Distribution by expanded cash income level of the imapcts of repealing the affordable care act's 3.8% net investment income tax (niit). 1, 2013, individual taxpayers are liable for a 3.8 percent net investment income tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

Why Taxes Are Important To The Investor - Ppt Download

Repurchases by a regulated investment company or real estate investment trust.

Net investment income tax repeal 2021. It is expected that this tax will be repealed as part of the health care overhaul in what will likely be one of several reforms to the tax code under a trump. The tax would apply to repurchases of stock after dec. How do i report the niit?

Conversely, a single taxpayer would owe $4,750 with the same facts (magi is greater than $200,000 before factoring in any investment income therefore the entire $125,000 is subject to the 3.8% tax). The net investment income tax will apply to a taxpayer only if their modified adjusted gross income exceeds $250,000 for married taxpayers filing jointly and surviving spouses, $125,000 for married taxpayers filing separately, and $200,000 for unmarried. Supreme court rules plaintiffs did not have standing to challenge affordable care act, net investment income tax remains in force.

Internal revenue service code section 1411 imposes a 3.8% tax on a taxpayer’s net investment income. If an individual has income from investments, the individual may be subject to net investment income tax. This change is effective for tax years beginning after the date of the act’s.

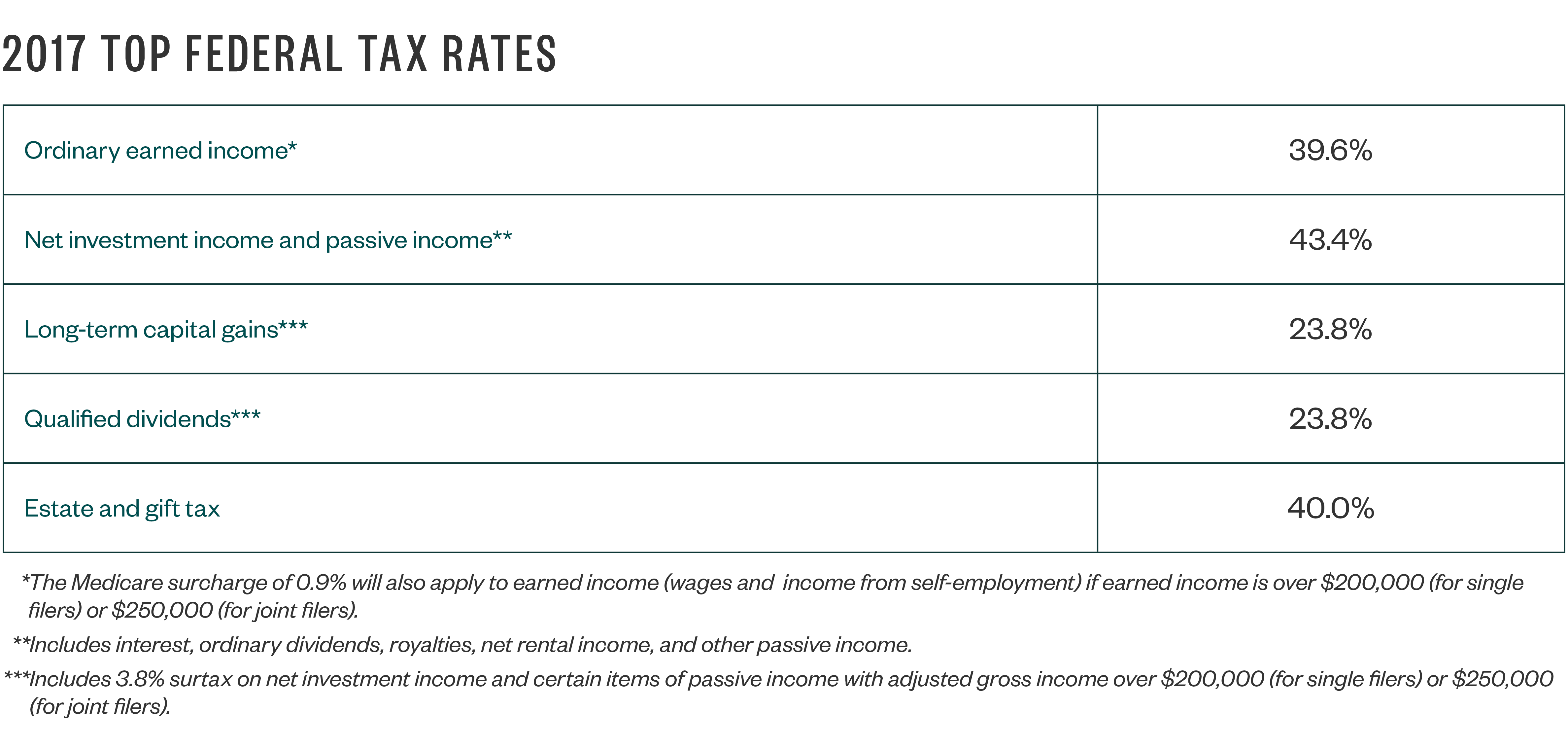

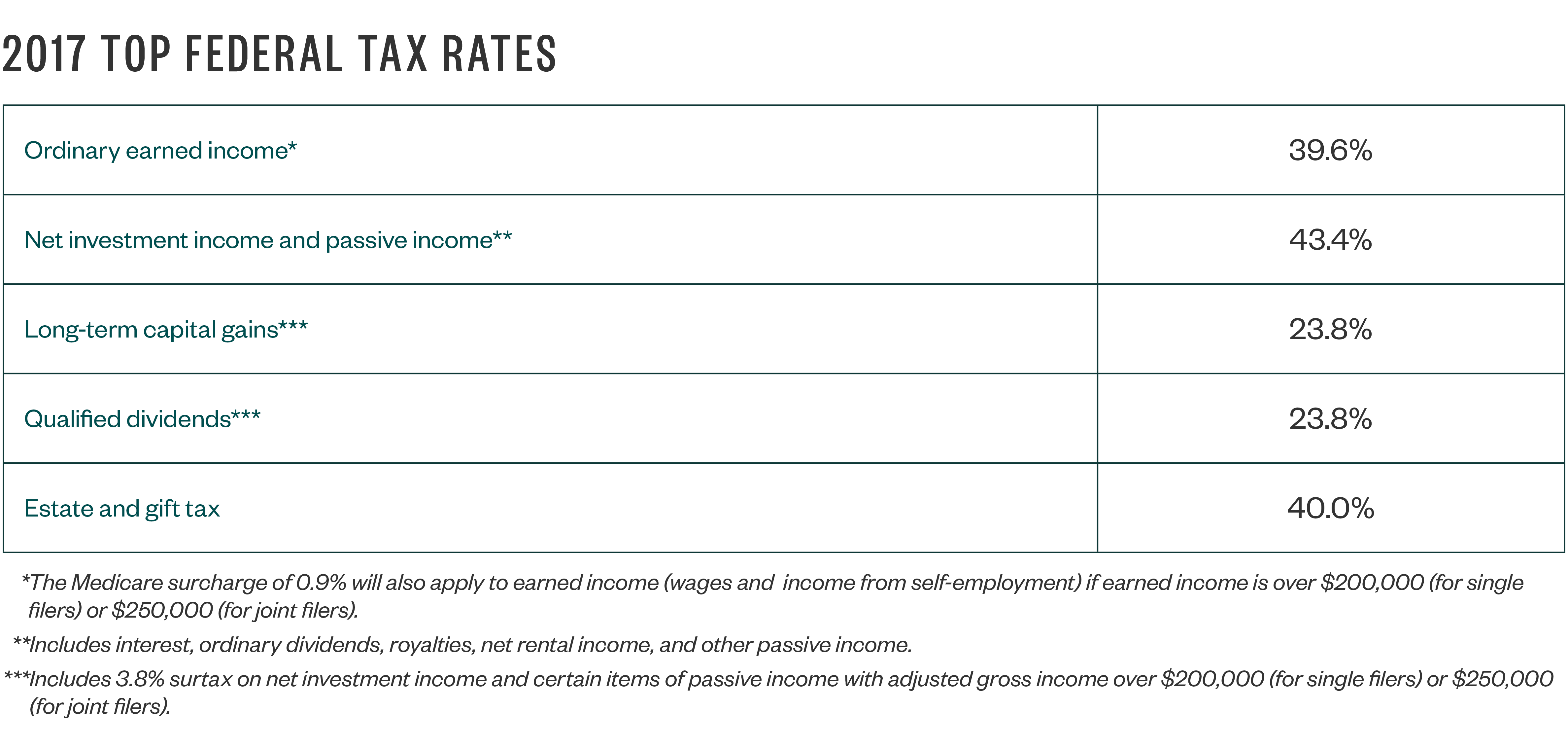

Additional medicare tax of 0.9% on earned income greater than $200,000 or $250,000 if filing jointly. Planning for the net investment income tax. April 28, 2021 the 3.8% net investment income tax:

The net investment income tax, or niit, is an irs tax related to the net investment income of certain individuals, estates and trusts. The net investment income tax form for individuals, trusts, and estates is form 8960. This dual regime is now eliminated, and the excise tax on net investment income for private foundations is changed to a single rate of 1.39%.

All about the net investment income tax. There is not going to be a net investment income tax repeal in 2021, but if the aca is repealed in the future, it is highly likely the niit would also be repealed. The section 250 deduction related to gilti would be reduced from 50% to 37.5% for tax years beginning after 2021, creating a gilti tax rate of 16.5625%.

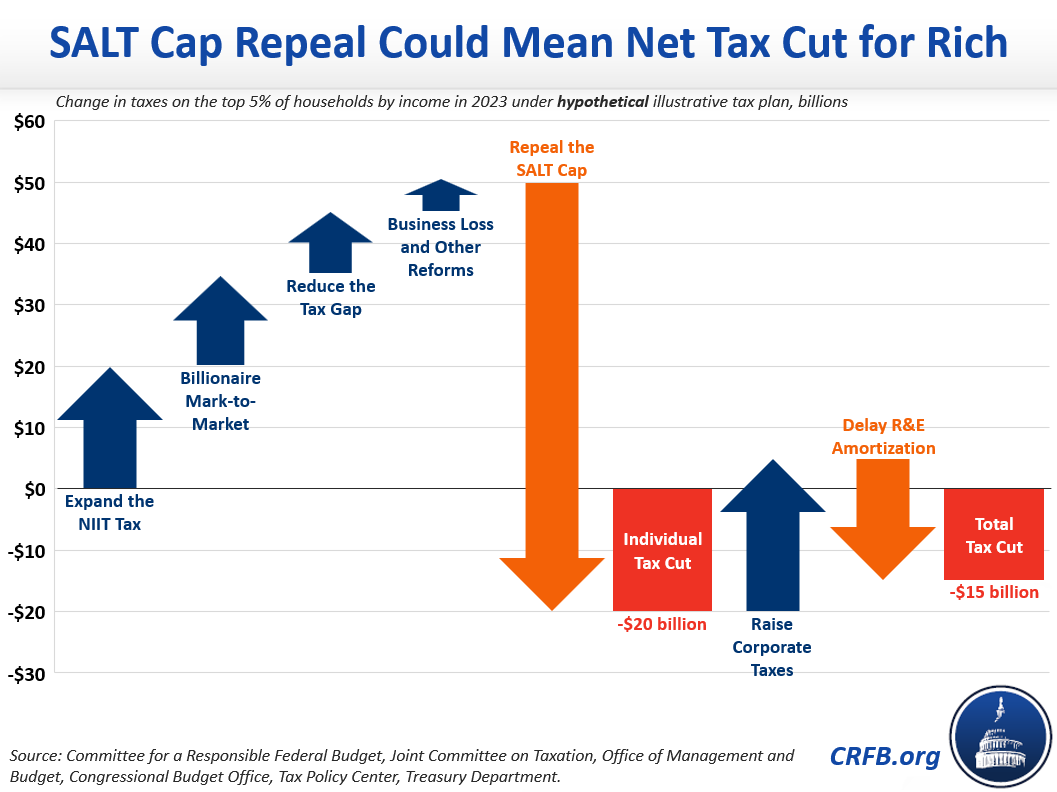

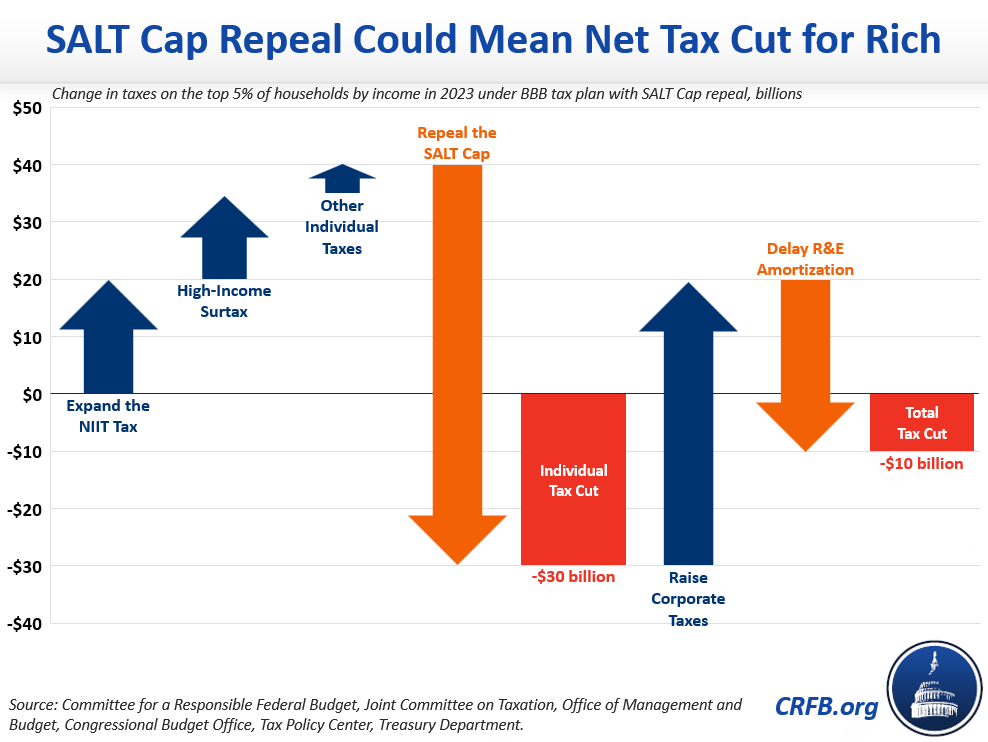

The house republican proposal to repeal and replace the affordable care act would eliminate several taxes imposed under the act. This provision is to be effective for sales occurring or dividends received on or after september 13, 2021. After factoring in the planned tax hikes on the rich, the package would translate to a $30 billion net direct tax cut for those in the top 5% when the.

Tax planning for the current net investment income tax. (ii) income and gains from a business activity in which the taxpayer does not materially. The net investment income tax is an additional 3.8% tax on “net investment income,” which generally includes (i) capital gain, interest, dividends, certain annuities, royalties, and certain rents (unless derived from a business activity in which the taxpayer materially participates);

The statutory authority for the tax is The affordable care act (aca)—the massive healthcare law known as obamacare—has been under the gun ever since its. The supreme court decision makes clear that the entirety of the aca is lawful and

June 17, 2021 by ed zollars, cpa. When a us district judge in texas ruled in 2018 that the affordable care act had been rendered retroactively unconstitutional in its entirety by the tax cuts and jobs act, a number of. If the supreme court were to repeal obamacare, in part or whole, it is possible that 3.8% tax on net investment income and the 0.9% additional medicare tax under obamacare would also be repealed.

Among these is the net investment income tax that imposes a 3.8 percent surtax on income from investments. The net investment income tax of 3.8% on net investment income for taxpayers with adjusted gross income above $200,000 or $250,000 if filing jointly. The trump administration has supported a complete repeal of the aca and the resulting taxes.

The biden camp favors a preservation of the existing law. The bill would amend sec. Per the white house’s fact sheet, “permanently eliminating carried interest is an important structural change necessary to ensure we have a tax code that treats all workers fairly”

Under the rules, the private foundation paid either a 1% or 2% tax on net investment income depending on the private foundation’s charitable expenditures. The 3.8% net investment income tax will be imposed on income not otherwise taxed as dividends, capital gains, or wages for persons with income greater than $400,000 for single taxpayers, $500,000 for married individuals filing jointly and. 1411 to apply the tax to net investment income derived in the ordinary course of a trade or business for taxpayers with taxable income over $400,000 (single filers), $500,000 (married taxpayers filing jointly or surviving spouses) or $250,000 (married taxpayers filing separately).

In any event, it appears that the niit will remain in place until the supreme court weighs in. While the legislation appears stalled for now, there is movement afoot to get rid of the 0.9 percent surcharge on wages above $250,000, even if a larger.

Five Tax Planning Questions To Answer Before Year End

After The Aca Tax Planning For The Current Net Investment Income Tax Cpa Practice Advisor

Why Taxes Are Important To The Investor - Ppt Download

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Biden Tax Plan And 2020 Year-end Planning Opportunities

2019 Tax Planning Guidelines For Individuals And Businesses - Insights Center - Mazars - United States

An Introduction To Net Investment Income Tax Credit Karma Tax

What Is The The Net Investment Income Tax Niit Forbes Advisor

How Ira Withdrawals Can Trigger 38 Medicare Surtax

Could Reconciliation Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

The Power Of 1031 Like-kind Exchanges - Ppt Download

After The Aca Tax Planning For The Current Net Investment Income Tax Cpa Practice Advisor

Tax Guide 2017

Congress Readies New Round Of Tax Increases - Freeman Law

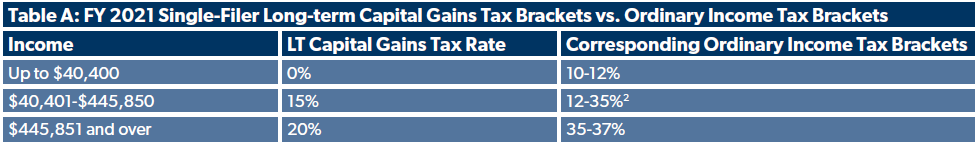

Whats The Deal With Capital Gains Taxes - Foundation - National Taxpayers Union

Pass-through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Reconciliation May Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

Net Investment Income Tax What It Is And Why It Might Disappear Soon The Motley Fool