To find the suta amount owed, multiply your. Some states require that both the employer and employee pay suta taxes.

The True Cost To Hire An Employee In Texas Infographic

What is the suta tax rate?

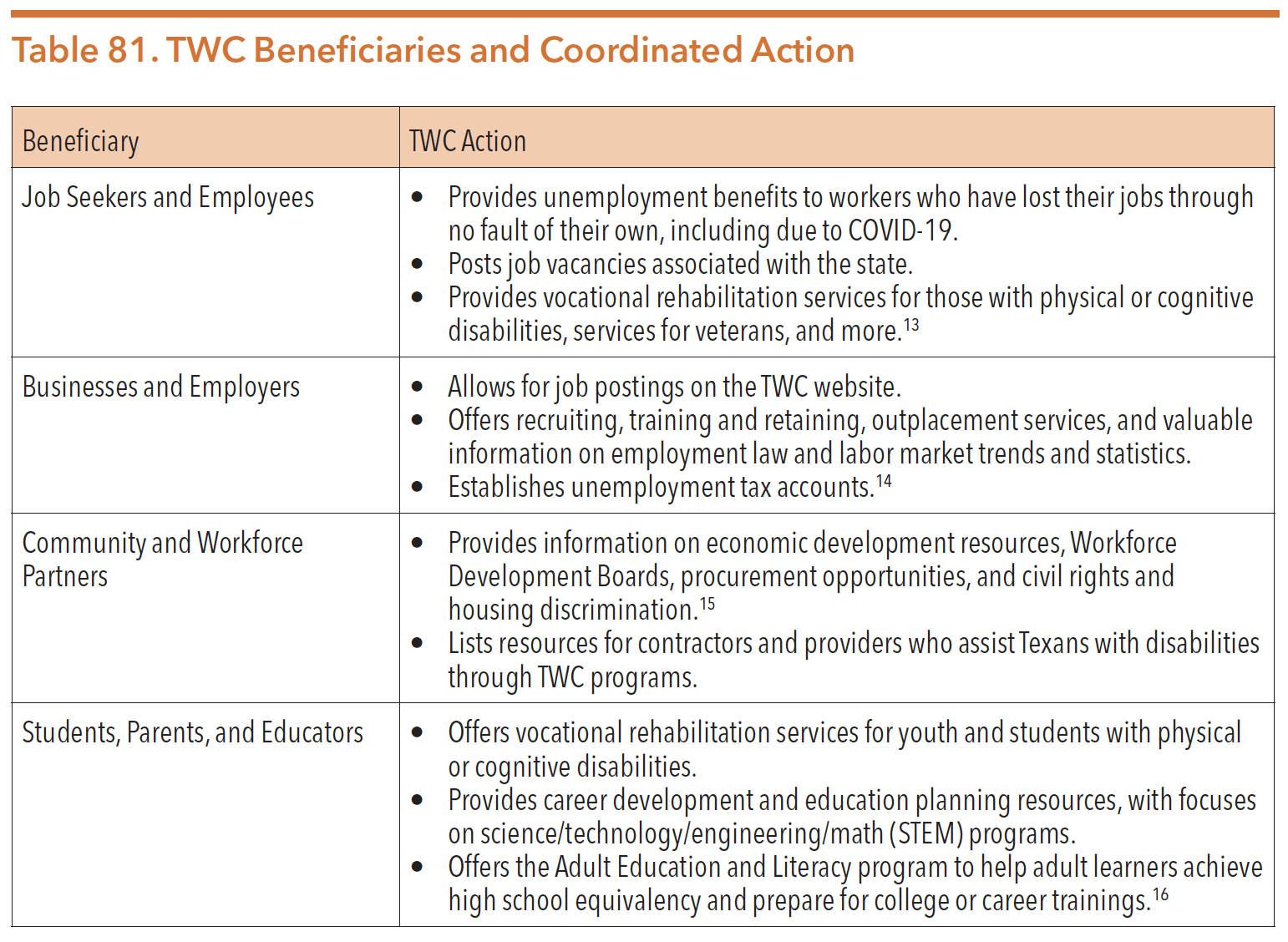

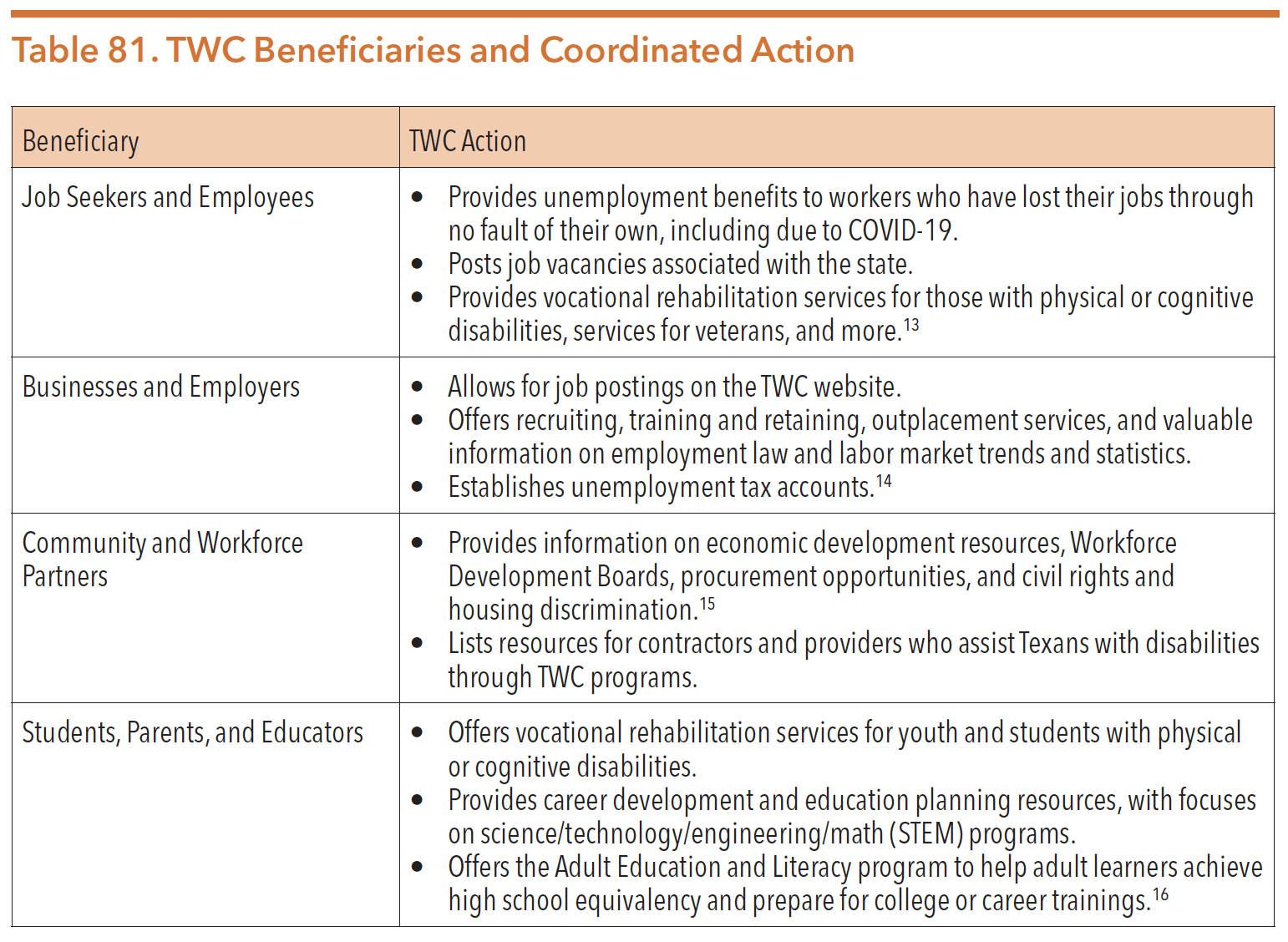

What is suta tax texas. An employer's sui rate is the sum of five components: The state unemployment tax act, known as suta tax, is a form of payroll tax that all states require employers to pay for their employees. Typically, suta dumping occurs when a business transfers payroll out of an existing company or organization to a new or different organization solely or primarily to.

Most states send employers a new suta tax rate each year. Staying with the texas example, the min/max tax rate for 2020 ranged from 0.31% to 6.31%. Determine in which state to report wages;

Get information about unemployment tax audits; The suta wage base is subject to revision every year. This means you will only contribute unemployment tax until the employee earns above a certain amount.

According to the irs, if you paid wages subject to state unemployment tax, you may receive a credit of up to 5.4% of futa taxable wages when you file your form 940. Most states send employers a new suta tax rate each year. Like other payroll taxes, you pay suta taxes on a percentage of each employee’s earnings, up to a certain amount.

List of texas workforce commission county codes Generally, states have a range of unemployment tax rates for established employers. Tax rate each state sets a range of minimum and maximum tax rates for suta taxes.

Assume that your company receives a good assessment, and your suta tax rate for 2019 is 2.7%. 52 rows suta, the state unemployment tax act, is the state unemployment insurance. Texas employers are also subject to state unemployment (suta) tax, federal unemployment (futa) tax, and their share of medicare and social security taxes.

Verify social security numbers online; Using the formula below, you would be required to pay $1,458 into your state’s unemployment fund. Generally, states have a range of unemployment tax rates for established employers.

Some states apply various formulas to determine the taxable wage base, others use a percentage of the state’s average annual wage,. The futa and suta taxes are filed on form 940 each year, regardless if a business has an employee on unemployment insurance. People also ask, what is suta on my paycheck?

In 2019, the taxable wage base for employees in texas is $9,000, and the tax rates range from.36% to 6.36%. Learn about the tax liability appeals process; Suta dumping is a tax evasion practice involving the manipulation of an employer’s unemployment insurance (ui) tax rate to achieve a lower rate and thereby pay fewer ui taxes.

The state unemployment tax act, known as suta, is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. New businesses in texas start with a suta tax rate of 2.7%. What is the suta tax rate for 2019?

The state unemployment tax act, known as suta , is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. General tax rate, replenishment tax rate, unemployment obligation assessment, deficit tax rate, and employment and training investment assessment. State unemployment taxes are referred to as suta tax or state unemployment insurance (sui).

Or, they may be referred to as reemployment taxes (e.g., florida). For more information, see state unemployment tax act (suta) dumping. The futa tax rate is a flat 6% but is reduced to just 0.6% if it’s paid on time.

Therefore, employers must ensure that they stay up to date with their suta wage base and withhold the accurate tax for each worker. The state unemployment tax act, better known as suta, is a form of payroll tax that all states require employers to pay for their employees. The $7,000 is often referred to as the federal or futa wage base.

Just like the suta wage base, suta tax rates also differ from state to state. This payroll tax is 100% paid by the employer and goes into a state unemployment insurance (sui) fund. Your state will assign you a rate within this range.

Texas is one of the few states that does not charge employees a state income tax (though texas employees must still pay federal income taxes, social security taxes, and medicare tax withholdings). Your state will assign you a rate within this range. This practice, known as state unemployment tax act (suta) dumping, is a common scheme in which a business with a higher unemployment tax rate shuffles employees to another business in order to pay a lower rate.

Suta is a counterpart to futa, the federal unemployment insurance program. Understand state unemployment tax act (suta) dumping; The futa tax rate is 6% and applies to the first $7,000 paid to each employee as wages during the year.

State unemployment tax assessment (suta) is based on a percentage of the taxable wages an employer pays. These contributions provide monetary support to. The fund pays unemployment benefits to employees who have become unemployed at no fault of their own.

The rate set is retroactive to january 1 for all employers in the state. Suta stands for state unemployment tax act. Moreover, each state has a range for its suta rates.

Each state establishes its own tax rate and wage base.

Unemployment Claims Could Drive Up Taxes For Already Hurting Texas Businesses Keye

1099-g Tax Form Causing Confusion For Some In Kentucky Newswest9com

Tax Relief Notification Texas Workforce Commission

Unemployment Claims Could Drive Up Taxes For Already Hurting Texas Businesses Keye

Texas Unemployment Tax Rate Decreases - Vbr

Fast Unemployment Cost Facts For Texas - First Nonprofit Companies

Payroll Software Solution For Texas Small Business

Suta Tax Requirements For Employers State-by-state Guide

Coronavirus Texas Workforce Commission Speaks With Employers Kvuecom

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvuecom

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

Tax Relief Notification Texas Workforce Commission

Texas Suta Increases Will Impact Employers What You Need To Know - Nextep

What Is Suta Tax Definition Rates Example More

2019 Futa Tax Rate Texas

Texas The Lone Star State

2019 Suta Tax Rate Texas

Unemployment Tax Information Texas Workforce Commission

What Is The Suta Tax And Why Is It Going Up In 2021 - Fourth