Nanny and household payroll tax information & faq. Convenience and complete control from your iphone or ipad (required).

The Official Morningside Nannies Blog Morningside Nannies - Part 5

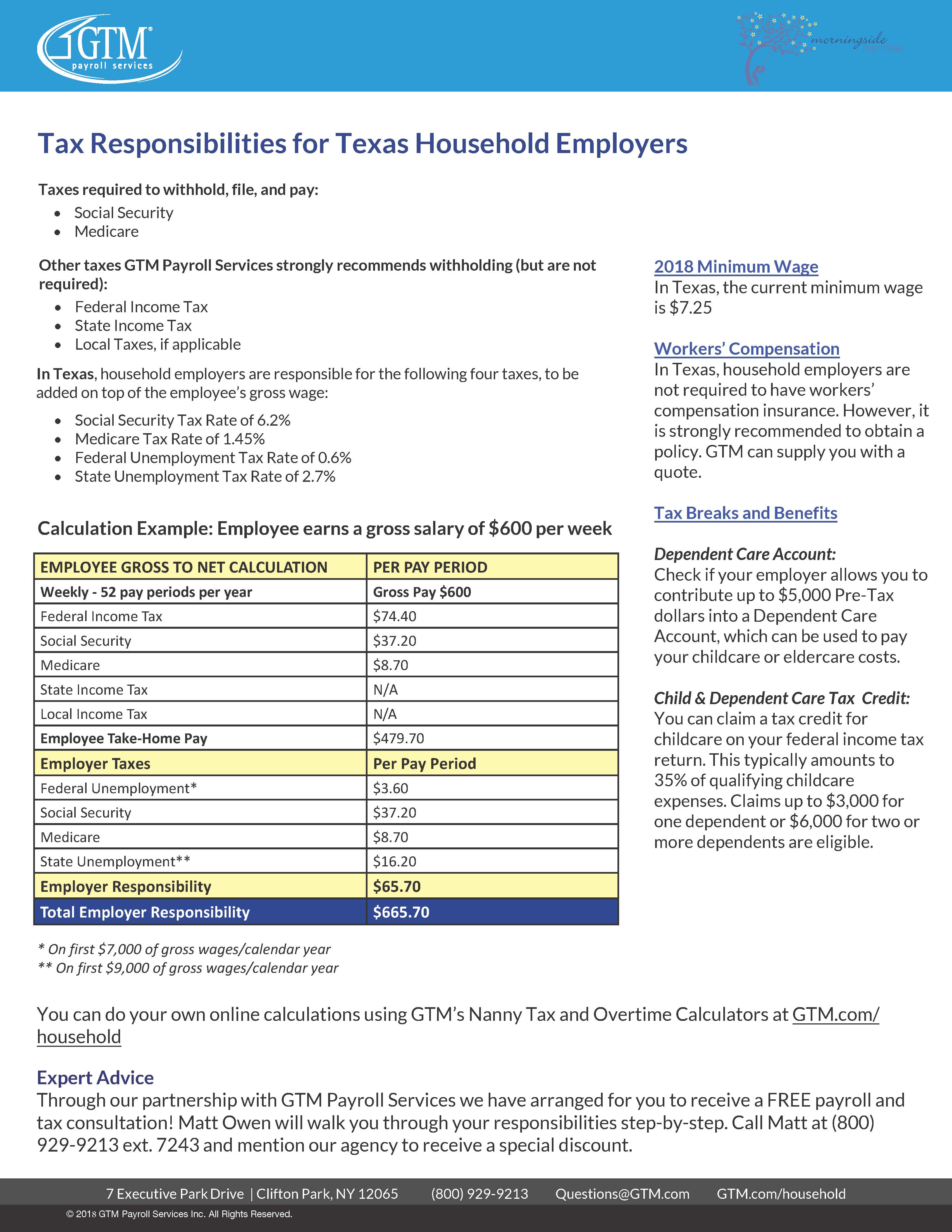

If you have a nanny, you probably owe payroll taxes by paying as little as $2,000 in wages over the course of the year, you are legally required to pay a collection of taxes commonly known as the nanny tax.

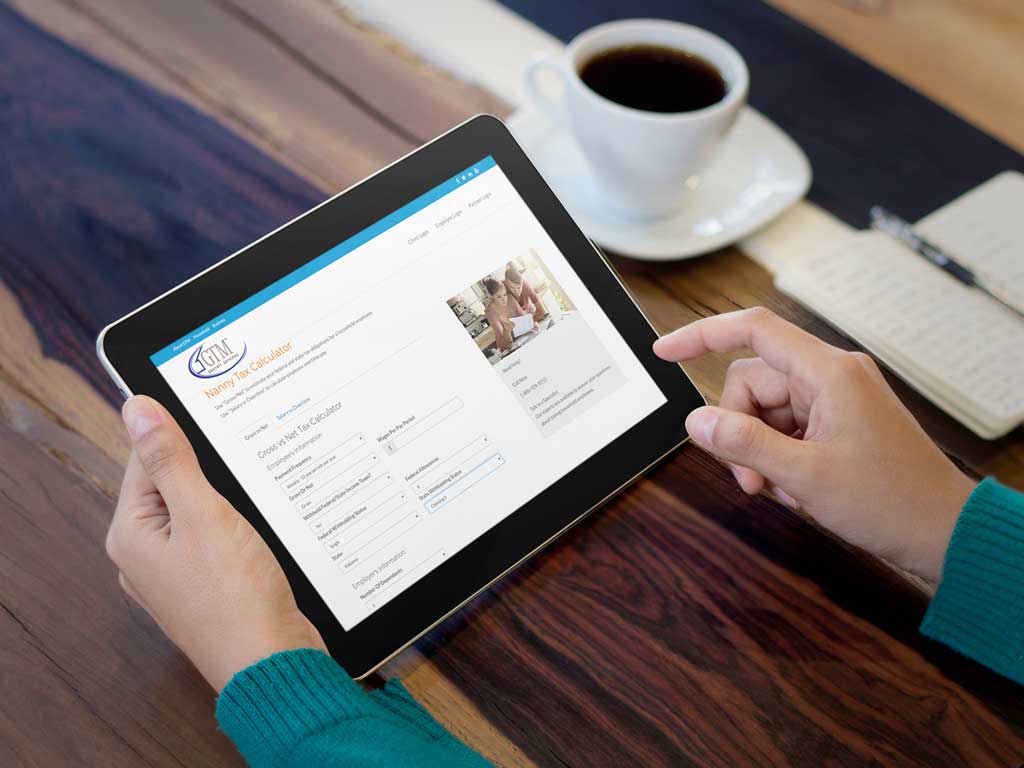

Nanny tax calculator free. The tax tables associated with the tax. You will, however, pay national insurance. The best nanny tax calculator.

Nanny tax calculator homework solutions. The federal unemployment tax you need to pay also depends on the state you live in. On the day the nanny starts working (or better:

Everyone who earns less than £100,000 per year is entitled to the full personal allowance. Nannymatters have provided professional nanny payroll services and expert tax advice for parents since 2002. Those two tax breaks can save you thousands of dollars and more than cover any nanny tax obligations.

As for social security and medicare tax payment, 7.65% will be shouldered by the employer and another 7.65% will be taken from wages — 6.2% for social security, and 1.45% for medicare. Subtract your employee’s share from her gross wages and record the amount you owe. Carefully work through the personal allowances worksheet.

For example, 7.65% of $600 is $45.90. Data is safeguarded with best in class security. When you earn less than this per year, you won’t pay income tax on your earnings.

Our writer will resolve the issue and will deliver again but without any reason, we do not rewrite the whole essay second time for free. Our free guide will lead you through each step of the process for you 2016 taxes and get you set for 2017. In 2021, the maximum amount of childcare expenses (like wages paid to a nanny) you can put toward the child and dependent care tax credit is $8,000 for one child and $16,000 for two or more children.

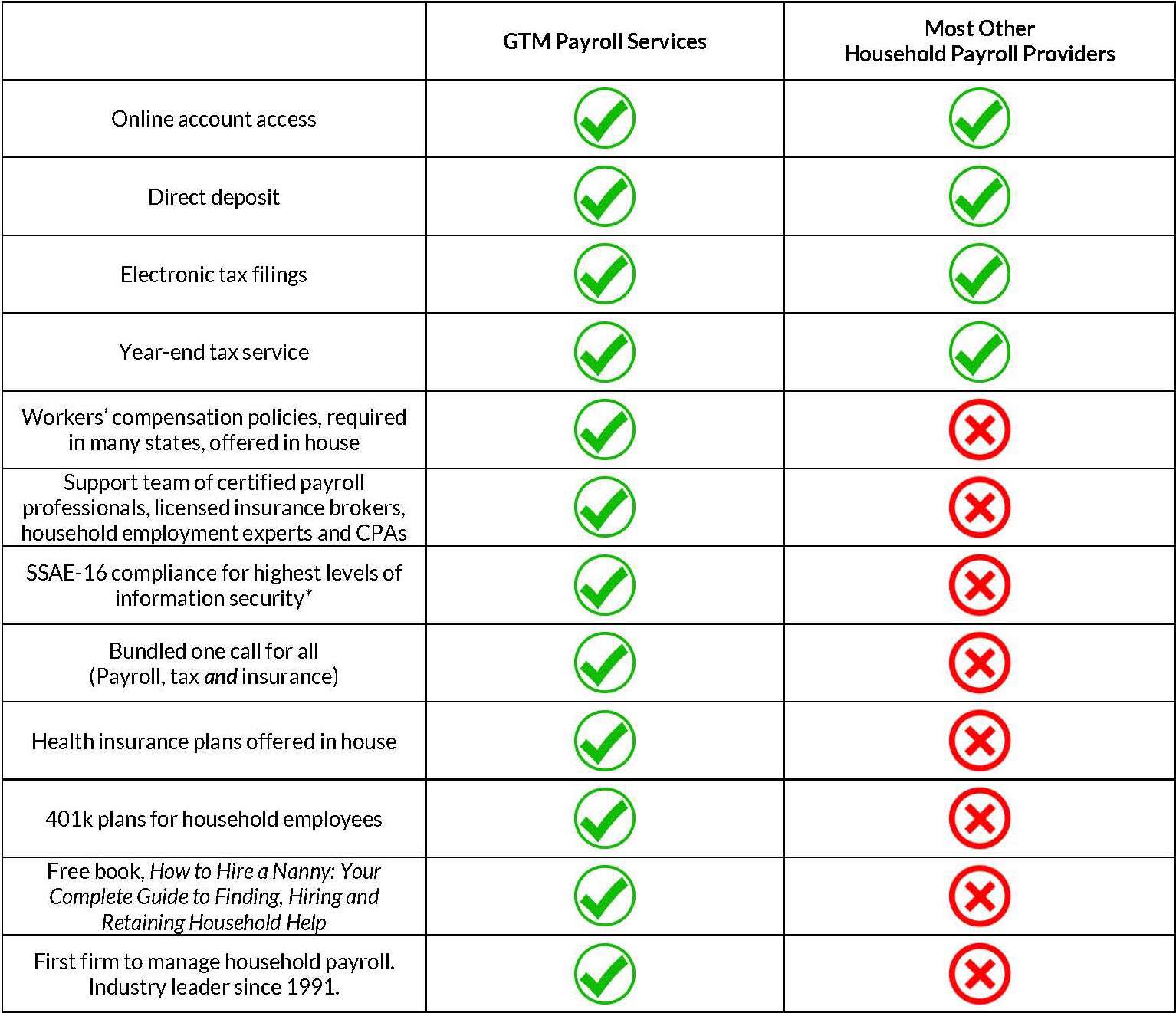

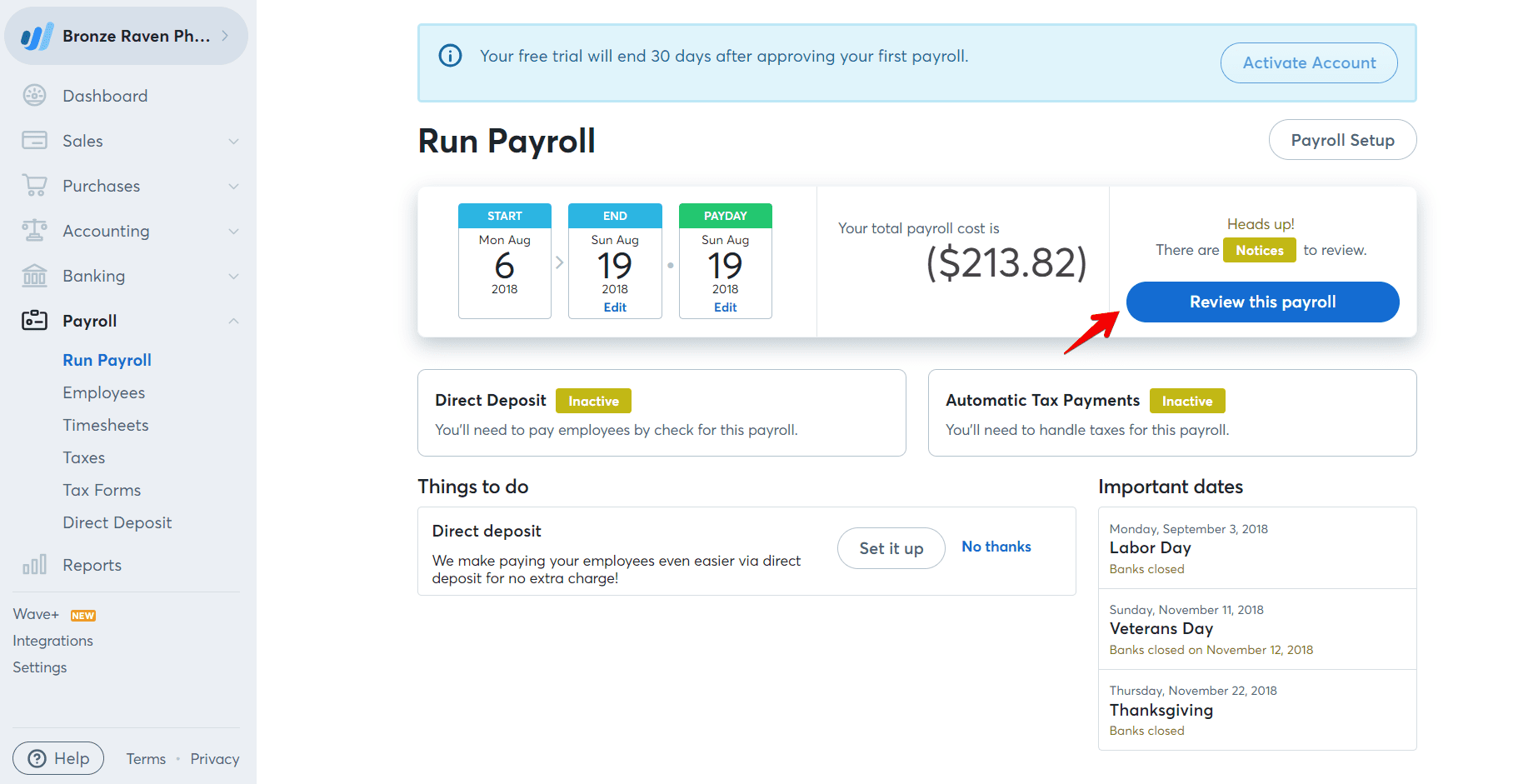

Makes it effortless to pay and file your caregiver’s taxes. Are you looking for a free nanny tax calculator? In fact we will even do it for you.

It is composed of the taxes the household withheld from the employee and the taxes the family pays as the employer. Necessary state taxes (such as. This is the amount of tax charged based on the gross salary of your nanny after her tax free earnings allowance ( tax code ) has been deducted from gross pay.

Use the nanny tax company's nanny payroll calculator to calculate nanny pay and withholding. The salary entered will round to the nearest £10. For a competitively priced annual fee, we remove all the worry that can arise when you become an employer.

In the 2021/22 tax year, this is the first £12,570 of your income. Calculate social security and medicare taxes. Pay quarterly estimated taxes to the irs in order to avoid a tax penalty at year end.

Nannychex is your household payroll and tax experts. A choice of a one step solution for all your tax needs or. Think that few arguments are missing.

Use gross/net to estimate your federal and state tax obligations for a household employee. This calculator assumes that you pay the nanny for the full year, and uses this amount as the basis to calculate what you need to pay per month. If the nanny has other employment the results shown will not apply.

You and your employee each pay 7.65% of gross wages (6.2% for social security and 1.45% for medicare). Paying legally means you might get a substantial tax credit. If you plan to employ your nanny for less than a year, the value stated here will be an overestimation.

Use our nanny tax calculator to help determine your nanny tax. Related posts from nanny tax calculator spreadsheet 7 tax return spreadsheet sample template 2020 a income tax return may be a set of forms that a taxpayer uses to calculate and report taxes owed to intern revenue service (irs).is that the annual deadline for filing a income tax return , though some sorts of taxpayers must file tax returns. Nanny tax calculator free inside the app (no subscription needed).

We'll discuss your specific circumstances, what's required of you as a household employer, and the unique requirements for your city and state with no obligation. We will help you with your nanny tax responsibilities, including the employment contract template. Some of the fees that are part of the nanny tax and required to be withheld are medicare and social security, as well as state and federal.

Provides its clients with comprehensive tax calculations and reporting, as well as assurance that all registration requirements are fulfilled. Use the free nanny tax calculator from care.com homepay to see your 2021 nanny payroll, budget and tax breaks. On line f enter a “1” to account for the childcare expense credits you will claim.

Nanny payroll and tax experts. If your nanny asked you to withhold federal income taxes, you can use the. Tax calculator for families of east wind nannies.

There are dozens of online calculators to choose from, but buyer beware. You don't have to withhold federal income tax for a nanny, but you can if you want. 7 steps for filing taxes as a nanny or caregiver.

Pay history, reports and tax documents are easily accessible. The easiest way to pay your nanny taxes is to increase the amount of tax you have withheld from you own paycheck. In example terms you add a zero to this giving a monetary figure of £12,500 pa or £1,041.67 gross per month is tax free any monthly gross earnings.

2019 / 2020 default tax code is 1250l. Then print the pay stub right from the nanny salary calculator. Accuracy is not a given, especially when ‘free’ is in the name.

Can I Deduct Nanny Expenses On My Tax Return - Taxhub

Nanny Salary Pension Calculator - Gross To Net - Nannytax

Nanny Payroll Service Comparison - Gtm Payroll Services

The 10 Best Nanny Payroll Services 2022 - The Baby Swag

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Guide To Paying Nanny Taxes In 2021

Nanny Tax Payroll Calculator Gtm Payroll Services

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Babysitter Taxes Should A Nanny Get A 1099 Or W-2 Hr Block

.png?width=800&name=2017%20W-2%20FORM%20(2).png)

W-2 Reporting Required For Nanny Tax-free Healthcare Benefits

Free Online Payroll Calculators Surepayroll

What Everyone Must Know About A Nanny Tax Calculator -

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

5 Answers You Need When Using A Nanny Tax Calculator

How To Pay Your Nannys Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

The Diy Household Employee Payroll Service Simple Nanny Payroll

Nanny Tax Payroll Calculator Gtm Payroll Services

Free Payroll Tax Calculator - Estimate 2016 Tax Costs Homepay Nanny Tax Payroll Taxes Nanny Share

Nanny Tax Payroll Calculator Gtm Payroll Services