Furthermore, the irs typically qualifies tax deductions on medical expenses. In other words, funeral expenses are tax deductible if they are covered by an estate.

2

The amount of the expenses claimed from the succession will be deducted, if applicable, from the death benefit paid by retraite québec , provided the deceased gave.

Are funeral expenses tax deductible in canada. As with any other creditor of the succession, supporting documents must be provided. If you choose to report funeral expenses on the estate’s tax return, use form 706. So are funeral notices, transportation of family and a reception after the funeral.

Are funeral expenses tax deductible in canada basics you need to know about memorial costs the finances associated with funerals can prove exorbitant and if you are not prepared to cover the costs it can prove devastating. Funeral and burial expenses are only tax deductible if they’re paid for by the estate of the deceased person. Polls, fees and parking associated with receiving medical treatment.

Funeral expenses are part of the charges on the succession and can be claimed by the person who paid them. Funeral costs in canada can be as low as $1,000 or as high as $20,000, with the average around $9,150. If your loved one incurred fees from the hospital, use of medical equipment, lab services, prescriptions, medical supplies, or routine exams, you must itemize.

4 tru e 5 fals e. However, the full amount of these deductible fees must first be reduced by any reimbursement of these fees that you have received. However, funeral expenses can qualify as tax deductions when the costs are paid out of a decedent’s estate.

Find deductions, credits, and expenses you can claim on your tax return to help reduce the amount of tax you have to pay. Deductible medical expenses may include, but are not limited to the following: None of those expenses is deductible.

The entire community properties of the spouses are included in the gross estate. The 1040 tax form is the individual income tax form, and funeral costs do not qualify as an individual deduction. This may include the costs of hiring a funeral director, embalming and preparation fees, and internment of the body.

However, transportation of a body back to canada for burial would be a qualifying expenditure. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedent's estate. Deducting funeral expenses as part of an estate.

To qualify for the death benefit, the deceased must have made contributions to the canada pension plan ( cpp) for at least: In other words, if you die and your heirs pay for the funeral themselves, they will not be able to claim any deductions for those expenses on their taxes. Funeral expenses, whether paid or unpaid, are deductible as funeral expense.

Many estates do not actually use this deduction, since most estates are less than the amount that is taxable. If the estate pays the costs for the funeral and the person who passed away had money for covering the final expenses, the estate can deduct the expenses from its tax return. Legal fees you paid to get a separation or divorce or to establish custody for a child, funeral expenses, wedding expenses, loans to family members (that presumably went “bad”) and a.

Eligible funeral services must be rendered in canada, so if you plan to retire and have your final resting place in boca raton, don’t bother. It is an excise tax. If you are settling an estate, you may be able to claim a deduction for funeral expenses if you used the estate's funds to pay for the costs.

If any funeral cost is relevant to the ceremony or burial and is a reasonable part of the service, it is eligible to be deducted. They are never deductible if they are paid by an individual taxpayer. Rules for claiming funeral expense tax deductions.

In short, these expenses are not eligible to be claimed on a 1040 tax form. Funeral expenses are not tax deductible because they are not qualified medical expenses. The average price varies by city and province, and that cost does not include cemetery property or burial charges.

You can deduct accounting or legal fees you paid to have an objection or appeal prepared against an assessment for income tax, canada pension plan or quebec pension plan contributions, or employment insurance premiums. The estate is on the hook for all funeral expenses, probate charges, and fees.

Reforming Tax Expenditures In Italy What Why And How In Imf Working Papers Volume 2014 Issue 007 2014

Canada Revenue Agency Tax Tip Eight Things To Remember At Tax Time Lifestyles Thesuburbancom

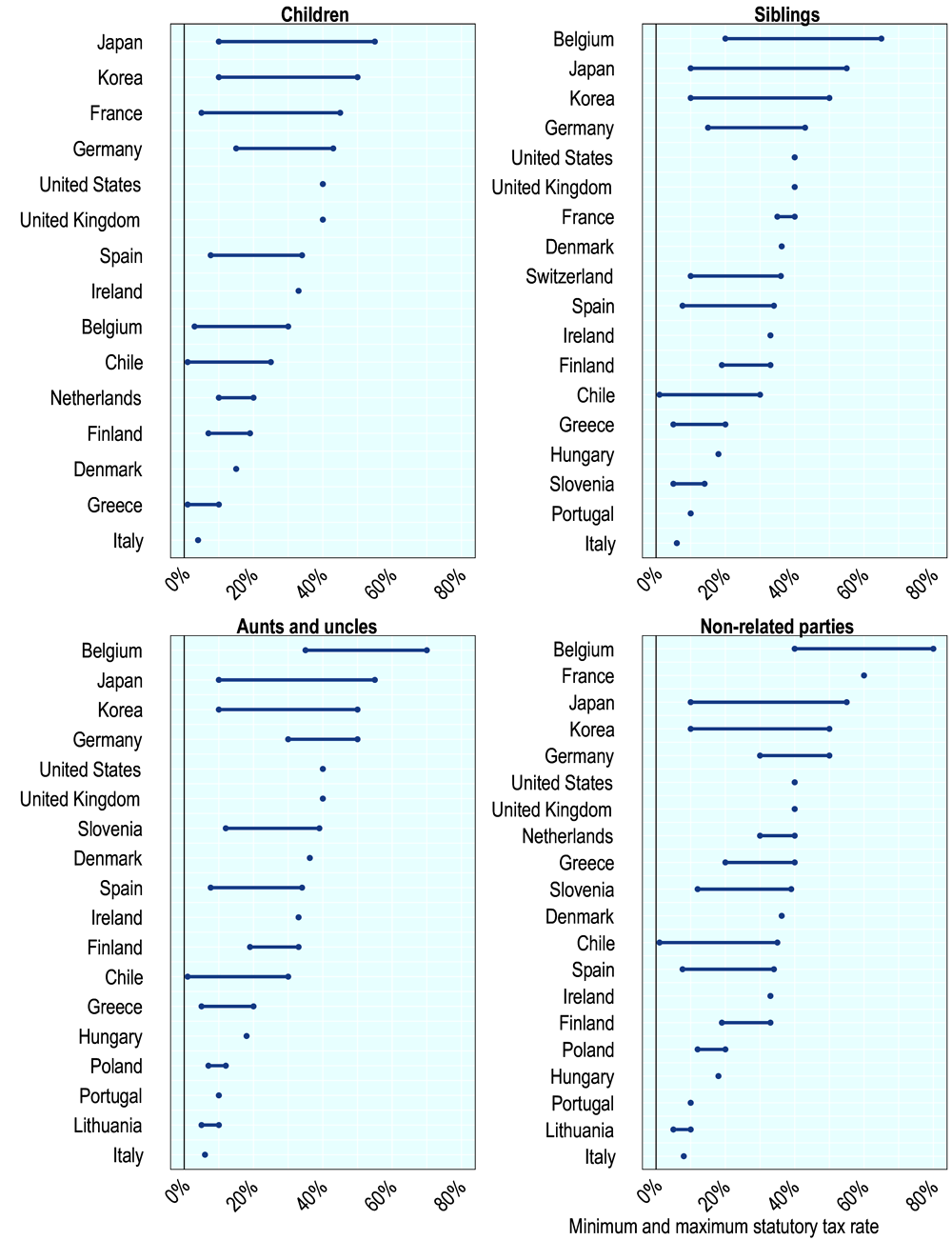

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Finances Of The Nation - Canadian Tax Foundation

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Reforming Tax Expenditures In Italy What Why And How In Imf Working Papers Volume 2014 Issue 007 2014

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Are Funeral Expenses Tax-deductible Funeralocity

Tax Deductions And Write-offs For Sole Proprietors Fifth Third Bank

Reforming Tax Expenditures In Italy What Why And How In Imf Working Papers Volume 2014 Issue 007 2014

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2014/05/10/death_and_taxes_filing_a_persons_final_return_is_harder_than_you_think/gordon_pape.jpg)

Death And Taxes Filing A Persons Final Return Is Harder Than You Think The Star

2

Cpp Payment Dates 2021 How Much Cpp Will You Get Payment Date Pension Benefits Retirement Income

Mri Technician Resume Examples - Httpresumesdesigncommri-technician-resume-examples Resume Examples Resume Format In Word Surgical Technician

Personal Tax Services C E Mcmahon Professional Corporation

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Reforming Tax Expenditures In Italy What Why And How In Imf Working Papers Volume 2014 Issue 007 2014

Turbotax Deluxe 2021 Tax Software Federal And State Returns Federal E-file State E-file Additional Mac Download E-delivery Costco