For calendar year filers, the due date is march 15, 2022. Cuomo’s initial budget proposal in january, and it comes at a time when many democrats are calling on pres.

Avoiding The Salt Limitation - New York Enacts A Pass-through Entity Tax To Help Taxpayers Work Around The Salt Limitation - Wffa Cpas

The assembly and senate have passed the budget legislation, and the legislation has been delivered to the governor for signature.

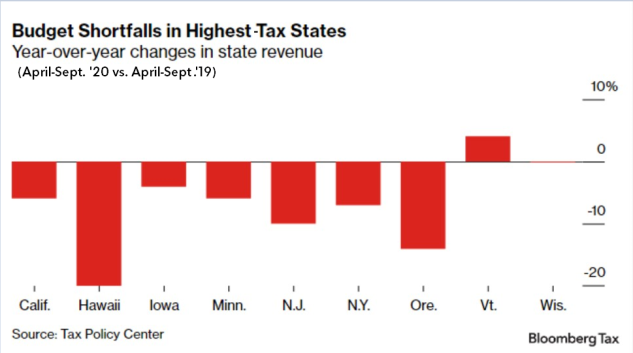

New york salt tax workaround. New york state budget changes: The new york state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions (the salt cap). Questions answered every 9 seconds.

The new york state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions (the salt cap). Questions answered every 9 seconds. State + local tax april 22, 2021 (no.

New york state legislature included a salt workaround in the most recently approved budget passed on april 6, 2021. The tax is phased in over three years beginning january 1, 2019. On april 6, 2021, the new york state legislature and governor andrew cuomo came to an agreement on the state’s operating budget.

New york is at least the tenth state to adopt such a provision. The provision was part of gov. July 1, 2021 by wffa.

The provision was part of gov. Biden to include the elimination of the salt cap as. Well, we finally have good news!

Election for 2021 tax year: The election is meant as a “workaround” to the $10,000 cap. Tax increases, salt cap workaround and additional covid relief.

For tax years beginning between january 1, 2021, and january 1, 2022, the elective tax is due and payable on or before the due date of the tax return without regard to any extension. Ad a tax advisor will answer you now! The pte election deadline for new york state is october 15, 2021.

The limitation on the deductibility of state and local taxes (“salt”) at $10,000 was part of the tax cuts and jobs act back in 2017, and, without pointing fingers, it seemed to many like it may have been. New york is at least the tenth state to adopt such a provision. This election can alleviate the loss of the salt deduction suffered by many new york taxpayers as a result of the federal salt cap, whether they are new york residents or.

The budget act includes a provision that allows partnerships and nys s corporations to elect to pay nys tax at the entity level in order to mitigate the impact of the $10,000 cap on salt deductions. New york is at least the tenth state to adopt such a provision. New guidance, affected industries, and what to know before the october 15, 2021 deadline 6 min the tax cuts and jobs act of 2017 (tcja) set a limit on the amount of state and local taxes (salt) that.

Through new york’s other salt workaround, known as the state’s employers compensation expense tax (“ecet”), employers that opt in will pay a payroll tax on employees’ annual wages of $40,000 or more, and employees will receive a tax credit corresponding in value to the payroll tax paid. New york state lawmakers finally agree to salt workaround. New york state 2021/2022 budget act (salt cap workaround) the new york state (nys) 2021/2022 budget act was signed into law on april 19, 2021.

New york is one of many states to enact this regime. Ad a tax advisor will answer you now!

Salt Cap Workaround Rules Due Soon From New York Tax Department

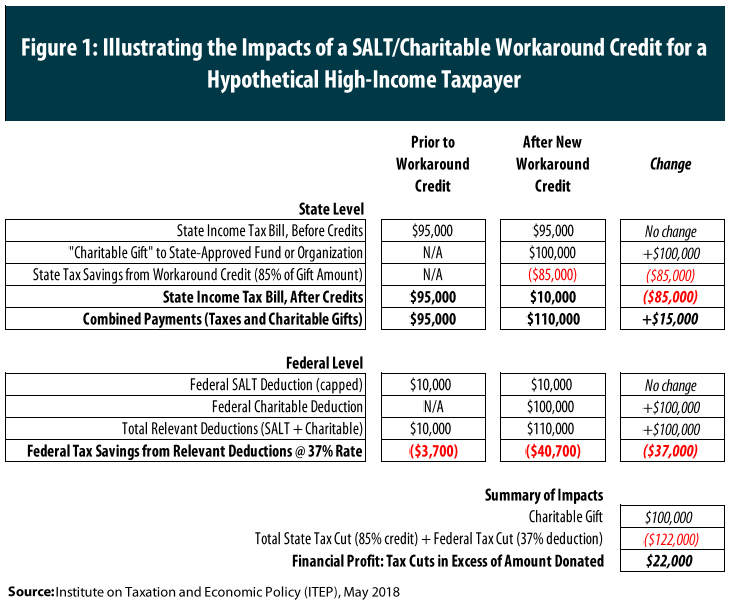

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K-12 Voucher Tax Credits Itep

Saltcharitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

Salt Cap Workarounds Will They Work Accounting Today

Governor Signs Bill That Could Provide Pass-through Entities A Salt Deduction Cap Workaround

Proposed New York State Unincorporated Business Tax Provides Salt Limitation Workaround - Legacy Advisors

Some States Offer Workarounds For State And Local Tax Deduction Limit

Ny California Others Set To Work Around Salt Deduction Cap

New York Budget Bill Proposes Pass-through Entity Salt Cap Workaround Noonans Notes Blog

Unlock State Local Tax Deductions With A Salt Cap Workaround

New York State Lawmakers Finally Agree To Salt Workaround Barclay Damon

Ny Increases Tax Rates Enact Salt Workaround - Insero Co Cpas

New York Enacts Pass-through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

High-tax New York Towns To Battle Irs Over Salt Cap Workaround Fox Business

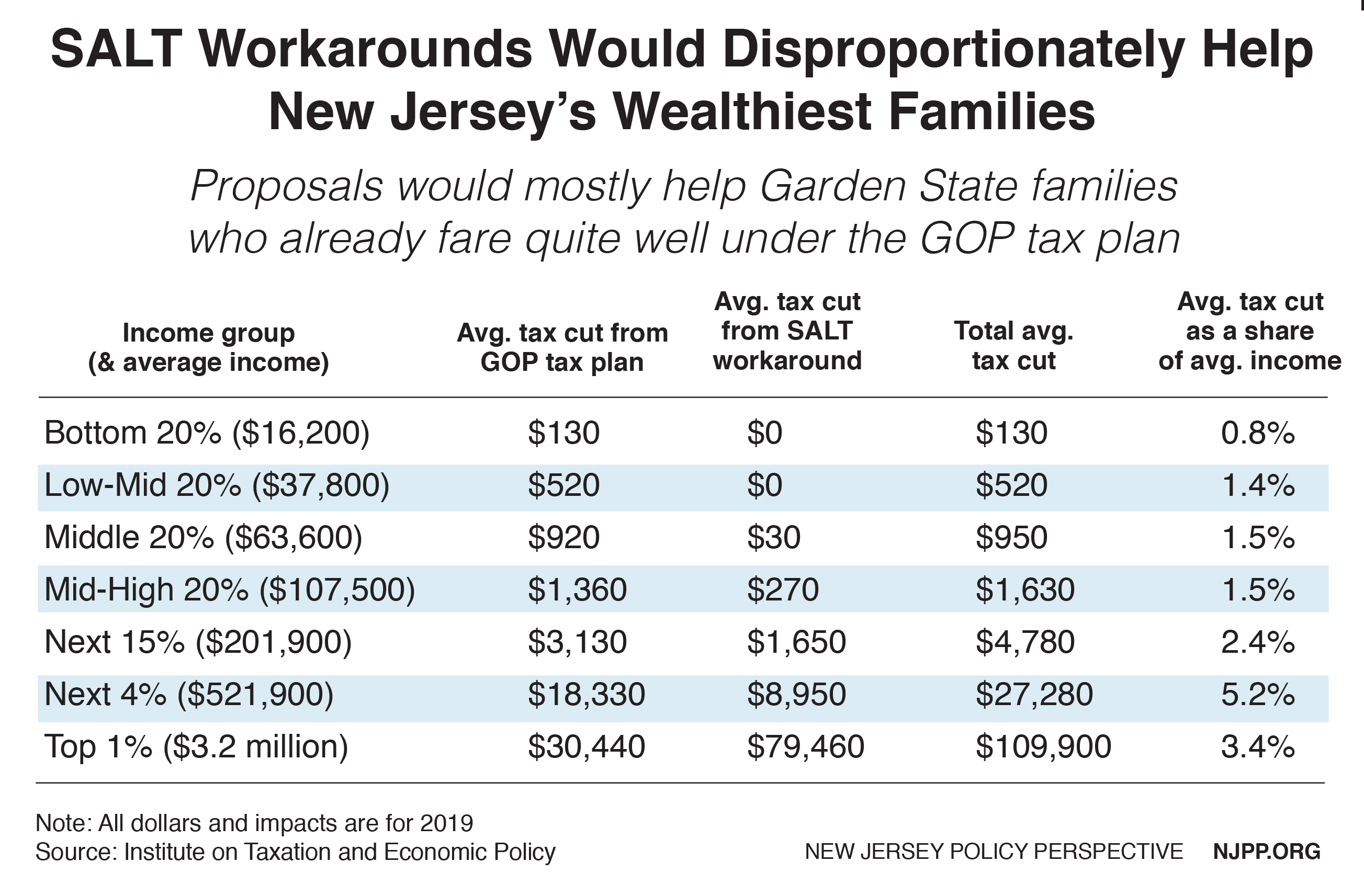

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan - New Jersey Policy Perspective

S4psgxj7uwexcm

Ny State Pass-through Entity Tax A Salt Cap Workaround Fuoco Group

New York State Elective Pass-through Entity Tax - Salt Cap Workaround - Dannible And Mckee Llp