Percent for the nation during the same period. Personal and small business tax preparation and bookkeeping services.

States With Highest And Lowest Sales Tax Rates

The current transient occupancy tax rate is 14%.

South san francisco sales tax rate 2020. The county sales tax rate is %. Subsequently, the ballot measure would then increase the city's tot rate to 13% effective january 1, 2020. The south san francisco, california sales tax is 9.25% , consisting of 6.00% california state sales tax and 3.25% south san francisco local sales taxes.the local sales tax consists of a 0.25% county sales tax, a 0.50% city sales tax and a 2.50% special district sales tax (used to fund transportation districts, local attractions, etc).

This is the total of state, county and city sales tax rates. New reporting requirements for cigarette tax reporting effective may 2020 reporting period; More than $100 but less than/equal to $250,000 $2.50 for each $500 or portion thereof.

The transient occupancy tax is also known as the hotel tax. The south san francisco sales tax rate is %. The current total local sales tax rate in south san francisco, ca is 9.875%.

The minimum combined 2021 sales tax rate for south san francisco, california is. Proposition f was approved by san francisco voters on november 2, 2020 and became effective january 1, 2021. 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% unemployment rate historical trend

Our new online services system expands to. The december 2020 total local sales tax rate was 9.750%. Proposition e was approved by san francisco voters on november 6, 2012.

South san francisco, ca sales tax rate. File monthly transient occupancy tax return. The south san francisco, california, general sales tax rate is 6%.

South san francisco lies north of san bruno and san francisco international airport in the colma creek valley south of daly city,. Update to postal code abbreviation table effective may 2020 filing period; San francisco (kron) — several cities will have a sales & use tax hike go into effect on july 1.

The california sales tax rate is currently %. Tax returns are required monthly for all hotels and motels operating in the city. Depending on the zipcode, the sales tax rate of south san francisco may vary from 6.5% to 9.75%.

1788 rows san francisco* 8.625%: Finally, measure ff would increase the city's tot rate to a maximum of 14% effective january 1, 2021. The information below is from the website of the san francisco assessor’s office, as of april 2020:

101 hickey boulevard, #125 south san francisco, california 94080, united states According to the united states census bureau, the city has a total area of 30.2 square miles (78 km 2), of which 9.1 square miles (24 km 2) of it is land and 21.0 square miles (54 km 2) of it (69.69%) is water. $1,000,000 or more but less than $5,000,000 $3.75.

Most of the raises were approved by. Our team, alan, charlie, jean and tyler, are here to assist you with complicated tax returns & advise with our combined 50+ years experience as tax advisers/enrolled agents. San francisco imposes a 14% transient occupancy tax on the rental of accommodations for stays of less than 30 days.

New sales and use tax rates operative july 1, 2020; The transfer tax rate for the city and county of san francisco, payable upon transfer of real property, is calculated as follows: The 9.875% sales tax rate in south san francisco consists of 6% california state sales tax, 0.25% san mateo county sales tax, 0.5% south san francisco tax and 3.125% special tax.

Information and tax returns for the collection of transient occupancy tax and conference center tax in south san francisco is available below. The current conference center tax is $2.50 per room night. Or to make things even easier, input the san francisco minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need.

Property taxes in san francisco after a property transfers, state law (proposition 13, passed in 1978) requires the assessor’s office to set a. Proposition f will complete the city’s transition from a payroll expense tax to a gross receipts tax, a decision initially approved by the voters in 2012 (proposition e). Every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), the california cities rate (0.5%), and in some case, special rate (3%).

The unemployment rate was 3.9 percent in san francisco county, and 3.6 percent in san mateo county. Ad create an online store. New tax rate on other tobacco products effective july 1, 2020 through june 30, 2021;

Utilize quick add to cart and more!. You can print a 9.875% sales tax table here. By appointment only, please contact us by phone or email for scheduling.

Your brand can grow seamlessly with wix. Sales tax = total amount of sale x sales tax rate (in this case 8.5%). More than $250,000 but less than $1,000,000 $3.40 for each $500 or portion thereof.

If passed by the voters, measure ff would first increase the city's tot rate to 12% effective january 1, 2019.

Seattles Tech Scene Looks Like San Franciscos Did 10 Years Agowhat Gives - Sfciti

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Frequently Asked Questions City Of Redwood City

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Homeowners Property Taxes Grew Faster During Pandemic

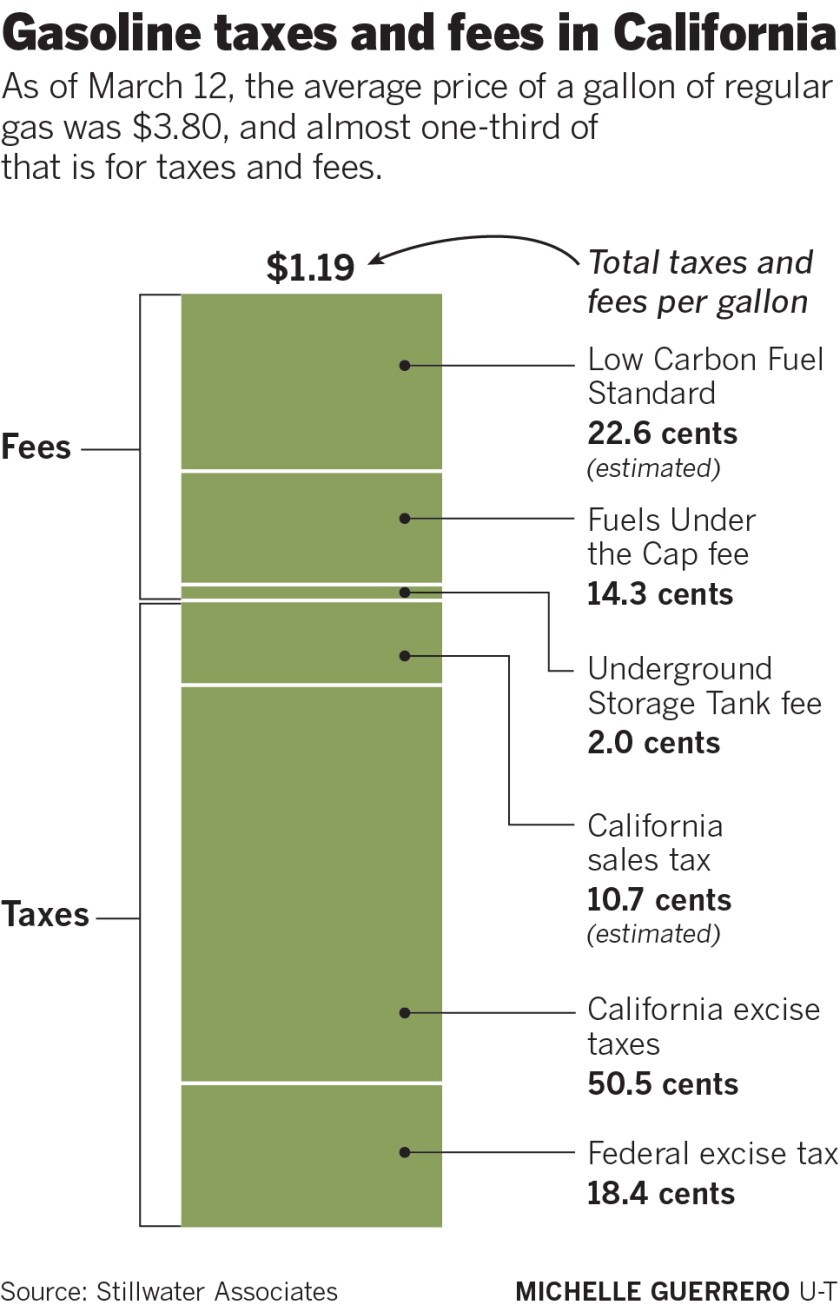

How Much Are You Paying In Taxes And Fees For Gasoline In California - The San Diego Union-tribune

States With Highest And Lowest Sales Tax Rates

Secured Property Taxes Treasurer Tax Collector

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

California Sales Tax Rates By City County 2021

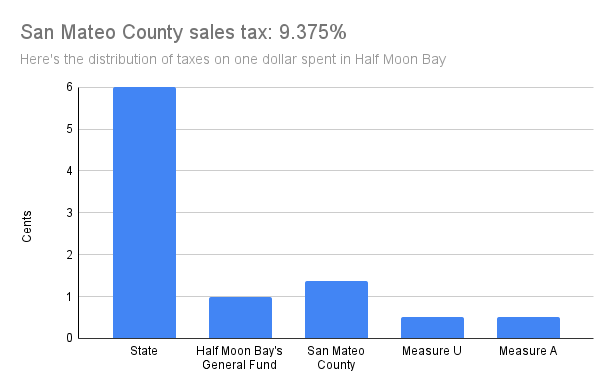

County Begins Collecting Higher Sales Tax Local News Stories Hmbreviewcom

California Prop 15 Results Proposition Fails Leaving 1978s Prop 13 Untouched Not Raising Property Taxes - Abc7 San Francisco

2

2

What Are Californias Income Tax Brackets - Rjs Law Tax Attorney

2

Car Rentals In South San Francisco From 39day - Search For Rental Cars On Kayak

Pdf Evaluating Saudi Arabias 50 Carbonated Drink Excise Tax Changes In Prices And Volume Sales