The list focuses on the main types of taxes: However, the government has recently approved a plan to reduce the tax rate to 20% for companies that raise wages aggressively and boost domestic capital.

Japan General Account Spending 2021 Statista

The country with the lowest tax rate in 2017 was a tie between….

Japan corporate tax rate 2017. In 2017, the united arab emirates was the country with the highest corporate tax rate across the globe. Foreign corporations where japanese resident individuals or japanese Corporate tax rate in japan remained unchanged at 30.62 percent in 2021 from 30.62 percent in 2020.

There are four types of corporate tax in japan i.e. 32.0 total % of gdp 2018 japan % of gdp: Data is also available for:

Jpn japan jey jersey kaz kazakhstan ken kenya kor korea lva latvia lbr liberia. Details of changes i) definition of frc under the new cfc rules, a frc will be determined by either an “equity ownership test” or a “de facto control test” (i.e. The federal corporate income tax was fist implemented in 1909, when the uniform rate was 1% for all business income above $5,000.

At present, japan’s corporate tax rate is 32.11 percent. Corporate tax, corporate inhabitant tax, enterprise tax, and special local corporate tax. The top statutory rate equals the sum of the corporate income tax rate applied to income in the to p bracket at the national level and, generally, the average of

Since then the rate peaked at 52.8% in 1969. Corporate tax rate in japan averaged 40.83 percent from 1993 until 2021, reaching an all time high of 52.40 percent in 1994 and a record low of 30.62 percent in 2019. The rates for local taxes may vary somewhat depending on the scale of the business and the local government under whose jurisdiction it is.

Companies also must pay local inhabitants tax, which varies with the location and size of the firm. The inhabitants tax, charged by both prefectures and municipalities, comprises the corporation tax levy (levied With a corporate tax of 40%, the country’s tax rate remained steady between 2017 and 2019.

The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after. For fiscal periods beginning on or after 1 april 2015 until 31 march 2017, an r&d tax credit, of generally between 8% and 10% of r&d expenditure, is. Local corporation tax applies at 4.4 percent on the corporation tax payable.

Japan tax update pwc 2 the new cfc rules will come into force for fiscal periods (of the frc) starting on or after 1 april 2018. In this report, the top statutory tax rate encompasses national and local tax rates: The tax rates for corporate tax, corporate inhabitant tax and enterprise tax on income (tax burden on corporate income) and per capita levy on corporate inhabitant tax for each taxable year are shown below.

Statutory corporate income tax rates 8 corporate effective tax rates 16. Kpmg’s corporate tax rates table provides a view of corporate tax rates around the world. Japan (red) tax on corporate profits indicator:

1, 2018, the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21% for all companies. Tax rate (applicable to fiscal years corporation tax is payable at 2 beginning between 1 april 2016 and 31 march 2017) tax rates for companies with stated capital of jpy 100 million or greater are as follows: Indirect tax rates, individual income tax rates, employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country, jurisdiction or region.

L corporate effective tax rates: 4.2 total % of gdp 2019 japan % of gdp: * tax rates shown in parentheses do not include local corporate special tax or special corporate business tax.

Corporate income tax rate for domestic and foreign companies is 25%. Corporate tax, individual income tax, and sales tax, including vat and gst, but does not list capital gains tax,. The current corporate tax rate in japan is 23.2%;

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Corporate Tax Reform In The Wake Of The Pandemic Itep

Data Shows Largest Firms Benefited Most From Indias Corporate Tax Cuts

Japans Corporate Tax Reform By Abe Government Global Finance Magazine

International Corporate Tax Avoidance A Review Of The Channels Magnitudes And Blind Spots In Imf Working Papers Volume 2018 Issue 168 2018

Beggar My Neighbour - Cutting Corporation Tax - Economics Help

Doing Business In The United States Federal Tax Issues Pwc

Corporation Tax Europe 2021 Statista

Unintended And Undesired Consequences The Impact Of Oecd Pillar I And Ii Proposals On Small Open Economies

Going For Growth 2018 - Japan Note - Oecd

Corporate Tax Reform In The Wake Of The Pandemic Itep

Ldp Enthusiasm Low For Kishidas Plan For Wealth Redistribution The Asahi Shimbun Breaking News Japan News And Analysis

2

2

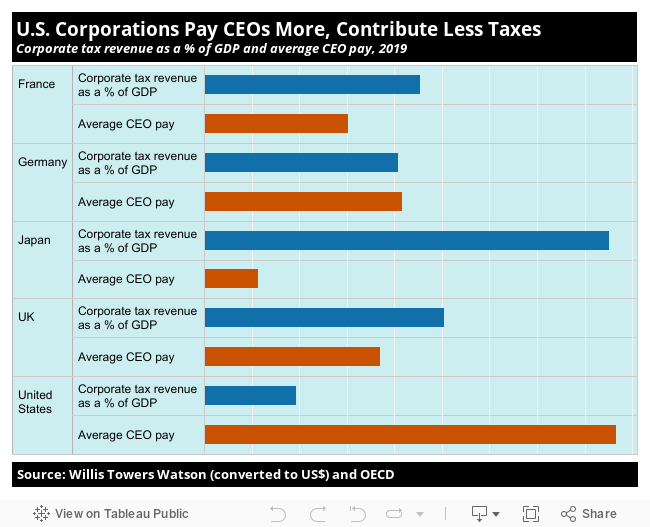

11 Charts On Taxing The Wealthy And Corporations - Institute For Policy Studies

Corporate Tax Trends In Europe 2018-2021 Tax Foundation

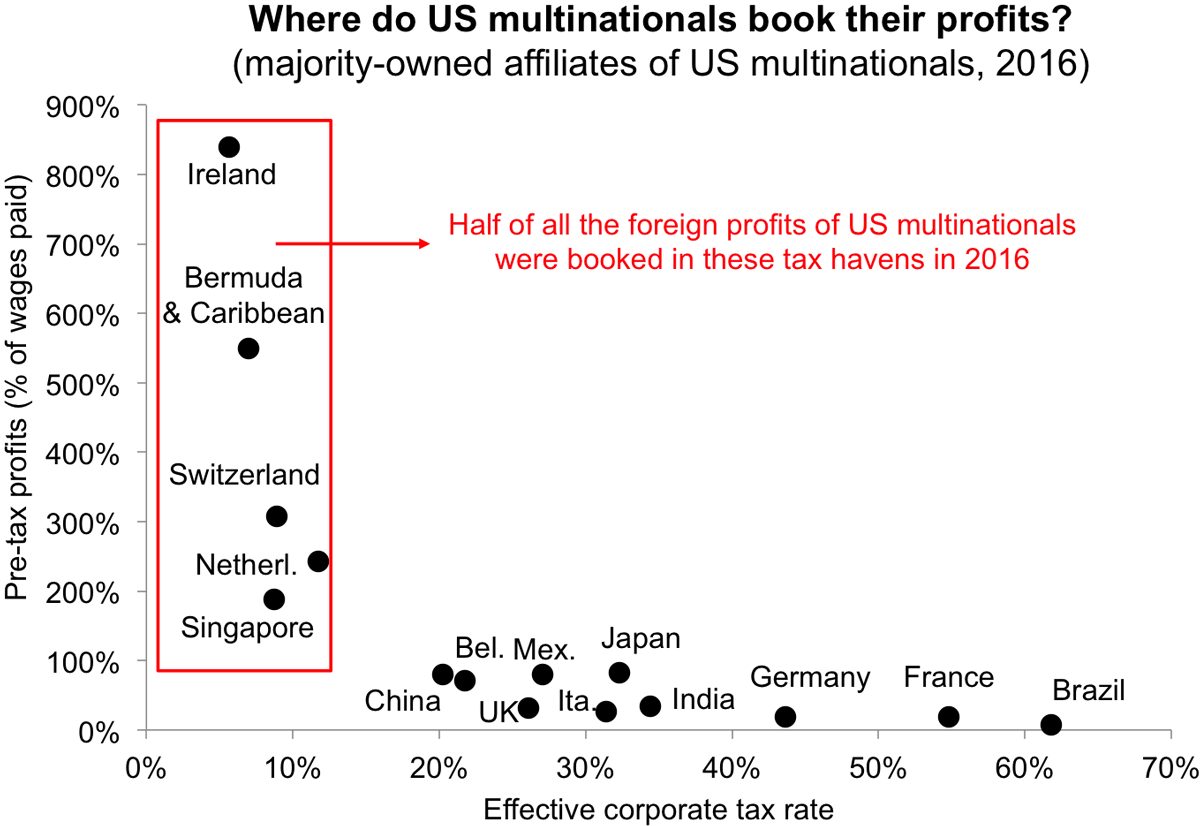

Taxing Multinational Corporations In The 21st Century - Economics For Inclusive Prosperity

2

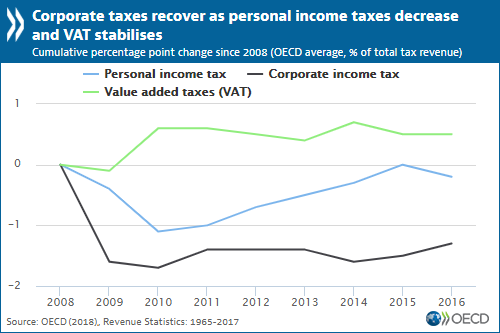

Tax Revenues Continue Increasing As The Tax Mix Shifts Further Towards Corporate And Consumption Taxes - Oecd