Alameda, ca property tax information. See what the tax bill is for any alameda, ca property by simply typing its address into a search bar!

2

Please see instructions on page 3 for filing deadlines.

Alameda county property tax 2021. • preliminary 2020/2021 av from alameda county shows growth of over 6%. The following fees will be added to the final sale price: 7 rows secured tax bills are payable online from 10/6/2021 to 6/30/2022.

The tax type should appear in the upper left corner of your bill. Normally, the sewer service assessment is consolidated with other property taxes, charges, and assessments in a single tax statement from the alameda county tax collector. Please find enclosed a separate property tax statement for annual sewer services.

For tax balances please choose one of the following tax types. Enter just one of the following choices and click the corresponding search button: Complete top portion and return to the assessor's office by 12/31/19.

Filing period july 1, 2019 thru december 31, 2019. No fee for an electronic check from your checking or. Filing deadlines vary depending upon the event which a claimant is filing.

This parcel combine request is for assessment purposes only and does not affect the legal boundaries of any parcel of land. Log in to the alameda county property taxes collection portal. Claimant name and mailing address.

There are several ways to pay your property taxes in alameda county. Residents of alameda county, where the median home value is $707,800, pay an average effective property tax rate of 0.78% for a median tax bill of $5,539. The assessor is responsible for the discovery and assessment of all taxable business personal property located in alameda county as of january 1st every year.

Please check each individual parcel for the fee amount. See alameda, ca tax rates, tax exemptions for any property, the tax assessment history for the past years, and more. Alameda county property tax lookup.

Enter the requested data to start the alameda property taxes lookup. Select alameda property taxes option. The median property tax in alameda county, california is $3,993 per year for a home worth the median value of $590,900.

2021/2022 assessed valuation (av) which is based on property values as of jan 1, 2021. Unlike real property, business personal property is not subject to proposition 13 value limitations and is appraised annually at its fair market value. No person shall use or permit the use of the parcel viewer for any purpose other than the conduct of official alameda county business.

To find a tax rate, select the tax year. Alameda county collects, on average, 0.68% of a property's assessed fair market value as property tax. 2021 claim for disabled veterans' property tax exemption.

For payments made online, a convenience fee of 2.5% will be charged for a credit card transaction; A california documentary transfer tax calculated at the rate of $.55 for each $500.00 or fractional part thereof. Alameda county has one of the highest median property taxes in the united states, and is ranked 68th of the 3143 counties in.

You can go online to the website of. Parcel number * how do i find my parcel number. Library special tax zone property development fund capital funds measure a1 fund total financing percent of total;

A county recording fee of $17 per parcel. The parcel viewer is the property of alameda county and shall be used only for conducting the official business of alameda county.

2

-ulnlc76m6bjlm

California Home Inspections - Homeguard In 2021 Home Inspection Cinco De Mayo California Homes

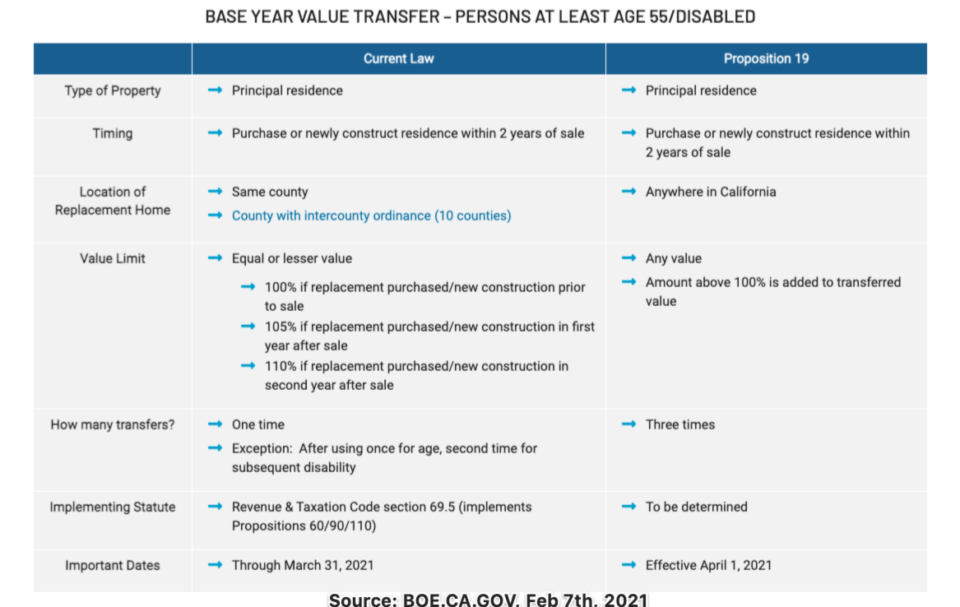

Prop 19 And Property Taxes In California - Marc Lyman

California Housing Market Continues To Normalize As Home Sales And Prices Curb In July Car Reports

Secured Property Taxes Treasurer Tax Collector

Hcd Grants And Funding

851 Capistrano Dr Salinas In 2021 Park Homes Backyard Fences Separating Rooms

2

2021 Ballot Guide - Centennial Institute

2

2

About Proposition 19 2020 Ccsf Office Of Assessor-recorder

2

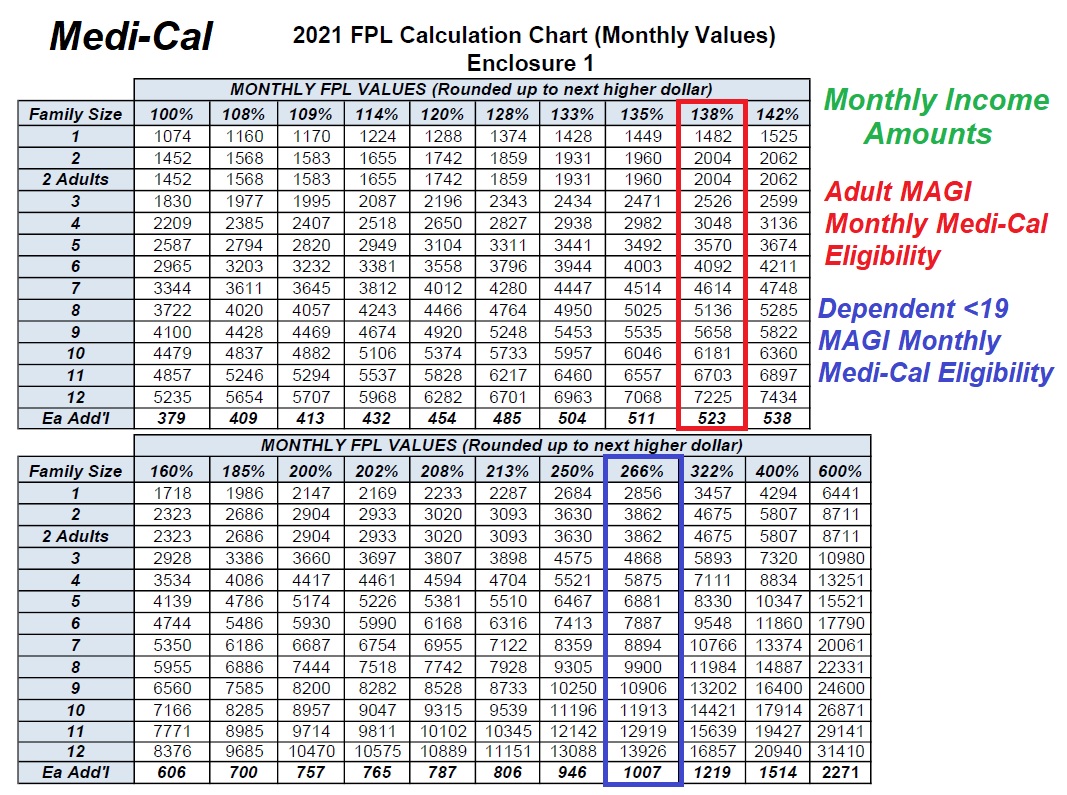

2021 Medi-cal Income Amounts Modest Increase Fpl -

International Competition For The New Gangseo-gu Government Office Complex South Korea

2

2

Search Unsecured Property Taxes