Taxable income amount rate of tax. The state sales tax rate in montana is 0.000%.

2

Alaska * arizona * arkansas:

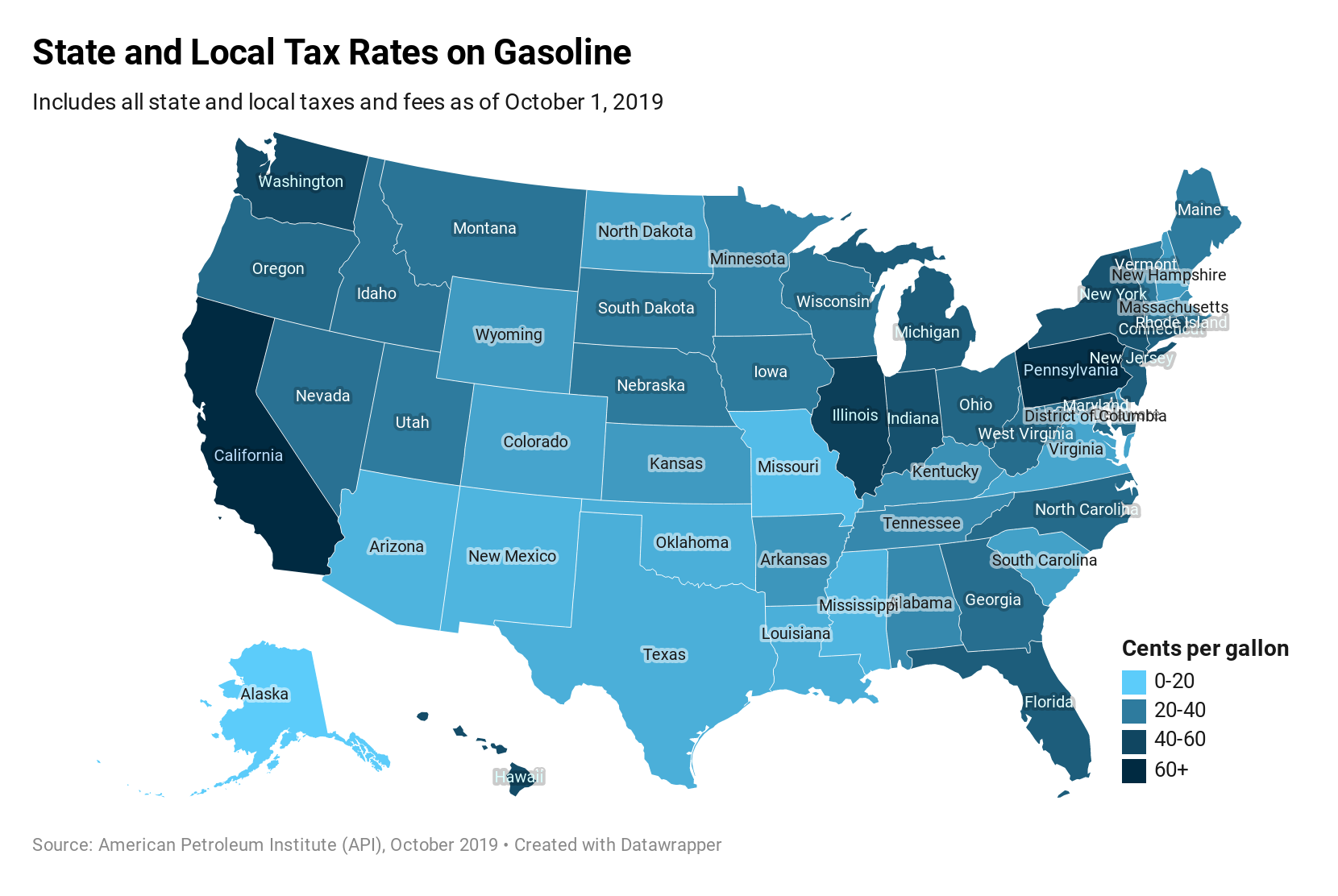

Montana sales tax rate 2019. For more information, see local sales tax information. D.c.’s rank does not affect states' ranks, but the figures in parentheses indicate where it would rank if included. There are a total of 105 local tax jurisdictions across the state, collecting an average local tax of n/a.

• the district of columbia’s sales tax rate increased to 6 percent from 5.75 percent. First $3,100 1% next $2,300. Montana has no state sales tax, and allows local governments to collect a local option sales tax of up to n/a.

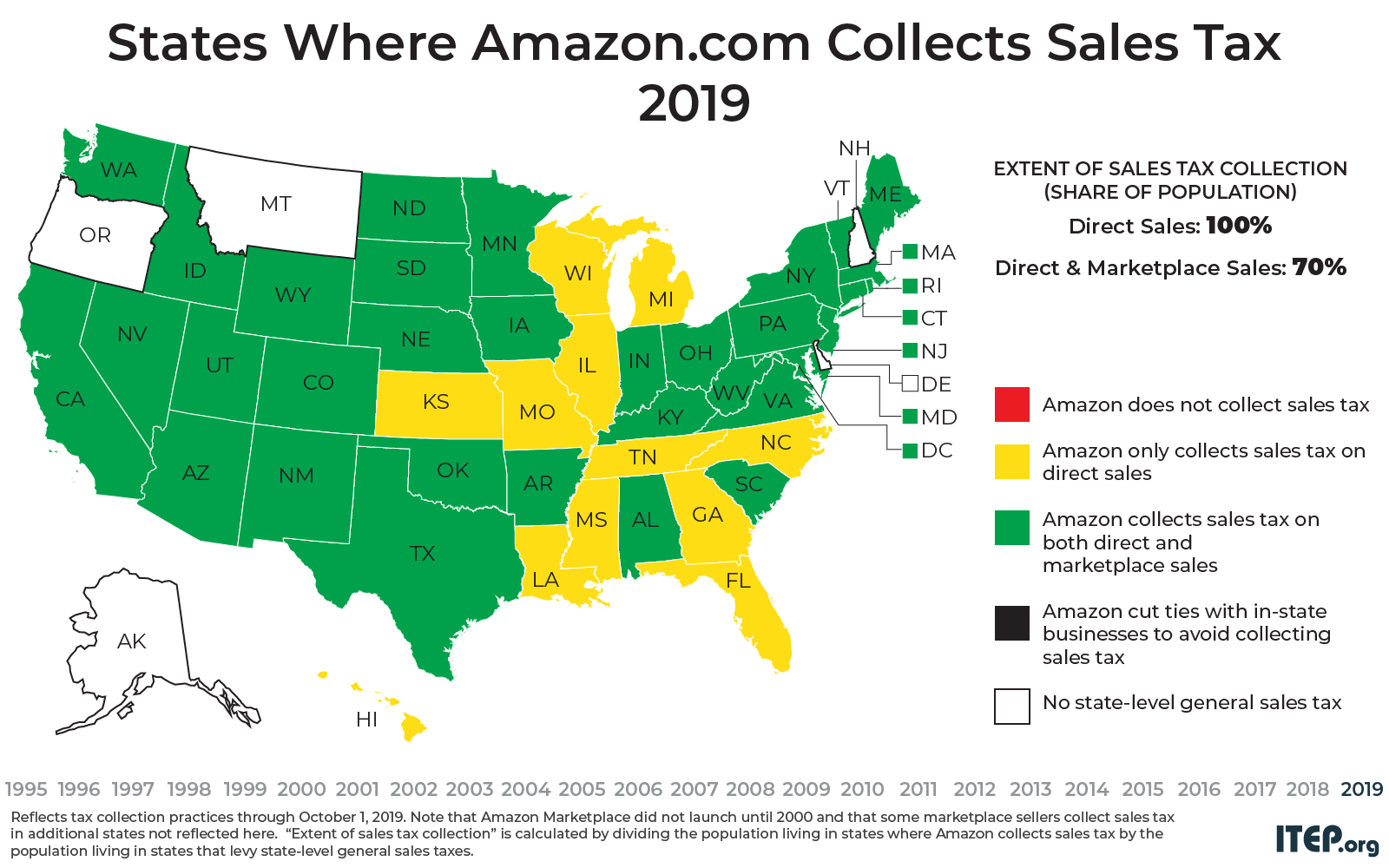

The following table shows tax rates for 2019. Has internet sales tax internet sales tax start date minimum sales thresholds ; Use leading seo & marketing tools to promote your store.

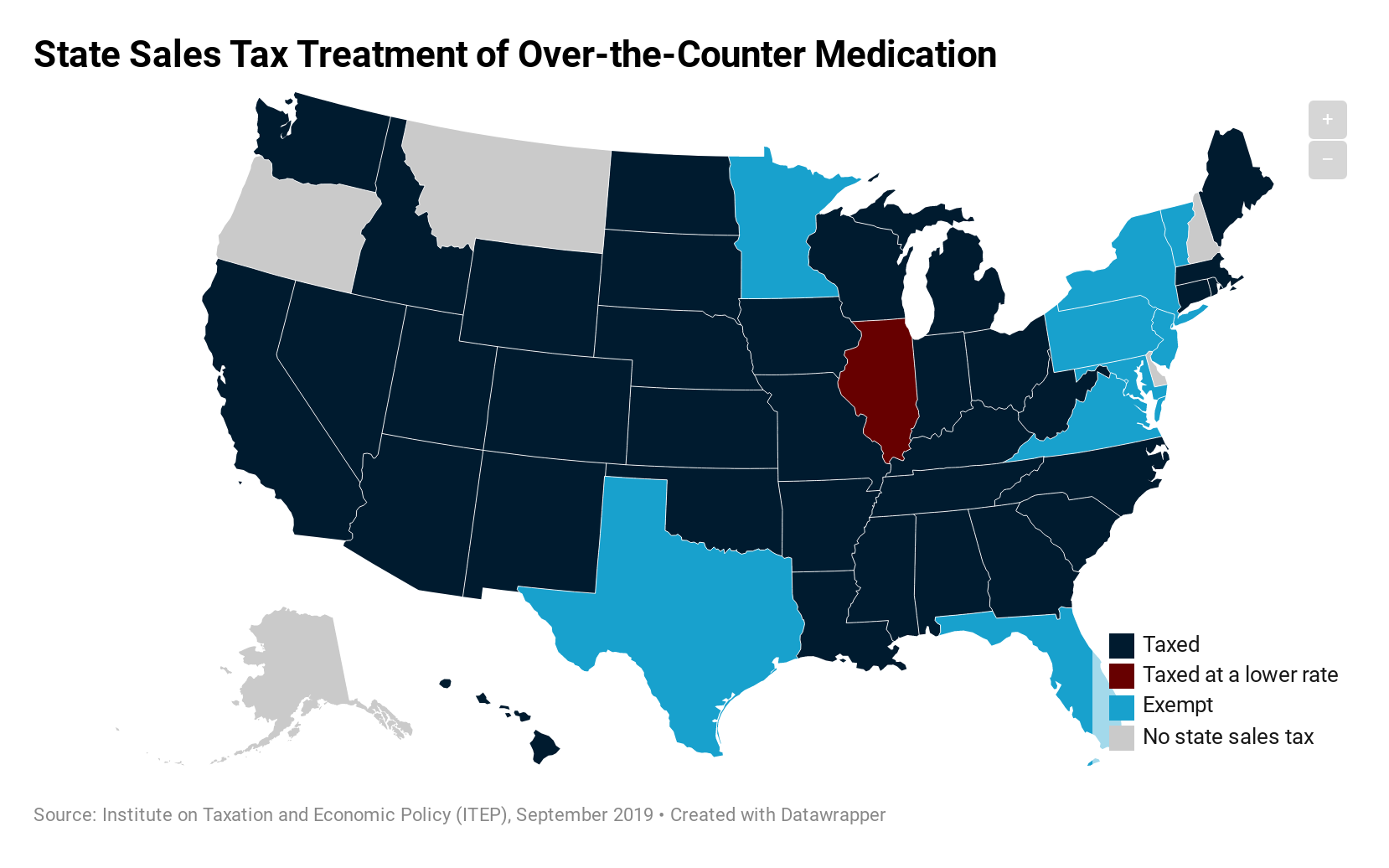

• sales tax rate differentials can induce consumers to shop across borders or buy products online. Montana has only a few other types of taxes. Start yours with a template!.

• sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Ad earn more money by creating a professional ecommerce website. You must pay montana state income tax on any wages received for work performed while in montana, even if your job is normally based in another state.

Detailed montana state income tax rates and brackets are available on this page. Explore data on montana's income tax, sales tax, gas tax, property tax, and business taxes. The montana revenue system is outdated and just flat out unfair.

Marketplace sales included towards the threshold for individual sellers January 1, 2019 (administrative announcement) april 1, 2019 (enacted legislation) $100,000 or 200 or more separate transactions: The results do not include special local taxes—such as admissions, entertainment, liquor, lodging, and restaurant taxes—that may also apply.

Ad earn more money by creating a professional ecommerce website. Find the latest united states sales tax rates. Each marginal rate only applies to earnings within the applicable marginal tax bracket , which are the same in.

New jersey's local score is represented as a negative. The montana income tax has seven tax brackets, with a maximum marginal income tax of 6.90% as of 2021. Montana tax rate is unchanged from last year, however, the income tax brackets increased due to the annual.

You must pay montana state income tax on any wages received for work performed while in montana, even if your job is normally based in another state. Let more people find you online. Let more people find you online.

2020 rates included for use while preparing your income tax deduction. There are no local taxes beyond the state rate. Start yours with a template!.

Total tax burden by income level the estimated burden on a family of three of all personal taxes—income, property, general sales, and auto taxes—is provided in the tables below for three different income levels. Learn about montana tax rates, rankings and more. % of income 13.9% 10.0%.

While montana has no statewide sales tax, some municipalities and cities (especially large tourist destinations) charge their own local sales taxes on most purchases. Because there is no sales tax here (great, and yet part of the problem), property owners, especially those. Salem county, n.j., is not subject to the statewide sales tax rate and collects a local rate of 3.3125%.

Previous or current calendar year: Click here for a larger sales tax map, or here for a sales tax table. The cities and counties in montana also do not charge sales tax on general purchases so.

Adopted a sales tax on The montana state sales tax rate is 0%, and the average mt sales tax after local surtaxes is 0%. Use leading seo & marketing tools to promote your store.

Use this calculator to find the general state and local sales tax rate for any location in minnesota. Montana taxes are below national averages at all income levels. The individual income tax is paid by montana residents and nonresidents with income taxable in.

There is no sales tax in the state and property taxes are below the national average. Combined state & average local sales tax rate lowe. Montana charges no sales tax on purchases made in the state.

Montana has seven marginal tax brackets, ranging from 1% (the lowest montana tax bracket) to 6.9% (the highest montana tax bracket). Montana has a progressive state income tax, with a top rate of 6.9%.

Montana State Taxes Tax Types In Montana Income Property Corporate

Best State In America Montana Whose Tax System Is The Fairest Of Them All - The Washington Post

Printable Montana Sales Tax Exemption Certificates

States Without Sales Tax Quickbooks

Ebay Sales Tax Everything You Need To Know Guide - A2x For Amazon And Shopify - Accounting Automated And Reconciled

Montana State Taxes Tax Types In Montana Income Property Corporate

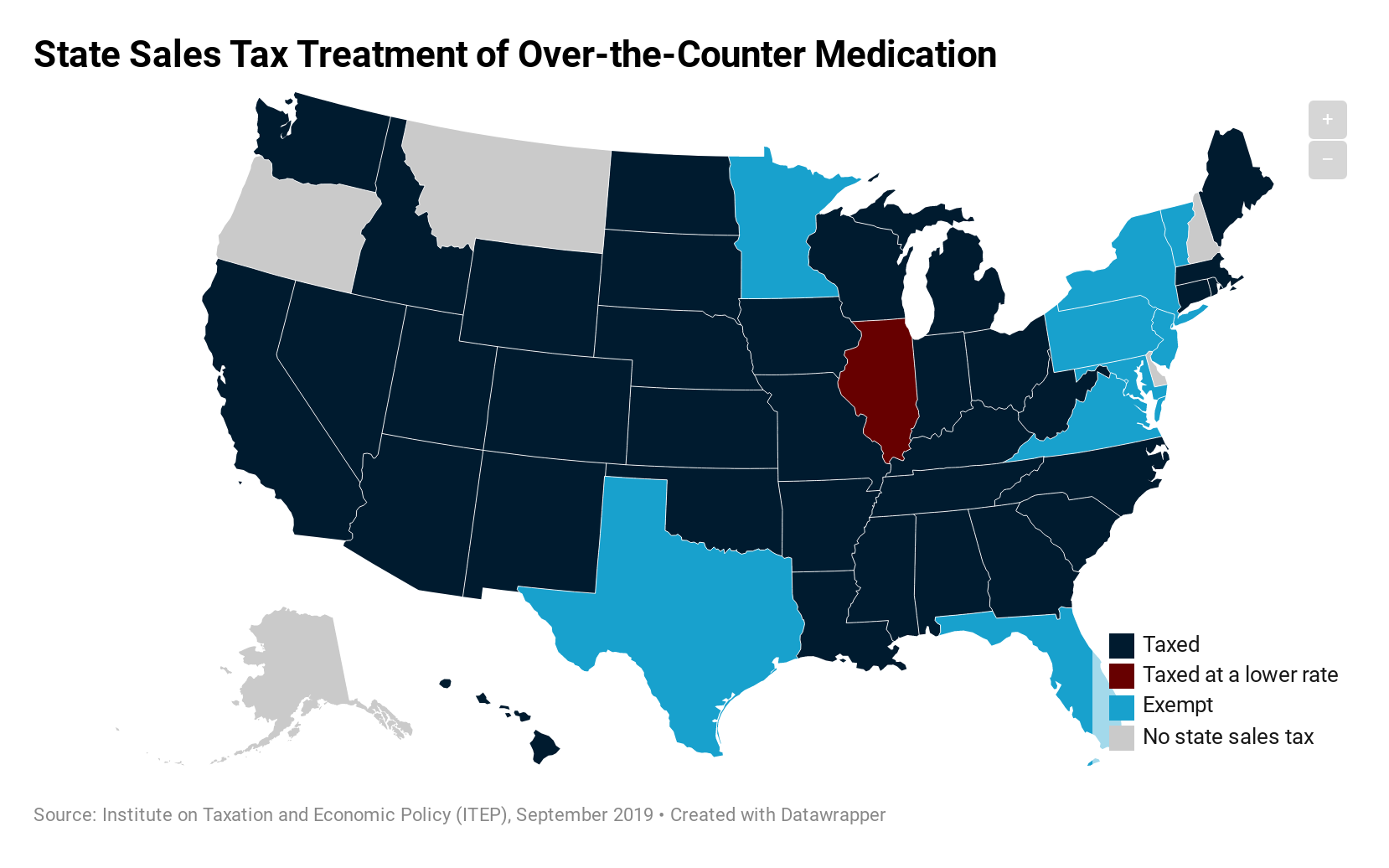

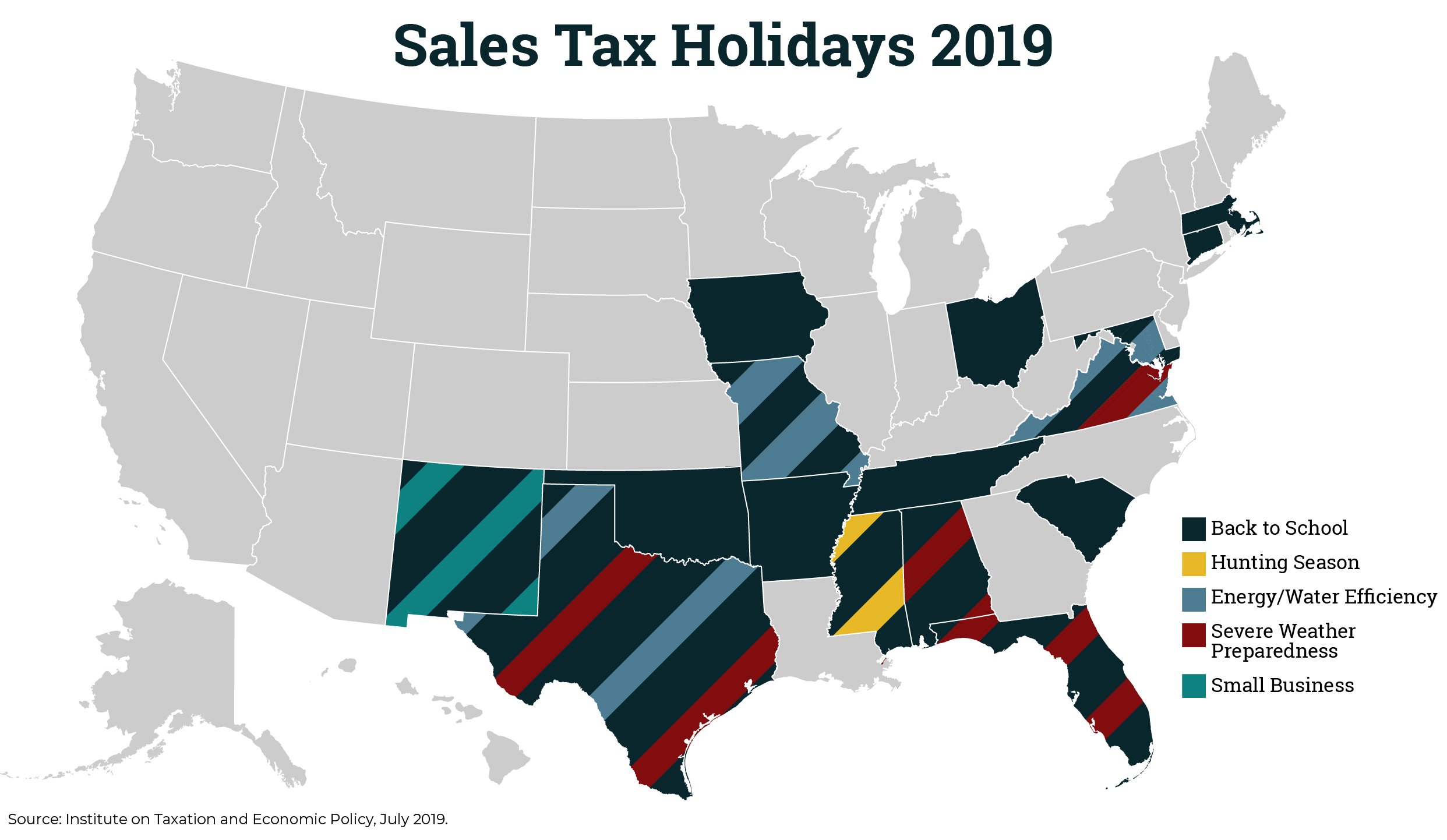

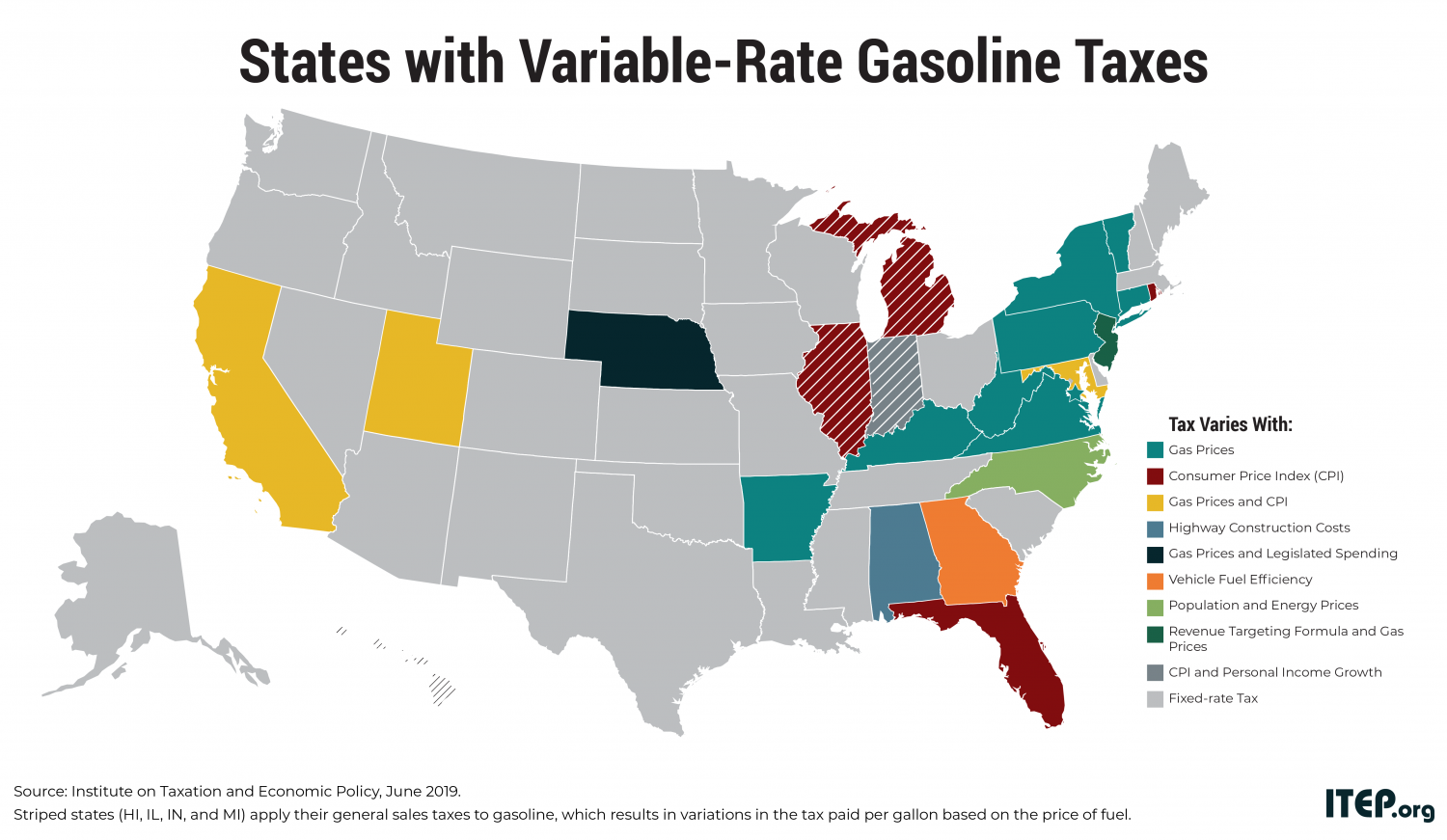

Maps Itep

Maps Itep

2

Sales Tax Calculator

Maps Itep

States Without Sales Tax Quickbooks

States With Highest And Lowest Sales Tax Rates

Maps Itep

2

Maps Itep

Montana State Taxes Tax Types In Montana Income Property Corporate

Eqkdqb7mjbevtm

Shrinking The Delaware Tax Loophole Other Us States To Incorporate Your Business