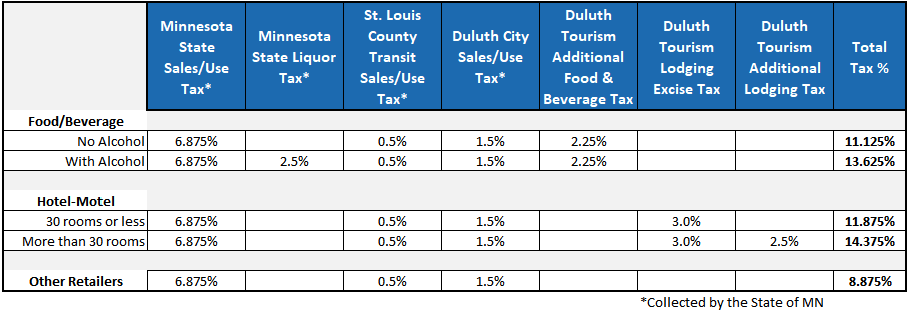

Please refer to the minnesota website for more sales taxes information. Duluth city sales/use tax* duluth tourism additional food & beverage tax duluth tourism lodging excise tax duluth tourism additional lodging tax total tax % 6.875% 0.5% 1.5% 2.25% 11.125% 6.875% 2.5% 0.5% 1.5% 2.25% 13.625% 6.875% 0.5% 1.5% 3.0% 11.875% 6.875% 0.5% 1.5% 3.0% 2.5% 14.375% 6.875% 0.5% 1.5% 8.875% *collected by the state of mn 30 rooms or less more than 30.

The 10 Best Restaurants With Outdoor Seating In Duluth - Tripadvisor

Tax records include property tax assessments, property appraisals, and income tax records.

Duluth mn city sales tax. This is the total of state, county and city sales tax rates. The december 2020 total local sales tax rate was also 8.875%. A sample of the 975 minnesota state sales tax rates in our database is provided below.

The duluth sales tax rate is %. Those with more than 30 units must also collect an additional 2.5% lodging tax. Starting october 1, 2019, the duluth sales and use tax rate is increasing to 1.5 percent.

The duluth sales tax rate is %. Why was the 1/2 percent sales tax created? The georgia sales tax rate is currently %.

The minnesota sales tax rate is currently %. The county sales tax rate is %. City of duluth from amending its sales and use tax ordinances so as to impose a sales or use tax at the rate of one percent!

The minimum combined 2021 sales tax rate for duluth, georgia is. Or two percent in cases covered by subdivision 2± upon any or all sales or uses which are taxed by the state of minnesota pursuant to minnesota statutes, chapter 297a, or minnesota statutes, chapter 297b. All lodging establishments must collect 3.0% for the lodging excise tax;

Duluth strikes out on sales tax duluth came up empty on its request for legislative authorization to increase its local sales tax this year, even though 77. This is the total of state, county and city sales tax rates. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates.

If, however, your purchases total more. The city put the idea to voters. If the items you are buying are for your personal use, you can buy up to $770 worth of taxable items during the calendar year without paying use tax.

The attraction may be poised to receive funding from duluth's tourism tax fund, with up to. There is no county sale tax for duluth, minnesota. The 55803, duluth, minnesota, general sales tax rate is 8.875%.

91% of city residents who were surveyed in , mn sales tax rate. Sales are reported and tax collected is remitted to the city of duluth treasurer.

Certain tax records are considered public record, which means they are available to the public, while. The duluth's tax rate may change depending of the type of purchase. Minnesota has a 6.875% sales tax and st louis county collects an additional n/a, so the minimum sales tax rate in st louis county is 6.875% (not including any city or special district taxes).this table shows the total sales tax rates for all cities and towns in st louis.

Is from a ½ percent sales tax that a majority of duluth voters approved by referendum in 2017. Duluth tax records include documents related to property taxes, business taxes, sales tax, employment taxes, and a range of other taxes in duluth, minnesota. Combined with the state sales tax, the highest sales tax rate in minnesota is 8.875% in the city of duluth.

Enjoy the pride of homeownership for less than it costs to rent before it's too late. The minimum combined 2021 sales tax rate for duluth, minnesota is. Blaine, mn sales tax rate:

Duluth city rate(s) 8.375% is the smallest possible tax rate (55801, duluth, minnesota) 8.875% is the highest possible tax rate (55802, duluth, minnesota) The tax data is broken down by zip code, and additional locality information (location, population, etc) is also included. The state legislature authorized the city to implement this tax in 2019, so 2020 will be the first year of the program.

The 2018 united states supreme court decision in south dakota v. Our dataset includes all local sales tax jurisdictions in minnesota at state, county, city, and district levels. The duluth, minnesota sales tax rate of 8.875% applies to the following ten zip codes:

The county sales tax rate is %. You can download the minnesota sales tax rates database from our partners at salestaxhandbook. 31 rows apple valley, mn sales tax rate:

Minnesota department of revenue will administer this tax. The city and visit duluth have struck a potential deal. The combined rate used in this calculator (8.875%) is the result of the minnesota state rate (6.875%), the duluth tax rate (1.5%), and in some case, special rate (0.5%).

July 24, 2019 page 1 of 3. 55802, 55803, 55804, 55805, 55806, 55807, 55808, 55811, 55812 and 55816. You owe use tax when minnesota / city of duluth sales taxes are not charged on taxable items you buy, whether you buy them in minnesota or outside the state.

An alternative sales tax rate of 8.375% applies in the tax region proctor, which appertains to zip code 55810. The duluth, minnesota sales tax is 8.38% , consisting of 6.88% minnesota state sales tax and 1.50% duluth local sales taxes.the local sales tax consists of a 1.00% city sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). (the previous sales and use tax rate was 1.0 percent).

Duluth sales and use tax rate increase to 1.5 percent. A duluth restaurant and its owners have pleaded guilty to tax fraud and will be required to pay nearly $300,000 in uncollected sales taxes. The current total local sales tax rate in duluth, mn is 8.875%.

4232 London Rd Duluth Mn 55804 - Realtorcom

1534 Minnesota Ave Duluth Mn 55802 - Realtorcom

2421 Pineview Ave Duluth Mn 55811 - Realtorcom

1515 Minnesota Ave Duluth Mn 55802 - Realtorcom

North Aviation Multiengine Seaplane Rating Duluth Minnesota Ingine Seaplane Rating Experience The Rugged And Versatile 1954

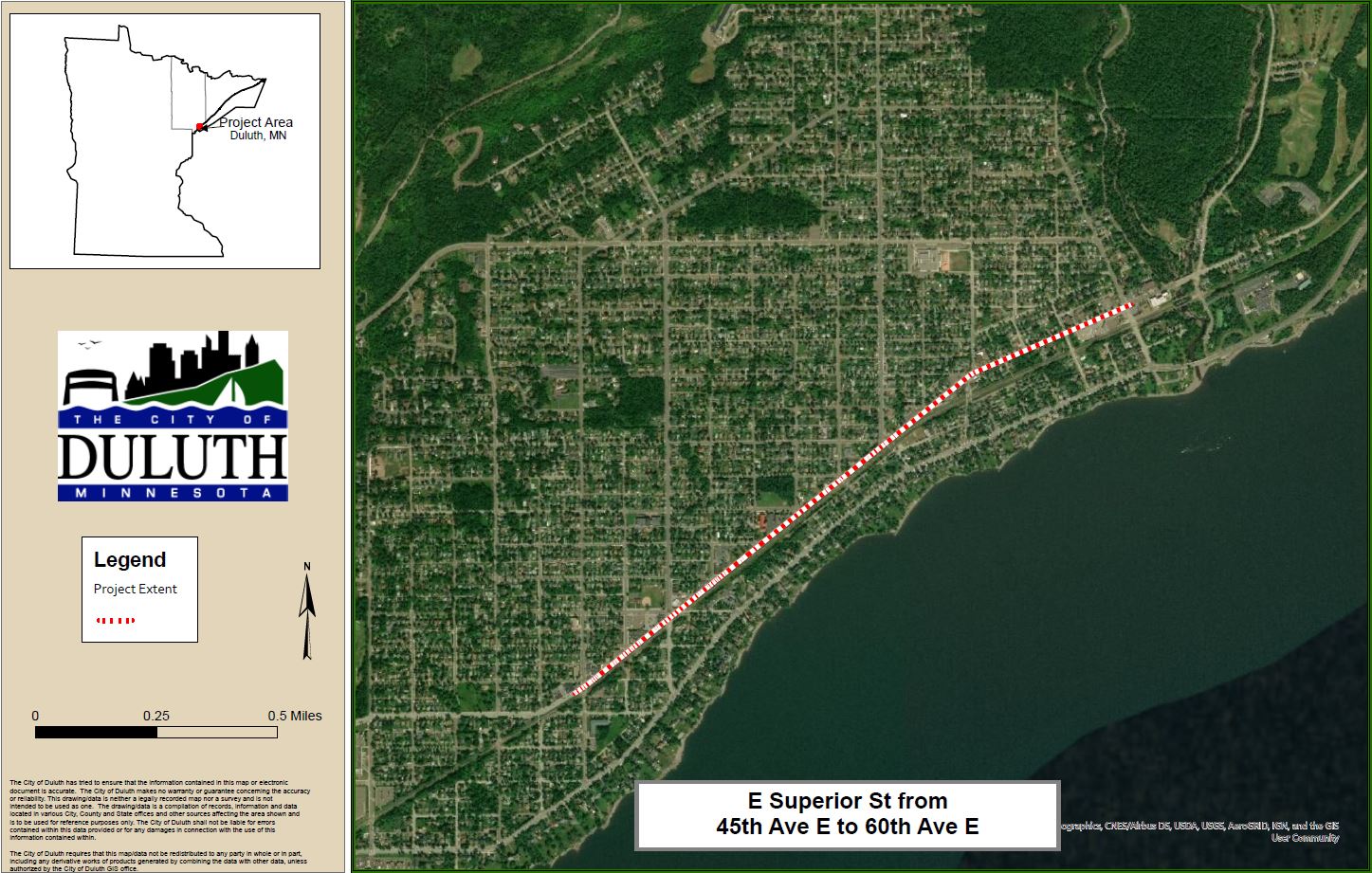

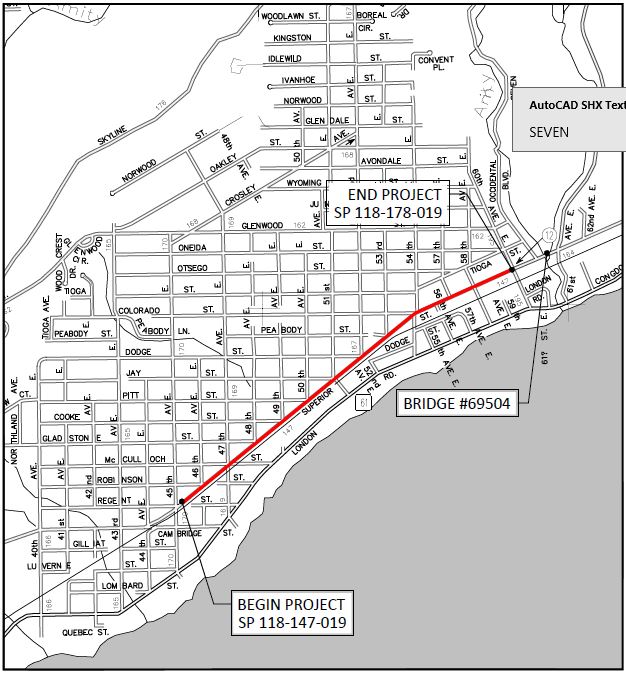

Mill Overlay Of E Superior St- 45th Ave E To 60th Ave E

1126 Mesaba Ave Duluth Mn 55811 Mls 6100706 Edina Realty

Employment Opportunities City Of Duluth Career Pages

902 Maple Bend Dr Duluth Mn 55811 - Realtorcom

Duluth Restaurant Owners Convicted For Using Zapper Software To Hide 290k In Sales Tax Revenue Twin Cities Business

Local View Us House Can Step Up Next Invest In Infrastructure Duluth News Tribune

Treasury

205 S 16th Ave E Duluth Mn 55812 Mls 6100691 Edina Realty

1534 Minnesota Ave Duluth Mn 55802 - Realtorcom

14 Industrial Avenue Duluth Mn 55808 Mls 6119928 Edina Realty

Mill Overlay Of E Superior St- 45th Ave E To 60th Ave E

505 S 72nd Ave W Duluth Mn 55807 Mls 6100663 Edina Realty

Flock Duluth - Home Facebook

Treasury