Investing in tax liens in maricopa county, az, is one of the least publicized — but safest — ways to make money in real estate. The buyer of the tax lien has the.

Maricopa County Arizona Zip Codes - 48 X 36 Laminated Wall Map Office Products - Amazoncom

Enjoy the pride of homeownership for less than it costs to rent before it's too late.

Maricopa county tax liens for sale. Sale year tax year parcels advertised $ value not auctioned (1) liens sold $ value avg int rate (2) struck to state (3) 2019: Any liens unavailable will be refunded; For official use only (treasurer ¶s office )

Enter the assessor parcel number (apn) to search for and then click on go. Maricopa county arizona delinquent tax sale. A number will be assigned to each bidder for use when purchasing tax liens through the treasurer’s office and the online tax lien sale.

Be sure to investigate thoroughly. How does a tax lien sale work? If you are already familiar with our system, you may disable tooltips.

Treasurer’s office lobby computer see. Preview and bidding will begin on january 26, 2021. Interested in a tax lien in maricopa county, az?

Maricopa county treasurer attention tax lien department 301 w. Maricopa county tax liens for sale. The certificate is then auctioned off in maricopa county, az.

If the taxes remain unpaid for two years, then the county treasurer offers the lien or cp for sale to the public. It is the bidder's responsibility to know the law governing these sales prior to participating in a tax certificate sale. The tax lien sale will be held on february 9, 2021.

Bidding is online only and will begin when the list is published and close on february 5, 2019. Every february in arizona, all 15 counties hold tax lien auctions. Enter the property owner to search for and then click on go.

3if the judgment creditor decides to bid on the property, the judgment creditor is responsible for paying the $150,000.00 homestead exemption amount, the prior unpaid real property taxes, the prior consensual liens and the sheriff’s costs of sale. Visit arizona tax sale to register and participate. Jefferson st, suite 140 phoenix, az 85003;

In fact, the rate of return on property tax liens investments in. • senior lien payoff amount to the senior lien holders; • senior tax lien amount to the maricopa county treasurer;

Disable tooltips just for this page. Registration for the 2021 maricopa county tax lien auction is currently unavailable. These parcels have been deeded to the state of arizona as a result of a property owner's failure to pay property taxes on the parcel for a number of years.

Confirmation of lien purchases will be sent by email; Delinquent taxes, tax liens and the sale of tax certificates at public auction for unpaid taxes are administered by the county treasurer and provided for in title 42, chapter 18 of the arizona revised statutes. It is the bidder's responsibility to know the law governing these sales prior to participating in a tax certificate sale.

Buying tax liens at auctions, direct or at other sales can turn out to be awesome investments. The sale of maricopa county tax lien certificates at the maricopa county tax sale auction generates the revenue maricopa county arizona needs to continue to fund essential services. These are delinquent real estate taxes, which means that you are buying a debt that, at the very least, will eventually be repaid with interest.

Parcels can be foreclosed on through quiet title court action three (3) years after the date of sale. Do not include city or apartment/suite numbers. Please check the bidding rules for availability.

Sign up today because the best tax deals might disappear as. Maricopa county makes no representation that a property is usable or marketable. The next delinquent property tax lien auction for maricopa county will be on february 5, 2019 for the 2017 tax year.

Enter the address or street intersection to search for and then click on go. Maricopa county arizona tax lien certificates are sold at the maricopa county tax sale annually in the month of february. Taxes are at least 2 years delinquent when they become available for tax lien certificate purchase.

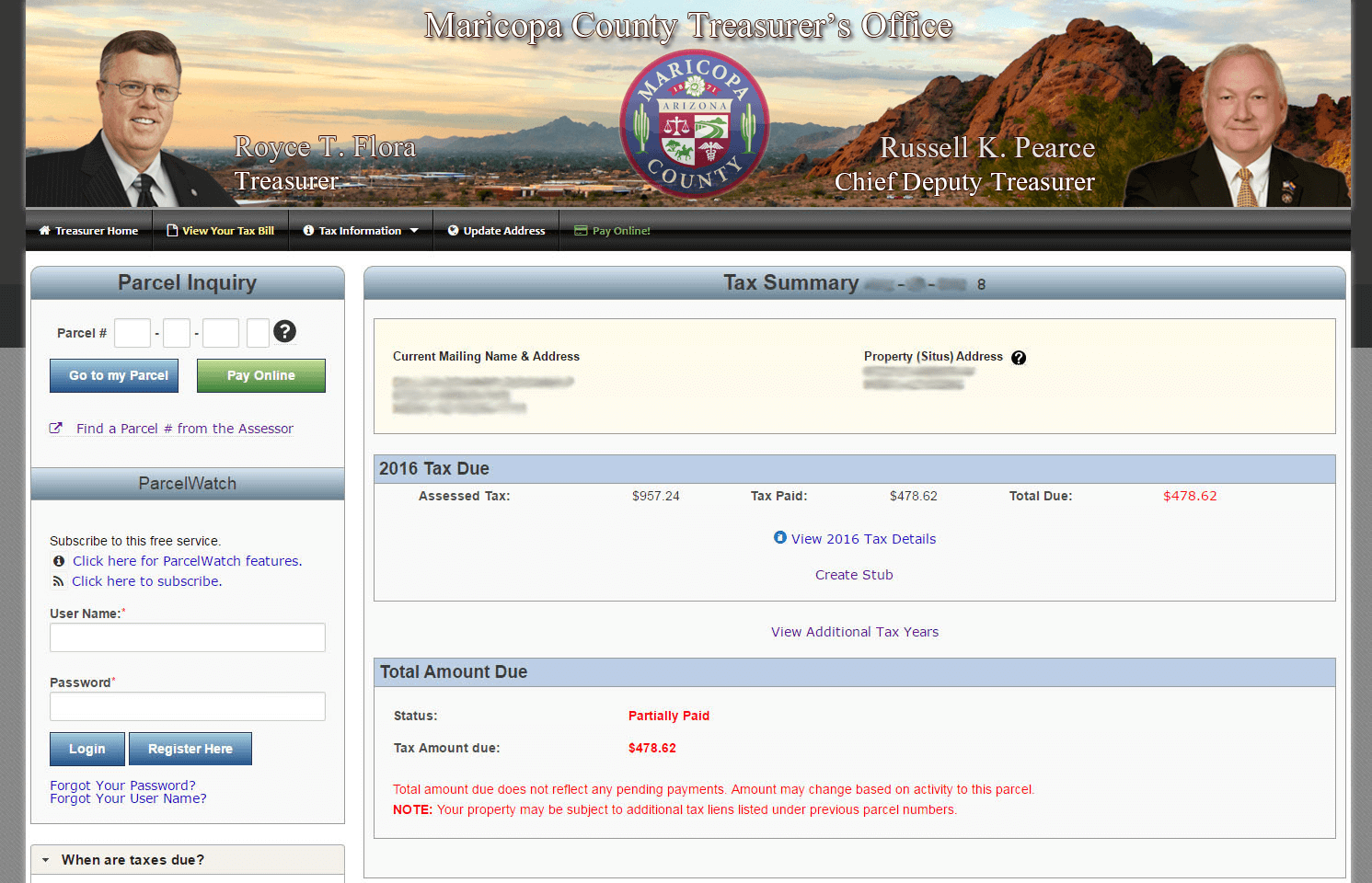

The maricopa county treasurer's tax lien web application allows you to monitor your cp buyer account with maricopa county. A cp is purchased from the county treasurer by paying the total of the back taxes along with 16% on that amount plus approximately five to. Select the township, range and section to search for and.

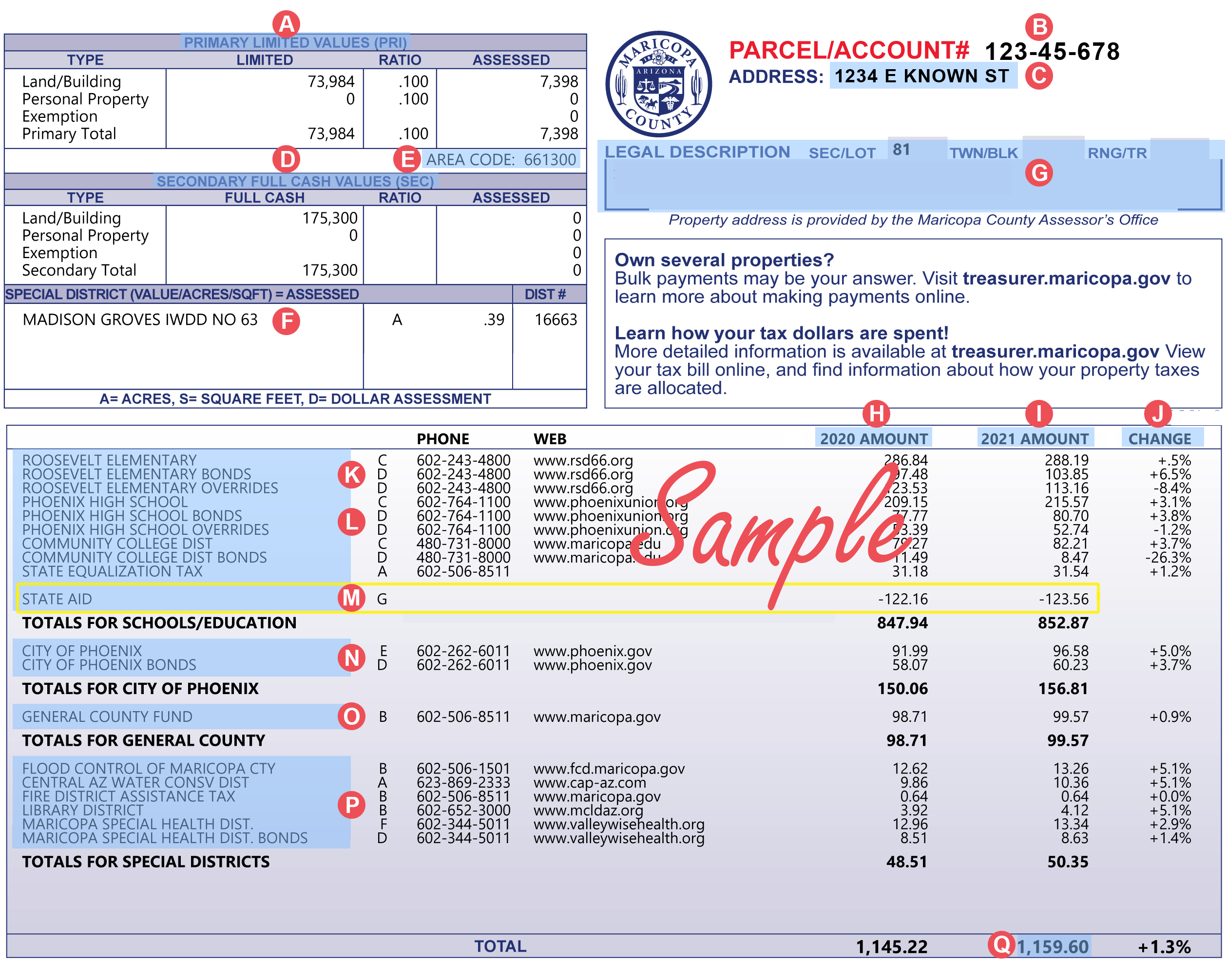

How Do I Pay My Taxes - Maricopa County Assessors Office

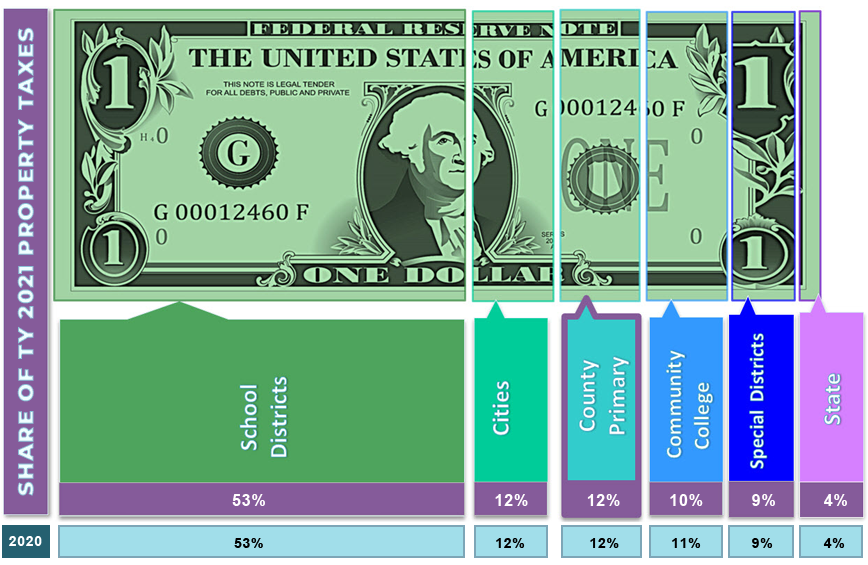

Tax Guide

How Do I Pay My Taxes - Maricopa County Assessors Office

Auctions Leases Maricopa County Az

Maricopa County Arizona Zip Codes - 48 X 36 Paper Wall Map Buy Online At Best Price In Uae - Amazonae

Tax Bill

Maricopa County Arizona Federal Loan Information - Fhlc

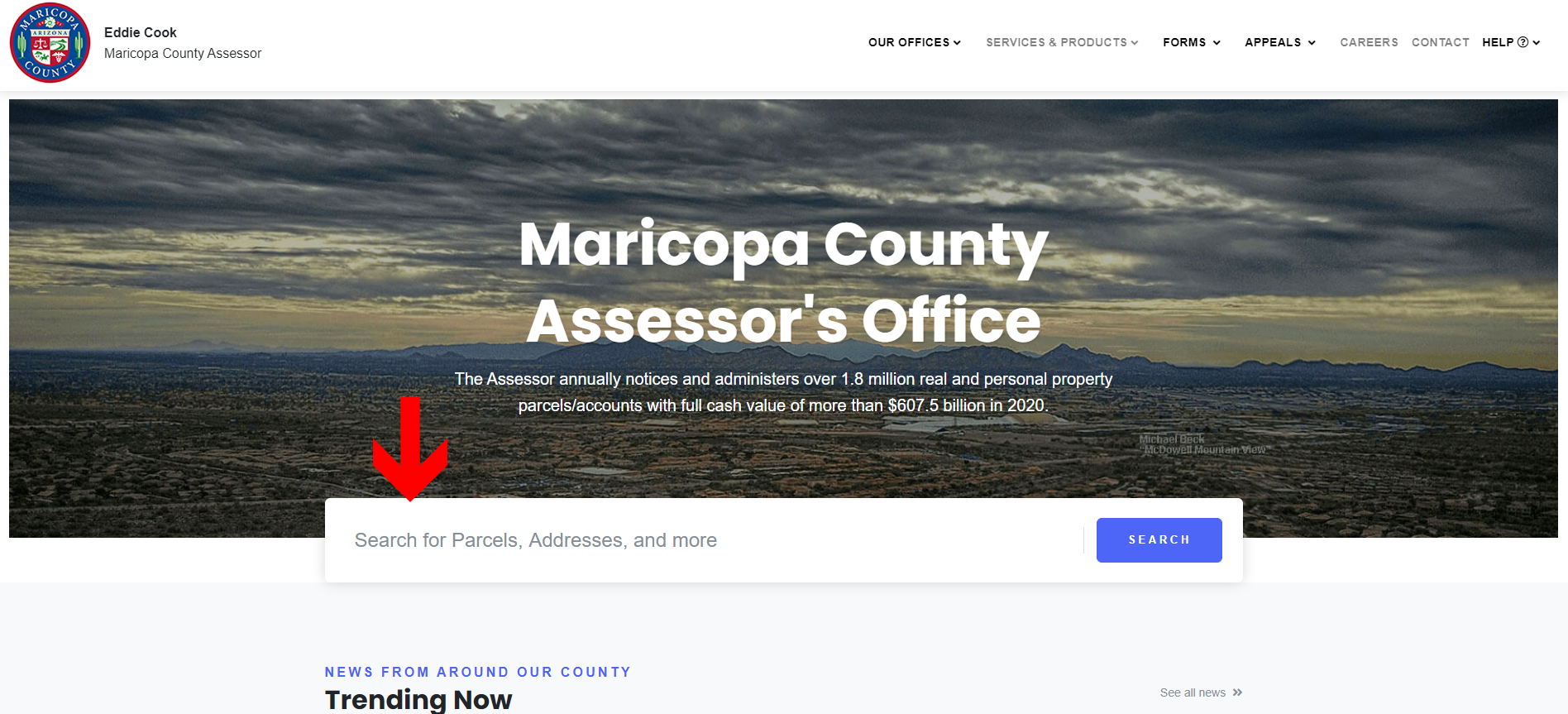

Maricopa County Assessors Office

Maricopa County Arizona Zip Codes - 48 X 36 Paper Wall Map Buy Online At Best Price In Uae - Amazonae

Maricopa County Assessor Interactive Map - Government Affairs

Get A Look At Phoenix And Nearby Cities In Maricopa County Maricopa County Buckeye Arizona Arizona

Maricopa County Treasurers Letter Meant As Farewell Not Politics

Maricopa County Island What Is It - Life Real Estate

Maricopa County May Lose Public Safety Funds If It Wont Comply With Audit Arizona Politics Azfamilycom

Maricopa County Board Of Supervisor Profiles And District Map - Government Affairs

Maricopa County Assessors Office

Maricopa County Assessors Office

News Flash Maricopa County Az Civicengage

Displaced In America Housing Loss In Maricopa County Arizona