Under president joe biden's proposal, individuals who inherit private businesses or property worth millions could face an immediate capital gains tax of more than 40%, even if they don't sell. A recent study from global tax, accounting and advisory firm ey may help explain why.

Hometreasurygov

By doing that, they take advantage of what’s called the angel of death loophole.

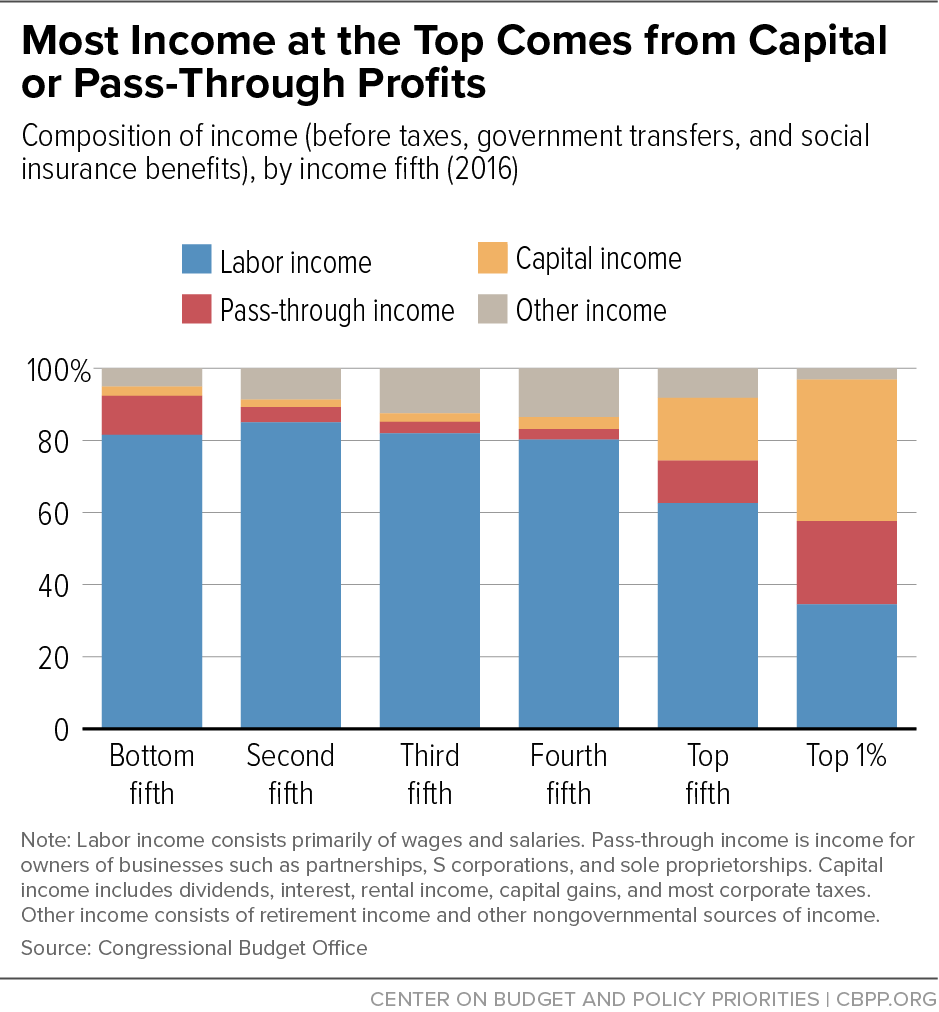

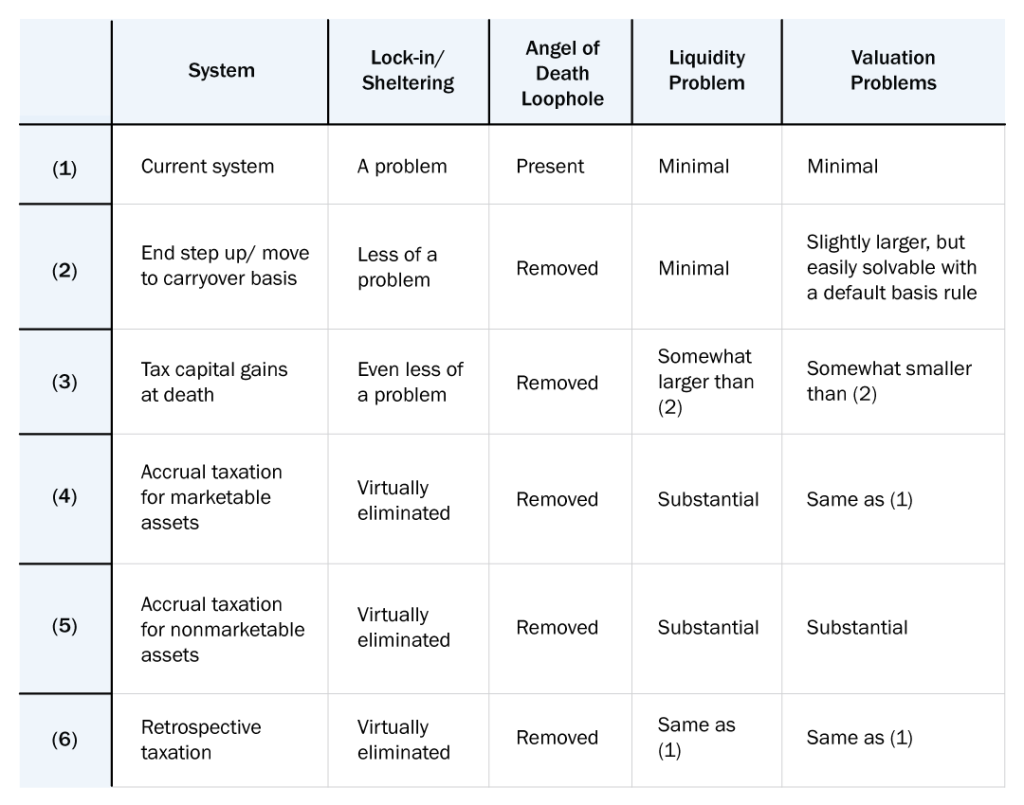

Taxing unrealized gains at death. If congress does not tax gains at death, taxpayers would have a significant incentive to hang on to assets until they die and avoid paying biden’s higher tax rate. This article may be helpful in identifying some of the main issues and alternatives if congress considers the proposal in its upcoming tax reform deliberations. That would exclude “small” business owners and.

But under the billionaire tax as proposed, unrealized capital gains would be taxed annually. Imagine a 50 percent death tax followed by a 40 percent death tax on what is left, and you get the idea. The 16th amendment authorizes taxation of “income,”… unrealized gains don’t fit under that rubric because the wealth is.

Either way, there is currently no tax on unrealized capital gains because the gains on these investments haven’t been realized; But congress could raise that floor to, say, $50 million. President biden’s proposal to require roughly 700 u.s.

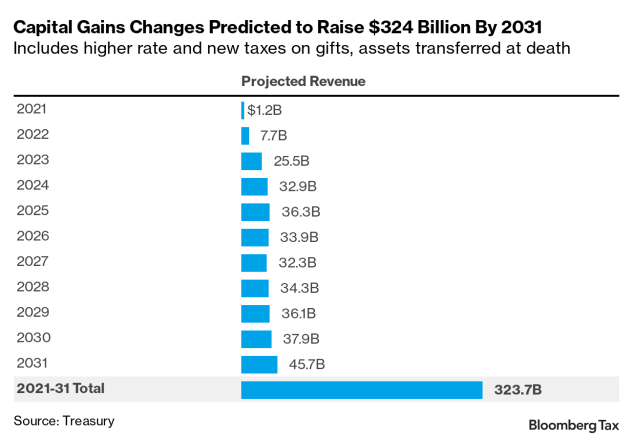

Taxing unrealized gains at death could let congress raise the capital gains rate to 50% before revenue from it would start to drop, according to the. Taxing unrealized capital gains at death is unlikely to raise revenue advertised, according to new analysis. A hallmark of our capital gains system is that it has always given taxpayers some tax planning flexibility, in terms of the ability to time their capital gains by deciding if and when to sell.

Finally, i think it is extremely unlikely that a law taxing unrealized capital gains is ever going to be enacted here in the u.s. There are two proposals for taxing unrealized gains at death. Only gains in excess of $1 million ($2 million for married couples) would be taxed and gains on assets that are part of a family business or family farm would.

These unrealized gains should be taxed at ordinary rates. Study finds taxing unrealized gains among most harmful revenue policies considered. Unrealized gains would be deemed realized on death or gift and taxed accordingly.

In other words, they don’t exist until the investment income is. When the house ways and means committee produced its components of the build back better act, it omitted a proposal to tax unrealized capital gains at the time of a person’s death. It finds that among those with small estates ($1 million or less), taxing capital gains at death would collect more revenue than the current estate tax from roughly half of the decedents.

First, a capital gains tax on unrealized appreciation may be imposed whenever property is transferred at death. But congress could raise that floor to, say, $50 million. For those with larger estates, replacing the estate tax with a tax on unrealized gains at death would result in a substantial reduction in total tax payments.

President biden has proposed taxing unrealized gains over $1 million when a single taxpayer dies (unrealized gains over $2 million for joint filers). Explore biden's unrealized capital gains plan. That would exclude “small” business owners and farmers.

House of representatives speaker nancy pelosi says democrats hope the plan would raise as much as $250 billion to help pay for expanding the. President trump proposed taxing unrealized gains above $10 million at death. The president, in his state of the union address on january 20, 2015, has again proposed a tax on gains on assets transferred at death.

After these unrealized, unsold, phantom gains are subject to the new 50 percent double death tax, there is still the matter of the old death tax to deal with. President trump proposed taxing unrealized gains above $10 million at death. To protect lower and middle income taxpayers from the tax, there could be a lifetime gain exemption threshold ($0.5 million, say) that has to be reached before the rules apply or an asset value threshold ($2 million;

Billionaires to pay taxes annually on unrealized capital gains has garnered wide support by democrats as another step to make the rich pay for the uncontrolled spending by the federal government. The leading deathtime capital gains tax proposal was detailed in the treasury tax reform studies published in The constitution may not even permit taxation of unrealized gains.

Right now, capital gains are generally taxed only when they’re sold and the capital gain is realized. As part of the tax proposals in president biden’s american families plan, unrealized capital gains over $1 million would be taxed at death.

Democrats Seek Backup Plan On Taxing Capital Gains - Wsj

To Tax Billionaires Democrats Should Keep It Simple The Japan Times

How Could Changing Capital Gains Taxes Raise More Revenue

Crsreportscongressgov

Biden Estate Tax A 61 Tax On Wealth Tax Foundation

Bidens Tax On Large Capital Gains At Death Will Catch A Few With Annual Incomes Of Less Than 400000

What Are Capital Gains Taxes And How Could They Be Reformed

How Would Biden Tax Capital Gains At Death

Senate Dems Propose Capital Gains Tax At Death With 1 Million Exemption

Dont Try To Mark To Market Capital Gains Tax Unrealized Gains At Death Instead Tax Policy Center

Taxing Wealth By Taxing Investment Income An Introduction To Mark-to-market Taxation - Equitable Growth

Tax Pros Perplexed By Scope Of Bidens Capital Gains Overhaul

Nmhc House Republicans Back Nmhc-supported Opposition To The Taxation Of Unrealized Capital Gains At Death

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Biden Plans To Tax Generational Wealth Transfer Through Unrealized Capital Gains At Death Brammer Yeend Cpas

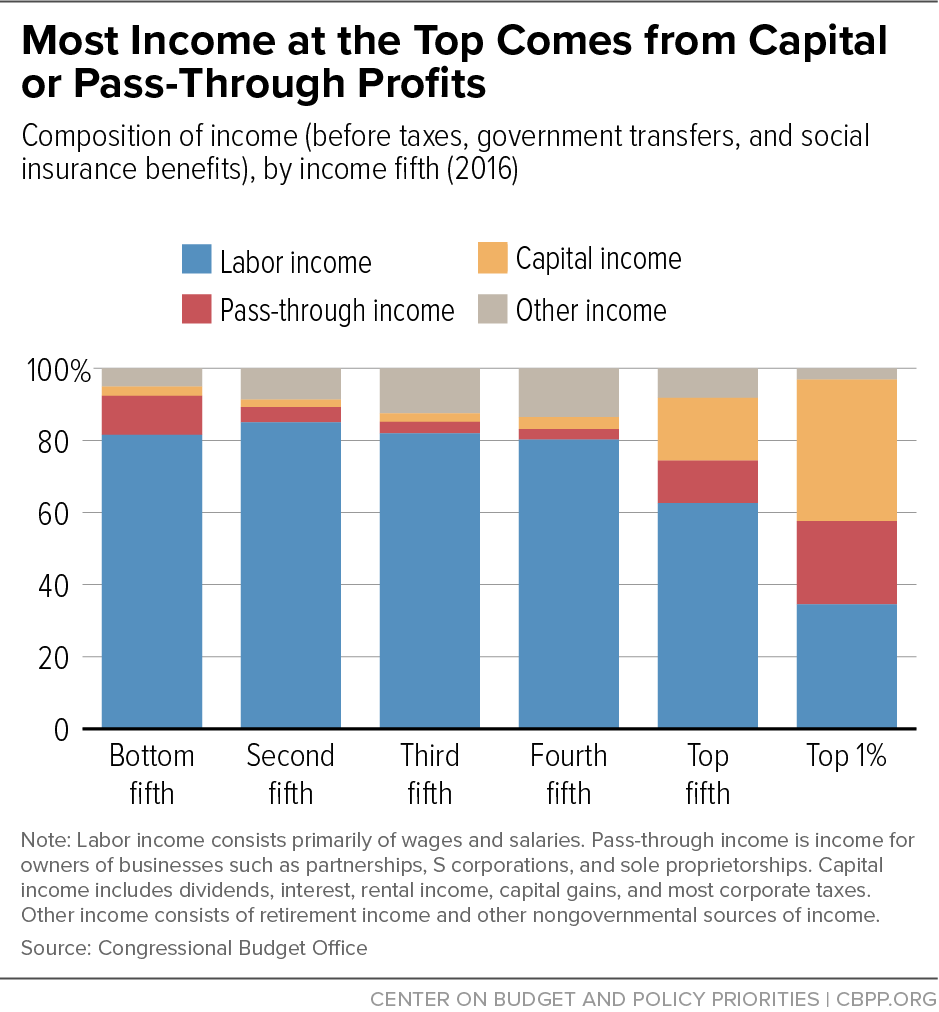

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Taxing Wealth By Taxing Investment Income An Introduction To Mark-to-market Taxation - Equitable Growth

Biden Capital Gains Tax Plan Could Raise 113 Billion If Step Up Is Killed

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation