In prince william county, virginia, the tax rate is 1.05%, which is substantially above the state average. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program.

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenovacom

For more information please visit prince william county's department of real estate assessments, or look up this property's current valuation.

Prince william county real estate tax payments. The email has a link to access the bill directly. The system will verbally provide you with a receipt number for you to write down. Press 1 for personal property tax.

Enter your payment card information. (just now) real estate tax prince william county, virginia. From the portal, you can schedule a payment, or print the bill and mail along with your payment.

Houses (2 days ago) the real estate tax is paid in two annual installments as shown on the tax calendar. Houses (3 days ago) when prompted, enter jurisdiction code 1036 for prince william county.press 1 for personal property tax.press 2 for real estate tax.enter the tax account numbers listed on the billing statement. ($300,000 / $100) x $1.2075 = $3,622.50.

Press 2 to pay real estate tax. Enter the tax account numbers listed on the billing statement. Advance payments are held as a credit on your real estate, personal property or business tax account and applied to a future tax bill (when the tax rate and assessment are set or when you file your business tax return).

Prince william county government, virginia. The median property tax in prince william county, virginia is $3,402 per year for a home worth the median value of $377,700. Houses (2 days ago) the tax rate is expressed in dollars per one hundred dollars of assessed value.

There are several convenient ways property owners may. Enter the account number listed on the billing statement. This estimation determines how much you’ll pay.

Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a. You can pay your real estate taxes online using echeck at www.pwcgov.org/tax. The real estate tax is paid in two annual.

The real estate tax is paid in two annual installments as shown on the tax calendar. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. When prompted, enter jurisdiction code 1036 for prince william county.

By creating an account, you will have access to balance and account information, notifications, etc. Prince william county has one of the highest median property taxes in the united states, and is ranked 120th of the 3143 counties in order of median property taxes. A convenience fee is added to payments by credit or debit card.

There are several convenient ways property owners may make payments: Click here to register for an account (or here to login if you already have an account). Free prince william county property tax records search.

Prince william county accepts advance payments from individuals and businesses. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program. $1.2075 2 hours ago the tax rate is expressed in dollars per one hundred dollars of assessed value.

Prince william county real estate taxes for the first half of 2020 are due on july 15, 2020. Press 2 for real estate tax. By mail to po box 1600, merrifield, va 22116.

You can pay a bill without logging in using this screen. (9 days ago) the median property tax (also known as real estate tax) in prince william county is $3,402.00 per year, based on a median home value of $377,700.00 and a median effective property tax rate of 0.90% of property value. The prince william county tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay your property taxes, or arrange a payment plan.

Prince william county collects, on average, 0.9% of a property's assessed fair market value as property tax. The bill remains available online (rendered in the same version as if you had gotten a printed bill) so you can access the bill at any time. For example, if the total tax rate were $1.2075 per $100 of assessed value, then a property with an assessed value of $300,000 dollars is calculated as:

Prince william county real estate taxes for the first half of 2021 are due on july 15, 2021. ($300,000 / $100) x $1.2075 = $3,622.50. To make matters worse for residential property owners, property tax bills are expected to go up in prince william county.

Prince william county property records are real estate documents that contain information related to real property in prince william county, virginia. Payments may be made to the county tax collector or treasurer instead of the assessor. Prince william county real estate tax payment.

Press 1 to pay personal property tax. For example, if the total tax rate were $1.2075 per $100 of assessed value, then a property with an assessed value of $300,000 dollars is calculated as: Find prince william county residential property tax records including land & real property tax assessments & appraisals, tax payments, exemptions, improvements, valuations, deeds, mortgages, titles & more.

The county also levies a supplemental. Electronic check or credit card online at tax.pwcgov.org; All you need is your tax account number and your checkbook or credit card.

Report Rents Rapidly Increasing In Eastern Prince William News Princewilliamtimescom

Rural Crescent The Elephant In Prince William Is Not Very Complex But Is It Politically Radioactive - Muneer Baig

Joinrenew Realtor Association Of Prince William

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Manassas Virginia Old Town Manassas Manassas Virginia Manassas Virginia

Prince William County Va News Wtop News

About Us

Best Of Prince William 2019 By Insidenova - Issuu

Pin By Faith Maricic Real Estate On Stop Paying Your Landlords Mortgage Lead Generation Real Estate Real Estate Leads Home Buying Process

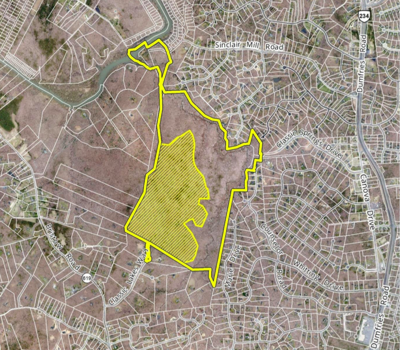

Prince William Board Approves Housing Development In Rural Crescent Headlines Insidenovacom

5572 Saint Charles Dr Woodbridge Va 22192 Dale City Saint Charles Keller Williams Realty

National Park Service Prince William Forest Park Sign Virginia Travel National Park Service Forest Park

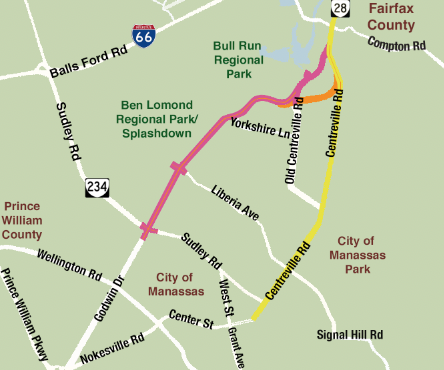

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenovacom

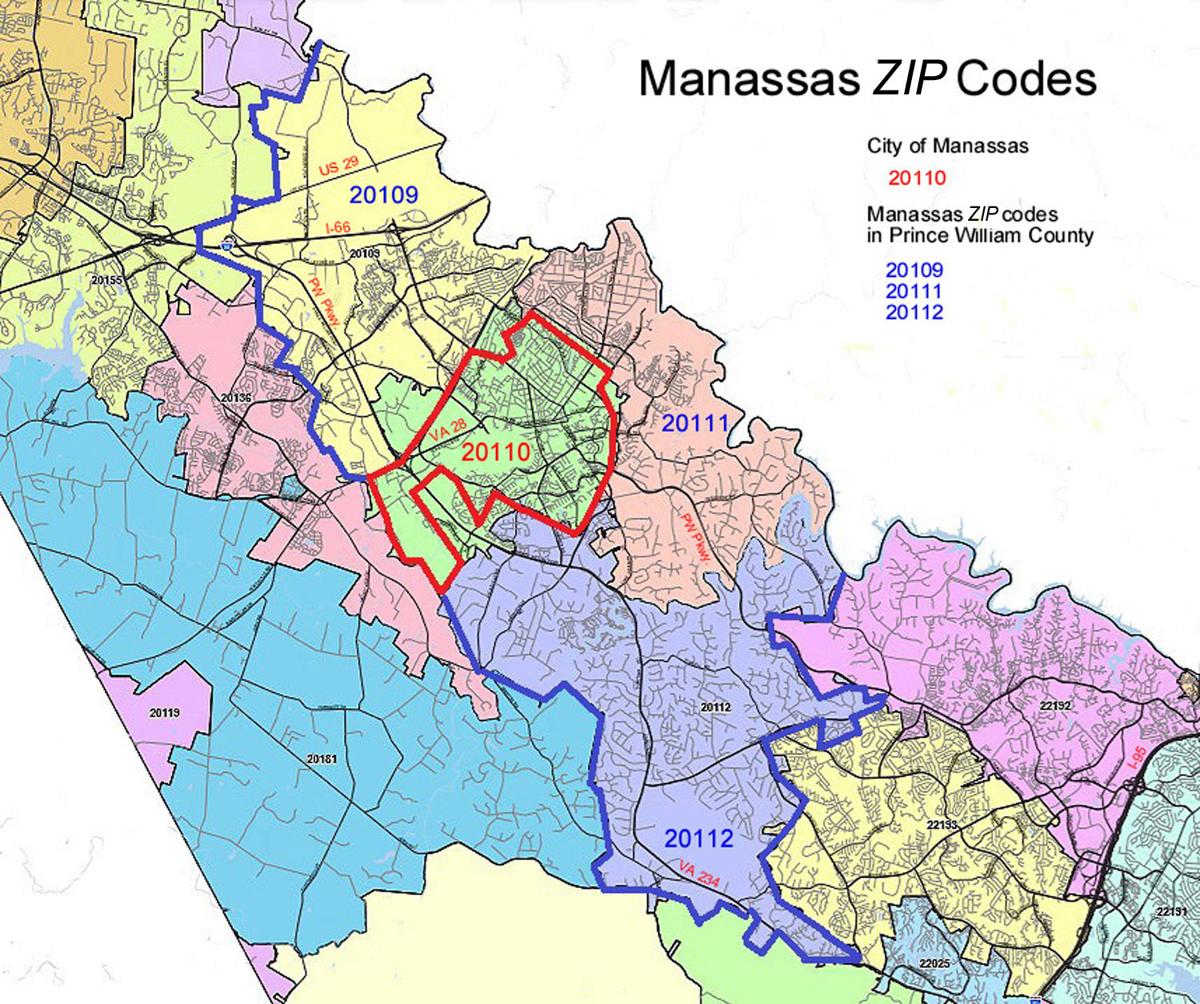

Guest Column When Is Manassas Not Manassas Opinion Princewilliamtimescom

5 Things Agents Need To Know About The Tax Grievance Process - Property Tax Grievance Heller Consultants Tax Grievance

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Personal Property Taxes For Prince William Residents Due October 5

County Unveils Rural Crescent Options News Princewilliamtimescom

Where Residents Pay More In Taxes In Northern Va Wtop News