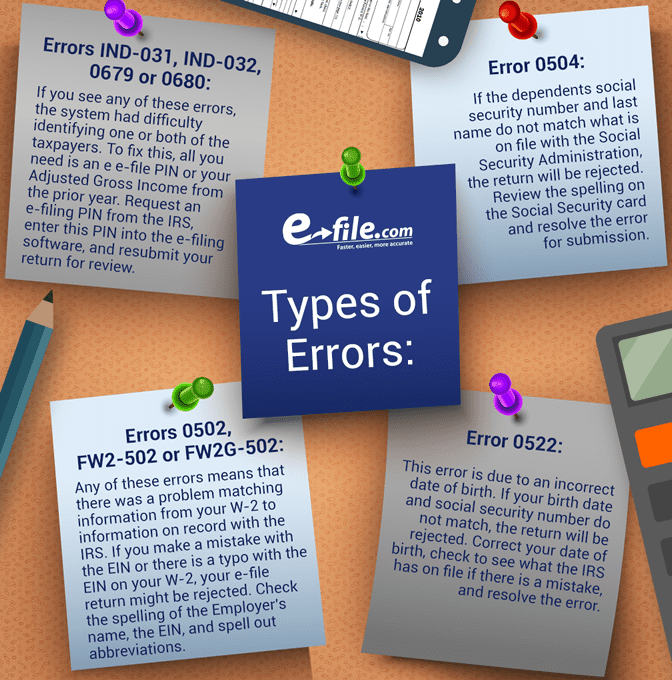

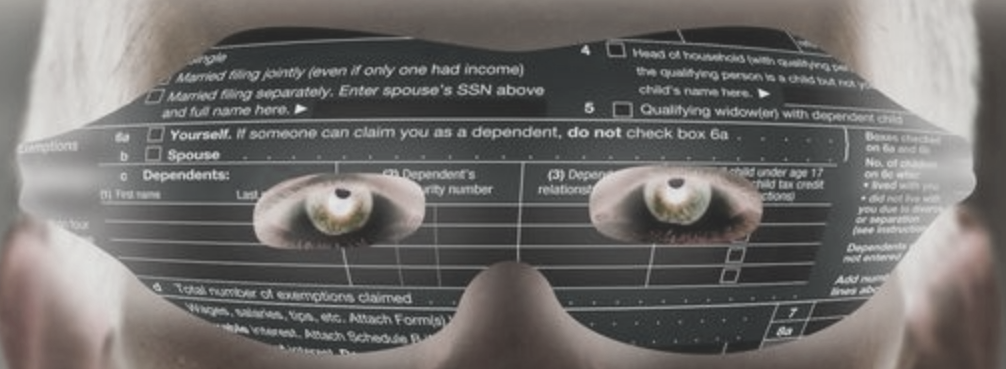

When you discover another a tax return has been filed with your social security number, you’ll use irs form 14039 to alert the irs. A case of fat fingers, digits transposed, a small error can result in an electronic filing error.

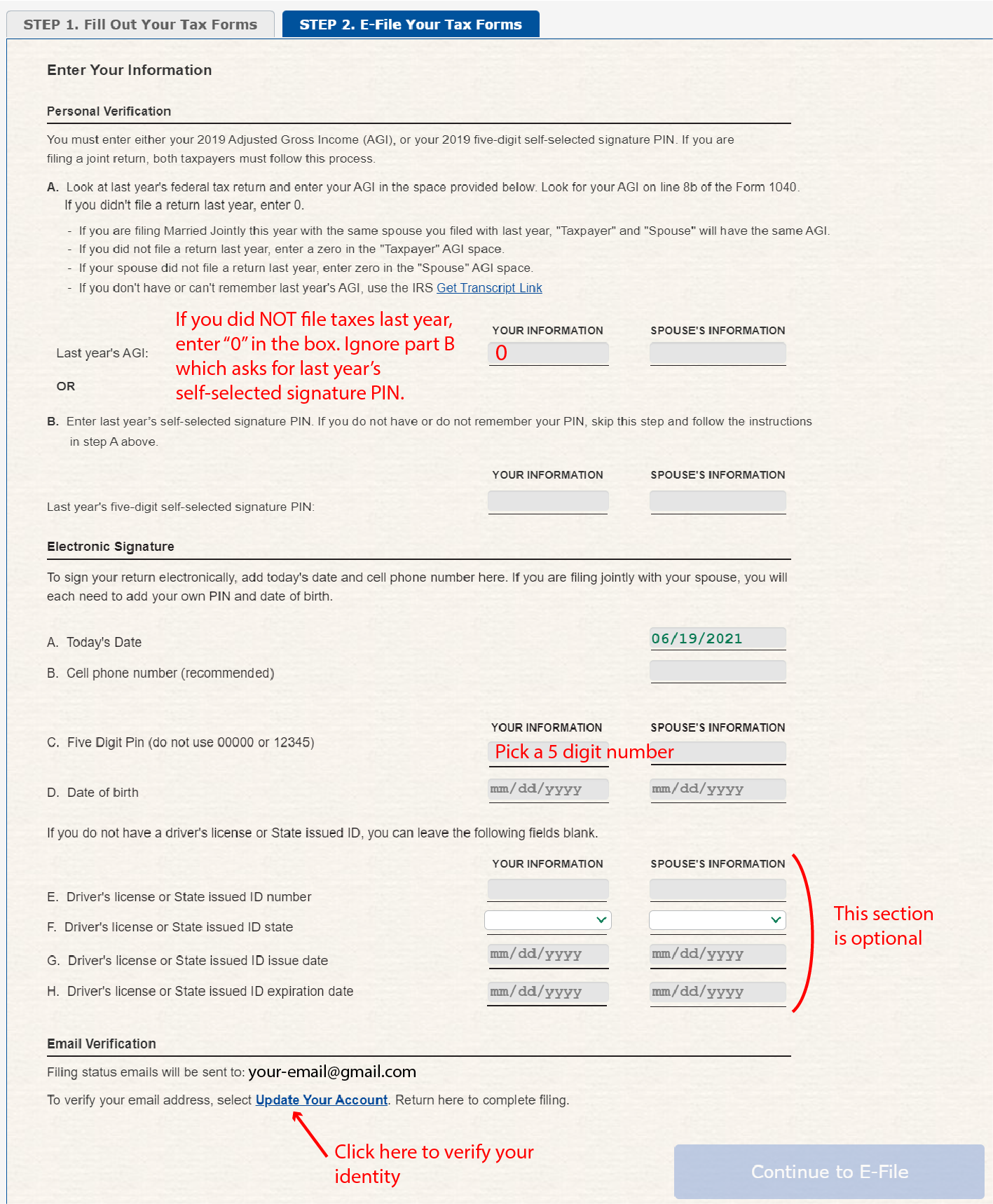

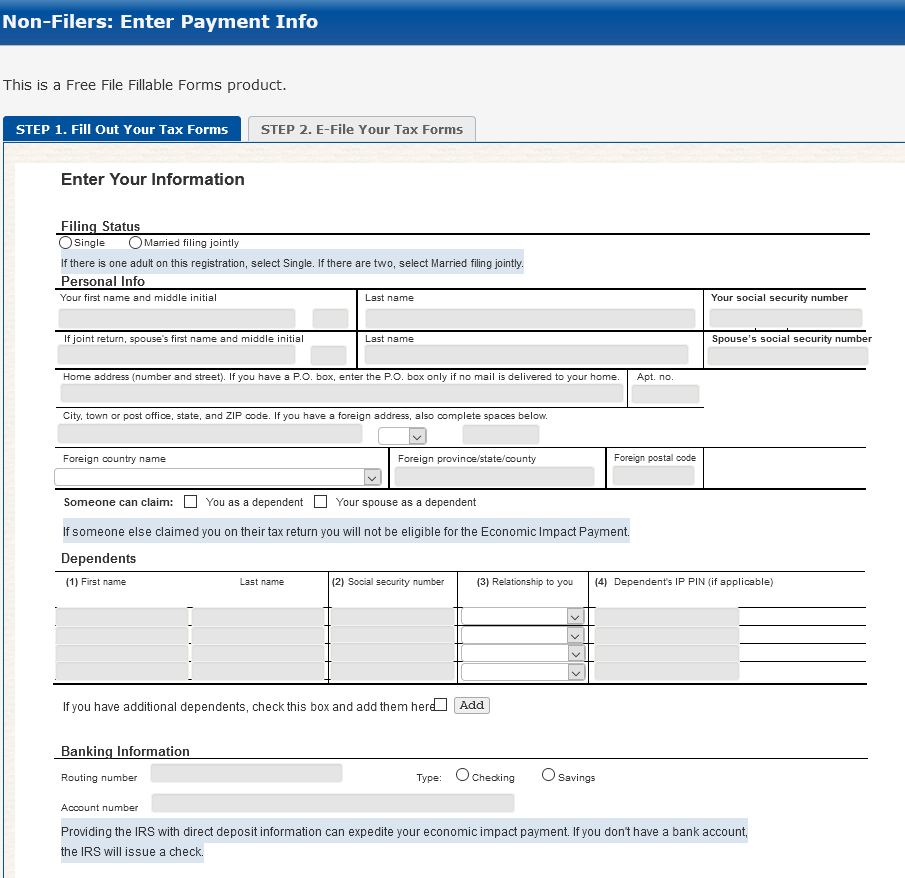

How To Fill Out The Irs Non-filer Form Get It Back

You entered the wrong ssn on your tax return:

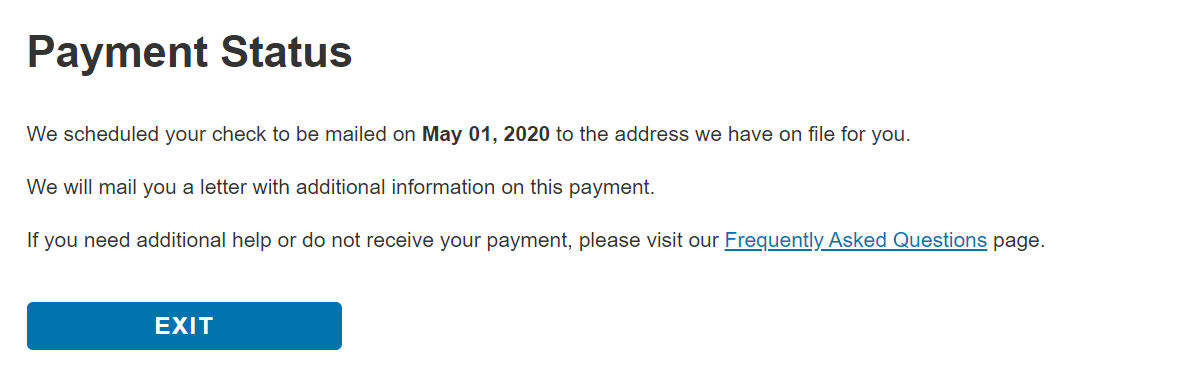

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

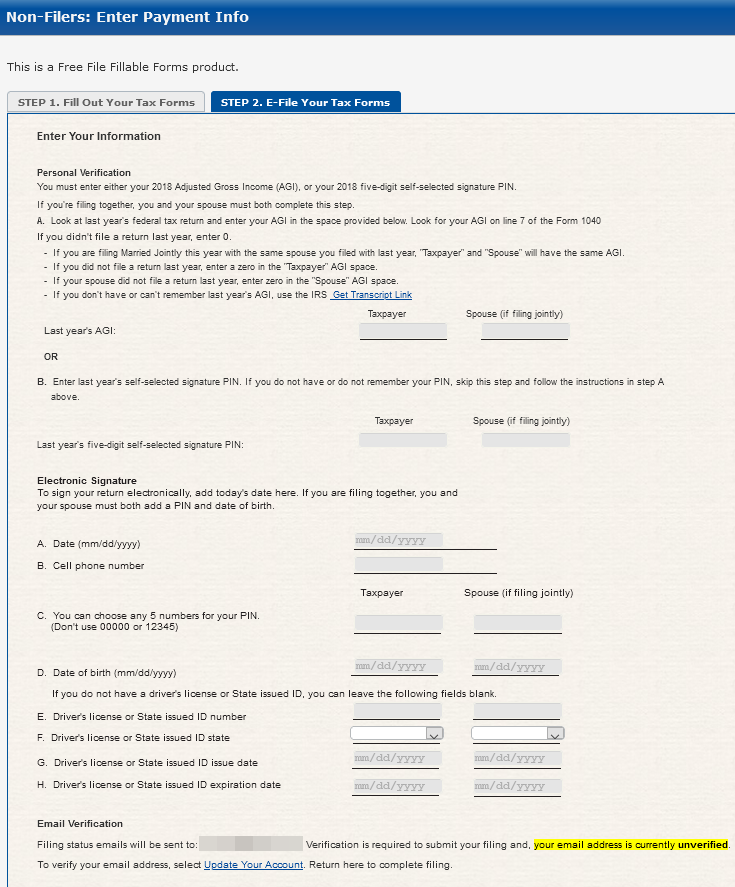

Tax return rejected ssn already used stimulus. The first thing to do: By filling out this form and submitting it with your return, you are alerting the irs that your return was rejected for efiling because of a duplicate social security number. I know i have not filed previously this year.

I filed for the stimulus check before filing my 2019 taxes. Did you suddenly change legal status and obtain a valid ssn for yourself within the last few months or will you be using an ssn that does not belong to you? If my taxes got rejected will i still get my stimulus check.

That is assuming you weren't listed as a dependent in 2018. When you receive a message saying that your tax return was rejected because an ssn has already been used, a few things might have gone wrong. When your dad's return got rejected, it is the same thing as it never being filed.

Primary taxpayer ssn must not be the same as the ssn on a previously accepted electronic return. Social security number already in use and not allowed to file my taxes? The root of the problem is that the guy went on the website and entered his info to apply for stimulus payment, and apparently this creates and submits a 1040 automatically with 0 data on it, for people who didnt yet file a 2019 return.

Potential reasons why your ssn has already been used: Registered for stimulus check on no filer tax before doing my taxes so recently did my taxes online and was rejected because ssn was already filed now what do i do or did i mess it all up. Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependent's ssn, the irs has security measures in place to ensure the accuracy of returns submitted.

I’m confused as to why you filed tax returns earlier this year using an itin and now wish to refile using an ssn. So if he didn't submit the return again with you listed as his dependent, then you should get the stimulus check. This reject code indicates that a dependent ssn claimed on the tax return has been used on another tax return.

It could also occur due to miskeying the ssn, but the first four letters of the otherwise unknown last name would also need to match. When you complete this form, you’ll indicate that someone has stolen your identity and it has affected your tax account since they have filed a return using your identifying information. The problem is that the tax return has been filed with the itin already, also it says on the back of the itin letter when you receve your ssn, please send is a copy of this notice, along with a copy of your ss card, so we can update our record, send these documents to.

The ssn in question also appears as the filer, spouse, or dependent on another tax return for this same year. Is this a case of identity theft? Check that you have entered every ssn number correctly.

Contact the irs identity protection specialized unit toll free at 18009084490 within 1 day. Per the irs quickalert released on june 25, 2020: Has my identify been stolen?

Report the identity theft to the federal trade commission at www.identitytheft.gov. Aleck income tax return was rejected, irs reject codes indicated his ssn had already been used. Use a fillable form at irs.gov, print, then attach the form to your return and.

You have to mail it in with supporting documents. One common scenario for this reject is when separated or divorced parents both claim their child. Let’s assume it was not your mistake.

He said glitches and mistypes happen and someone probably typed my ssn by mistake, so just paper file it. You need to file an amended return. If someone uses your ssn to fraudulently file a tax return and claim a refund, your tax return could get rejected because your ssn was already used to file a return.

Submission must not be a duplicate of a previously accepted submission. Got the following message with my rejected federal return. I called the irs and the guy didn’t seem to give a crap and just said to paper file it.

When this happens, you’ll need to print your tax return and file it with form 14039, identity theft affidavit. If the return is being rejected due to a return in that ssn already being filed, yes, you need to print, sign and mail the return in for processing. Ssn has been used on a previously accepted return.

This is the most common issue where, the social security number (ssn) that has been entered on your tax return for yourself, doesn’t match the records of the irs. Once the irs receives your return and form 14039, they will send you an acknowledgment letter. Is there a way to fix this electronically? rule number:

What is the procedure for aleck to have the irs put an indicator on his tax records for questionable activity.

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

How To Correct An E-file Rejection E-filecom

Ssn Already Used By Someone Else On A Tax Return - Crossborder Planner

Non-filers Form Initially Rejected Rstimuluscheck

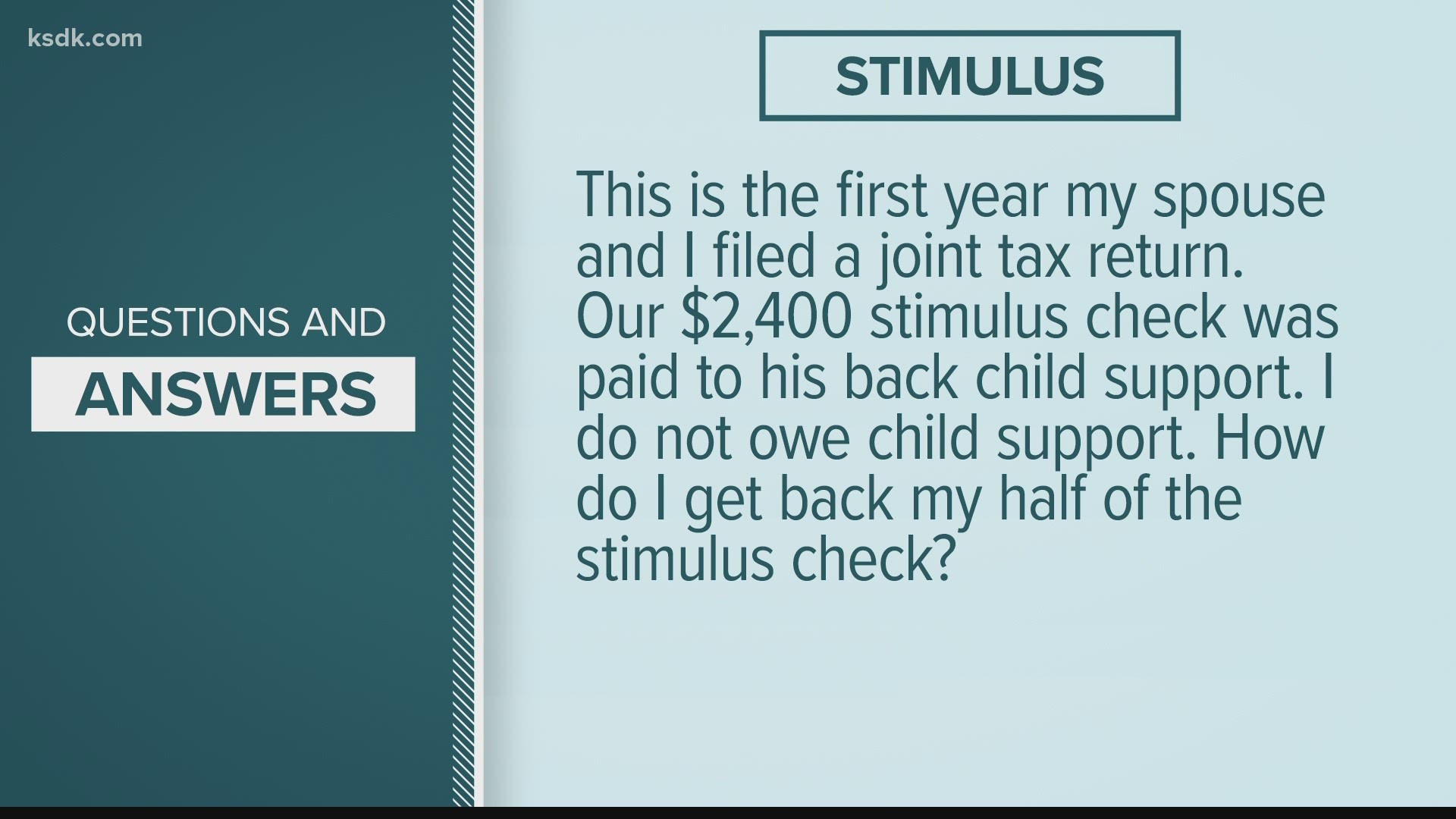

13 Of Your Stimulus Payment Questions Answered

Identity Theft What To Do If Someone Has Already Filed Taxes Using Your Social Security Number - Turbotax Tax Tips Videos

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdkcom

Tax Id Theft Victim Get A Copy Of The Fraudulent Return Filed In Your Name - Dont Mess With Taxes

Rejected Tax Return Common Reasons And How To Fix

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Form 4506 Request For Copy Of Tax Return Definition

If You Didnt Get A Stimulus Check Read This By Ben Hassan Medium

Dont Make These Mistakes On Your Tax Return Taxact Blog

Solved Re Why Was My Stimulus Package Registration Via D

Rejected Return Due To Stimulus Hr Block

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

Common Irs Error Reject Codes And Suggested Solutions - Taxslayer Pros Blog For Professional Tax Preparers

Irs Gov Stimulus Refund 2021 Direct Deposit 2021

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

Fraudulent Tax Return And Identity Theft Prevention Steps