Section 197.3632(8)(a), florida statutes, requires that the. (1) a prospective purchaser of residential property must be presented a disclosure.

Pin On Florida Legal

It has been used in many states since the late 1940s and early 1950s to pay for redevelopment projects.

Ad valorem tax florida statute. Property purchasing tax disclosure law. The ad valorem tax provided for herein shall be in addition to county and all other ad valorem taxes provided for by law. Tax increment financing in florida.

The property tax oversight (pto) program publishes the florida ad valorem valuation and tax data book twice a year. Your ad valorem property taxes are determined by multiplying the taxable value of your property by the millage rate for the current tax year. An ad valorem tax levied by the board for operating purposes, exclusive.

Taxes are based on the assessed value and the millage of each taxing authority. Exemption for certain permanently and totally disabled veterans and for surviving spouses of veterans; These are levied by the county, municipalities, and various taxing authorities in the county.

The levy of ad valorem taxes shall be approved by referendum when required by the state constitution. Claims by members of armed forces. [2] the statute also authorizes the county to levy ad valorem taxes as provided therein.

Florida statute 689.261 sale of residential property; The levy of ad valorem taxes shall be approved by referendum when required by the state constitution. Ad valorem taxes are based on the assessed value and the millage of each taxing authority.

The ad valorem tax provided for herein shall be in addition to county and all other ad valorem taxes provided for by law. Such tax shall be assessed, levied, and collected in the same manner and same time as county taxes. If a florida property tax appraiser denies your longstanding ad valorem tax exemption, you may be able to get it back by challenging the denial in front.

Section 125.016, florida statutes, is a general grant to counties of the authority to impose an ad valorem tax, and provides, in full: The taxable value of the property is determined by the county property appraiser, a constitutional officer. Tax increment financing (often referred to as tif) is a method to pay for redevelopment of a slum or blighted area through the increased ad valorem tax revenue resulting from that redevelopment.

Such tax shall be assessed, levied, and collected in the same manner and same time as county taxes. (1) “ad valorem tax” means a tax based upon the assessed value of property. — an elected board may levy and assess ad valorem taxes on all taxable property in the district to construct, operate, and maintain district facilities and services, to pay the principal of, and interest on, general obligation bonds of the district, and to provide for any sinking or other funds established in connection with such bonds.

This is the disclosure law in the florida statutes on disclosure of ad valorem taxes to a prospective purchaser. (1) in any administrative or judicial action in which a taxpayer challenges an ad valorem tax assessment of value, the property appraiser’s assessment is presumed correct if the appraiser proves by a preponderance of the evidence that the assessment was arrived at by. Chapter 197 which apply to general ad valorem assessments (property taxes), including the use of.

Disclosure of ad valorem taxes to prospective purchaser. Article vii of the florida constitution and chapters 192, 193, 194, 195, 196, 197, 200, and 201 of the florida statutes. These are levied by the county, municipalities, and various taxing authorities in the county.

“annually an ad valorem tax of not exceeding 1½ mills may be levied upon all property in the county, which shall be levied and collected as other county taxes are levied and collected. Ad‐valorem property tax exemptions florida statute 193.621 provides that for purposes of assessment for ad‐valorem property taxes, pollution control equipment shall be. The term “property tax” may be used interc hangeably with the term “ad valorem tax.”

Authority for non ad valorem: Additional homestead exemption for persons 65 and older. Set forth in § 197.3632(3) and (4).

Exemption for surviving spouses of first responders who die in the line of duty. Authority for ad valorem taxes:

Pin On Feeling Guilty

Dormyfloridacom Filing Taxes Child Support Laws Revenue

Today Is A Shopaholics Dream Come True Floridas Taxfreeweekend Has Arrived This Years Tax Holida Tax Holiday Tax Free Weekend How To Apply

Ecommerce Businesses Can Integrate Shopping Carts Automatically From Walmart Amazon Shopify And Ebay Sales Tax Filing Taxes Revenue

Fl Veterans Property Tax Exemptions -- You Need To Read This Dormyfloridacom Dor Property Brochures Pt109pdf Property Brochures Brochure Property Tax

Sales Tax Collection Tips Ten Quick Tax Rules To Help With The Murkiness Of State Taxes If You Need More Help Visit Our Sales Tax Tax Rules Tax Preparation

9 Tips For Buying A Vacation Home Sarasota Real Estate Vacation Home Real Estate Tips

January Is Property Tax Month In Most States Property Tax Florida Real Estate Property

Bfp Affidavit - Entity Real Words Property

Floridas Ad Valorem Tax Exemption Dean Mead

Florida Estate Tax - Rules On Estate Inheritance Taxes

9 Best Tax Laws Ranked By State Tax Relief Center State Tax Tax Help Tax Rules

Florida Dept Of Revenue - Property Tax - Taxpayers - Exemptions Property Tax Filing Taxes Revenue

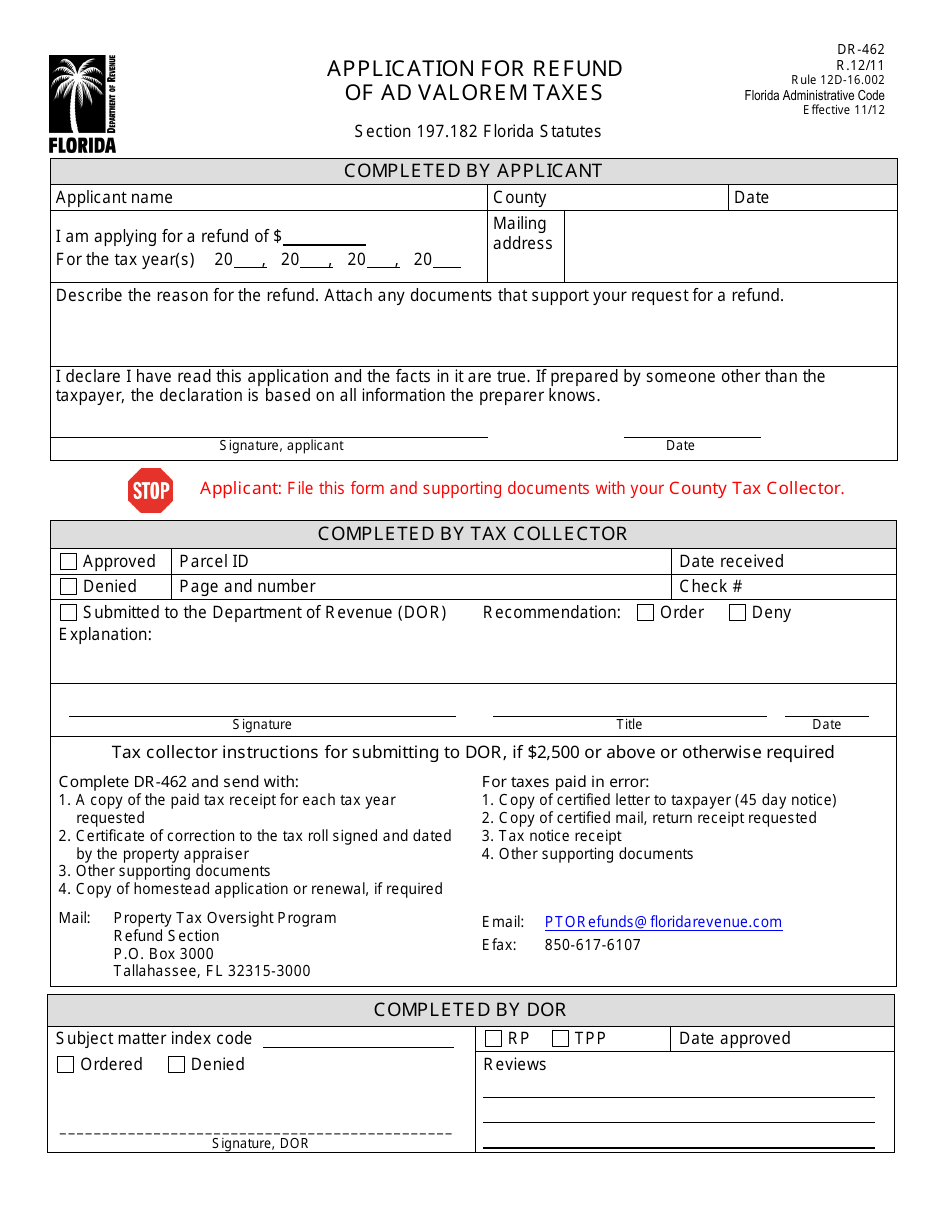

Form Dr-462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Rental Property Tax Deductions Rental Property Management Being A Landlord House Rental

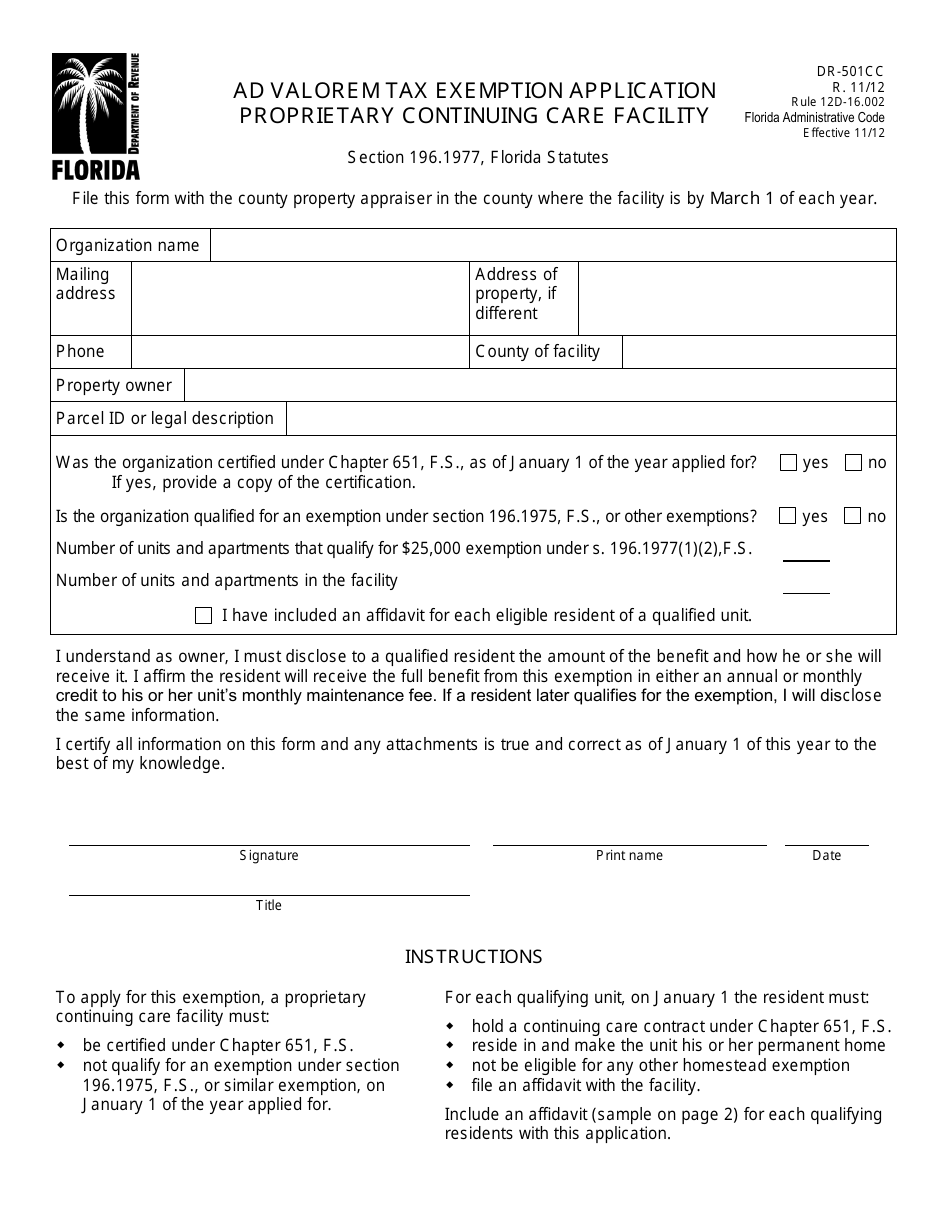

Form Dr-501cc Download Printable Pdf Or Fill Online Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Florida Templateroller

New Tax Laws Have Home Buyers Checking New Places Corporate Law Property Tax Tax Rules

Fl Dept Rev - Classification Of Workers For Reemployment Tax Employees Vs Independent Contractors Filing Taxes Florida Child Support Laws

Free Form Dr-462 Application For Refund Of Ad Valorem Taxes - Free Legal Forms - Lawscom