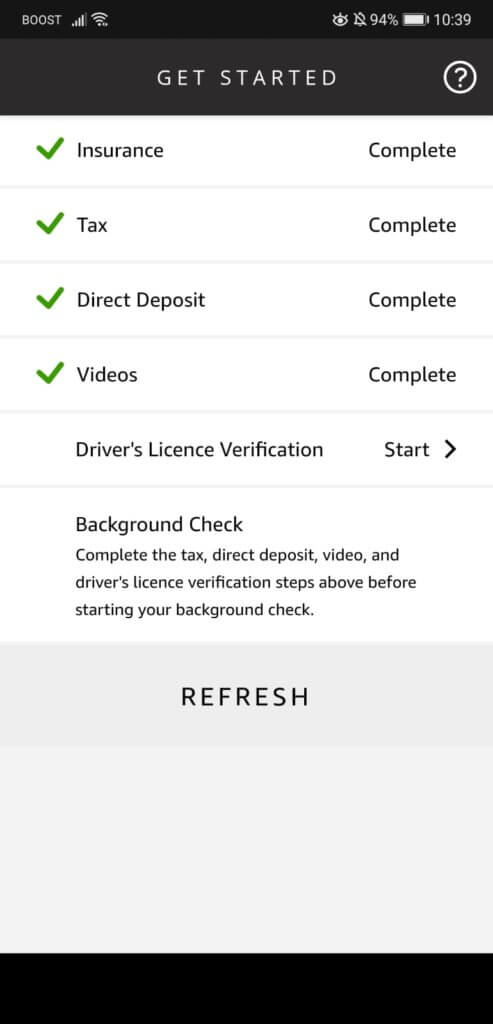

To obtain your amazon flex debit card account and routing numbers, open your amazon flex card app and tap on direct deposit. How to file your taxes as an amazon flex delivery driver.

Taxes For Amazon Flex 1099 Delivery Drivers

If you see a block you want, you tap it and swipe to accept.

How to file taxes for amazon flex. You’ll need to submit a tax return online declaring your income and expenses once a year by 31 january, as well as paying tax twice a year by 31 january and 31 july. I started driving for amazon flex in november, yet only found out about the standard mileage deduction last week. Tax returns for amazon flex.

The coupon code you entered is expired or invalid, but the course is still available! Taxes for uber, lyft, postmates, instacart, doordash and amazon flex drivers are handled differently. If you are an amazon flex self employed delivery driver you will get a form.

100% of the tax shown on your prior year’s tax return. They are both forms that are used to report your yearly income. So i’ve been trying to prepare for when my taxes are due, but i haven’t received my 1099 form yet.

(your prior year tax return must cover all 12 months.) to prepare estimates for next year, you can just type w4 in the search box at the top of your return , click on find. To help you prepare, we compiled information about deadlines, deductions, forms and sales tax reporting. Enroll in course for $47.

In other words, you do not work for amazon. You need to follow your state's instructions for gig workers. Press question mark to learn the rest of the keyboard shortcuts.

Learn how to prepare and file your taxes as an uber, lyft, postmates, instacart, doordash and amazon flex driver. The new information is as follows:twitter handle = @thesetaxguy new facebook page = /theself. Update (please read):some of my contact information has changed.

There isn't one, aside from maybe amazon corporate, but you should not need one. Then click on jump to and it will take you to the estimated tax payments section. Self employment consists of medicare and social security taxes and are usually paid by employers of traditional jobs.

The irs requires s to be sent out by january 31st. Your tax liability as an amazon flex driver. What should you know about doing taxes as an amazon flex driver?

Amazon flex drivers are currently classified as independent contractors. Below is an example 1099 form with total earnings of $5500 noted in box 7. You must know what you are doing if you don’t want to get in trouble.

You are only going to be eligible for care act benefits and only if you are not still working as a flex driver. Filing taxes as an amazon seller can be a mystery. Are you making money by driving for amazon flex?

Amazon will send you a 1099 tax form stating your taxable income for the year. If amazon accepts you for the block you’ll receive a confirmation message. To see how much you'll owe, use our self employment tax calculator.

Press j to jump to the feed. Make quicker progress toward your goals by driving and earning with amazon flex. If you end up with $49, is that $30 net + $19 tips, or is it $44 net + $5 tips, or something in between.

As a classified independent contractor you are required to file your own federal and state income taxes as well as self employment tax. Go to the amazon flex app > menu> settings > personal information > bank account and insert your amazon flex debit card account and routing number. This is my first time filing taxes for earnings.

This means that they're not entitled to amazon employee benefits or the same tax withholding to which employees are subjected. Flex drivers are not amazon employees. As an independent contractor, you will use the information on form 1099 from amazon flex to complete schedule c and schedule se, which in turn are needed to complete sections of form 1040 that pertain to your amazon flex earnings and tax amounts.

Daiwa House Industry Business Model Canvas Business Model Canvas Business Model Canvas Examples Online Business Models

Intuit Careers Tax Preparer Jobs I Turbotax Live Turbotax Tax Preparation Online Assessments

What Are Income Limits That Will Allow You To Qualify For Medi-cal Or Coveredca Health Plans Income Health Plan How To Plan

Top Delivery Driver Tax Mistakes By Postmates And Amazon Flex Drivers - Rideshare Dashboard Amazon Flex Driver Delivery Driver Postmates

Conquistador Flex - Tactical Pants Men - With Cargo Pockets Army Olive Sr At Amazon Mens Clothing Store Tactical Pants Pocket Army Tactical

Pin On Peter Nouck

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

6 Doordash Beginner Driver Tips To Make More Money Make More Money Doordash Door Dasher Tips

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes - Money Pixels

How To Do Taxes For Amazon Flex - Youtube

How To Start An Amazon Fba Private Label Business - Seller At Heart Bookkeeping Job Amazon Fba Private Label

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes - Money Pixels

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

These Last-minute Tips To Help Make The Ordeal A Lot Less Stressful Time To Get Filing Tax Mistakes Filing Taxes Tax Deadline

Irsuber Mileage Log Tax Deduction With Triplog Tracking App Mileage Tracker App Mileage Tracker Tracking App

Do I Have To Pay Taxes On Freelance Work Paying Taxes Tax Debt Freelance Work

Amazon Flex Filing Your Taxes - Youtube

Pin By Gig Time Delivery Gear On Doordash Gear In 2021 Window Signs Signs Food Delivery

Register Flex Offers Make Money Blogging Blogging Advice Blogging For Beginners