Therefore, the following calculation applies to the new worksite: Political subdivisions that levy an lst at a rate that exceeds $10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the political.

Understanding Your Tax Forms The W-2 Tax Forms W2 Forms Life Insurance Calculator

Act 7 of 2007 amended the local tax enabling act, act 511 of 1965, to permit municipalities and school district to impose, on persons employed within the jurisdiction, a combined local services tax (lst) of up to a maximum of $52 a year.

Pa local services tax deductible. However, there are resources available on the department of community and economic development's website where you can obtain more information about local income tax information and local services. I knew it was a local tax but i wasn't sure about the mandatory deductible part : I have an lst or local services tax in box 14.

Are lst deductions based on where i live or where i am employed? If your employee presents a pay stub accompanied by an employee statement of principal employment as proof that a $52 lst is being withheld by another employer regardless of tax jurisdiction in pennsylvania, you should not withhold it again. There is some confusion about whether or not you can deduct local service taxes due to the fact that they previously were deductible under the former tax code when they were claimed as “unreimbursed business expenses.”

Why is there a number 22 in box 20 instead of my residence or work locality? Pennsylvania allows four deductions against income. If the employee works the rest of the

Months late x.0083 x line 1) (line 1 + 2 + 3)) print employee name employee address employee ssn start date tax. This tax is 0.5% of your earned income for the municipality and between.9% and 1.5% for the school district in which you reside. Does the eme to pay theployee hav local services tax to the city of pittsburgh?

Flat $10 local services tax and paid $10. Each individual who exercises such a privilege for any length of time during the tax year is liable for this tax unless the individual has previously paid the equivalent in local services taxes for the calendar year. Only the gross receipts portion of the philadelphia business privilege tax is deductible for pennsylvania personal income taxes.

Since pennsylvania does not have federal tax accounting limitations and thresholds, 100 percent of actual unreimbursed pa allowable employee business expenses may be deducted from income for pennsylvania personal income tax purposes. Interim ‘total service tax’ =. Local services tax (lst, emst) local taxes are not administered by the pennsylvania department of revenue but by local taxing authorities.

(employee must show proof that $10 was withheld) the rate of the local services tax is $52 for pittsburgh. The local services tax is levied by the political subdivision upon individuals engaging in an occupation in that taxing district. Taxable compensation at the local level is almost identical to taxable compensation at the state level, except that housing allowances provided to members of the clergy are not taxable at the local level.

You may not take a deduction for the net income tax portion. If the total lst rate enacted is $10.00 or less, the tax is to be collected in a lump sum. The name of the tax is changed to the local services tax (lst).

How and when is the tax deducted from my pay? Would the category for that be other mandatory deductible state or local tax not listed? With the passage of pennsylvania act 32 (effective january 1, 2012) the commonwealth, as an employer, withholds and remits local earned income taxes to a

Any individual making less than $12,000 in a calendar year can file for an exemption with their employer. Local services tax (lst) a local services tax is paid by everyone working in the township. Interim pay period tax = $52 / 26 pay periods = $2.

The local services tax shall be deducted for the municipality or school district in which you are employed. The tax is $52.00 per year. In june the employee started a new job in pittsburgh earning $5,000 a month.

If the total lst rate enacted exceeds $10.00, the tax will be deducted at a rate of $1.00 per week. (i live in pa) thank you! Irc section 529 qualified tuition program contributions, and irc section 529a pennsylvania able savings account program contributions.

Tax collector 2132 northway road williamsport, pa 17701 local services tax please attach a list if you have more than 10 employees phone: If the total lst rate enacted is $10 or less, the tax is to be collected in a lump sum. This tax is usually collected by payroll withholding and remitted to the tax collector.

A $36 tax would be collected at 69 cents a week for employees paid weekly, or at $3 a month for employees that are paid monthly. The tax amounts that have been withheld are required to be remitted at the end of each quarter. Deductible from compensation for state income tax purposes.

This is the date when the taxpayer is liable for the new tax rate. For areas under act 199, deductions will be greater than $1.00 per week. Deductions allowed for pennsylvania tax purposes.

The local services tax shall be collected through payroll deductions from the employer for all employees.

Corporate Income Tax In Indonesia - Acclime Indonesia

6 Top Tax Deductions For Lawyers And Law Firms Clio

I_prospektus Awal - Ipo Boba - 2021 Pdf

Huge Mid-latitude Cyclone Dec 4 Weather Map Doppler Radar National Weather Service

2

Pdf Capital Intensity And Tax Avoidance

Corporate Income Tax In Indonesia - Acclime Indonesia

Your Home Is Your Greatest Asset So Put It To Work A Home Equity Loan Makes It Easy To Afford The Things You Wan Home Equity Line Of Credit Home Equity

Article

800 Flowers La Mirada Ca - How Much Should You Invest On Blossoms For A Funeral Funeral Flowers Sympathy Flowers Funeral Flower Messages

I_prospektus Awal - Ipo Boba - 2021 Pdf

Ch01 Solution W_kieso_ifrs 1st Edi

2

Walk-a-thon Pledge Forms Read A Thon School Fund Pledge

Lap Djat Djien Mat Troi Hcm Khai Minh Tech Httpthesunvncomvn Httpsthesunvncomvncong-ty- Corporate Values Medical Center Hospital Environmental Justice

Mens Wearhouse National Suit Drive July 1 - 31 2016 Give A Suit Change A Life Read More Visit A Local Store Ht Mens Wearhouse People In Need Men

Pin On Real Estate

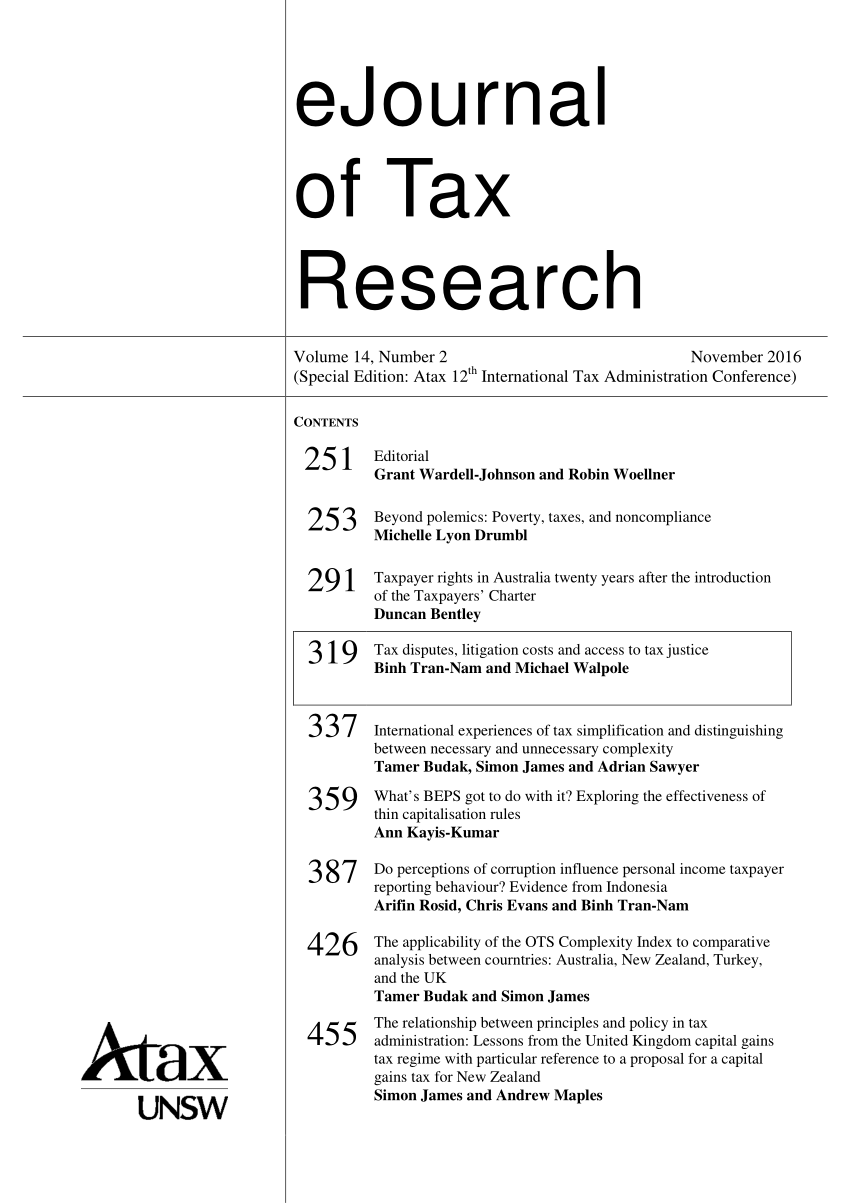

Pdf Tax Disputes Litigation Costs And Access To Tax Justice

Elow Car Insurance On Twitter Business Insurance Car Insurance Insurance Broker