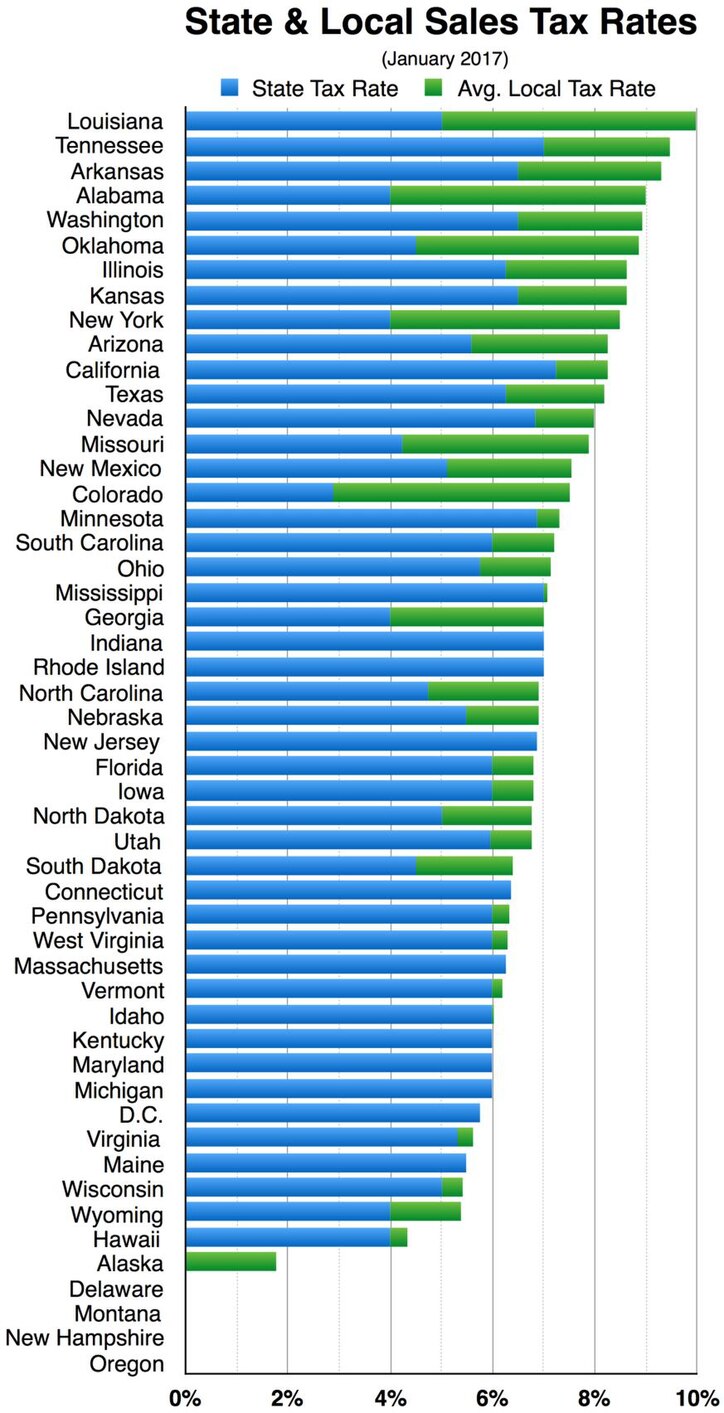

Every 2021 combined rates mentioned above are the results of north dakota state rate (5%), the county rate (0% to. This system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax and other fees.

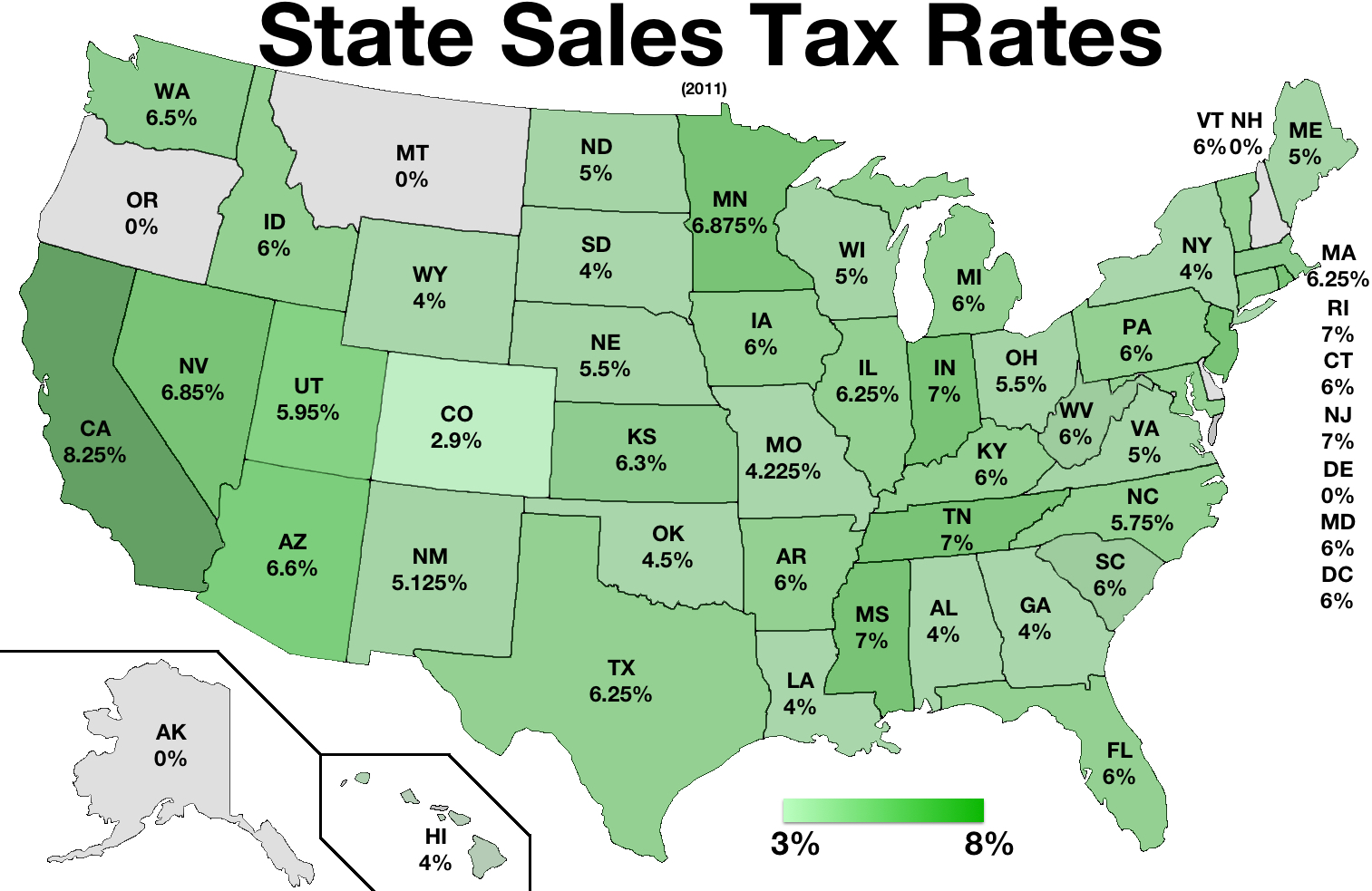

Sales Taxes In The United States - Wikiwand

You can look up your local sales tax rate with taxjar’s sales.

North dakota sales tax calculator. Recognized for north dakota income tax purposes. The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota. North carolina has a 4.75% statewide sales tax rate , but also has 324 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.188%.

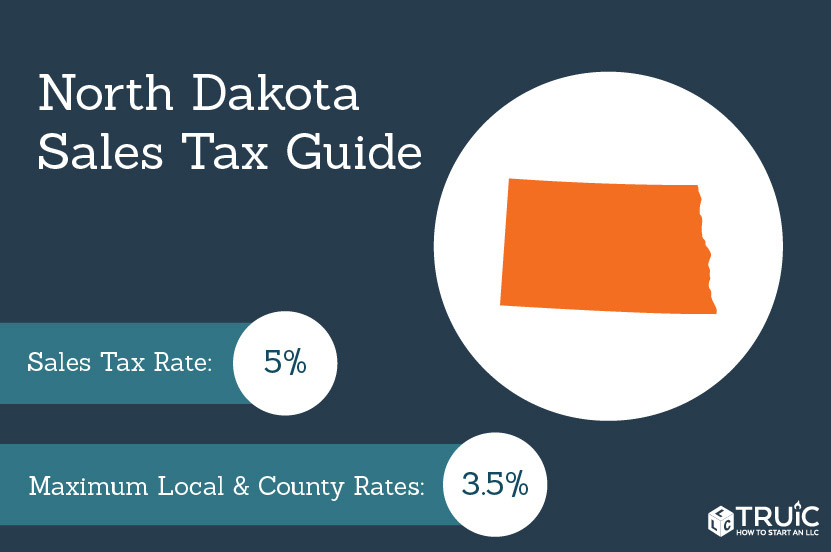

Cities and/or municipalities of north dakota are allowed to collect their own rate that can get up to 3% in city sales tax. The state’s sales taxes stand below the national average. The current income tax rates are the lowest in the country, ranging from 1.1% to 2.9%.

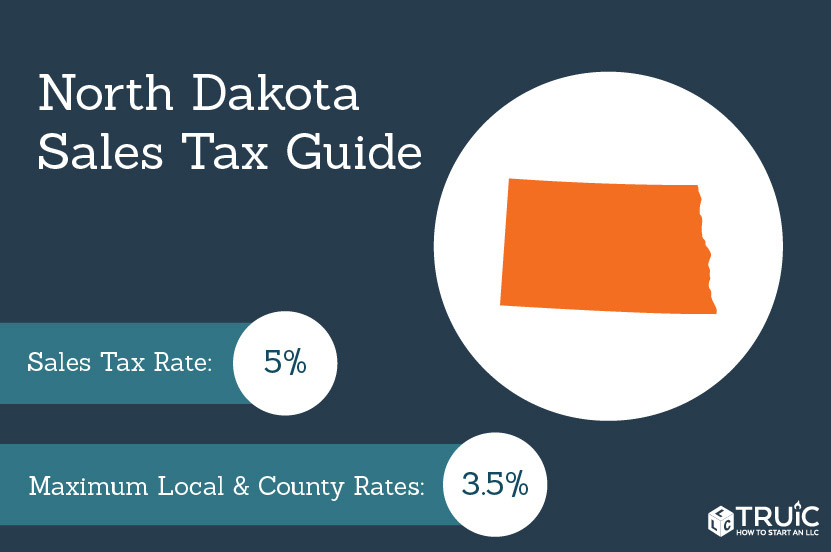

Depending on local municipalities, the total tax rate can be as high as 8.5%. The north dakota (nd) state sales tax rate is currently 5%. The state general sales tax rate of north dakota is 5%.

The north dakota sales tax rate is 5%. The average effective property tax rate in north dakota is also just 0.99%. When calculating the sales tax for this purchase, steve applies the 5.0% state tax rate for north dakota, plus 0.5% for cass county’s tax.

Find tax information, laws, forms, guidelines and. Apportioned vehicles can not be calculated by this system. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

A customer living in fargo, north dakota finds steve’s ebay page and purchases a $350 pair of headphones. Choose normal view to work with the calculator within the surrounding menu and supporting information or select full page view to use a focused view of the north dakota sales tax comparison calculator. North dakota assesses local tax at the city and county levels, but does not assess local tax for special jurisdictional areas such as school districts or transportation authorities.

How 2021 sales taxes are calculated in north dakota. All fees will be recalculated by the motor vehicle division and are subject to change. The north dakota office of state tax commissioner is the government agency responsible for administering the tax laws of north dakota.

Sales Taxes In The United States - Wikiwand

North Dakota Tax Calculator

Indiana Sales Tax Calculator Reverse Sales Dremployee

Sales Tax On Grocery Items - Taxjar

How Is Tax Liability Calculated Common Tax Questions Answered

North Dakota Income Tax Calculator - Smartasset

Sales Tax Calculator Check Your State Sales Tax Rate

Combined State And Local General Sales Tax Rates Download Table

Car Tax By State Usa Manual Car Sales Tax Calculator

North Dakota Income Tax Calculator - Smartasset

Sales Taxes In The United States - Wikiwand

Our Free Online Sales Tax Calculator Calculates Exact Sales Tax By State County City Or Zip Code County Sales Tax South Dakota

2021 Tax Guidance North Dakota Office Of State Tax Commissioner

Car Tax By State Usa Manual Car Sales Tax Calculator

States With Highest And Lowest Sales Tax Rates

Sales Tax Calculator For Purchase Plus Tax Or Tax-included Price

North Dakota Sales Tax - Small Business Guide Truic

North Dakota Sales Tax Rates By City County 2021

Sales Tax Calculator Check Your State Sales Tax Rate