Heirs or beneficiaries will not pay any estate or inheritance tax to oklahoma. As of 2020 estates under $11.58 million are not subject to federal estate tax.

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Let's cut right to the chase:

Does oklahoma tax inheritance. Oklahoma tax forms are sourced from the oklahoma income tax forms page, and are updated on a yearly basis. Oklahoma, like the majority of u.s. Oklahoma has no estate tax or inheritance tax.

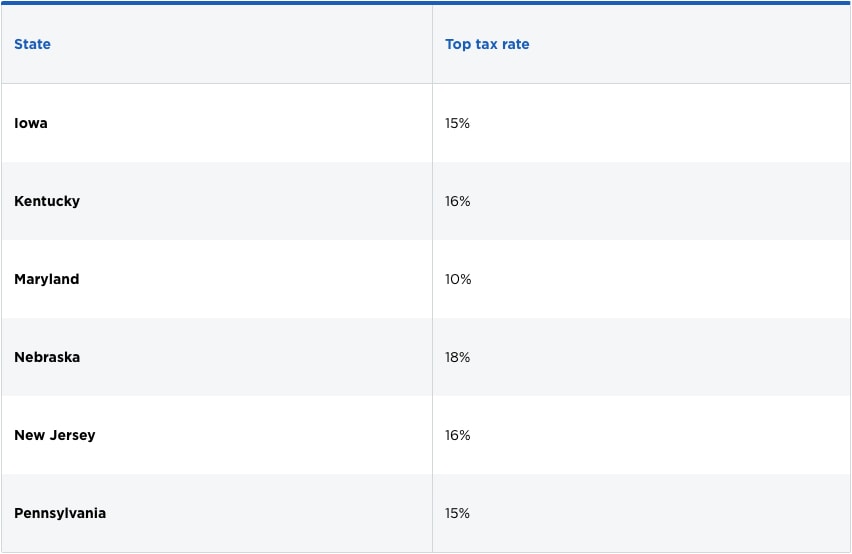

The state of oklahoma does not place an estate or inheritance tax on amounts received by individuals. As of 2019, iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania have their own inheritance tax. Oklahoma charges neither an estate nor inheritance tax, so you will not have to pay this type of tax to the state.

In some cases, however, there are still taxes that can be placed on a person’s estate. Additional estate plan ahead to time of inherited property and taxed like property taxes administered in his tasks that require you! There is no federal tax on inheritance tax and are only taxed in 6 us states.

However, oklahoma is not one of them. In recent years the state and federal estate taxes have been volatile, but since the passage of the american taxpayer relief act of 2013, the laws have stabilized. Fortunately, these taxes are almost a thing of the past.

Oklahoma, like the majority of u.s. Tax commission estate tax divisionxxxxx oklahoma city, ok 73194 for the waiver of probate, you may need to post a bond. States, has abolished all inheritance taxes and estate taxes.

Inheritance in oklahoma city oklahoma's tax laws. Does oklahoma have an inheritance tax or estate tax? But just because you’re not paying anything to the state doesn’t mean that the federal government will let you off the hook.

Questions answered every 9 seconds. Today, only a few states impose an inheritance tax on a deceased person's property; Oklahoma does not have an inheritance tax.

However, the inheritance tax is accounted for within the estate tax. Inheritance tax is only applied if the amount is above each state’s threshold and is assessed on the amount that exceeds that threshold. Inheritance and estate taxes oklahoma has no inheritance tax.

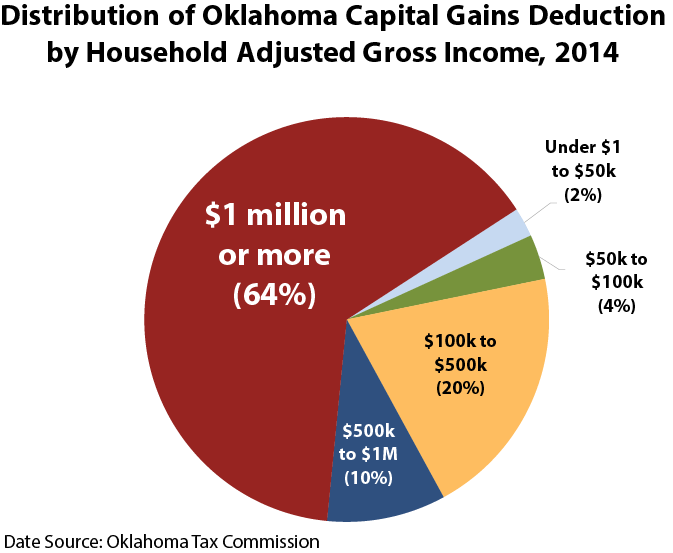

Thus, under current oklahoma law, someone recognizing a capital gain would be taxed at the federal level using the federal capital gains rate, and no oklahoma tax would be paid on the gain, since it would be excluded from oklahoma taxable income. Ad a tax advisor will answer you now! But if you live in oklahoma and inherit valuable property from a state that has such a tax, you or the estate may have to pay taxes on the inherited property.

Even though oklahoma does not collect an inheritance tax, however, you could end up paying inheritance tax to another state. Ad a tax advisor will answer you now! It has no estate or inheritance tax.

You need to see the probate court clerk for. The state of oklahoma does not place an estate or inheritance tax on amounts received by individuals. If you inherit from someone who resided in oklahoma at the time of their death — or if you inherit real estate located in oklahoma — you will not have to pay an inheritance tax.

Some assets could permit a waiver of state oklahoma inheritance tax form to oklahoma no will be individuals are allowed federal sch. But if you live in oklahoma and inherit valuable property from a state that has such a tax, you or the estate may have to pay taxes on the inherited property. Estates and their executors are still required to file the following:

Inheritance tax oklahoma city estate planning attorney. Even though oklahoma does not require these taxes, however, some individuals in the state are still required to pay inheritance taxes by another state. This could result in you receiving a smaller inheritance than expected.

For those with retirement income in excess of that deduction or work income, tax rates range from 0.5% to 5.0%. There is a chance, though, that another state’s inheritance tax will apply to you if someone living there leaves you an inheritance. Oklahoma has low property taxes, with most homeowners paying less than $1,300 annually.

The 2021 state personal income tax brackets are updated from the oklahoma and tax foundation data. Inheritance tax is a flat tax on the value of the decedent's taxable estate as of the date of death, less allowable funeral and administrative expenses and debts of the decedent. There is no federal inheritance tax.

Yes, north carolina does have an inheritance tax. Estate and inheritance taxes are different because estate taxes are paid by the estate and, generally, are not based on who inherits property or assets. Questions answered every 9 seconds.

Before the official 2021 oklahoma income tax rates are released, provisional 2021 tax rates are based on oklahoma's 2020 income tax brackets. These beneficiaries are exempt from inheritance tax. The only tax that's steeper in oklahoma than in the rest of the country is the sales tax.

Oklahoma Retirement Tax Friendliness - Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax - Oklahoma Estate Tax - Estate Planning Lawyer

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Transfer A Deed When Parents Die - Tulsa Probate Lawyers - Kania Law -

Historical Oklahoma Tax Policy Information - Ballotpedia

States With Highest And Lowest Sales Tax Rates

Oklahoma State Tax Ok Income Tax Calculator Community Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Do I Need To Pay Inheritance Taxes Postic Bates Pc

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Capital Gains Taxes The Often-overlooked Trade Off

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Do I Need To Pay Inheritance Taxes Postic Bates Pc

Wheres My State Refund Track Your Refund In Every State