Some of the highlights of the fresh start program are: This was in recognition of those who were hit hard by the 2007 subprime mortgage loan recession, continuing to the modern.

Irs Tax Debt Relief - Fast Affordable Professional - Civic Tax Relief

Some of the areas that the fresh start program impacts:

Civic tax relief fresh start program. In tax relief, the offer in compromise program, in the united states, is an internal revenue service program under which allows qualified individuals with an unpaid tax debt to negotiate a settled amount that is. We guarantee that you will pay the absolute minimum amount. Through the fresh start program, the maximum amount of tax liability that would merit a notice of federal tax lien has been increased from $5,000 to $10,000.

Earn less than $100,000 a year individually earn less than $200,000 a year as a couple not have a large tax balance from the previous tax year the irs fresh start tax relief program was launched in 2012 to help taxpayers who were struggling from the effects of the ongoing financial crisis. This expansion will enable some of the most financially distressed taxpayers to clear up. The irs fresh start tax program can help you reduce this amount or even completely absolve you from these penalties.

The threshold amount went from $5,000 to $10,000. The irs fresh start program is a streamlined installment plan that makes it easier for individuals and small businesses to pay back taxes while avoiding tax liens. The fresh start program is a tax relief program used by some of our clients to help repay their tax debt over time.

The fresh start program increased the amount that taxpayers can owe before the irs generally will file a notice of federal tax lien. Back tax can occur unintentionally, such as when taxpayers incorrectly fill out their tax returns or, or intentionally, such as failing to report all income or evading taxes altogether. Designed for taxpayers who owe less than $50,000, the irs fresh start tax relief program can get you out of debt.

Have been unemployed or seen a decrease in income; Should you decide to go it alone, and pursue irs tax debt forgiveness without assistance, the programs below will. Tax liens | fresh start program.

Second, the irs fresh start initiative allows you to pay back your text debt in a more affordable way. The irs may impose penalties of up to 40% of the unpaid tax balance. Fidelity tax relief will work to see if you qualify for the irs fresh start program.

Here we go through the basics of the irs fresh start program and where things are at in 2021. The irs has a fresh start program that has been expanded and made easier such irs problems as irs settlement (tax settlement, tax levy (irs levy), tax return, and tax liens. Individuals and businesses can qualify.

First, the irs fresh start program provides three different payment options to pay back taxes. If you’re struggling to pay what you owe, take a look at the irs fresh start initiative. Anthem tax services offers a wide range of tax relief services, from tax preparations and unfiled returns to offer in compromise (oic) and fresh start forgiveness.

Irs fresh start program guide with 2021 updates. And, taxpayers may also waive receiving the said notice if they are going to pay their tax debt via the direct debit installment agreement. Changes implemented by the program largely revolved around tax lien.

Business taxes could include income taxes and related payroll taxes. The irs made changes to its policies regarding tax liens with the fresh start tax relief program. For taxpayers who owe back tax to the irs, they can apply for tax relief using the irs fresh start program at any time.

Learn more on our website. It is a response by the federal government to the predatory practices of the irs, who use compound interest and financial penalties to punish taxpayers with outstanding tax debt. If you do not file your tax return or pay your taxes on time, you may be subject to interest and penalties.

To qualify for the fresh start program, you must: The irs officially launched the fresh start program back in 2011 with the aim of helping taxpayers get a “fresh start” with their tax debt and get some relief. Get started today with the “irs fresh start program”.

*i understand i may not qualify for any conviction relief. It increased the maximum amount for a streamlined installment agreement from $25,000 to $50,000. 600 anton blvd ste 1100.

Civic tax relief fresh start program. Flat fee tax relief offers a free consultation. The fsi increased the tax debt threshold at which the irs will file a notice of federal tax lien (letter 3172).

The fresh start initiative was introduced by the irs to expand the options eligible taxpayers have to pay back taxes and avoid tax liens. What is the fresh start initiative? Back tax can affect your credit score, affect your.

If you believe you meet these conditions you may apply for relief by sending in a letter and your documentation to: Fresh start in 2011 to help struggling taxpayers. Lonnie p (5 stars) 09/12/2021.

Regardless of the circumstance, the irs almost always finds out and has 10 years to collect unpaid taxes. The irs rules are complicated and the fresh start program is no exception. This allows taxpayers to set up a payment plan with less paperwork.

If you meet these conditions your returns may be accepted under the fresh start program. The goal of the program was to help taxpayers and small businesses with paying back taxes and avoiding tax liens. The fresh start initiative program provides tax relief to select taxpayers who owe money to the irs.

The tax commission will waive the penalty involved with each year approved, provided the tax and interest have been paid. What is offer in compromise (oic) or fresh start program? Here are some of the changes summarized:

Our goal is to help decrease your tax liability and save you money as quickly as possible. That amount is now $10,000. Fresh start program) immigration relief

The starting point for who qualifies is the amount of tax debt owed. What is irs fresh start program penalty assistance? Or return completed form to:

The irs began the fresh start program in 2011, to help struggling taxpayers.

Key Policy Insights Oecd Economic Surveys Norway 2019 Oecd Ilibrary

2

Pjk Berbagi Bahan Pokok Di Kampung Kb

2

2

Contact Irs And State Tax Experts - Civic Tax Relief

2

Contact Irs And State Tax Experts - Civic Tax Relief

Pdf Supporting Youth Civic And Political Engagement Supranational And National Policy Frameworks In Comparative Perspective

Irs Tax Debt Relief - Fast Affordable Professional - Civic Tax Relief

2

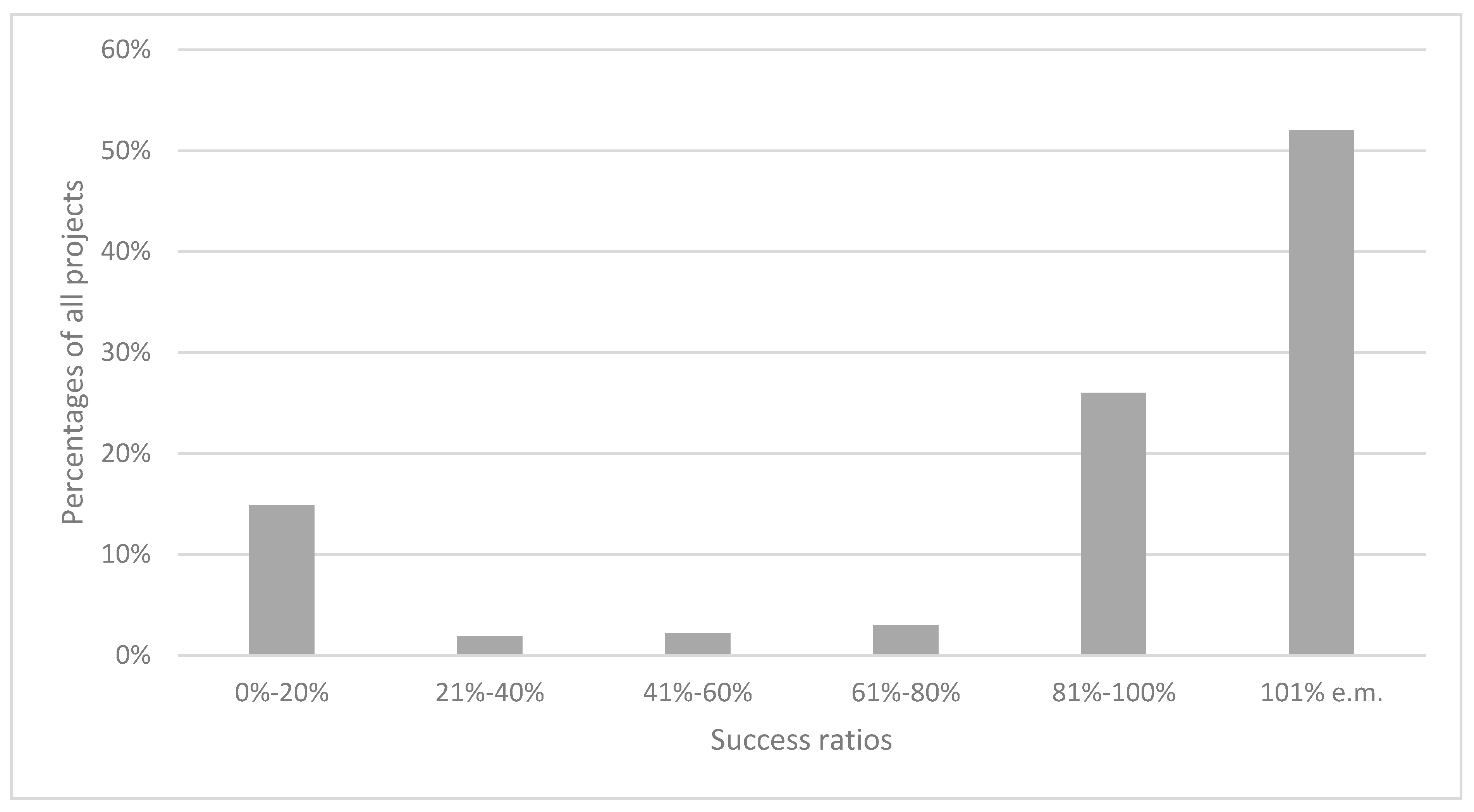

Jrfm Free Full-text Civic Crowdfunding In Local Governments Variables For Success In The Netherlands Html

Tax Relief Reviews - Tax Settlement Reviews - Civic Tax Relief

When And Why You Must File Irs Form 8300 - Civic Tax Relief

Case Studies In Tax Revenue Mobilization In Low-income Countries In Imf Working Papers Volume 2019 Issue 104 2019

1040 Income Tax Cheat Sheet For Kids Consumer Math Consumer Math High School Financial Literacy Lessons

Contact Irs And State Tax Experts - Civic Tax Relief

Tax Debt Relief Real Help Or Just A Scam Credit Karma Tax

Index Angkasa Pura 2