The agency opened the portal on its website as the white house announced child tax credit awareness day on monday to raise awareness about the extra stimulus funds for families. A community to discuss the upcoming advanced child tax credit.

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Important changes to the child tax credit are helping many families get advance payments of the credit:

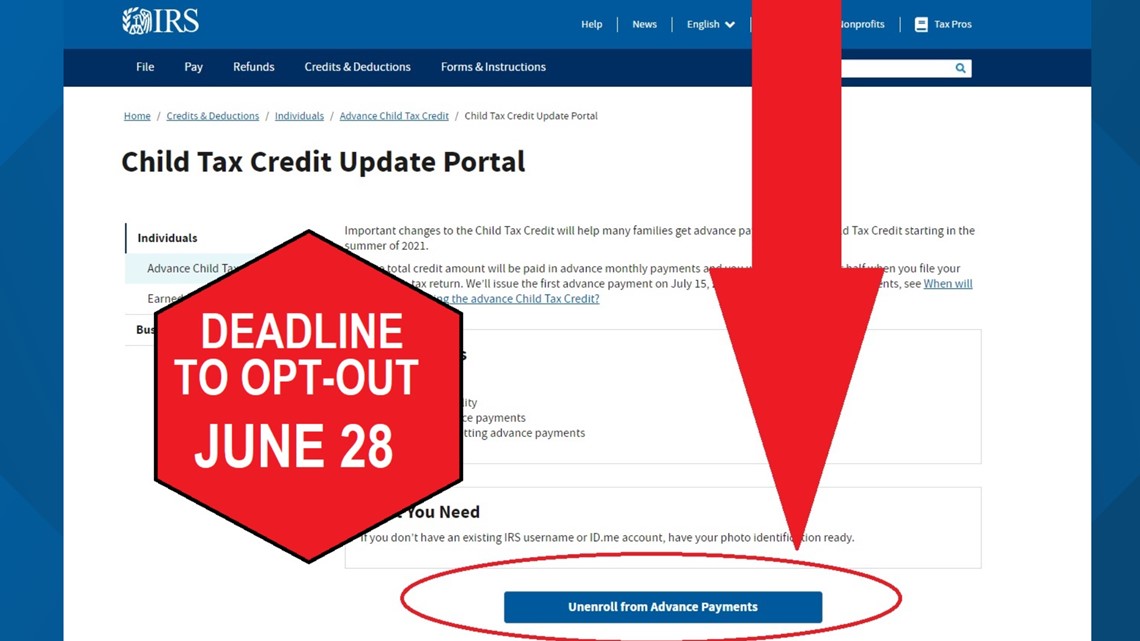

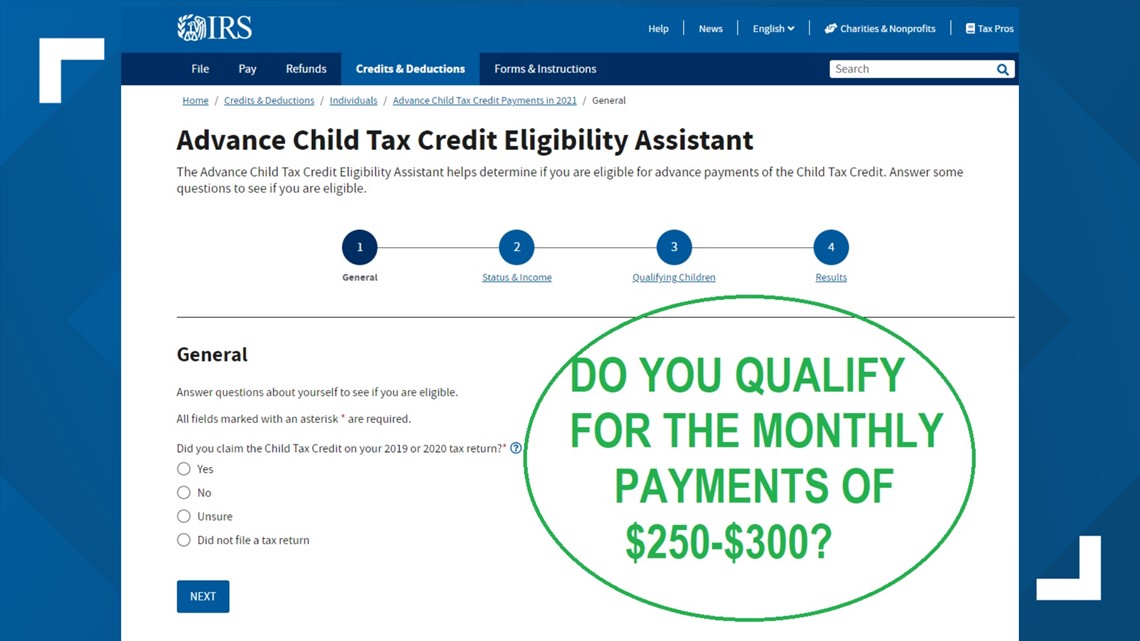

Child tax credit portal. The second round of the advance monthly payments of the child tax credit hit bank accounts through direct deposit on august 13. Code for america’s new portal, getctc, will help families access the child tax credit and other tax benefits they might have missed, including stimulus payments. On the child tax credit portal, you can enroll yourself for the advanced payments of the credit to be sent to your bank account spread over six months or opt out of them.

A spanish version of the internal revenue service's child tax credit update portal has been launched just in time to make information and payment changes for the final monthly payment of the year. Posted by 21 hours ago. Irs child tax credit update portal now available in spanish the child tax credit portal has been updated just before the final deadline to make changes for the dec.

This tool is designed to help families quickly and easily make changes to the monthly child tax credit payments they are receiving from the irs. Does the child tax credit. According to the irs, you can use the child tax credit update portal to see your processed monthly payment history.

This summer, the irs opened its child tax credit online portals.the first portal is for people not normally required to file an. With just one child tax credit remaining for 2021, united states citizens have until november 29 to make any final changes in their irs portal. But no matter what month your child was born in 2021, you get the entire tax credit for the year.

Since the payments were initially based on 2020 tax filings, reporting a 2021 income decrease may allow some families who weren't eligible for the full amount to get it now. To provide the advance child tax credit payments, the irs needs to know current information about you and your children. Families eligible for the expanded child tax credit (ctc) don’t have to wait until they file their taxes in 2022 to start getting payments.

The deadline to make changes for the dec. By updating the irs child tax credit update portal, families can enroll for direct deposits, change bank account information and mailing addresses. A new website from the irs aims to help millions of eligible families sign up for the monthly advance child tax credit (ctc.

The irs launched an updated child tax credit update portal monday morning and is giving families about 24 hours to get the information updated that could be used for the next tax credit payment on. The child tax credit update portal lets you opt out of receiving this year's monthly child tax credit payments. Getctc makes it easy for families with low or no income to get the flexible cash they deserve.

How the irs child tax credit portals can help parents with payments. That means you will start getting a monthly advance, probably in november if you do it now. It begins to phase out after that.

Updating your address can be important even if you get the cash as direct deposits because of an irs letter known as letter 6419. The deadline to unenroll or update your information on the child tax credit update portal was 11:59 p.m. Half the total credit amount is being paid in advance.

The irs automatically enrolled every taxpayer that claimed the child tax credit and expects to claim in the upcoming tax season as well. The webpage features a set of frequently asked questions and a user guide for the child tax credit update portal (publication 5549) pdf. You will get half of this money in 2021 as an advance payment and the other half in 2022 when you file a tax return.

Anyone know when the portal will update to december pending deposits? Eastern time on november 29, 2021. The tool has been available only in english until now.

Irs child tax credit portal. Parents and relative caregivers can get up to $3,600 per child for tax year 2021 from the new ctc. Does the child tax credit continue in january since they passed that bill??

The irs said a new feature will be added to its online child tax credit update portal monday which will allow payment recipients to update their 2021 income information. The full monthly child tax credit benefit is eligible for incomes up to $75,000 for individuals, $112,500 for heads of household and $150,000 for married couples. It'll be a good way to watch for pending payments that haven't gone through your.

Having trouble accessing the child tax credit portal? Here is a direct link to the portal that let’s you sign up to adjust your child tax credit — and, in your case, add a newborn.

Irs Child Tax Credit Portal How Can I Use It To Opt Out And What Other Uses Does It Have - Ascom

How To Opt-out Or Unenroll From The Child Tax Credit Payments Wfmynews2com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Wheres My Refund - Tax News Information

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

Irs Opens Child Tax Credit Portal How To Check If Youre Getting 300 Monthly Payments - Syracusecom

Advance Payments And Child Tax Credit Update Portal

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Opt-out Or Unenroll From The Child Tax Credit Payments Wfmynews2com

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information - The Georgia Virtue

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca

Irs Child Tax Credit 2021 Unenroll Cahunitcom

Do You Qualify For The Child Tax Credit Payments Find Out Here Wfmynews2com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Child Tax Credit 2021 Unenroll Cahunitcom

Irs Opens Non-filer Portal For Child Tax Credit Registration

Irs Child Tax Credit 2021 Portal Access Cahunitcom

Child Tax Credit Payments Unenrollment Process Lupe Ruiz

The Child Tax Credit Portal Is Now Live - Youtube