Motor fuel/gasoline/other fuel tax form. Copies of records may be purchased at $1.00 per page.

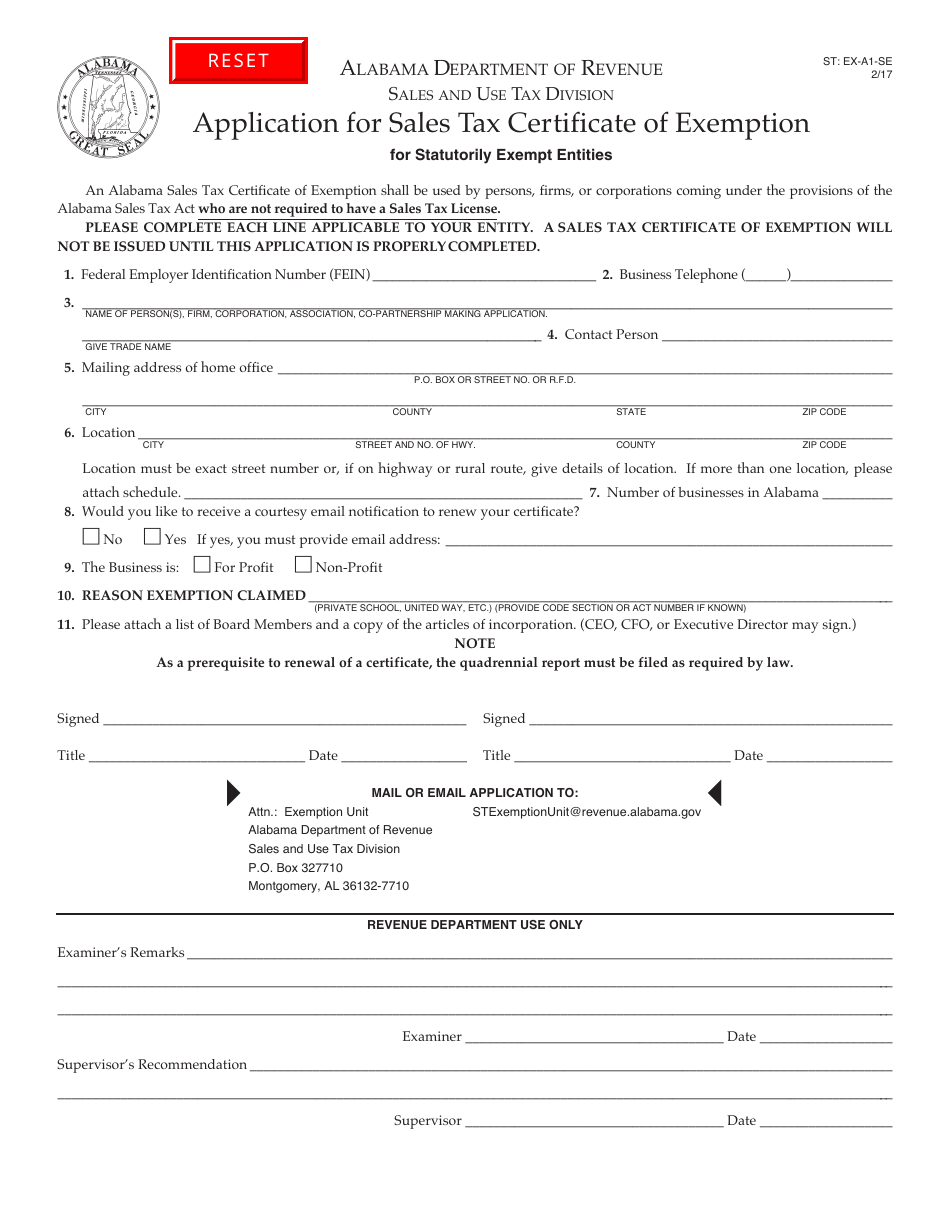

Form St Ex-a1-se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Montgomery county records available in the records & recording division is open to the public unless specifically restricted by law.

Montgomery county al sales tax registration. Delinquent tax p & i; Businesses must use my alabama taxes (mat) to apply online for a tax account number for the following tax types. Contact the montgomery county alabama revenue commissioner for instructions on obtaining the montgomery county alabama tax sale list.

8 new montgomery county al sales tax registration results have been found in the last 90 days, which means that every 12, a new montgomery county al sales tax registration result is figured out. Montgomery county was formed in 1816 when monroe county, which had encompassed a large portion of central and southern alabama, was split into four smaller counties (conecuh, monroe, montgomery, and wilcox).montgomery county itself was later reduced in size when parts of it were taken to form parts of the new counties of bullock, elmore and lowndes. The tax sale list includes the item number, parcel number, legal owner, and legal description of the property's to be offered at the montgomery county alabama tax lien certificate sale.

Montgomery county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in montgomery county, alabama. Alabama has state sales tax of 4% , and allows local governments to collect a local option sales tax of up to 7%. There are a total of 287 local tax jurisdictions across the state, collecting an average local tax of 3.982%.

The texas state sales tax rate is currently %. Office does not process any transactions requiring a vehicle inspection after 3:30 p.m. The 2018 united states supreme court decision in south dakota v.

Instructions for uploading a file. Montgomery county clerk 350 pageant lane, suite 502 clarksville, tn 37040 ( map | directions ) phone: Montgomery county property records are real estate documents that contain information related to real property in montgomery county, alabama.

Combined application for sales/use tax form. Sales/seller's use/consumers use tax form. Registration renewals (license plates and registration stickers) vehicle title transfers.

Change of address on motor vehicle records. Tax statement & online payments; You can read full instructions on how to register select tax types through my alabama taxes help.

Including city and county vehicle sales taxes, the total sales tax due will be between 3.375% and 4% of the vehicle's purchase price. As couponxoo’s tracking, online shoppers can recently get a save of 43% on average by using our coupons for shopping at montgomery county al sales tax registration. The application must include a bill of sale, previous registration, and proof of sales tax payment.if you have not yet paid sales tax, you must register at.

The minimum combined 2021 sales tax rate for montgomery county, texas is. In addition to taxes, car purchases in alabama may be subject to other fees like registration, title, and plate fees. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

Average sales tax (with local): The montgomery county sales tax rate is %. Montgomery county probate court courthouse annex iii, 101 s lawrence st.

This is the total of state and county sales tax rates. You can find these fees further down on the page. Combined application for sales/use tax form.

Enjoy the pride of homeownership for less than it costs to rent before it's too late. You may also obtain an al boat registration form at the marine patrol division office in montgomery. Tax rates access directory of city, county, and state tax rates for sales & use tax.

General 3.50% discount cannot be taken on seller's use or consumer's use tax To schedule an appointment at our main office in montgomery, alabama, click here. These records can include montgomery county property tax assessments.

Certification of a document is an additional $2.00 charge.

I-24 Monteagle Mountain Remember Thismy Dads Home Beautiful Places House Dad East Tennessee

Emergency Rental Assistance Montgomery County Eramco Montgomery County Al

Alabama Sales Tax Bond Jet Insurance Company

Alabama Birth Certificate Signed By Catherine Molchan Donald Birth Certificate Alabama Digital

2

Sales Tax Audit Montgomery County Al

Dealer Alabama Department Of Revenue

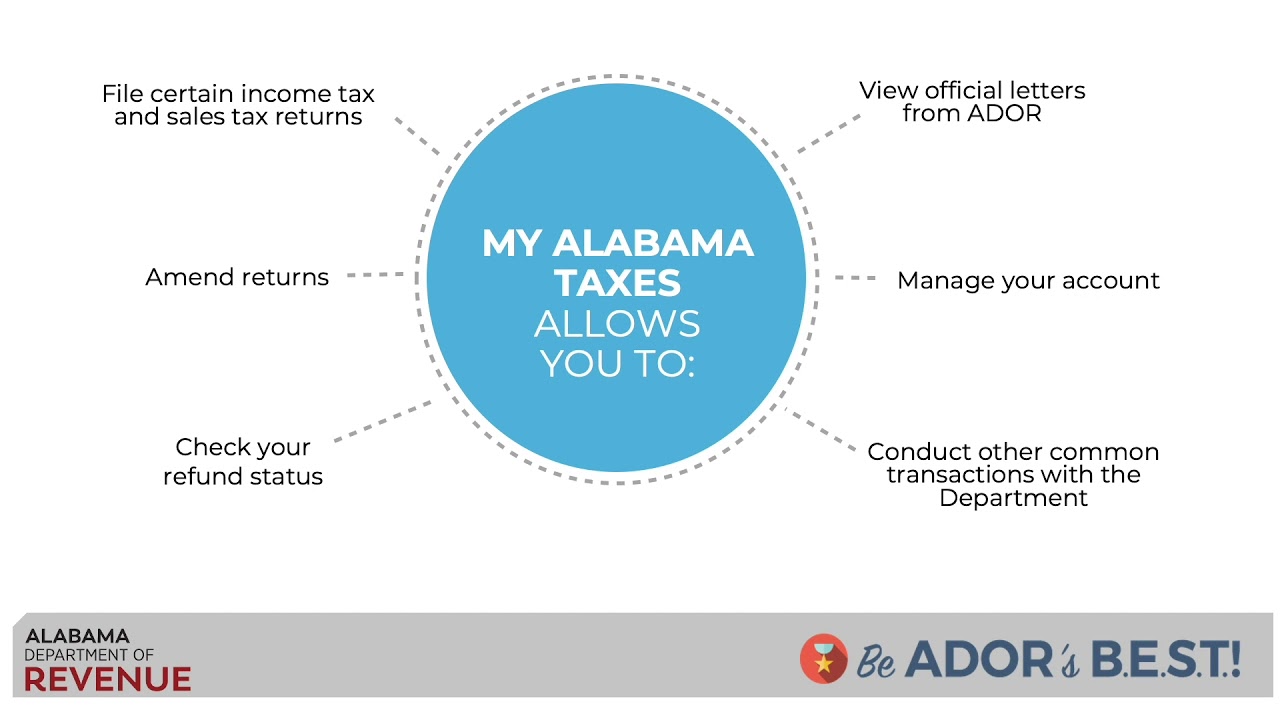

Sales And Use Tax My Alabama Taxes - Youtube

2

My Alabama Taxes - Mat

Capertons Old South Store Weogufka Al Old General Stores Sweet Home Alabama Olds

2

Alabama Sales Tax - Taxjar

Other Alabama Taxpayer Forms Avenu Insights Analytics Taxpayer

2

Temporary Tags Alabama Department Of Revenue

Motor Home Alabama Department Of Revenue

2

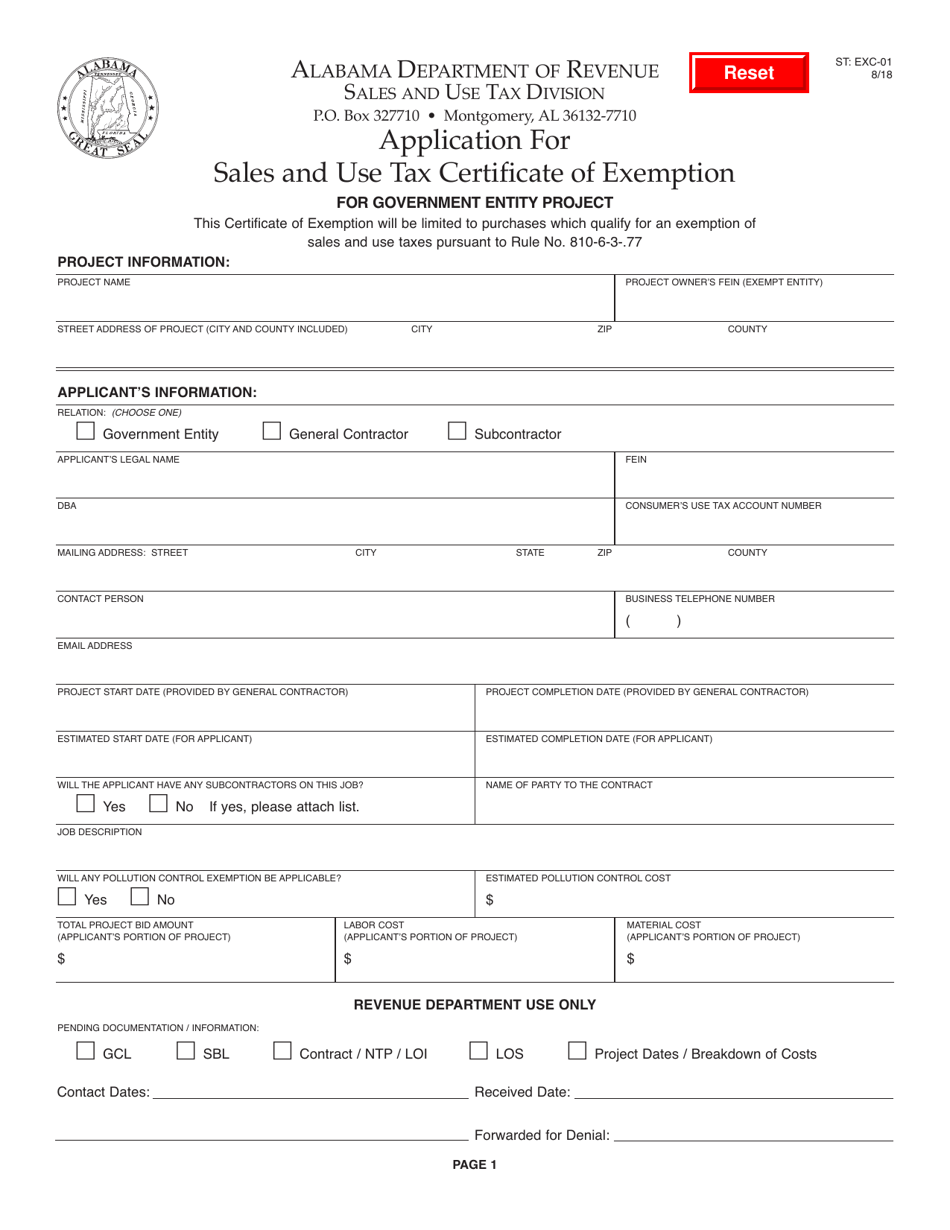

Form St Exc-01 Download Fillable Pdf Or Fill Online Application For Sales And Use Tax Certificate Of Exemption For Government Entity Project Alabama Templateroller