Sep 2 maryland student loan forgiveness september 15, 2021 deadline. The student loan debt relief tax credit program deadline of september 15 is just under two weeks away, and comptroller peter franchot and maryland college officials are urging students to take.

Student Loan Refinance Pros And Cons White Coat Investor

For example, if you owe $800 in taxes without the credit, and then claim a $1,000 student loan debt relief tax credit, you will get a $200 refund.

Maryland student loan tax credit deadline. However, most students usually get a credit of $1000. The deadline to apply is september 15th. Open from jun 30, 2021 at 11:59 pm edt to sep 15, 2021 at 11:59 pm edt.

The tax credit is claimed on your maryland income tax return when you file your maryland taxes. Applications must be submitted by september 15. Maintain maryland residency for the 2021 tax year;

The student loan debt relief tax credit program deadline of september 15 is just under two weeks away, and comptroller peter franchot and maryland college officials are urging students to take. The program, which is administered by the maryland higher education commission, provides an income tax credit for maryland residents who are making eligible undergraduate and/or. The maryland student loan tax credit scheme offers eligible students and applicants a credit of up to $5000.

15 deadline for applications to a maryland student loan debt tax credit is fast approaching Have completed and submitted an application. Maryland taxpayers who have incurred at least $20,000 in undergraduate and/or graduate student loan debt, and have at least $5,000 in outstanding student loan debt at the time of applying for the tax credit.

The maryland student loan debt relief tax credit provides qualified taxpayers up to $5,000 towards paying off existing student loans. Maryland residents who have significant student loan debt may benefit from a maryland tax credit program. If the credit is more than the taxes you would otherwise owe, you will receive a tax refund for the difference.

The tax credit has to be recertified by the maryland state government every year, so it's not a guaranteed credit each year. This means that one student will receive a maximum of $5000 in credit. Have at least $5,000 in outstanding student loan debt remaining when applying for the tax credit;

Applications for the maryland student loan debt relief tax credit are due on sept. The info and application go up in july and the deadline is september. Maryland student loan tax credit.

To qualify, you must be making payments on student loan debt incurred in pursuit of eligible undergraduate or graduate degrees from accredited universities or colleges. Marylanders struggling with student debt have a week left to get some help with their loans from the state. To be eligible for the student loan debt relief tax credit, you must:

In order to qualify for the credit, you must apply for the program before september 15, 2019. Complete the student loan debt relief tax credit application. From july 1, 2020 through september 15, 2020.

From july 1, 2021 through september 15, 2021. However it comes with a ton of caveats: From july 1, 2021 through september 15, 2021.

The program, which is administered by the maryland higher education commission, provides an income tax credit for maryland residents making eligible undergraduate and/or graduate education payments on. Comptroller peter franchot urges eligible marylanders to act fast and apply for the student loan debt relief tax credit program for tax year 2021. Maryland’s student loan debt relief tax credit can help save you money, but you need to act fast because the deadline to apply is sept.

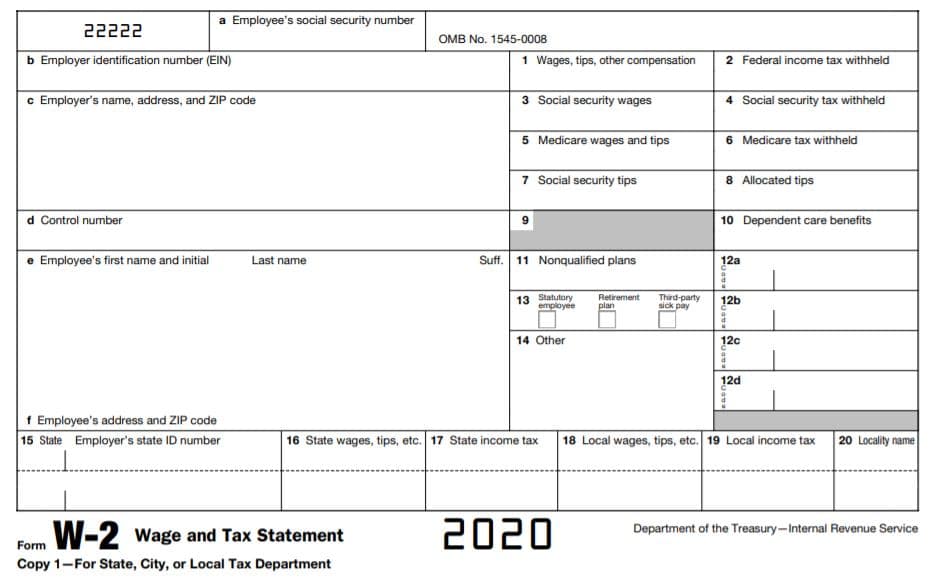

Have incurred at least $20,000 in undergraduate and/or graduate student loan debt; Comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Applicants must submit their official college transcripts, proof of educational loans, and a copy of their most recent maryland income tax return.

Last year the state granted over $9 million in tax credits to residents through the program. Definitely not something widely available and really only applies to maryland residents who. The maryland higher education commission (mhec) administers the program and will begin accepting applications for 2019 tax credits on july 1st, 2019.

Cumberland — comptroller peter franchot urges eligible marylanders to apply for the student loan debt relief tax credit program by sept. Maryland’s student loan debt relief tax credit can help save you money, but you need to act fast because the deadline to apply is sept. The 2019 student loan debt relief tax credit application process is now open.

You must have applied for the credit last year, before the due date. Very early for this (they don't even have all of the information up yet) but i used this for my 2017 taxes and got $1200 to put toward my student loans.

How To Get Rid Of Student Loans - Savingforcollegecom

Student Loans 101 How To Manage Your Student Loan Debt White Coat Investor

Student Loan Forgiveness Programs The Complete List 2021 Update

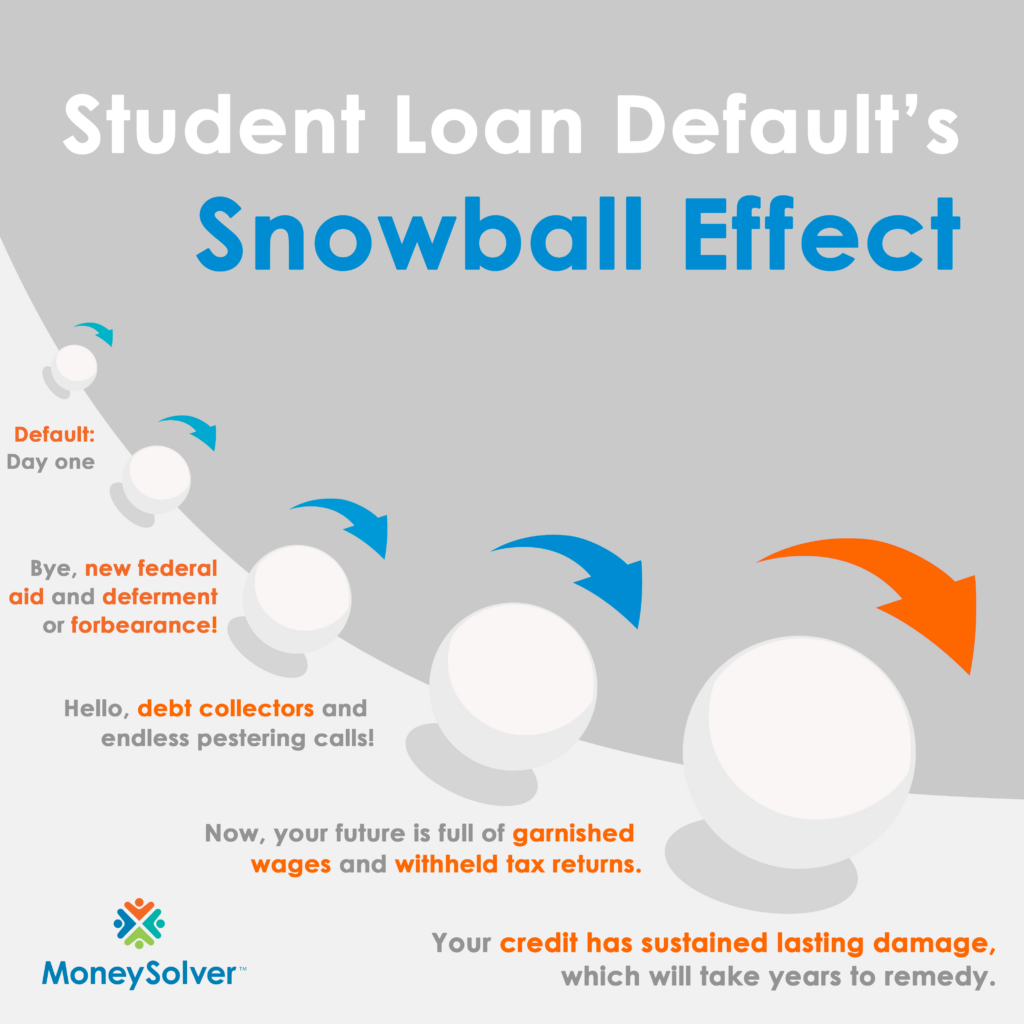

Student Loan Default Pit Could Make Things Worse

Paying Off Student Loans The Good The Bad And The Ugly - Moneysolver

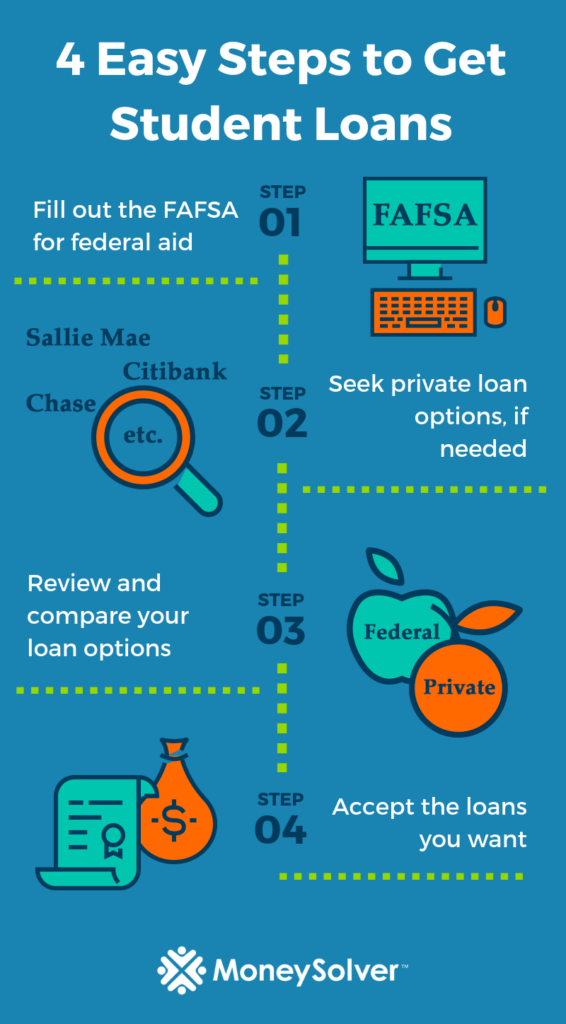

How To Apply For College Loans A Beginners Guide - Student Loan Hero

Will Student Loan Forbearance Be Extended Again Money

Employer Student Loan Repayment Benefit Will You Get Tax-free Money

Students To Service Program Service Program Student National Health Service

How To Get A Student Loan Before Your Tuition Is Due - Moneysolver

2020 Guide To Brown Mackie College Lawsuits Student Loan Forgiveness Fsld

Learn How The Student Loan Interest Deduction Works

Learn How The Student Loan Interest Deduction Works

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Maryland Taxpayers May Qualify For Student Loan Debt Relief Tax Credit

Learn How The Student Loan Interest Deduction Works

Pros And Cons Of Income-driven Repayment Plans For Student Loans

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero