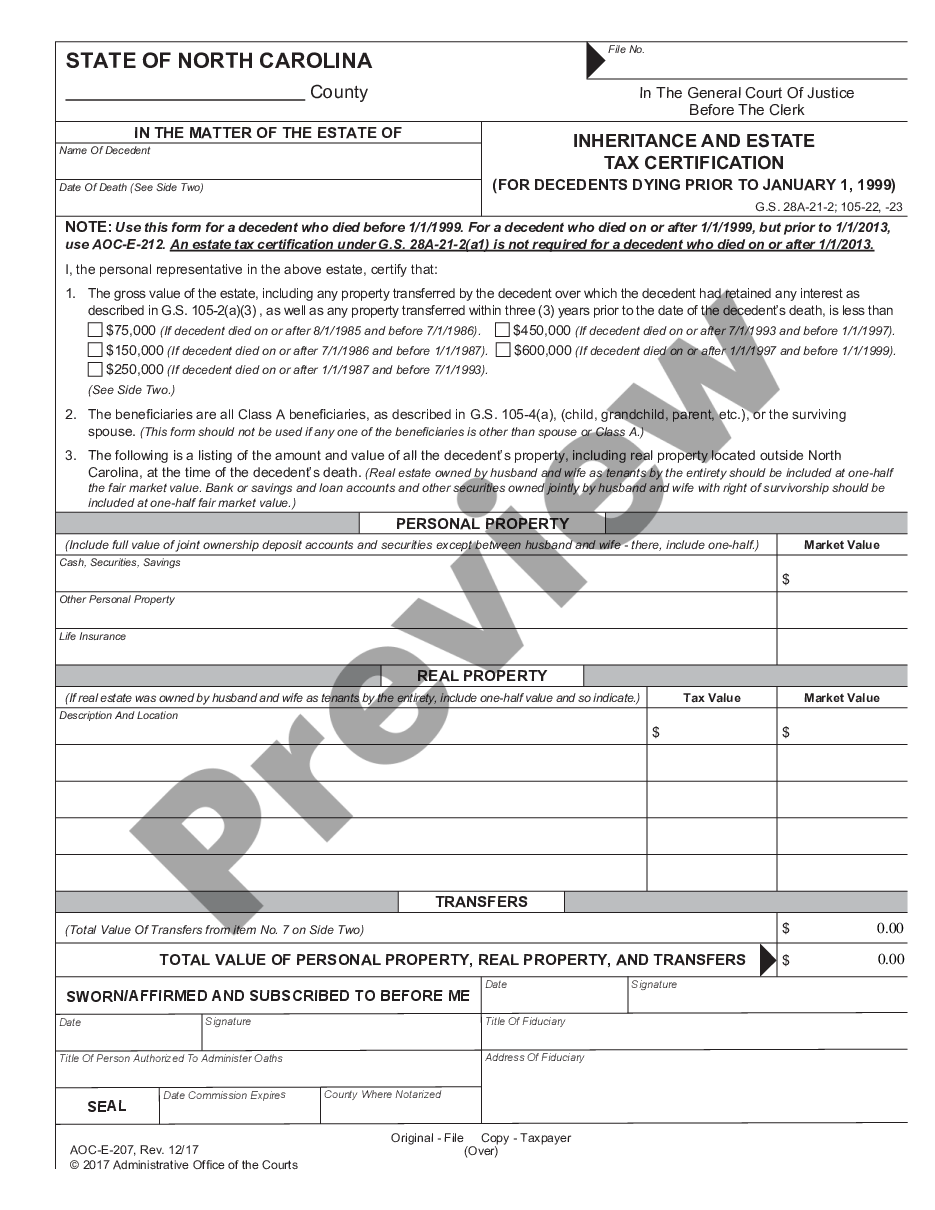

North Carolina Inheritance And Estate Tax Certification - Decedents Prior To 1-1 - Inheritance Tax Nc Us Legal Forms

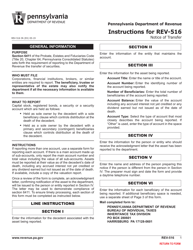

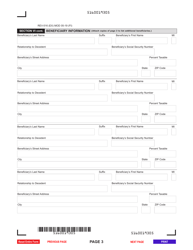

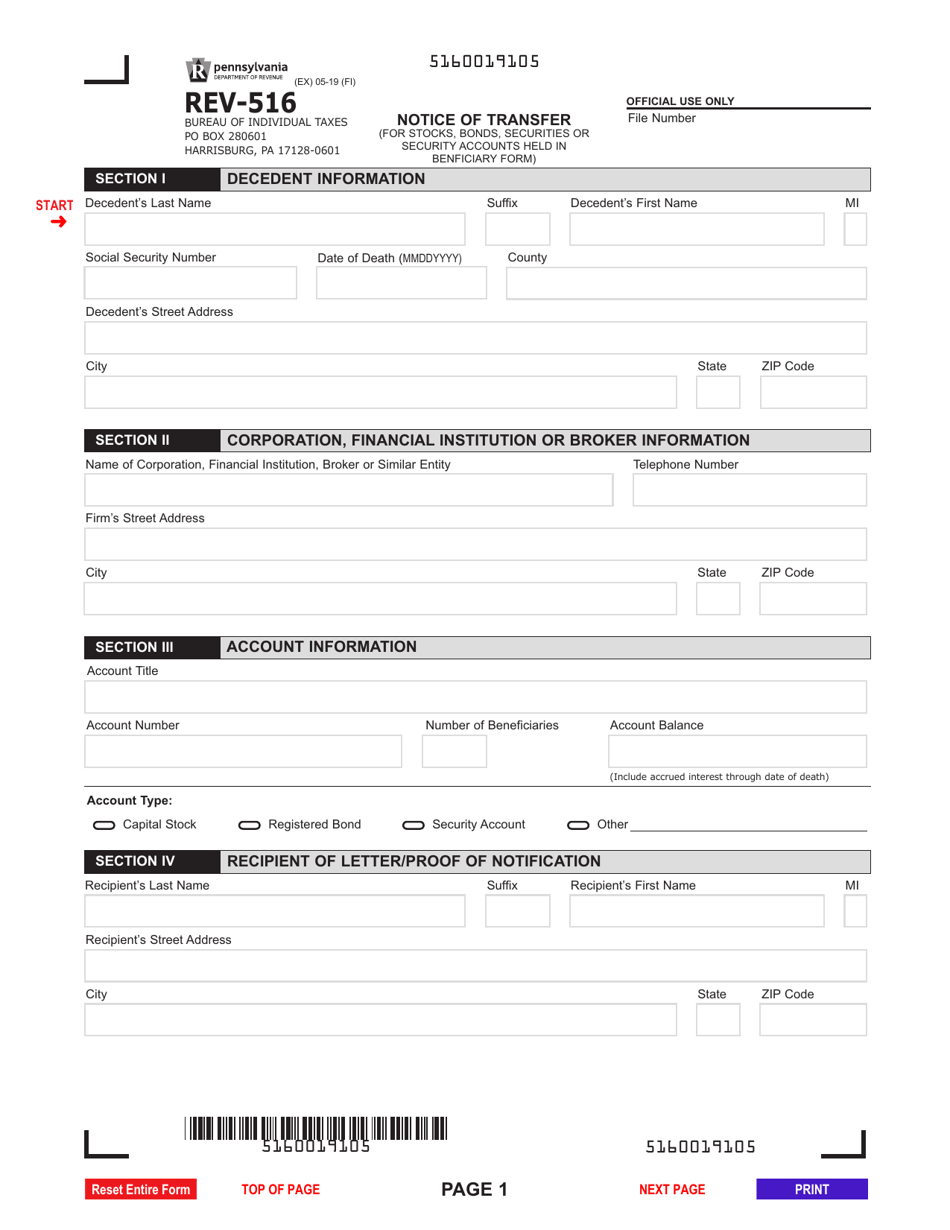

Instructions for filing this notice are on the reverse side.

Pa inheritance tax waiver request. A discount of 5% of the total inheritance tax due is available if the inheritance tax is paid within. Interest and penalties are further discussed in. Summary of pa inheritance tax • there is no pa gift tax • but gifts made within one year of death > $3,000 per calendar year are included in estate • if gifts are spread over two calendar years, you can get two $3,000 exclusions • cautions:

The law was amended by act 255 of 1982, which applies only to estates of decedents who died between december 13, 1982, and october 3, 1991. Pennsylvania inheritance tax on assets passing to your brothers, sisters, nieces, nephews, friends and others. Enter the identifying number of.

Enter the information for the asset. All real property and all tangible personal property of a resident decedent, including but not limited to cash, automobiles, furniture, antiques, jewelry, etc., located in pennsylvania at the time of the decedent's death is taxable. Paying the pennsylvania state inheritance taxes and, if necessary, federal estate taxes.

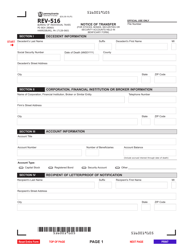

However, if you are the surviving spouse you or you have a tax clearance from the pit division that shows inheritance taxes have already been paid on this account, then you are not required to file this form. — no corporation, financial institution, brok er or similar entity shall transfer on its books or issue a new certificate for any share of its capital stock, its registered bonds, a security or a security account, belonging to or s tanding in Pennsylvania requires that an inheritance tax return be filed within 9 months of the decedent’s death pursuant to the inheritance and estate tax act.

One way to avoid tax completely is to never inherit at all if you do this you're said to disclaim your (a) payment of inheritance tax. Pa inheritance tax was previously imposed by the inheritance and estate tax act of 1961, which applies to estates of decedents who died between january 1, 1962, and december 13, 1982.

2) file an inheritance tax return showing that the debt (s) owed were greater than the value of the property. To effectuate the waiver you must complete the pa form rev 516; Use this form to appeal tax interest up to $15,000 and penalties up to $35,000.

Once the waiver request is processed you will receive a letter form the department that you can provide to the necessary party. However, this may be reserved for mortgagees that take ownership via sheriffs sale. The tax rates depend on the relationship of the decedent to the individuals inheriting assets.

The document is only necessary in some states and under certain circumstancessituations when inheritance tax waiver isn't requiredinheritance tax waiver is not an issue in most 1) file for a lien release. The standard inheritance tax rate is 40% of anything in your estate over the â£325,000 threshold.

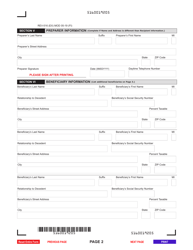

This can be done even if an estate was not raised/opened for the deceased. Decedent street address city st a te zip county. The beneficiary pays inheritance tax while estate tax is collected from the deceased's estate assets may be subject to both estate and inheritance taxes neither of the taxes or just one of them.

If the amounts due exceed these limits, you must contact the. Enter the information for the decedent associated with the. One waiver request must be submitted per asset.

What are the inheritance tax rates in pennsylvania? Signa ture of prep arer da ytime telephone number. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate.

Enter the name or title of the account. Enter the information of the entity that maintains the. After processing, you will receive a waiver letter granting the institution permission to transfer the asset to the beneficiary (ies).

After processing, you will receive a waiver letter granting the institution permission to transfer the asset to the beneficiary (ies). The tax rates for beneficiaries and how they are related to the decedent are as follows: However, once the balance is paid, it is possible to contact the pennsylvania inheritance tax division to request a waiver of interestand penalties , particularly in cases where the decedent died many years ago.

One waiver request must be submitted per asset.

2

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

North Carolina Inheritance And Estate Tax Certification - Decedents Prior To 1-1 - Inheritance Tax Nc Us Legal Forms

2

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

2

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

Is There An Inheritance Tax In Arkansas

2

Penn Mutual Variable Life Account I

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

2

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

Form Rev-516 Download Fillable Pdf Or Fill Online Notice Of Transfer For Stocks Bonds Securities Or Security Accounts Held In Beneficiary Form Pennsylvania Templateroller

2

2

Arizona Inheritance Tax Waiver Form - Fill And Sign Printable Template Online Us Legal Forms

2

It-nr Inheritance Tax Return Non - Resident Decedent Pages 1 - 41 - Flip Pdf Download Fliphtml5