The new york highway use tax (hut) is imposed on motor carriers operating certain motor vehicles on new york state public highways. This equipment rental rate schedule supersedes the february 2014 equipment rental rate schedule.

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax - Youtube

When a locality creates a vehicle use tax, the dmv is authorized by the nys vehicle and traffic law and the nys tax law to collect the taxes from residents of the locality.

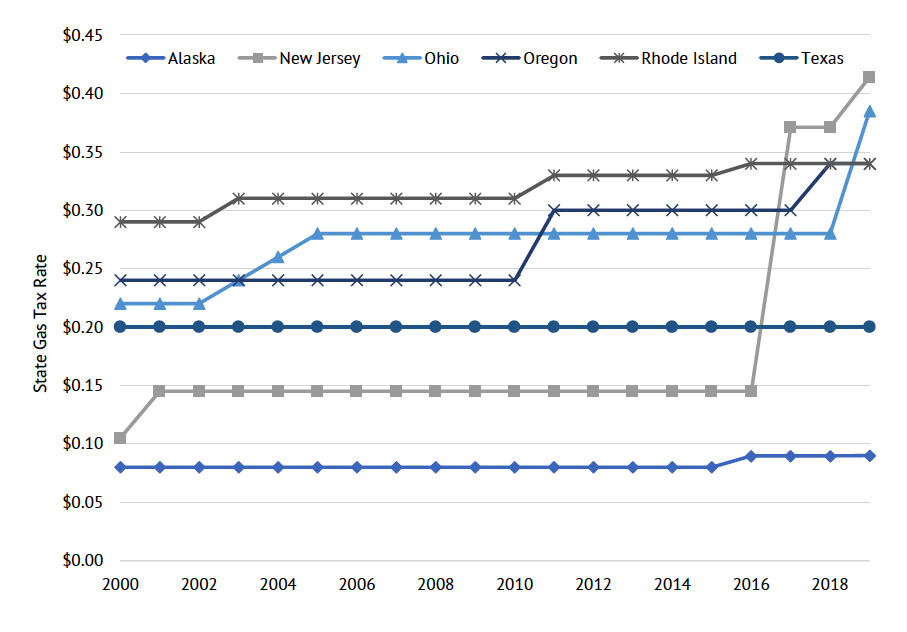

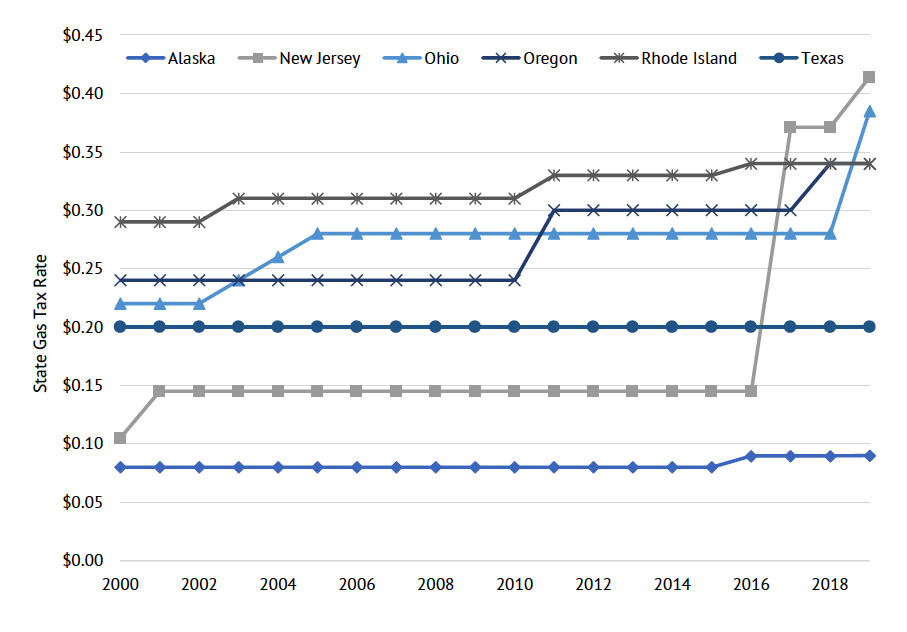

Ny highway use tax rates. Form mt‑903 is filed monthly, annually, or quarterly, based on the amount of the previous full calendar year’s total highway use tax liability: Figure and pay the tax due on a vehicle for which you completed the suspension statement on another form 2290 if that vehicle later exceeded. Nys tax department hut registration unit building 8, room 639 w a harriman campus albany, ny 12227.

Filed monthly if the first year’s hut paid was over $4000.00. Highway use tax schedule totals (first complete schedule 1 or schedule 2, or both, on back page and then enter final totals in boxes 1a and 1b below.) schedule 1 total tax schedule 2 total tax total highway use tax (add 1a and 1b) 1a. To be eligible for quarterly filing in oregon, the account must have a 12 month filing history, and during those 12.

The office of operations management hereby rescinds all previously established schedules for the above purposes. About form 2290, heavy highway vehicle use tax return. Highway use tax schedule totals (first complete schedule 1 or schedule 2, or both, on back page and then enter final totals in boxes 1a and 1b below.) schedule 1 total tax schedule 2 total tax total highway use.

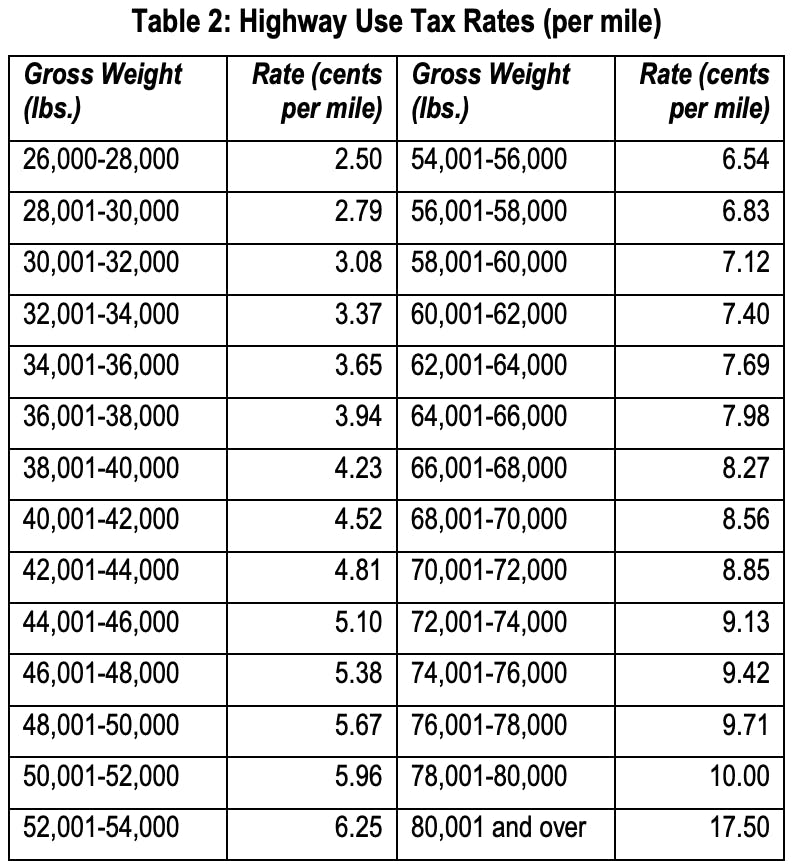

The tax rate per mile for vehicles weighing 78,001 to 80,000 pounds is $0.0546 per mile. Use highway use tax web file to report and pay highway use tax. Once we receive your final return, your highway use tax account will be inactivated, though you'll still have access to all other online services.

The primary tax rates used start at $0.0084 per mile for vehicles weighing between 18,001 to 20,000 pounds. Vehicle (as defined in tax law article 21) in new york state. The ny use tax only applies to certain purchases.

The new york use tax is a special excise tax assessed on property purchased for use in new york in a jurisdiction where a lower (or no) sales tax was collected on the purchase. New york city and several counties have created vehicle use taxes through local laws or ordinances. New york thruway toll miles must be reported but are not taxed by hut.

The tax is based on mileage traveled on new york state public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you Snow on new york state highways pursuant to section 12 of the new york state highway law. For vehicles over 80,001 pounds, an additional tax of $0.0028 is added per ton.

The weight of the motor vehicle and the method that you choose to report your taxes determines the tax rate that you must pay. Monthly ‑ more than $4,000 annually ‑ $250 or less (with tax department approval) The tax rate is based on the weight of the vehicle and the method that you choose to report the tax.

The tax is based on mileage traveled on new york state public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you. 2021 new york state use tax. Portion of the new york thruway, is subject to the highway use tax.

The new york highway use tax, or ny hut tax, is based on both the miles traveled on new york highways and the weight of the vehicle. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more;

The tax is based on mileage traveled at a rate determined by the weight of the motor vehicle. Scheduled payments (up to the due date) direct payment from your bank account. You must obtain a hut permit if you travel new york roadways and your vehicle gross weight exceeds 18,000 lbs.

Vehicle (as defined in tax law article 21) in new york state. Filed monthly, but carriers can apply to file quarterly. Filed quarterly for the first year.

Automatic calculation of amount due.

Ny Hut Permits Jj Keller Permit Service

Nyc Is Dead Forever Heres Why James Altucher

How Will The Mayoral Candidates Manage New Yorks Streets - The New York Times

Lajou5o-ejclum

Ny Hut Permits Jj Keller Permit Service

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Ata Ooida Decry Connecticuts New Vehicle Miles Traveled Truck Tax Commercial Carrier Journal

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax - Youtube

Ata Ooida Decry Connecticuts New Vehicle Miles Traveled Truck Tax Commercial Carrier Journal

The Interstate Highway System - Definition Purpose Facts - History

Pa Commission Proposes Adding And Increasing Fees Axing Gas Tax To Fund Transportation Needs Pittsburgh Post-gazette

How Much Gas Tax Money States Divert Away From Roads - Reason Foundation

What Is Ifta Geotab

Legislature Passes Highway Usage Tax On Large Commercial Trucks

How Much Gas Tax Money States Divert Away From Roads - Reason Foundation

Dentons - Global Tax Guide To Doing Business In The United States

Ny Highway Use Tax Hut Explained - Youtube

Legislature Passes Highway Usage Tax On Large Commercial Trucks